Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me with requirement B Elise's prior year (Year 1) income tax liability was $35,000. Her current year (Year 2) AGI did not exceed

Please help me with requirement B

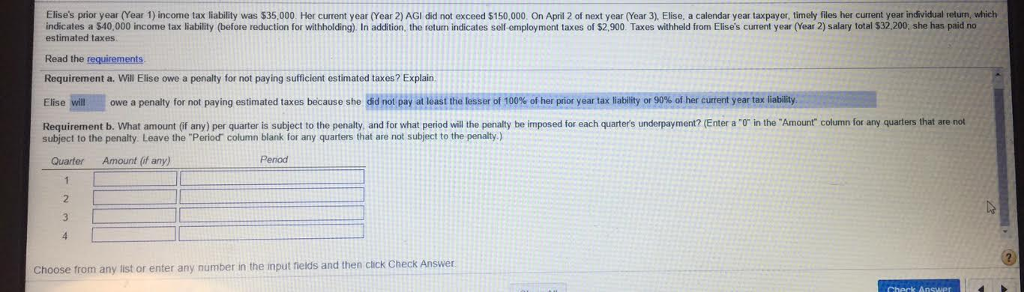

Elise's prior year (Year 1) income tax liability was $35,000. Her current year (Year 2) AGI did not exceed $150,000. On April 2 of next year (Year 3). Elise, a calendar year taxpayer, timely files her current year individual return, which indicates a $40,000 income tax liability (before reduction for withholding). In addition, the return indicates self-employment taxes of $2, 900. Taxes withheld from Elise's current year (Year 2) salary total $32.200; she has paid no estimated taxes. Read the requirements. Will Elise owe a penalty for not paying sufficient estimated taxes? Explain. Elise will owe a penalty for not paying estimated taxes because she did not pay at least the lesser of 100% of her prior year tax liability or 90%of her current year tax liability. What amount (if any) per quarter is subject to the penalty, and for what period the penalty be imposed for each quarters underpayment? (Enter a '0' in the "Amount" column for any quarters that are not subject to the penalty. Leave the "Period" column blank for any quarters that are not subject to the penalty.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started