Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me with the first three questions The balance sheets at the end of each of the first two years of operations indicate the

please help me with the first three questions

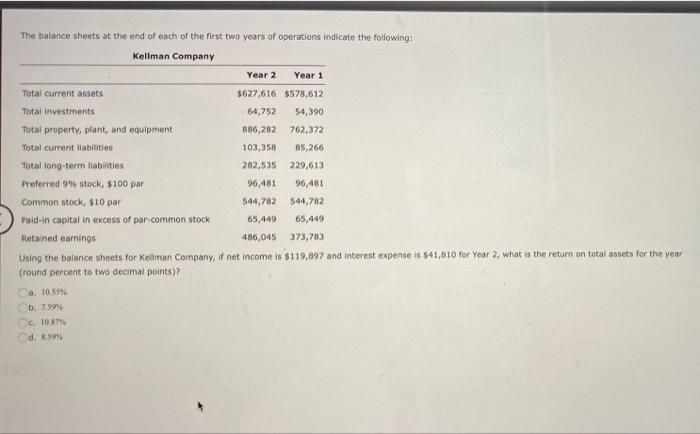

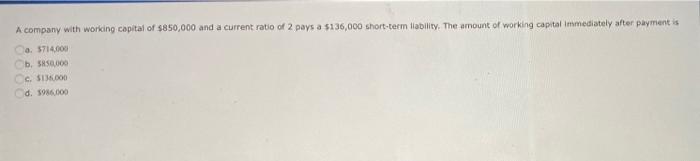

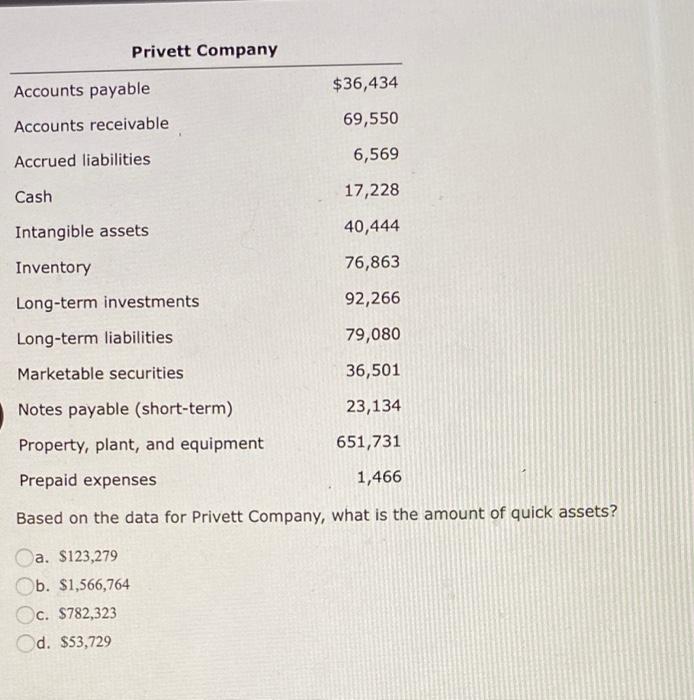

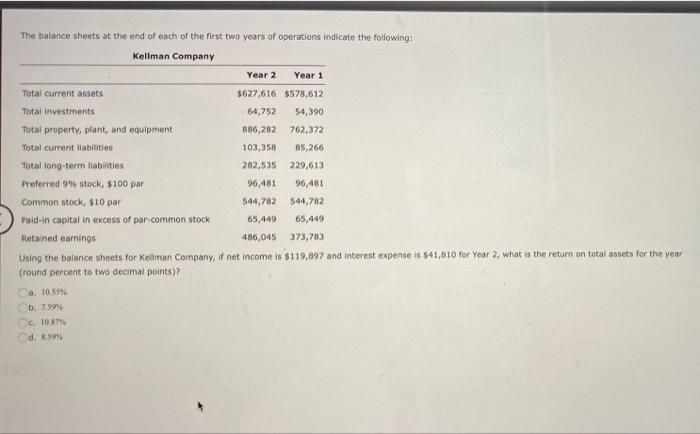

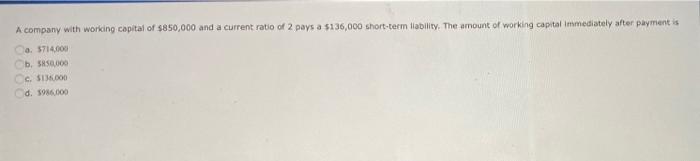

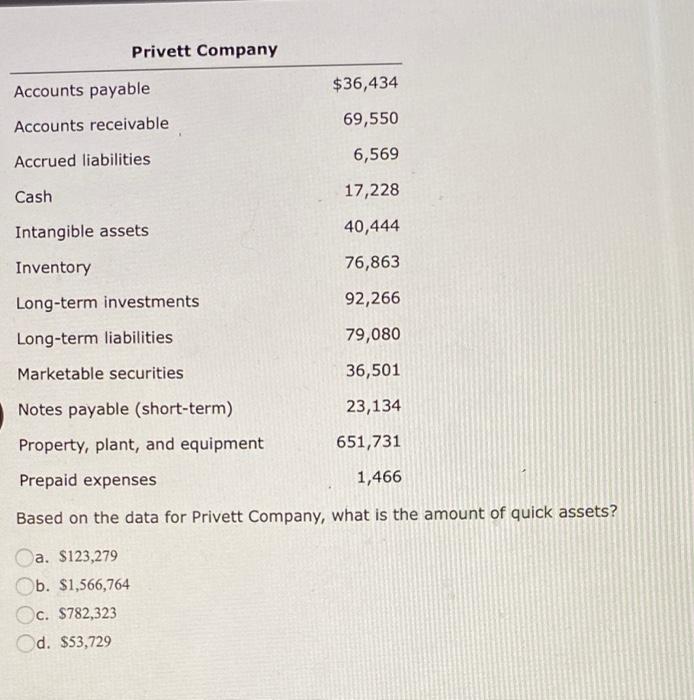

The balance sheets at the end of each of the first two years of operations indicate the following: Kellman Company Year 2 Year 1 Total current assets $627,616 $578,612 Total investments 64,752 54,390 Total property, plant, and equipment 886,282 762,372 Total current liabilities 103,358 85,266 Total long-term liabilities 282,535 229,613 Preferred 9 stock, $100 par 96,481 96,481 Common stock, $10 par 544,782 544,762 Paid-in capital in excess of par common stock 65,449 65,449 Retained earnings 486,045 373,783 Using the balance sheets for Kollman Company, ir net income is $119,897 and interest expense is $41,810 for Year 2. what is the return on total assets for the year (round percent to two decimal points)? Ca. 10:55 b. 759 10.87% Cd.sos A company with working capital of $850,000 and a current ratio of 2 pays a $136,000 short-term liability. The amount of working capital immediately after payment is a. 5714.000 b. SR50.000 c. $136.000 d. 1986.000 Privett Company Accounts payable $36,434 Accounts receivable 69,550 Accrued liabilities 6,569 Cash 17,228 Intangible assets 40,444 Inventory 76,863 Long-term investments 92,266 Long-term liabilities 79,080 Marketable securities 36,501 Notes payable (short-term) 23,134 Property, plant, and equipment 651,731 Prepaid expenses 1,466 Based on the data for Privett Company, what is the amount of quick assets? Ca. $123,279 b. $1,566,764 c. $782,323 d. $53,729

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started