Answered step by step

Verified Expert Solution

Question

1 Approved Answer

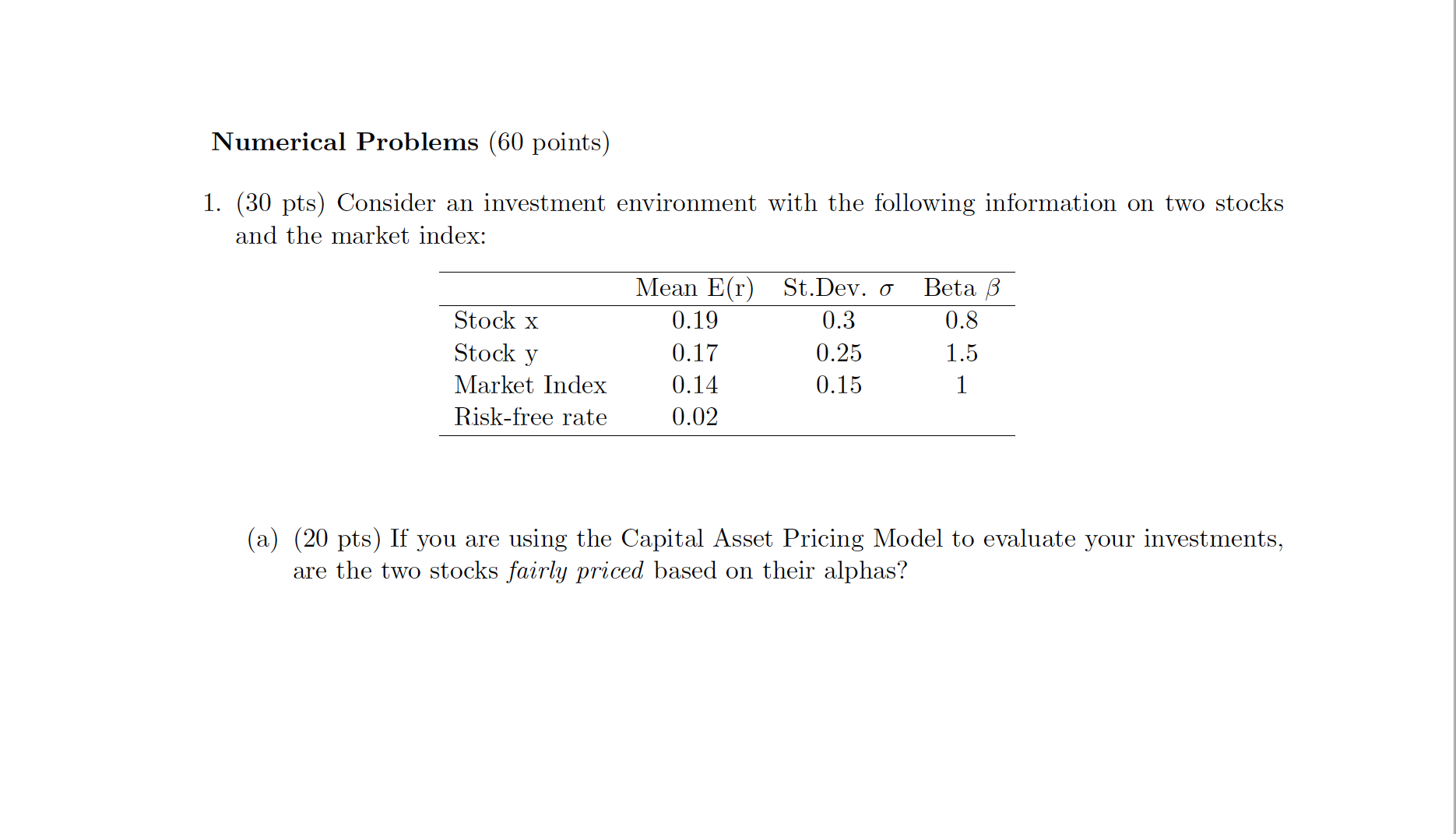

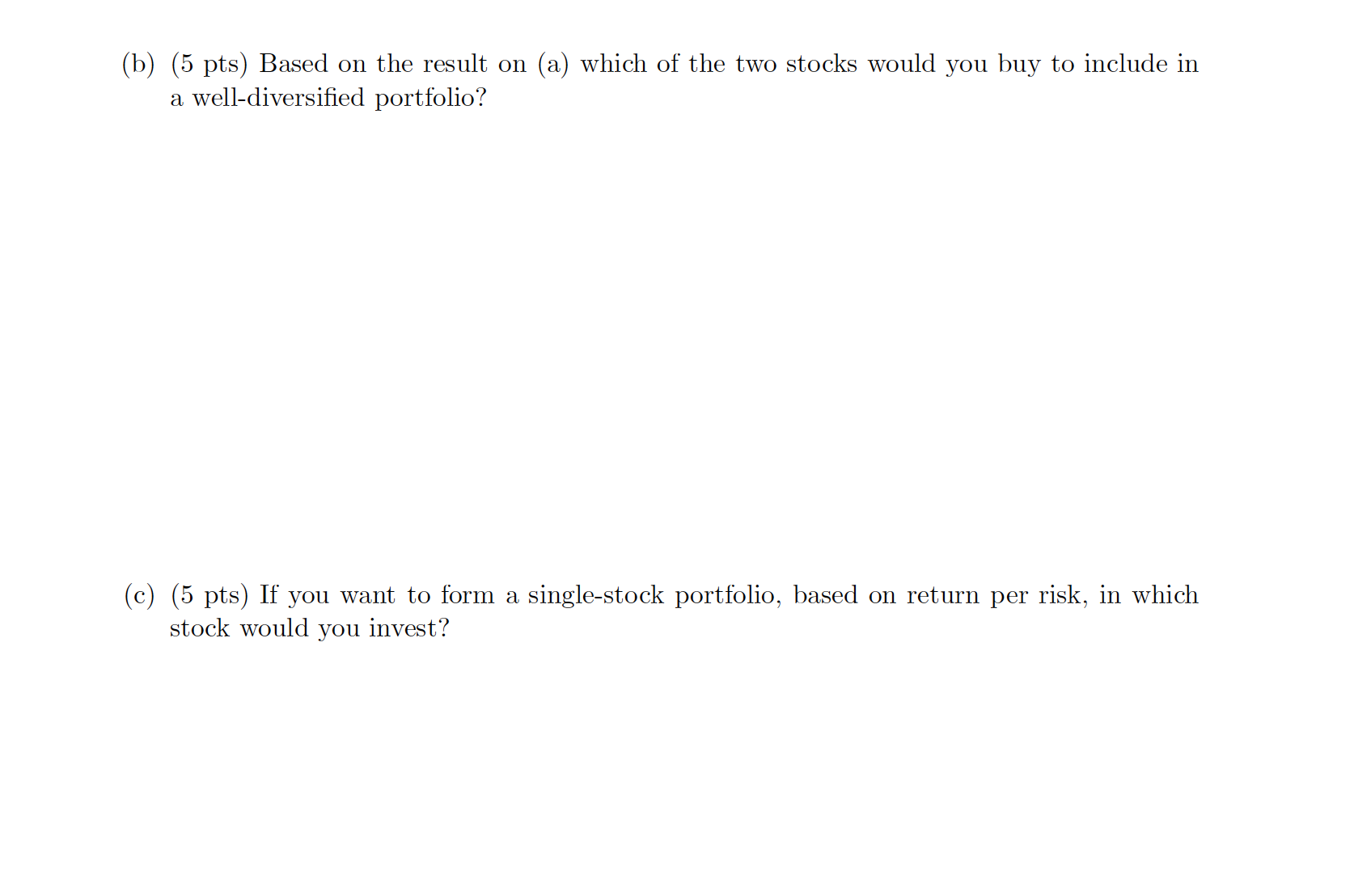

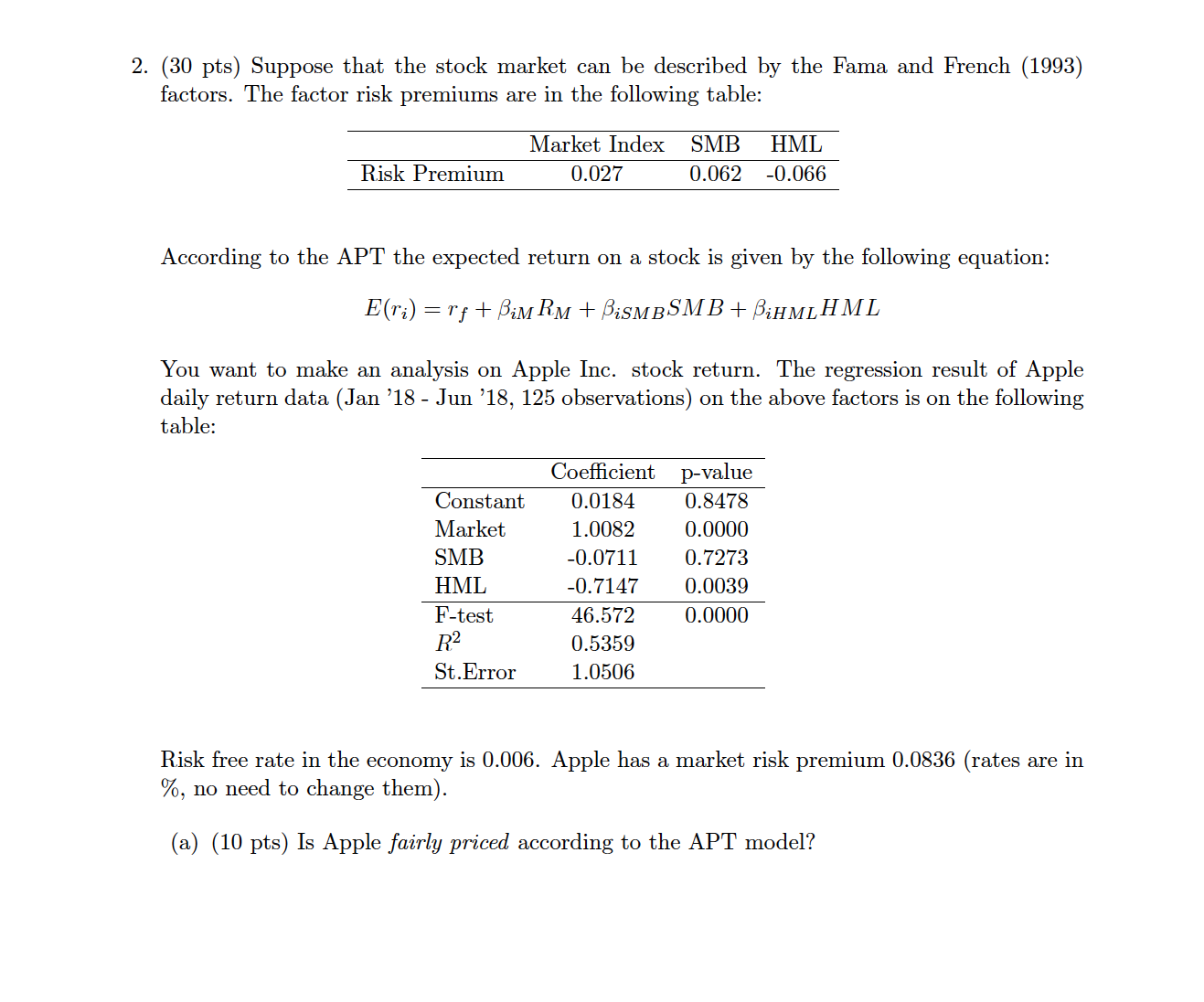

