Question

please help me with parts 1-4 Mohave Corp. is considering outsourcing production of the umbrella tote bag included with some of its products. The company

please help me with parts 1-4

Mohave Corp. is considering outsourcing production of the umbrella tote bag included with some of its products. The company has received a bid from a supplier in Vietnam to produce 8,100 units per year for $8.50 each. Mohave has the following information about the cost of producing tote bags:

| Direct materials | $ | 4.00 | |

| Direct labor | 2.00 | ||

| Variable manufacturing overhead | 1.00 | ||

| Fixed manufacturing overhead | 2.00 | ||

| Total cost per unit | $ | 9.00 | |

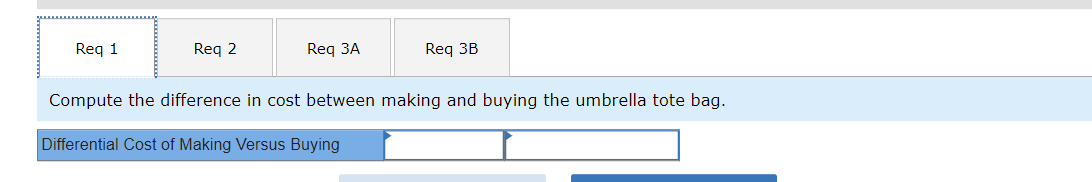

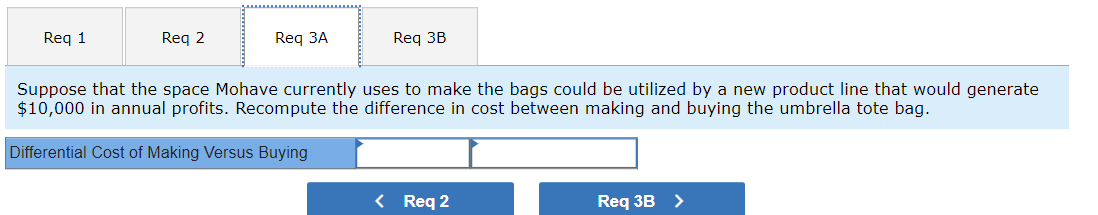

Mohave has determined that all variable costs could be eliminated by outsourcing the tote bags, while 60 percent of the fixed overhead cost is unavoidable. At this time, Mohave has no specific use in mind for the space currently dedicated to producing the tote bags. Required: 1. Compute the difference in cost between making and buying the umbrella tote bag. 2. Based strictly on the incremental analysis, should Mohave buy the tote bags or continue to make them? 3-a. Suppose that the space Mohave currently uses to make the bags could be utilized by a new product line that would generate $10,000 in annual profits. Recompute the difference in cost between making and buying the umbrella tote bag. 3-b. Does this change your recommendation to Mohave?

ompute the difference in cost between making and buying the umbrella tote b Should Mohave buy the tote bags or continue to make them? Make Buy uppose that the space Mohave currently uses to make the bags could be utilized by a new product line that would generate 10,000 in annual profits. Recompute the difference in cost between making and buying the umbrella tote bag. Does this change your recommendation to Mohave

ompute the difference in cost between making and buying the umbrella tote b Should Mohave buy the tote bags or continue to make them? Make Buy uppose that the space Mohave currently uses to make the bags could be utilized by a new product line that would generate 10,000 in annual profits. Recompute the difference in cost between making and buying the umbrella tote bag. Does this change your recommendation to Mohave Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started