Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE HELP ME WITH LABELING FOR THE ONES MARKED WITH X . Chart of Accounts: Londonderry Fine Arts Center (LFAC) is a museum dedicated to

PLEASE HELP ME WITH LABELING FOR THE ONES MARKED WITH X.

Chart of Accounts:

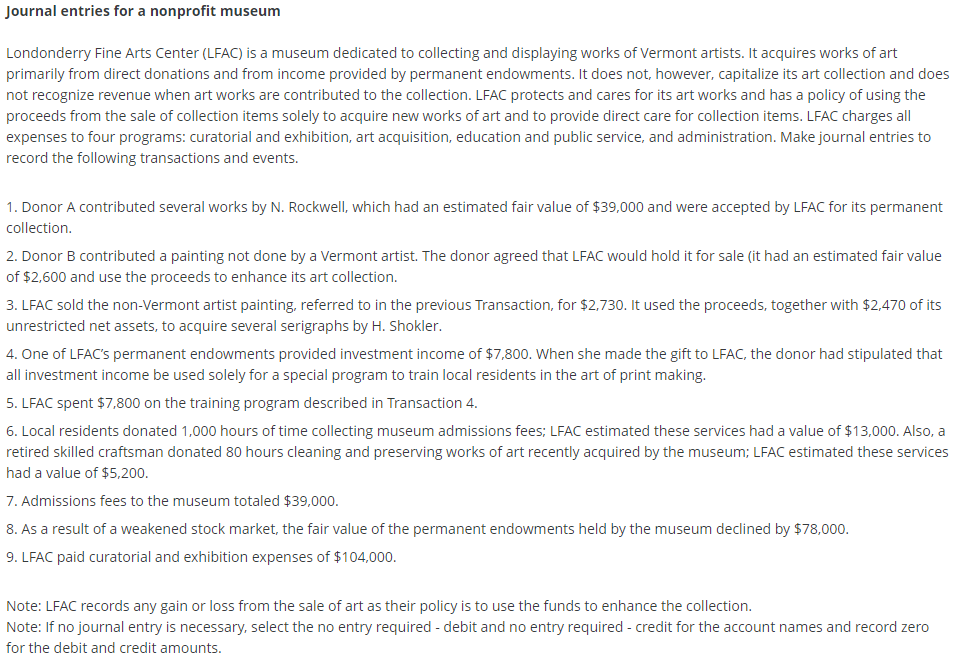

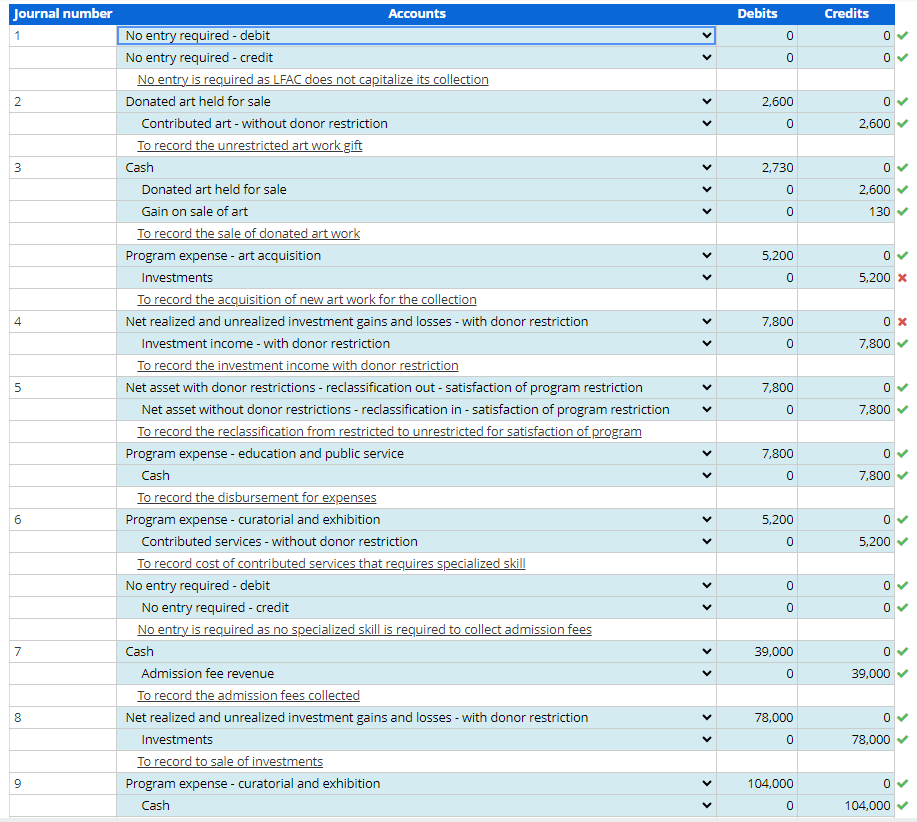

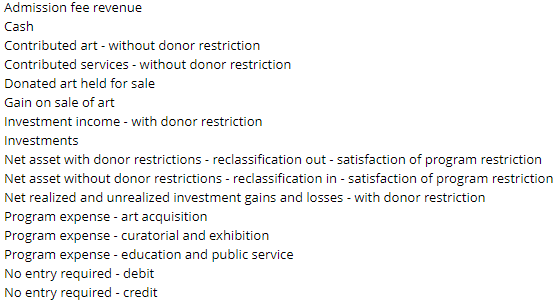

Londonderry Fine Arts Center (LFAC) is a museum dedicated to collecting and displaying works of Vermont artists. It acquires works of art primarily from direct donations and from income provided by permanent endowments. It does not, however, capitalize its art collection and does not recognize revenue when art works are contributed to the collection. LFAC protects and cares for its art works and has a policy of using the proceeds from the sale of collection items solely to acquire new works of art and to provide direct care for collection items. LFAC charges all expenses to four programs: curatorial and exhibition, art acquisition, education and public service, and administration. Make journal entries to record the following transactions and events. 1. Donor A contributed several works by N. Rockwell, which had an estimated fair value of $39,000 and were accepted by LFAC for its permanent collection. 2. Donor B contributed a painting not done by a Vermont artist. The donor agreed that LFAC would hold it for sale (it had an estimated fair value of $2,600 and use the proceeds to enhance its art collection. 3. LFAC sold the non-Vermont artist painting, referred to in the previous Transaction, for $2,730. It used the proceeds, together with $2,470 of its unrestricted net assets, to acquire several serigraphs by H. Shokler. 4. One of LFAC's permanent endowments provided investment income of $7,800. When she made the gift to LFAC, the donor had stipulated that all investment income be used solely for a special program to train local residents in the art of print making. 5. LFAC spent $7,800 on the training program described in Transaction 4. 6. Local residents donated 1,000 hours of time collecting museum admissions fees; LFAC estimated these services had a value of $13,000. Also, a retired skilled craftsman donated 80 hours cleaning and preserving works of art recently acquired by the museum; LFAC estimated these services had a value of $5,200. 7. Admissions fees to the museum totaled $39,000. 8. As a result of a weakened stock market, the fair value of the permanent endowments held by the museum declined by $78,000. 9. LFAC paid curatorial and exhibition expenses of $104,000. Note: LFAC records any gain or loss from the sale of art as their policy is to use the funds to enhance the collection. Note: If no journal entry is necessary, select the no entry required - debit and no entry required - credit for the account names and record zero for the debit and credit amounts. Admission tee revenue Cash Contributed art - without donor restriction Contributed services - without donor restriction Donated art held for sale Gain on sale of art Investment income - with donor restriction Investments Net asset with donor restrictions - reclassification out - satisfaction of program restriction Net asset without donor restrictions - reclassification in - satisfaction of program restriction Net realized and unrealized investment gains and losses - with donor restriction Program expense - art acquisition Program expense - curatorial and exhibition Program expense - education and public service No entry required - debit No entry required - credit

