Please help me with part A and B if possible.

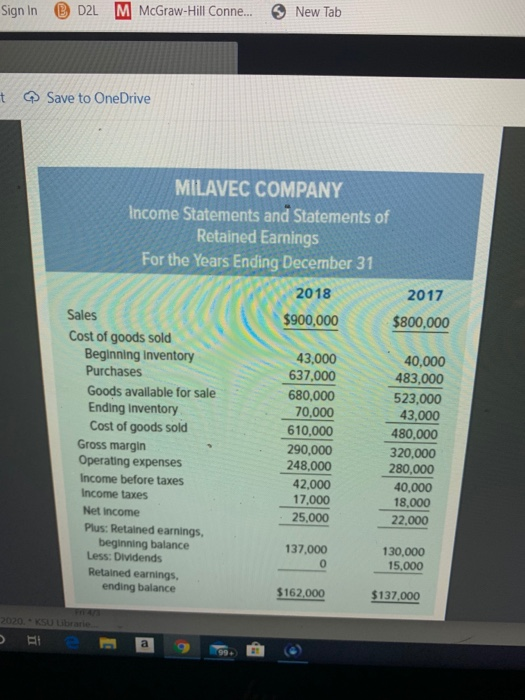

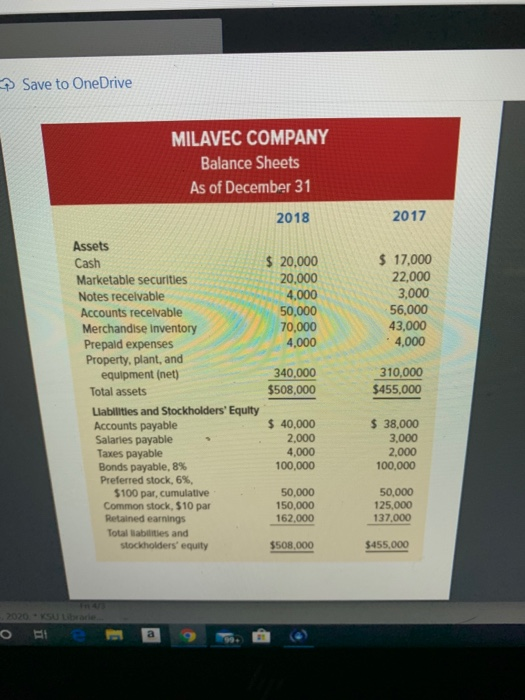

up to 5 bonus points (eamed as a group) applied to your final exam score Assignment Specifics: Part A - To be completed (individually) before we start CL9-Submit to Assignment folder named "Ch 9 Milavec before" due by April 10(earn up to 3 bonus points, individual assignment) Before we start Ch 9, review the Milavec Financial Statements (attached at the bottom of this assignment) and make some initial observations about the company. Individually, come up with at least 3 observations about the company you can share with your group. (For example, by looking at the Income Statement you can see that the company is currently operating profitably. Your observations can be simple or complex, broad (like the example provided) or detailed. Part B - First Group Action - Select your point of view and groups - Submit to Assignment folder named "Milavec Groups Selection and POV" due by April 13 Each group will be working through the Milavec Financial Statements from one of 3 perspectives or point of view (POV) 1) Investors considering investing $100,000, who will purchase Preferred Stock 2) Lenders considering loaning $100,000 for a 5-10 year term 3) Internal Management tasked with increasing profits over 3 years by 5% There will be a group selection process and a POV selection process facilitated by sign-up genius. Use the signup genius link to select your group. Once your group is determined, use the 2ml signup genius to select your POV. Once your group is formed and your POV is selected, work together to share your initial individual observations. Then considering your group's POV, develop 3 or 4 observations to share about Milavec Company that will help others understand Milavec and will help your group formulate an opinion about Milavec that will help you draw a conclusion Submit your group name, group members, selected POV, and your group's initial observations about Milavec. Daily Student News P2020 VS Librarie Sign In D2L M McGraw-Hill Conne... New Tab t Save to OneDrive MILAVEC COMPANY Income Statements and Statements of Retained Earnings For the Years Ending December 31 2018 2017 $900,000 $800,000 Sales Cost of goods sold Beginning Inventory Purchases Goods available for sale Ending Inventory Cost of goods sold Gross margin Operating expenses Income before taxes Income taxes Net Income Plus: Retained earnings, beginning balance Less: Dividends Retained earnings ending balance 43,000 637,000 680,000 70,000 610.000 290,000 248,000 42,000 17,000 25,000 40,000 483,000 523,000 43,000 480,000 320,000 280,000 40,000 18.000 22.000 137,000 130.000 15.000 $162,000 $137,000 2020 KSU bar Save to OneDrive MILAVEC COMPANY Balance Sheets As of December 31 2018 2017 Assets $ 20,000 20,000 4,000 50,000 70,000 $ 17,000 22,000 3,000 56,000 43,000 4,000 4.000 340,000 $508,000 310,000 $455,000 Cash Marketable securities Notes receivable Accounts receivable Merchandise Inventory Prepaid expenses Property, plant, and equipment (net) Total assets Llabilities and Stockholders' Equity Accounts payable Salaries payable Taxes payable Bonds payable, 8% Preferred stock, 6% $100 par, cumulative Common stock, $10 par Retained earnings Total abilities and stockholders' equity $ 40,000 2,000 4,000 100,000 $ 38,000 3,000 2.000 100,000 