Question

PLEASE HELP ME WITH QUESTIONS 1 AND 2. THANK YOU. 1.The controller of the Red Wing Corporation is in the process of preparing the companys

PLEASE HELP ME WITH QUESTIONS 1 AND 2. THANK YOU.

1.The controller of the Red Wing Corporation is in the process of preparing the companys 2024 financial statements. She is trying to determine the correct balance of cash and cash equivalents to be reported as a current asset in the balance sheet. The following items are being considered:

- Balances in the companys accounts at the First National Bank; checking $13,800, savings $22,400.

- Undeposited customer checks of $5,500.

- Currency and coins on hand of $610.

- Savings account at the East Bay Bank with a balance of $430,000. This account is being used to accumulate cash for future plant expansion (in 2026).

- $26,000 in a checking account at the East Bay Bank. The balance in the account represents a 20% compensating balance for a $130,000 loan with the bank. Red Wing may not withdraw the funds until the loan is due in 2027.

- U.S. Treasury bills; 2-month maturity bills totaling $18,000, and 7-month bills totaling $23,000.

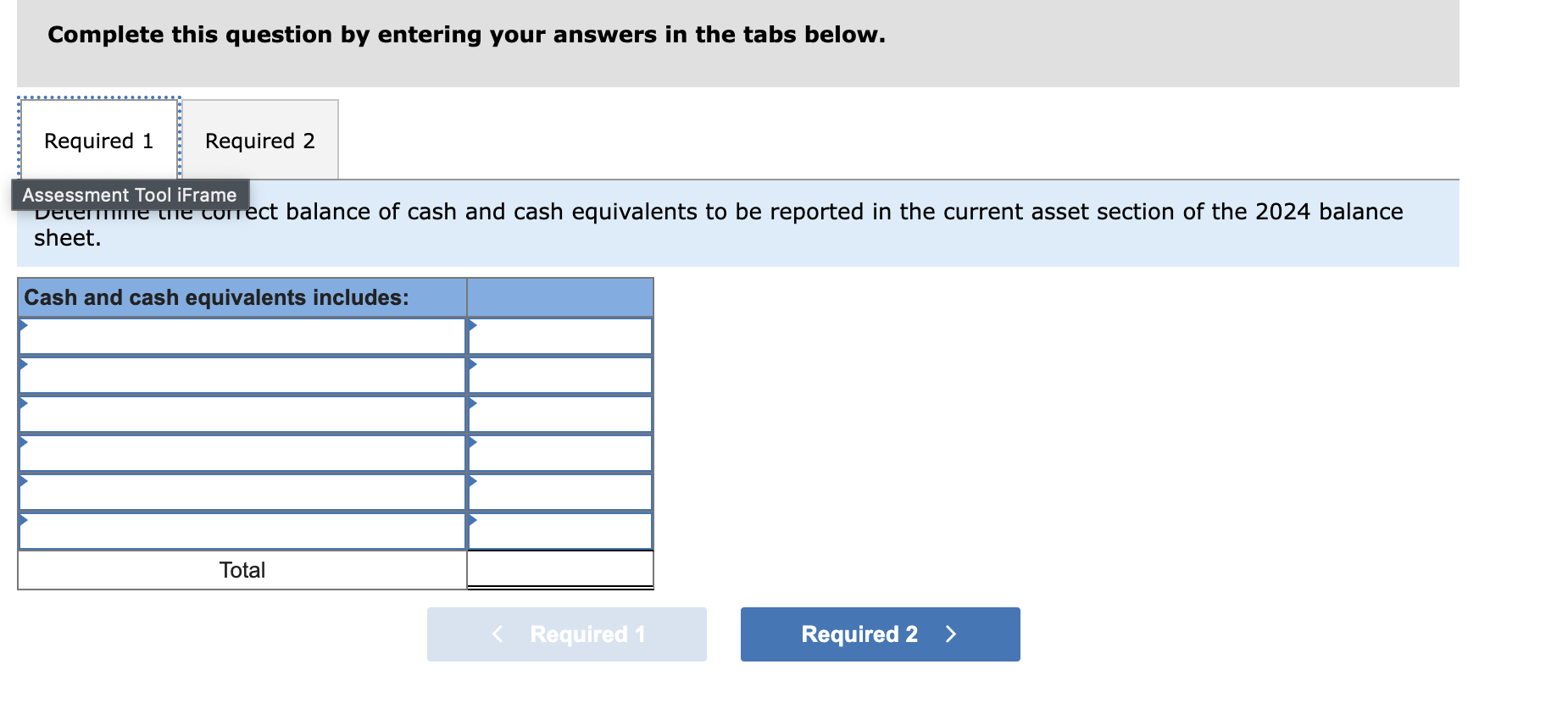

Required:

