Question

Please help me with question 5 and a step by step how to complete it. Question 5: Refer to Questions 1 and 2. Richard has

Please help me with question 5 and a step by step how to complete it.

Question 5:

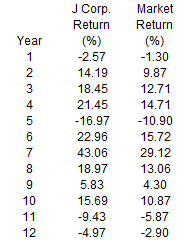

Refer to Questions 1 and 2. Richard has just received an unexpected bonus at work worth $3,750 and, given the J. Corp.'s reputation for excellent investment decision making, he will invest all of the bonus in J Corp. stock. Given the rates of return for stocks A, B, C, and D presented in Question 1 and the rates of return for J Corp. stock and the market presented in Question 2, as well as the cash amounts he is investing in stocks A, B, C, and D as you determined in Question 1,

a) What is the beta of Richard's portfolio? (3 Marks) (round to two decimal points) b) Richard's portfolio is... (2 Mark) aggressive, defensive, or neither

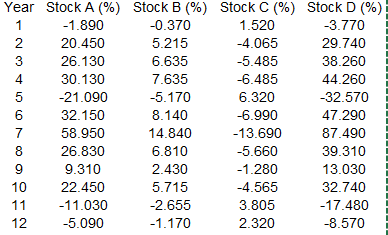

Question 1 (4 Marks) Richard must decide how to allocate the capital in his portfolio. Richard has $15,000 available to invest. He finds the rates of return for four stocks for the past 12 years and the results are given below. Richard plans to invest 25% of his funds in each stock.

a) How much will he invest in each stock? $3,750 (1 Mark)

b) The expected return of Richard's porfolio is: 5.50 % (2 Marks)(Round your answer to one one-hundreth of a percent)

c) The standard deviation of Richard's portfolio return is: 19.00 % (1 Mark)(Round your answer to one one-hundredth of a percent)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started