50,000 150,000 162,000 50.000 125.000 137.000 $508,000 $455.000 up to 5 bonus points (eamed as a group) applied to your final exam score Assignment Specifics: Part A - To be completed (individually) before we start CL9-Submit to Assignment folder named "Ch 9 Milavec before" due by April 10(earn up to 3 bonus points, individual assignment) Before we start Ch 9, review the Milavec Financial Statements (attached at the bottom of this assignment) and make some initial observations about the company. Individually, come up with at least 3 observations about the company you can share with your group. (For example, by looking at the Income Statement you can see that the company is currently operating profitably. Your observations can be simple or complex, broad (like the example provided) or detailed. Part B - First Group Action - Select your point of view and groups - Submit to Assignment folder named "Milavec Groups Selection and POV" due by April 13 Each group will be working through the Milavec Financial Statements from one of 3 perspectives or point of view (POV) 1) Investors considering investing $100,000, who will purchase Preferred Stock 2) Lenders considering loaning $100,000 for a 5-10 year term 3) Internal Management tasked with increasing profits over 3 years by 5% There will be a group selection process and a POV selection process facilitated by sign-up genius. Use the signup genius link to select your group. Once your group is determined, use the 2ml signup genius to select your POV. Once your group is formed and your POV is selected, work together to share your initial individual observations. Then considering your group's POV, develop 3 or 4 observations to share about Milavec Company that will help others understand Milavec and will help your group formulate an opinion about Milavec that will help you draw a conclusion Submit your group name, group members, selected POV, and your group's initial observations about Milavec. Daily Student News P2020 VS Librarie Sign In D2L M McGraw-Hill Conne... New Tab t Save to OneDrive MILAVEC COMPANY Income Statements and Statements of Retained Earnings For the Years Ending December 31 2018 2017 $900,000 $800,000 Sales Cost of goods sold Beginning Inventory Purchases Goods available for sale Ending Inventory Cost of goods sold Gross margin Operating expenses Income before taxes Income taxes Net Income Plus: Retained earnings, beginning balance Less: Dividends Retained earnings ending balance 43,000 637,000 680,000 70,000 610.000 290,000 248,000 42,000 17,000 25,000 40,000 483,000 523,000 43,000 480,000 320,000 280,000 40,000 18.000 22.000 137,000 130.000 15.000 $162,000 $137,000 2020 KSU bar Save to OneDrive MILAVEC COMPANY Balance Sheets As of December 31 2018 2017 Assets $ 20,000 20,000 4,000 50,000 70,000 $ 17,000 22,000 3,000 56,000 43,000 4,000 4.000 340,000 $508,000 310,000 $455,000 Cash Marketable securities Notes receivable Accounts receivable Merchandise Inventory Prepaid expenses Property, plant, and equipment (net) Total assets Llabilities and Stockholders' Equity Accounts payable Salaries payable Taxes payable Bonds payable, 8% Preferred stock, 6% $100 par, cumulative Common stock, $10 par Retained earnings Total abilities and stockholders' equity $ 40,000 2,000 4,000 100,000 $ 38,000 3,000 2.000 100,000 50,000 150,000 162,000 50.000 125.000 137.000 $508,000 $455.000