- Determine the correct balance of cash and cash equivalents to be reported in the current asset section of the 2024 balance sheet.

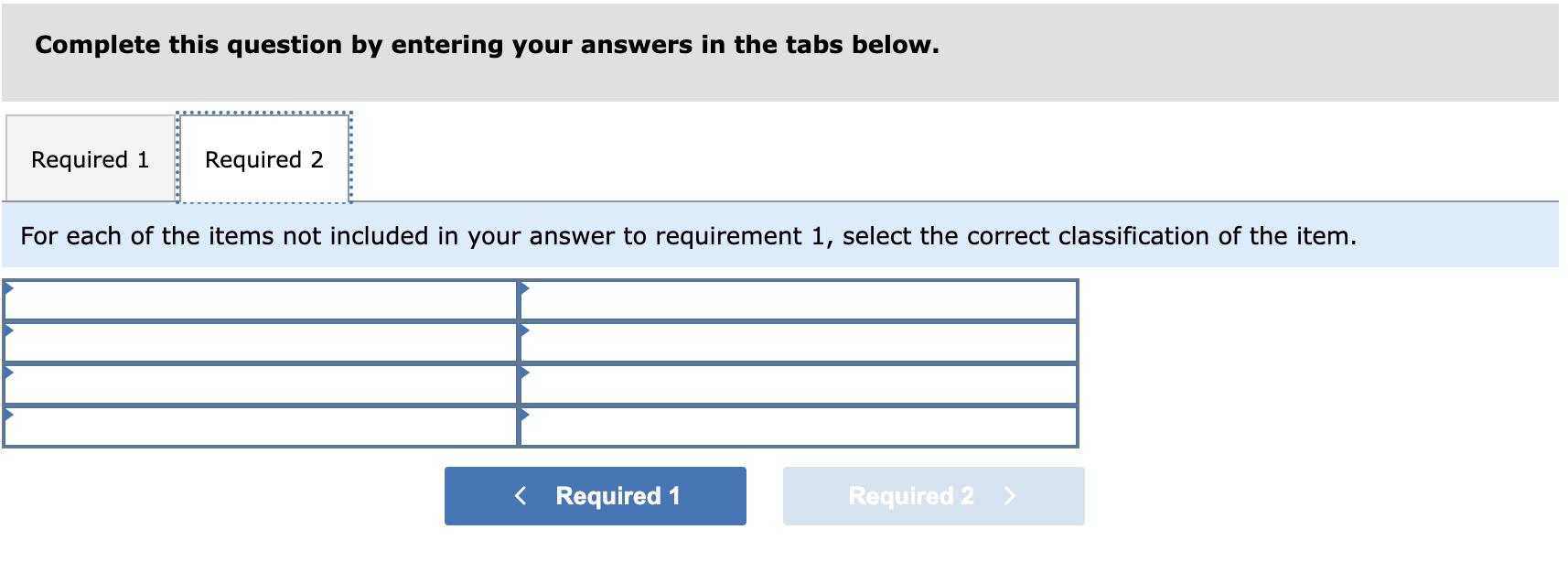

- For each of the items not included in your answer to requirement 1, select the correct classification of the ite