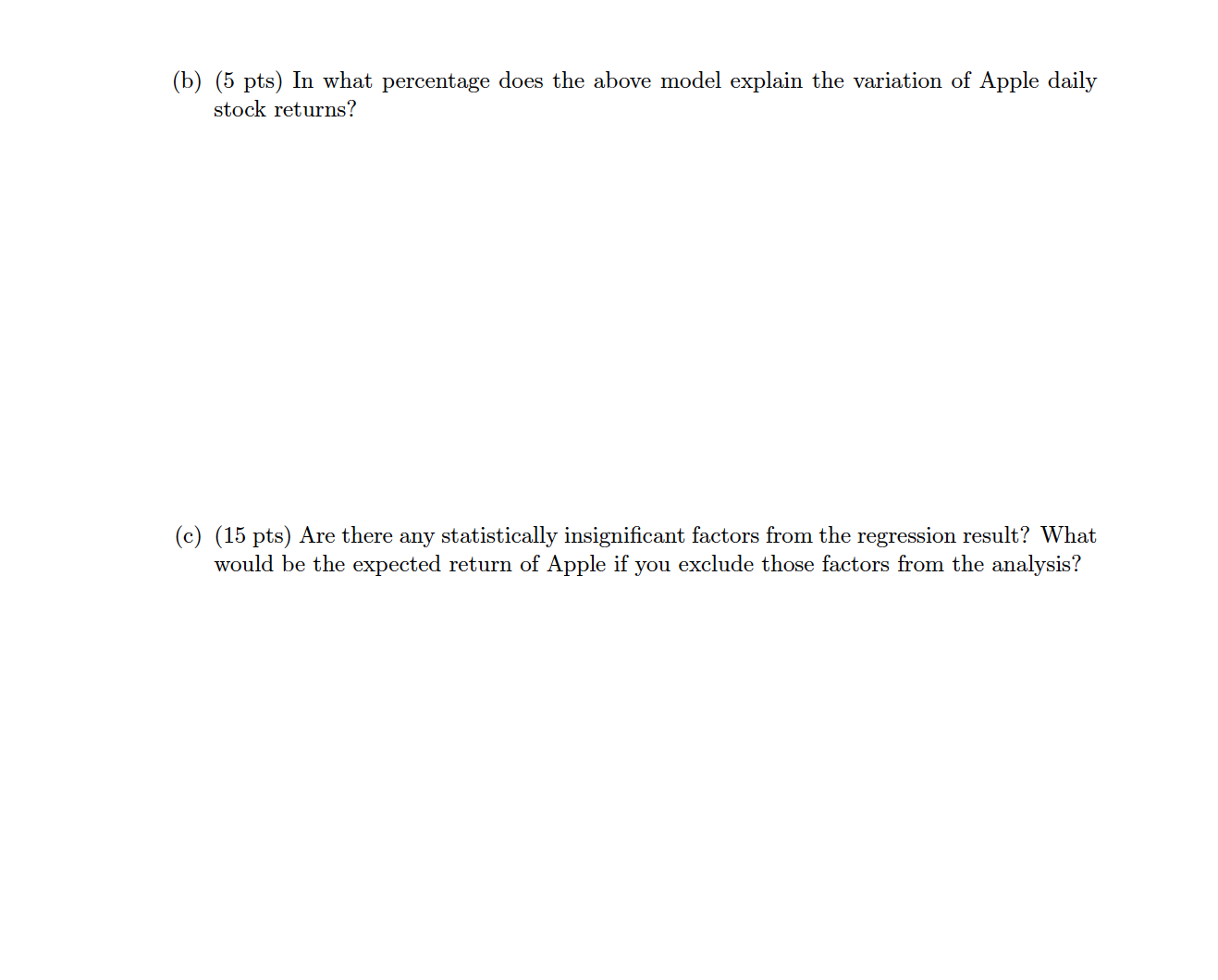

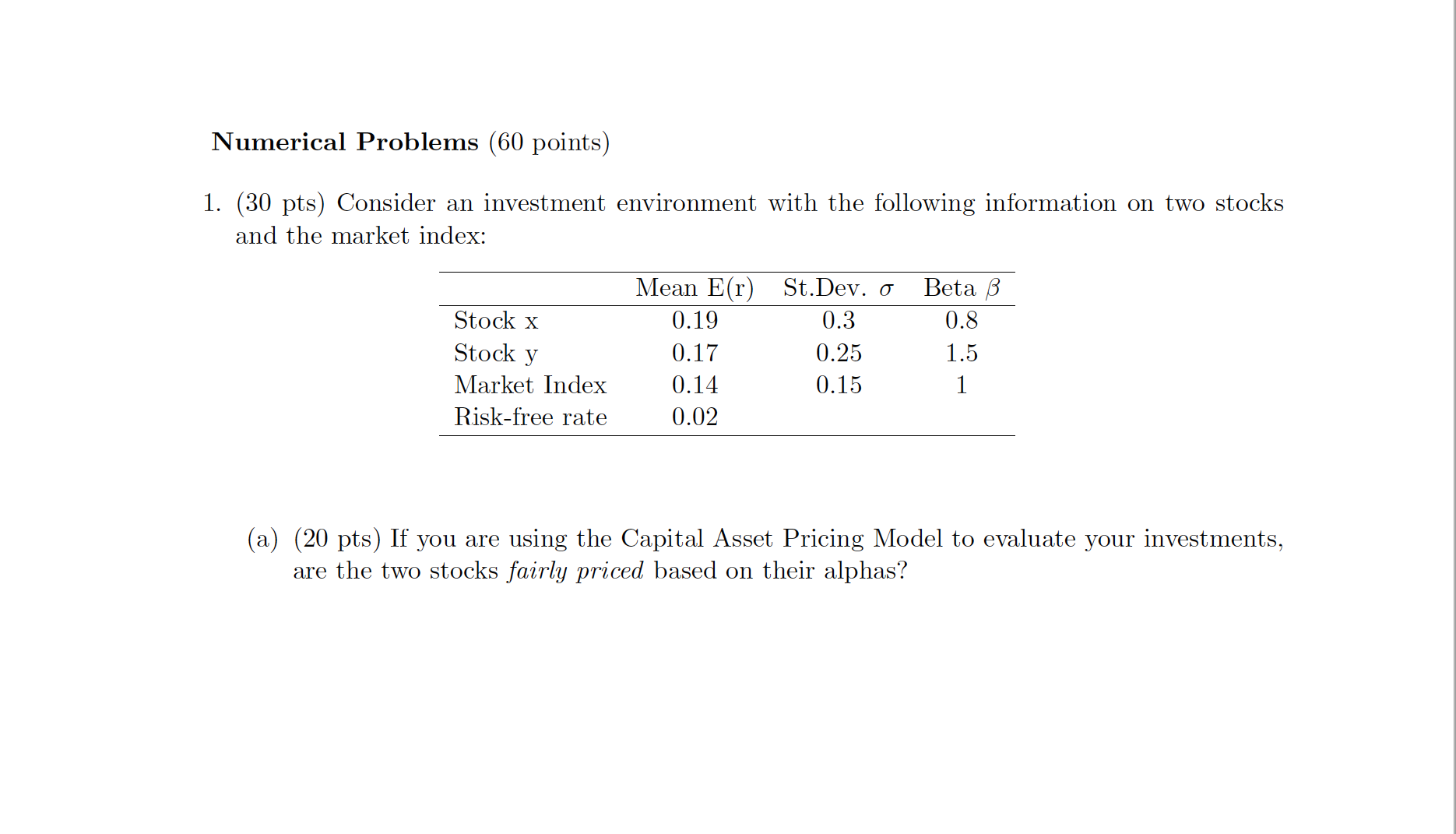

