Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me with the first two questions Delaney Company is considering replacing equipment that originally cost $512,000 and has accumulated depreciation of $358,400 to

please help me with the first two questions

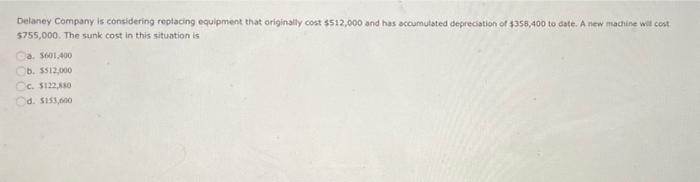

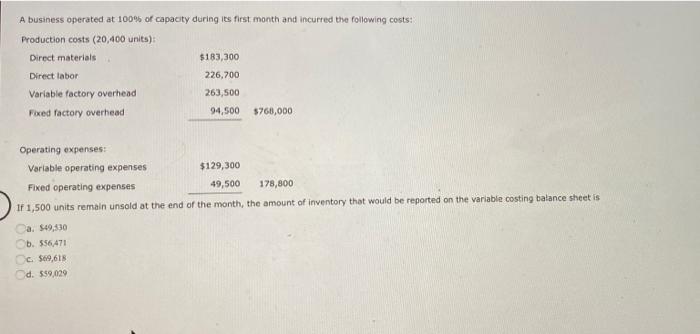

Delaney Company is considering replacing equipment that originally cost $512,000 and has accumulated depreciation of $358,400 to date. A new machine will cost $755,000. The sunk cost in this situation is Ca. $601,400 Ob. $512,000 Cc. $122,880 Od. $153,000 A business operated at 100% of capacity during its first month and incurred the following costs: Production costs (20,400 units): Direct materials $183,300 Direct labor 226,700 Variable factory overhead 263,500 Fixed factory overhead i 94,500 $768,000 Operating expenses: Variable operating expenses $129,300 Fixed operating expenses 49,500 178,800 If 1,500 units remain unsold at the end of the month, the amount of inventory that would be reported on the variable costing balance sheet is a. $49,530 Ob. $56,471 Oc. $69,618 Od. $59,029

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started