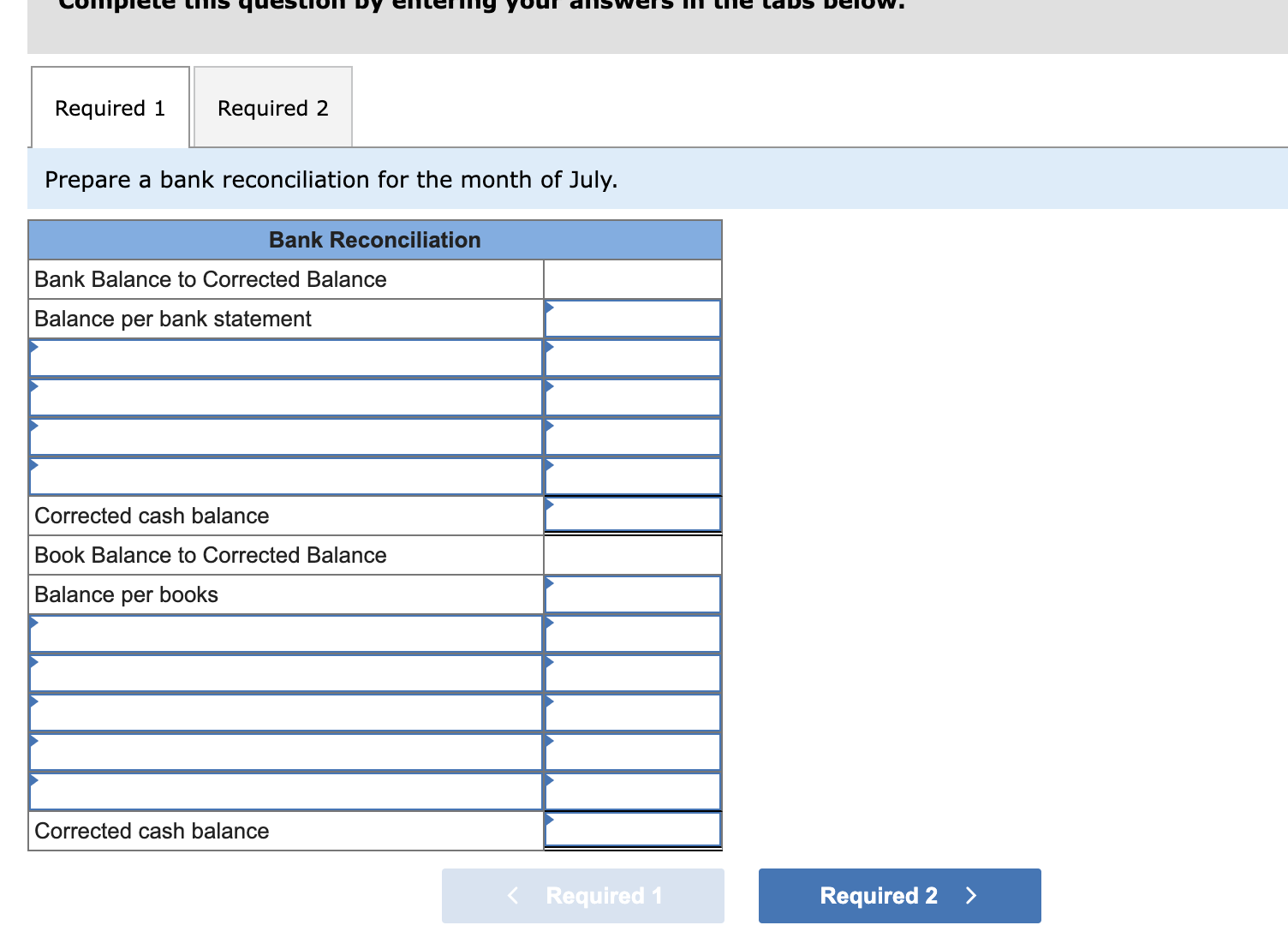

2. Harrison Company maintains a checking account at the First National City Bank. The bank provides a bank statement along with canceled checks on the last day of each month. The July 2024 bank statement included the following information:

| Balance, July 1, 2024 | $ 55,928 |

|---|---|

| Deposits | 179,700 |

| Checks processed | (192,810) |

| Service charges | (40) |

| NSF checks | (1,300) |

| Monthly payment on note, deducted directly by bank from account (includes $320 in interest) | (3,420) |

| Balance, July 31, 2024 | $ 38,058 |

The companys general ledger account had a balance of $39,258 at the end of July. Deposits outstanding totaled $6,500 and all checks written by the company were processed by the bank except for those totaling $8,440. In addition, a $2,200 July deposit from a credit customer was recorded as a $220 debit to cash and credit to accounts receivable, and a check correctly recorded by the company as a $40 disbursement was incorrectly processed by the bank as a $400 disbursement.

