please help me with part 2.

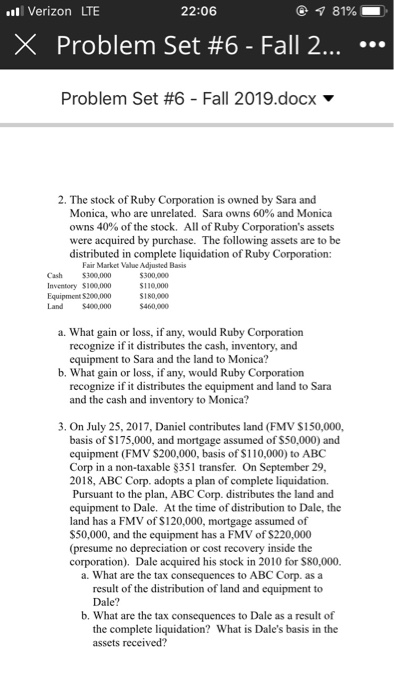

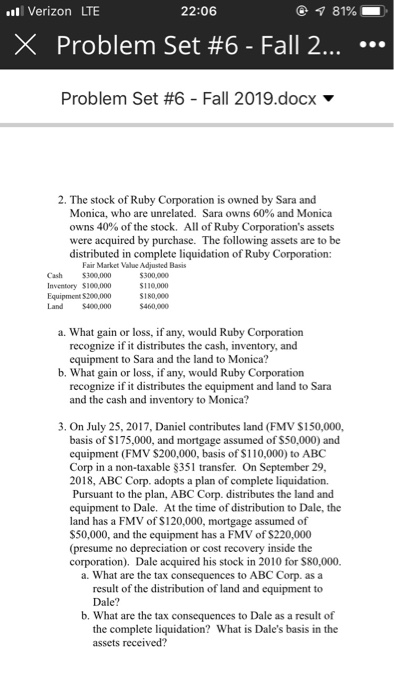

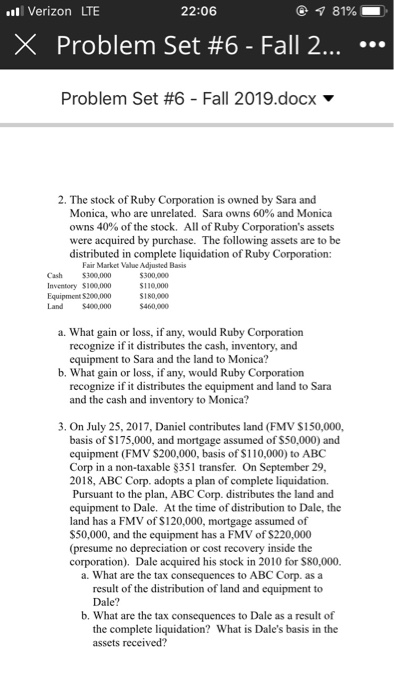

. Verizon LTE 22:06 @ 81% X Problem Set #6 - Fall 2... ... Problem Set #6 - Fall 2019.docx 2. The stock of Ruby Corporation is owned by Sara and Monica, who are unrelated. Sara owns 60% and Monica owns 40% of the stock. All of Ruby Corporation's assets were acquired by purchase. The following assets are to be distributed in complete liquidation of Ruby Corporation: Fair Market Value Adjusted Basis Cash S100,000 $300.000 Inventory S100,000 SI10.000 Equipment $200,000 SINO,000 Land $400,000 $460.000 a. What gain or loss, if any, would Ruby Corporation recognize if it distributes the cash, inventory, and equipment to Sara and the land to Monica? b. What gain or loss, if any, would Ruby Corporation recognize if it distributes the equipment and land to Sara and the cash and inventory to Monica? 3. On July 25, 2017, Daniel contributes land (FMV $150,000, basis of S175,000, and mortgage assumed of $50,000) and equipment (FMV S200,000, basis of $110,000) to ABC Corp in a non-taxable $351 transfer. On September 29, 2018, ABC Corp. adopts a plan of complete liquidation. Pursuant to the plan, ABC Corp. distributes the land and equipment to Dale. At the time of distribution to Dale, the land has a FMV of $120,000, mortgage assumed of $50,000, and the equipment has a FMV of $220,000 (presume no depreciation or cost recovery inside the corporation). Dale acquired his stock in 2010 for $80,000. a. What are the tax consequences to ABC Corp. as a result of the distribution of land and equipment to Dale? b. What are the tax consequences to Dale as a result of the complete liquidation? What is Dale's basis in the assets received? . Verizon LTE 22:06 @ 81% X Problem Set #6 - Fall 2... ... Problem Set #6 - Fall 2019.docx 2. The stock of Ruby Corporation is owned by Sara and Monica, who are unrelated. Sara owns 60% and Monica owns 40% of the stock. All of Ruby Corporation's assets were acquired by purchase. The following assets are to be distributed in complete liquidation of Ruby Corporation: Fair Market Value Adjusted Basis Cash S100,000 $300.000 Inventory S100,000 SI10.000 Equipment $200,000 SINO,000 Land $400,000 $460.000 a. What gain or loss, if any, would Ruby Corporation recognize if it distributes the cash, inventory, and equipment to Sara and the land to Monica? b. What gain or loss, if any, would Ruby Corporation recognize if it distributes the equipment and land to Sara and the cash and inventory to Monica? 3. On July 25, 2017, Daniel contributes land (FMV $150,000, basis of S175,000, and mortgage assumed of $50,000) and equipment (FMV S200,000, basis of $110,000) to ABC Corp in a non-taxable $351 transfer. On September 29, 2018, ABC Corp. adopts a plan of complete liquidation. Pursuant to the plan, ABC Corp. distributes the land and equipment to Dale. At the time of distribution to Dale, the land has a FMV of $120,000, mortgage assumed of $50,000, and the equipment has a FMV of $220,000 (presume no depreciation or cost recovery inside the corporation). Dale acquired his stock in 2010 for $80,000. a. What are the tax consequences to ABC Corp. as a result of the distribution of land and equipment to Dale? b. What are the tax consequences to Dale as a result of the complete liquidation? What is Dale's basis in the assets received