Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me with number 12 10. A man aged 40 wishes to accumulate a fund for retirement by depositing $1.000 at the ning of

please help me with number 12

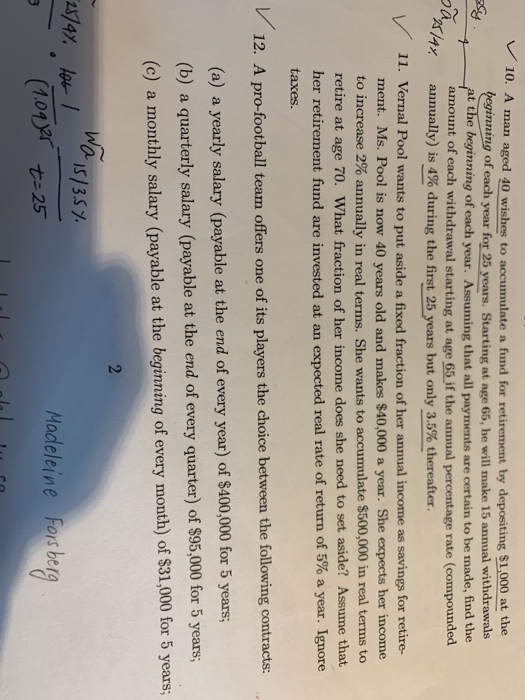

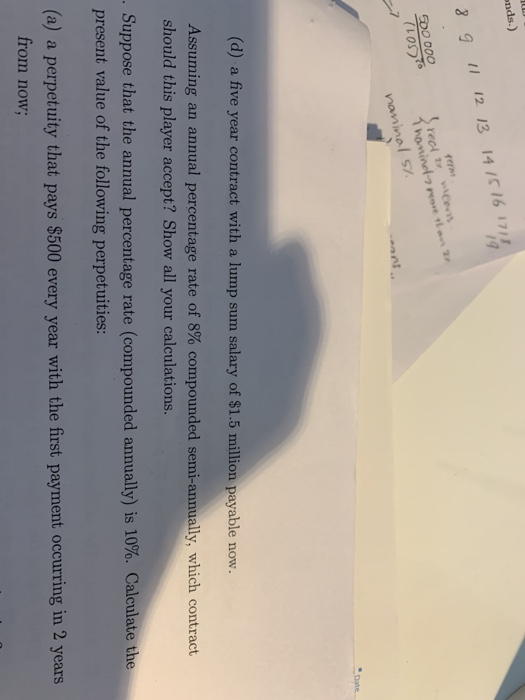

10. A man aged 40 wishes to accumulate a fund for retirement by depositing $1.000 at the ning of each year for 25 years. Starting at age 65, he will make 15 annual withdrawals at the beginning of each year. Assuming that all payments are certain to be made, find the amount of each withdrawal starting at age 65 if the annual percentage rate (compounded annually) is 4% during the first 25years but only 3.5% thereafter. 11. Vernal Pool wants to put aside a fixed fraction of her annual income as savings for retire- ment. Ms. Pool is now 40 years old and makes $40,000 a year. She expects her income to increase 2% annually in real terms. She wants to accumulate $500,000 in real terms to retire at age 70. What fraction of her income does she need to set aside? Assume that her retirement fund are invested at an expected real rate of return of 5% a year. Ignore taxes 12. A pro-football team offers one of its players the choice between the following contracts: (a) a yearly salary (payable at the end of every year) of $400,000 for 5 years; (b) a quarterly salary (payable at the end of every quarter) of $95,000 for 5 years (c) a monthly salary (payable at the beginning of every month) of $31,000 for 5 years; as l 35% Madeleine Fer beg nds.) 19 11 12 13 14 /C 161711 inol s/ (d) a five year contract with a lump sum salary of $1.5 million payable now Assuming an annual percentage rate of 8% compounded semi-annually, which contract should this player accept? Show all your calculations. . Suppose that the annual percentage rate (compounded annually) is 10%. Calculate the present value of the following perpetuities: (a) a perpetuity that pays $500 every year with the first payment occurring in 2 years from now Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started