Required:

- Prepare a bank reconciliation for the month of July.

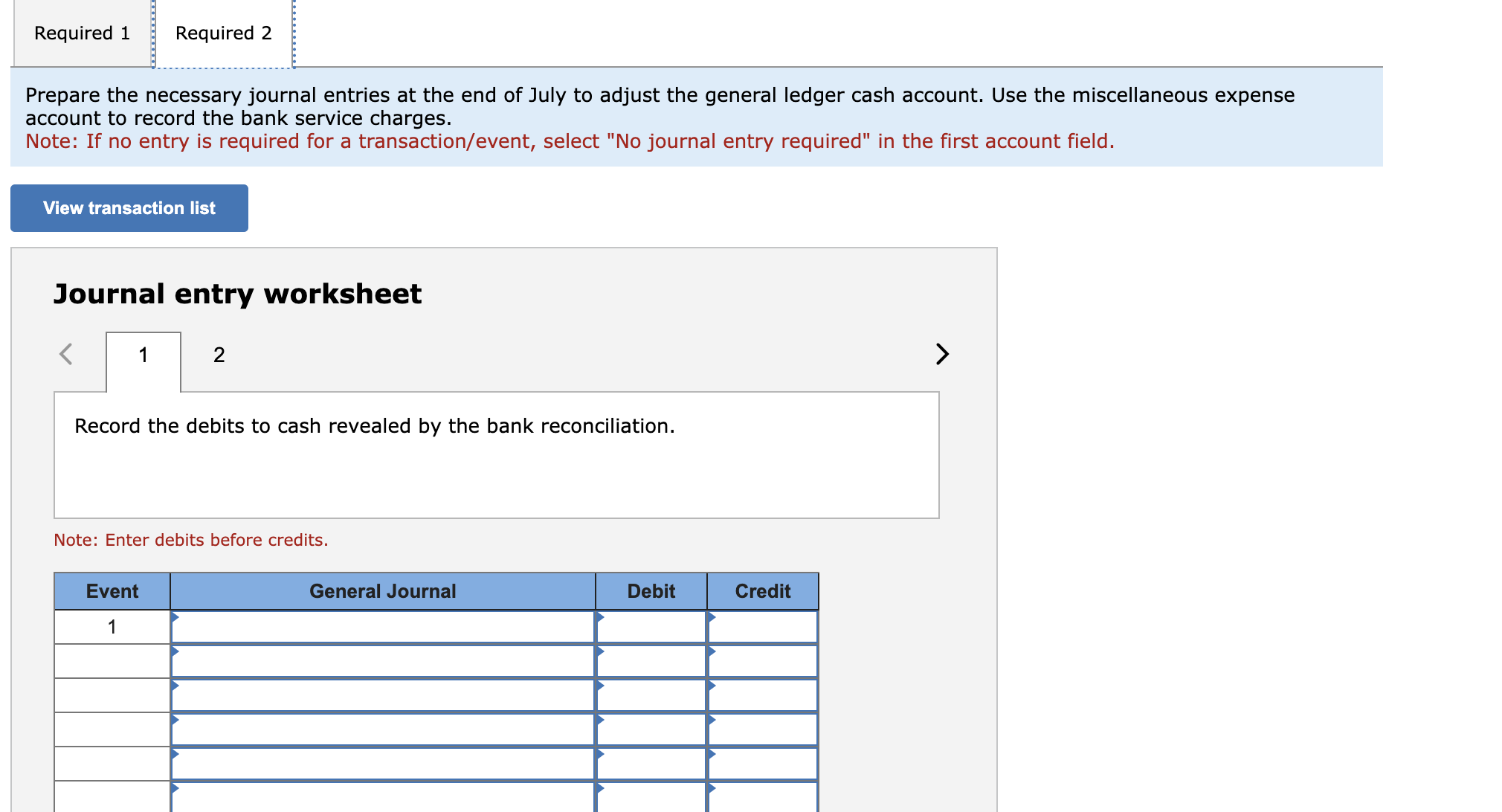

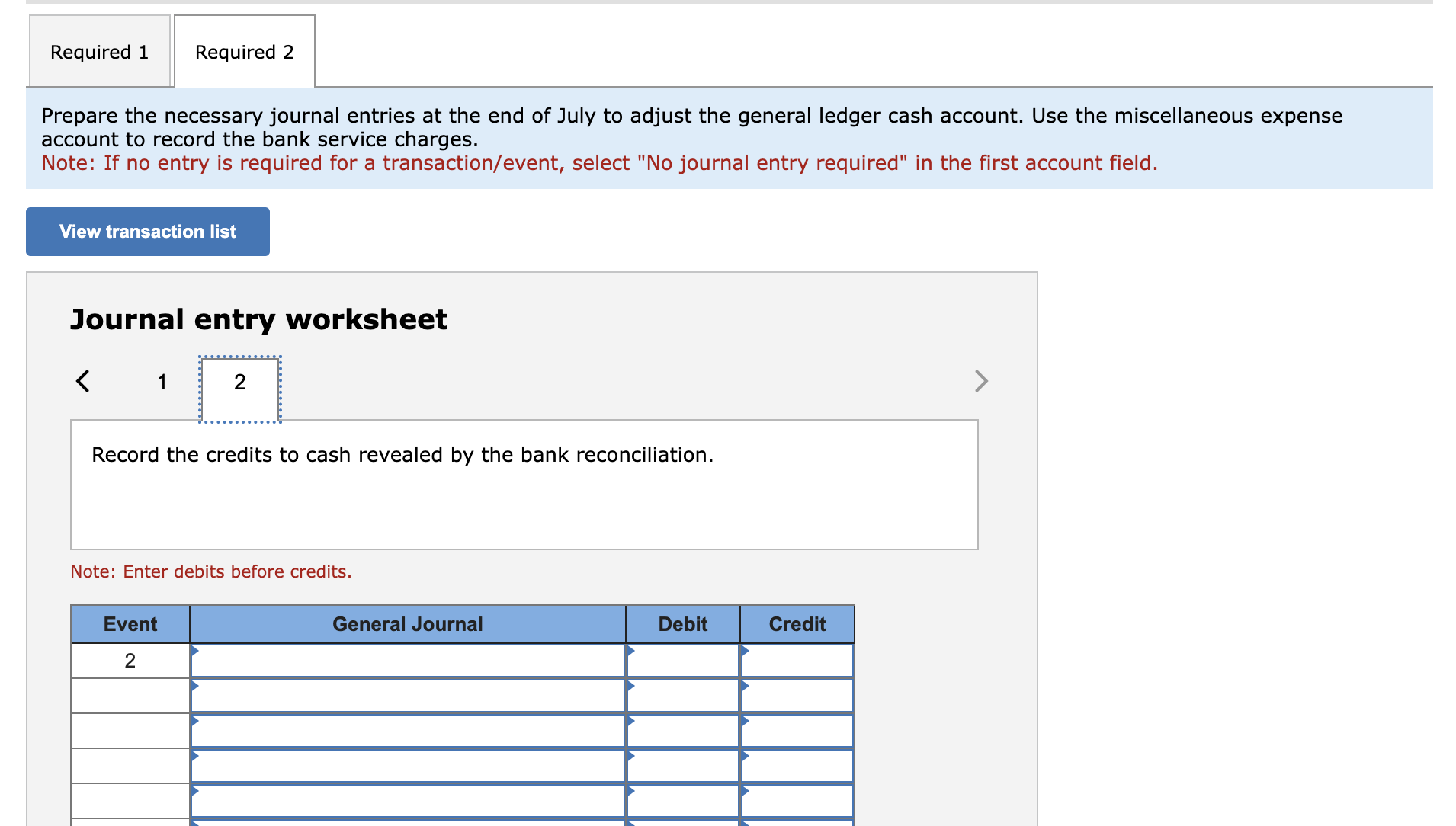

- Prepare the necessary journal entries at the end of July to adjust the general ledger cash account. Use the miscellaneous expense account to record the bank service charges.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started