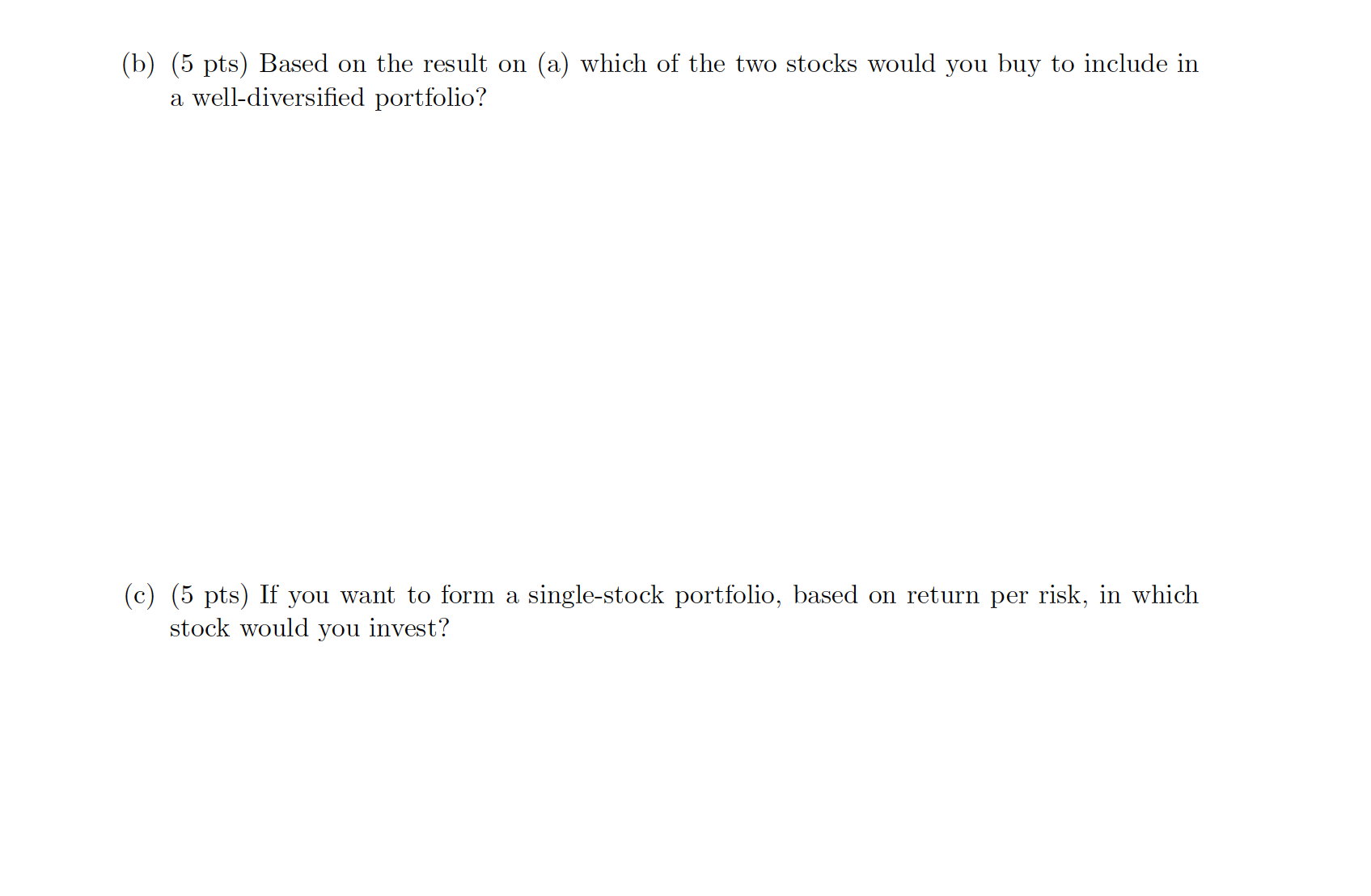

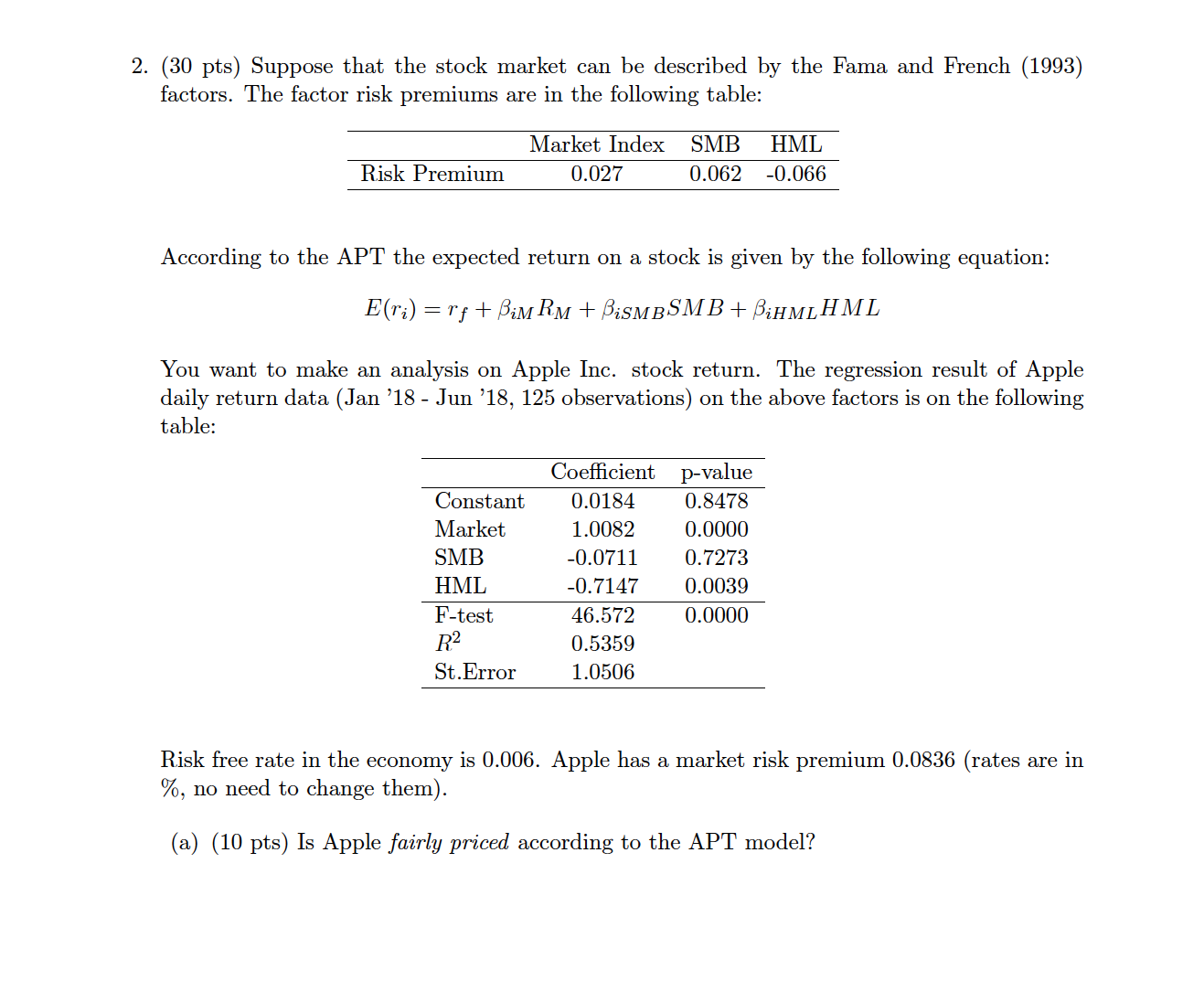

