Question

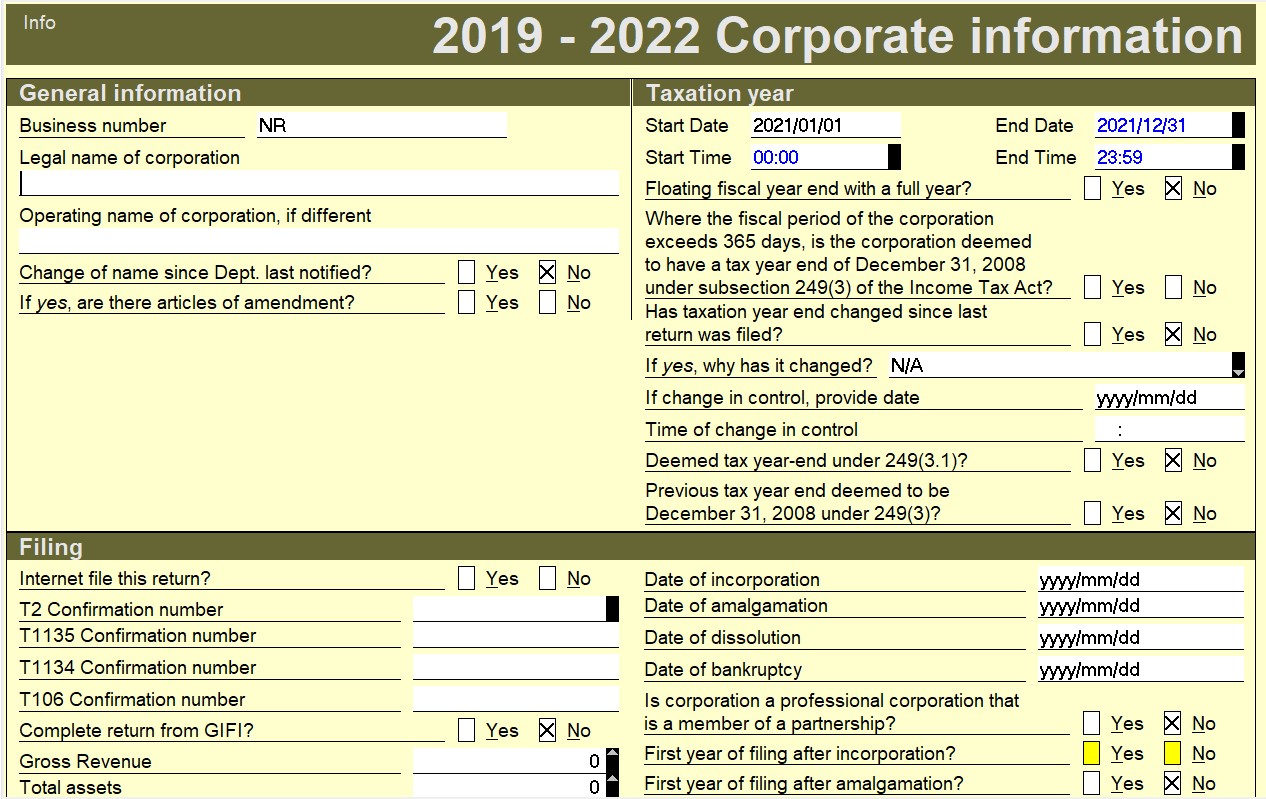

Please help me with the following. and the screenshots are the profile software which needs to be filled according the given information. Thanks PROFILE ASSIGNMENT

Please help me with the following. and the screenshots are the profile software which needs to be filled according the given information. Thanks