Londonderry Fine Arts Center (LFAC) is a museum dedicated to collecting and displaying works of Vermont artists. It acquires works of art primarily from direct donations and from income provided by permanent endowments. It does not, however, capitalize its art collection and does not recognize revenue when art works are contributed to the collection. LFAC protects and cares for its art works and has a policy of using the proceeds from the sale of collection items solely to acquire new works of art and to provide direct care for collection items. LFAC charges all expenses to four programs: curatorial and exhibition, art acquisition, education and public service, and administration. Make journal entries to record the following transactions and events. 1. Donor A contributed several works by N. Rockwell, which had an estimated fair value of $39,000 and were accepted by LFAC for its permanent collection. 2. Donor B contributed a painting not done by a Vermont artist. The donor agreed that LFAC would hold it for sale (it had an estimated fair value of $2,600 and use the proceeds to enhance its art collection. 3. LFAC sold the non-Vermont artist painting, referred to in the previous Transaction, for $2,730. It used the proceeds, together with $2,470 of its unrestricted net assets, to acquire several serigraphs by H. Shokler. 4. One of LFAC's permanent endowments provided investment income of $7,800. When she made the gift to LFAC, the donor had stipulated that all investment income be used solely for a special program to train local residents in the art of print making. 5. LFAC spent $7,800 on the training program described in Transaction 4. 6. Local residents donated 1,000 hours of time collecting museum admissions fees; LFAC estimated these services had a value of $13,000. Also, a retired skilled craftsman donated 80 hours cleaning and preserving works of art recently acquired by the museum; LFAC estimated these services had a value of $5,200. 7. Admissions fees to the museum totaled $39,000. 8. As a result of a weakened stock market, the fair value of the permanent endowments held by the museum declined by $78,000. 9. LFAC paid curatorial and exhibition expenses of $104,000. Note: LFAC records any gain or loss from the sale of art as their policy is to use the funds to enhance the collection. Note: If no journal entry is necessary, select the no entry required - debit and no entry required - credit for the account names and record zero for the debit and credit amounts. Admission tee revenue Cash Contributed art - without donor restriction Contributed services - without donor restriction Donated art held for sale Gain on sale of art Investment income - with donor restriction Investments Net asset with donor restrictions - reclassification out - satisfaction of program restriction Net asset without donor restrictions - reclassification in - satisfaction of program restriction Net realized and unrealized investment gains and losses - with donor restriction Program expense - art acquisition Program expense - curatorial and exhibition Program expense - education and public service No entry required - debit No entry required - credit Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started