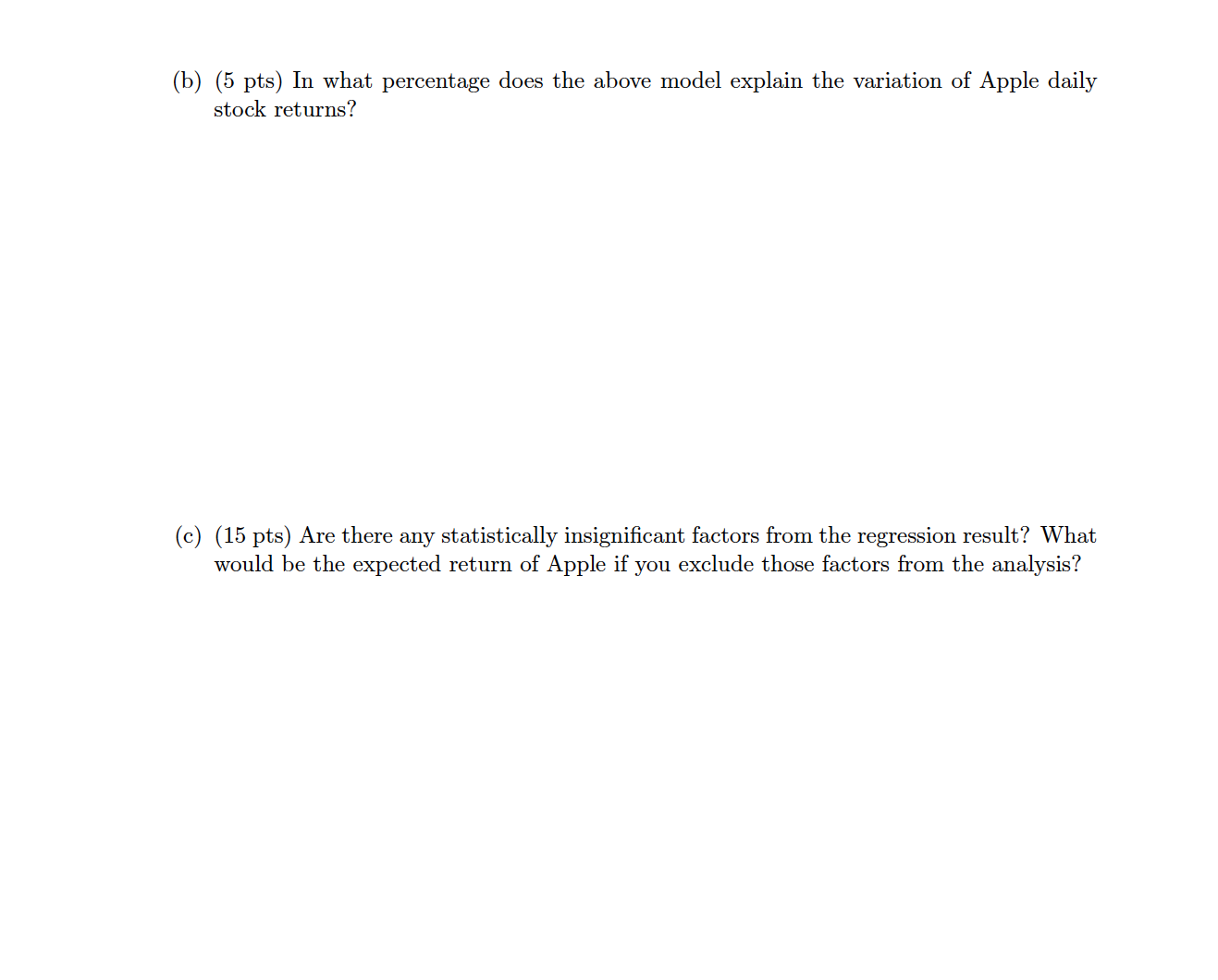

Please help me with the 2 questions in the attachment They are from McMaster commerce 3FB3 course Thank you! Numerical Problems (60 points) 1. (30

Please help me with the 2 questions in the attachment

They are from McMaster commerce 3FB3 course

Thank you!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started