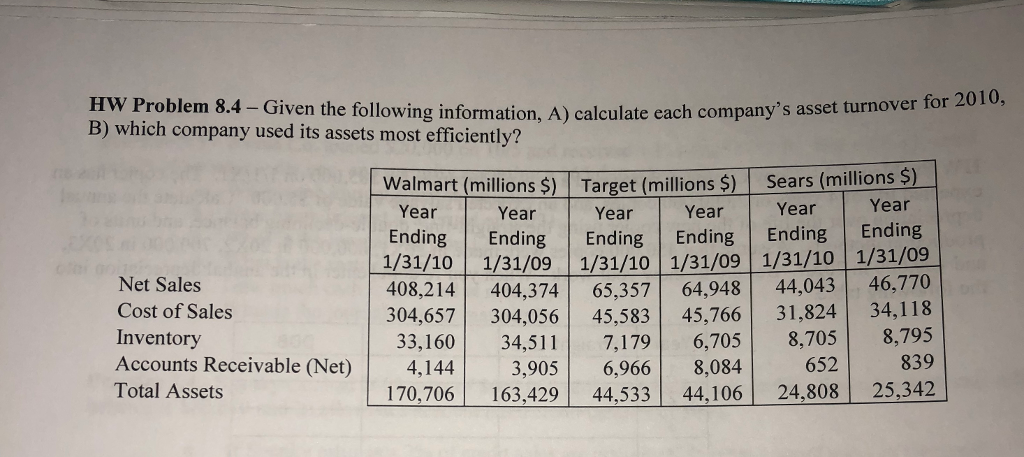

Please help me with HW Problem 8.1,8.2, 8.3, & 8.4

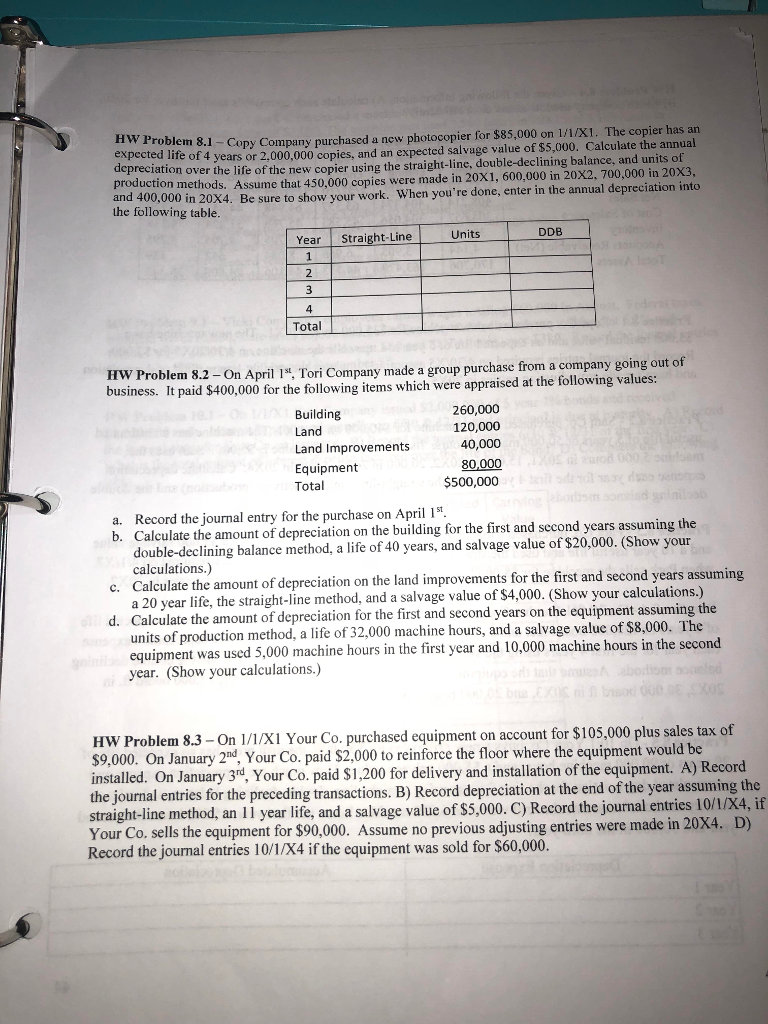

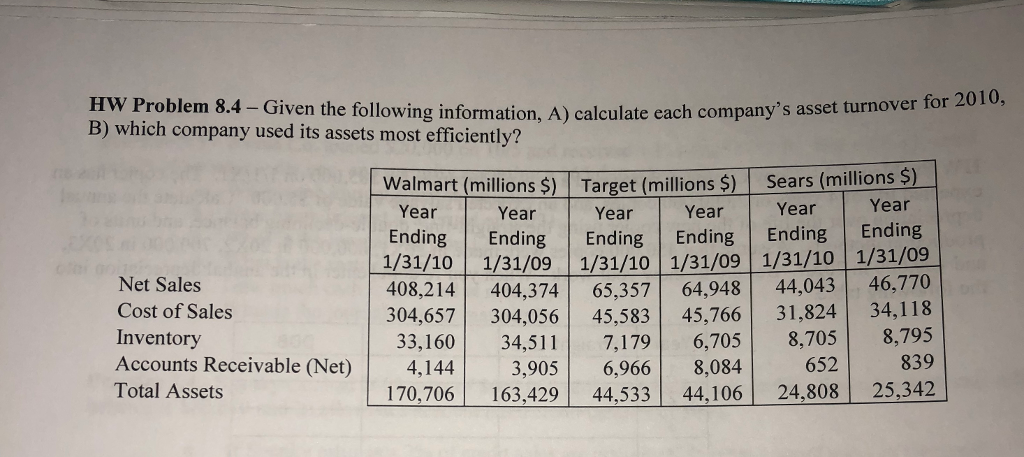

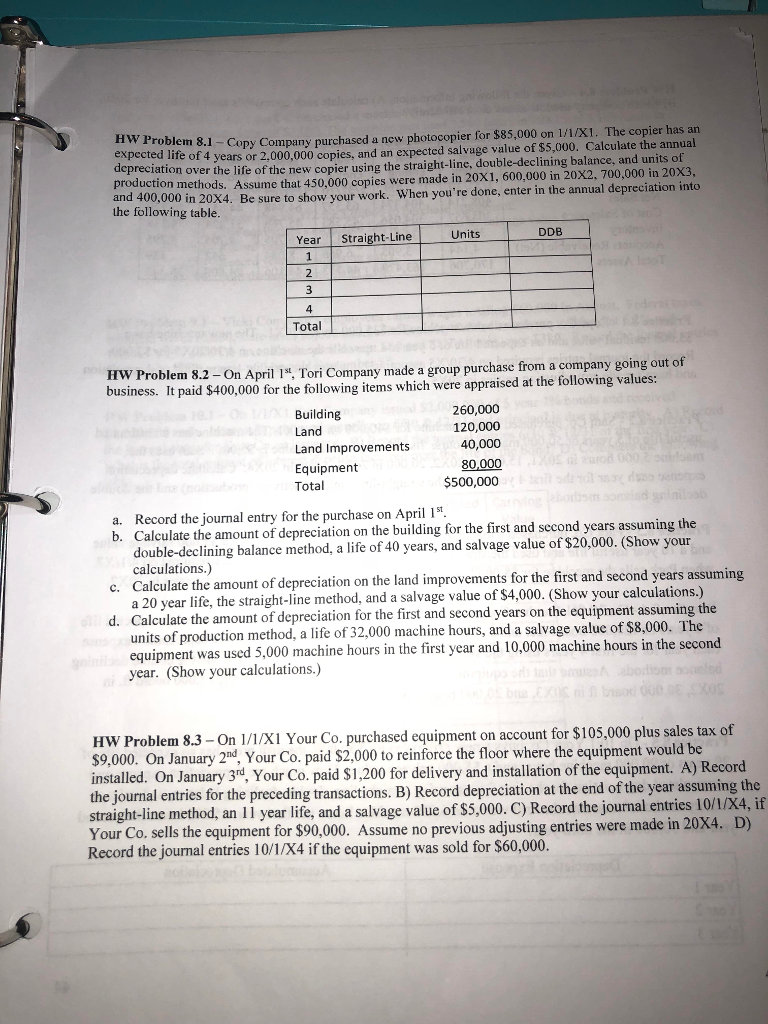

1 Copy Company purchased a new photocopier for $85,000 on 1/1/X1. The copier has an or 2,000,000 copies, and an expected salvage value of $5,000. Calculate the annual expected life of 4 years ation over the life of the new copier using the straight-line, double-declining balance, and units of production methods. Assume that 450,000 copies were made in 20X1, 600,000 in 20X2, 700,000 in 20X3, and 400,00 0 in 20X4. Be sure to show your work. When you're done, enter in the annual depreciation into the following table. Units DDB Year Straight-Line Total HW Problem 8.2-On April 1 Tori Company made a group purchase from a company going out business. It paid $400,000 for the following items which were appraised at the following values: y made a group purchase from a company going out of Building Land Land Improvements Equipment Total 260,000 120,000 40,000 80,000 $500,000 Record the journal entry for the purchase on April 1 s Calculate the amount of depreciation on the building for the first and second years a a. b. uble-declining balance method, a life of 40 years, and salvage value of $20,000. (Show your calculations.) c. Calculate the amount of depreciation on the land improvements for the first and second years assuming a 20 year life, the straight-line method, and a salvage value of $4,000. (Show your calculations.) Calculate the amount of depreciation for the first and second years on the equipment assuming the units of production method, a life of 32,000 machine hours, and a salvage value of $8,000. The equipment was used 5,000 machine hours in the first year and 10,000 machine hours in the seconed year. (Show your calculations.) d. HW Problem 8.3 -On 1/1/XI Your Co. purchased equipment on account for $105,000 plus sales tax of $9,000. On January 2nd, Your Co. paid $2,000 to reinforce the floor where the equipment would be installed. On January 3rd, Your Co. paid S1,200 for delivery and installation of the equipment. A) Record the journal entries for the preceding transactions. B) Record depreciation at the end of the year assuming the straight-line method, an 11 year life, and a salvage value of $5,000. C) Record the journal entries 10/1/X4, if Your Co. sells the equipment for $90,000. Assume no previous adjusting entries were made in 20x4. D) Record the journal entries 10/1/X4 f the equipm ent was sold for $60,000