PROFILE ASSIGNMENT

1. Include your name in the First Legal Name of the Corporation.

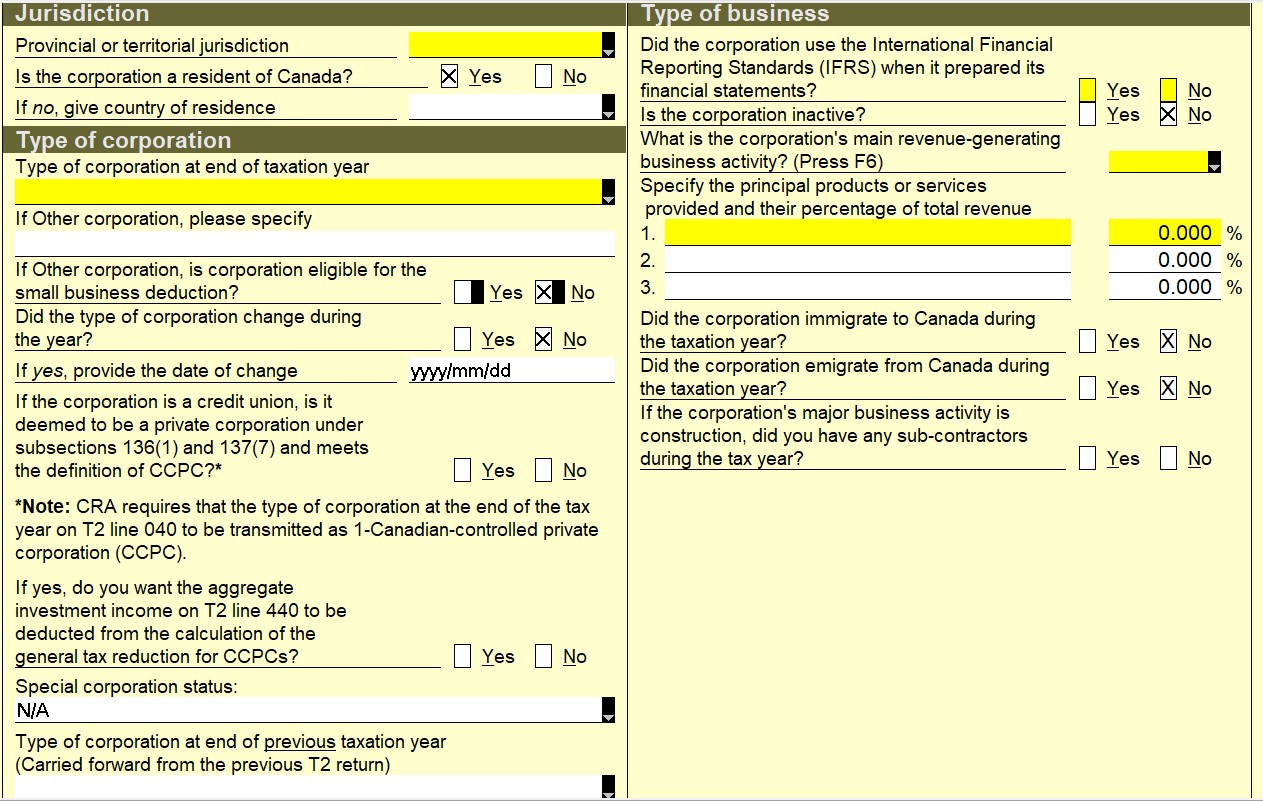

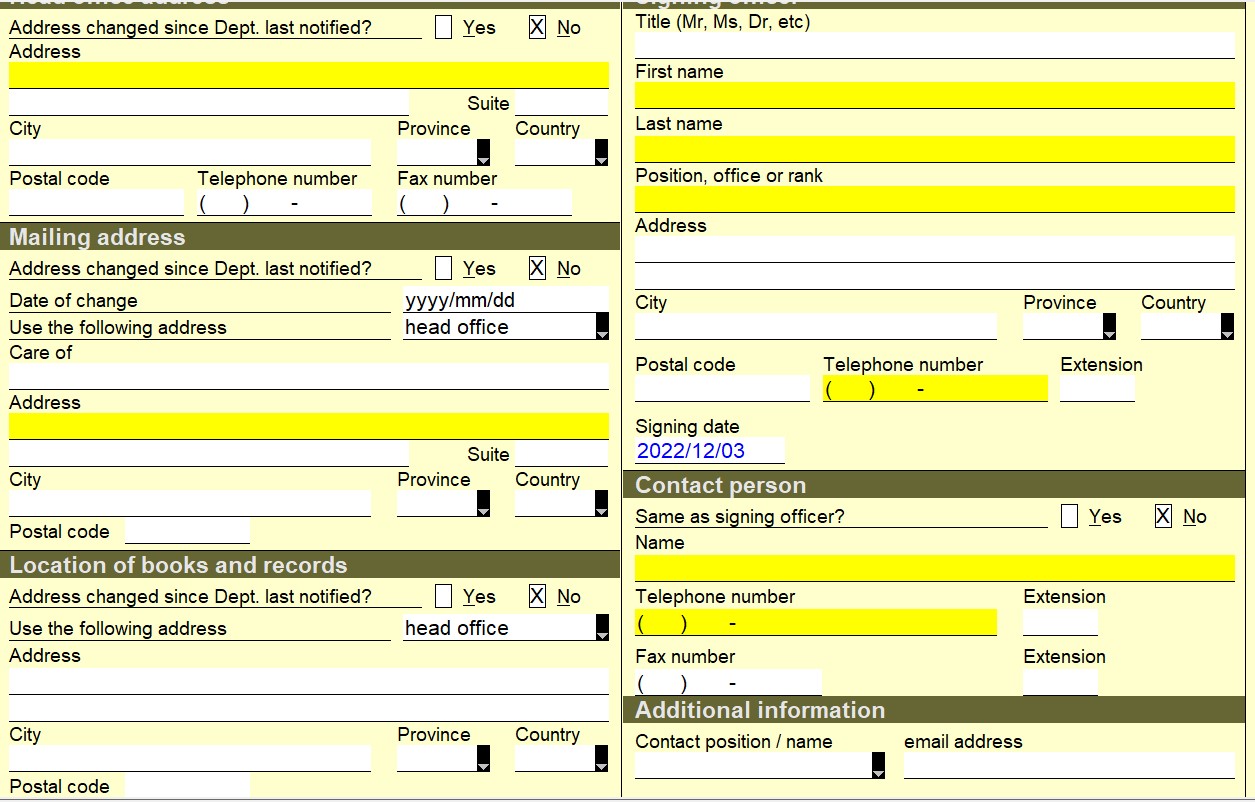

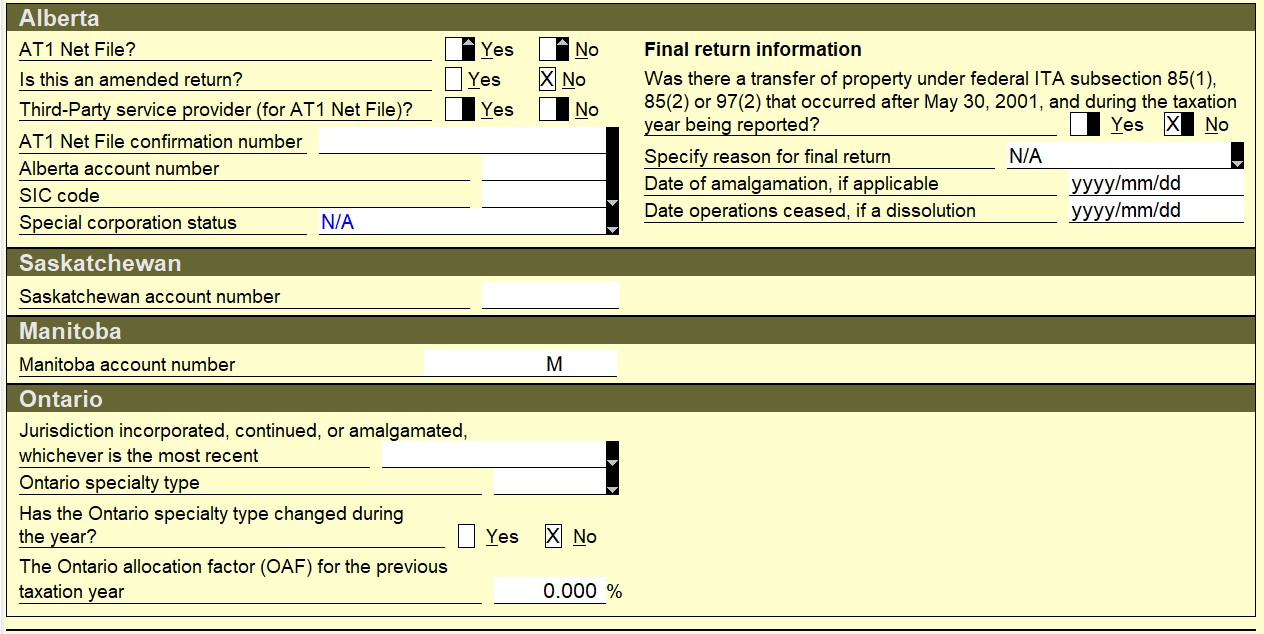

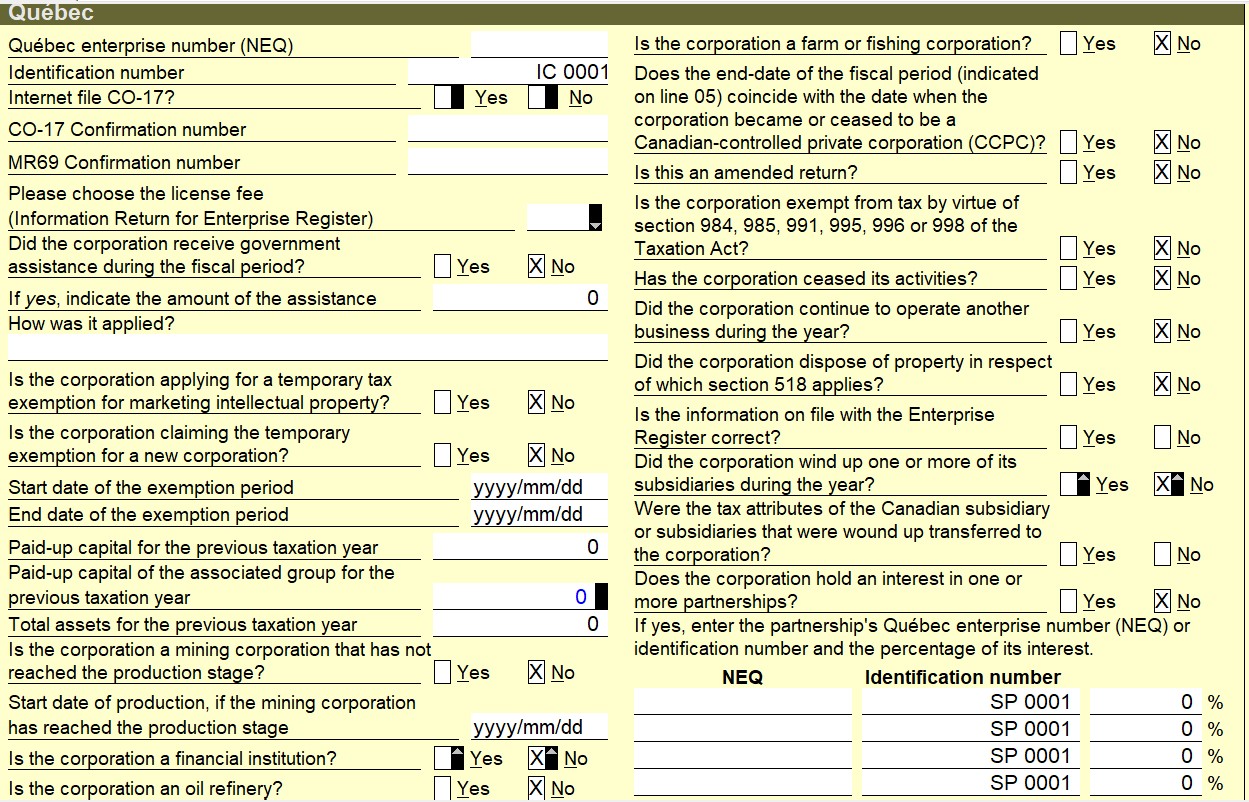

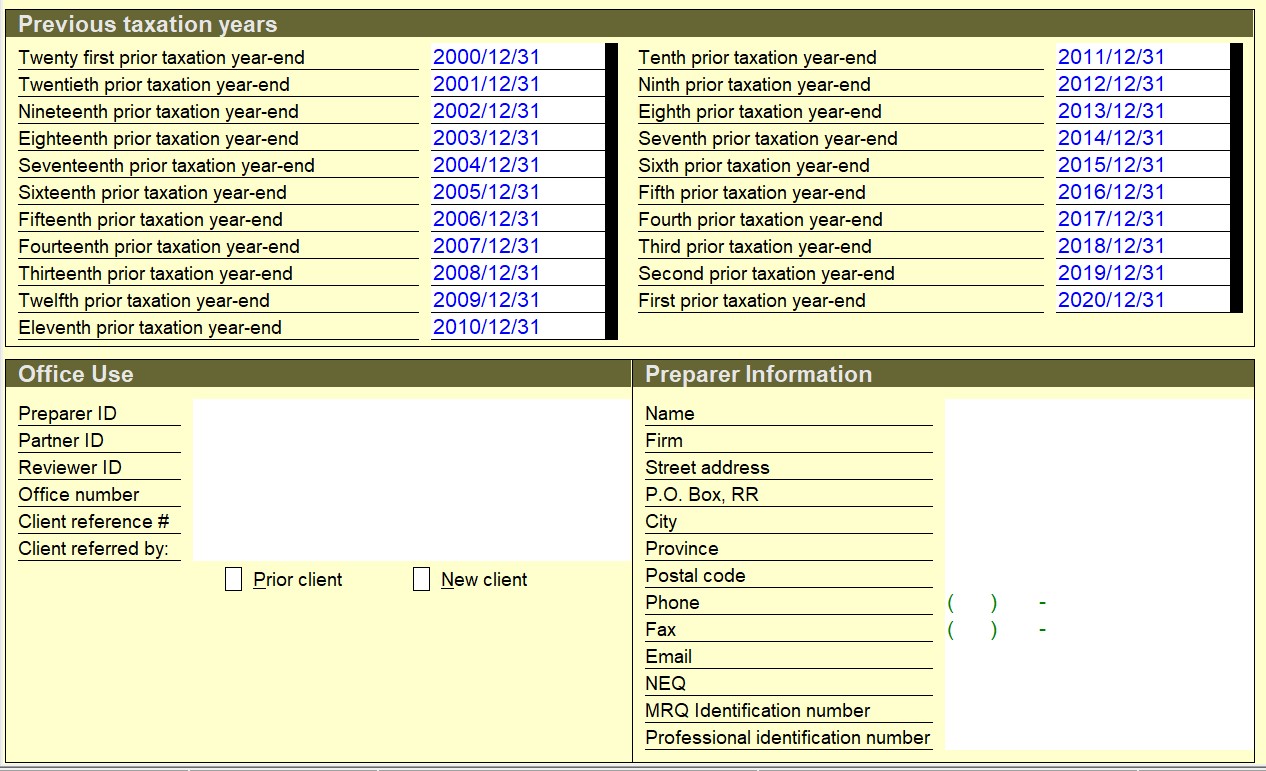

Use NR for the corporation's business number. The corporation's name is "Your First Name" Inc. It is a Canadian Controlled Private Corporation based in Ontario. Its head office is located at 700 King Street, Toronto, Ontario, M5T 2T9. Its telephone number is (416) 944-2222. The signing officer and contact person is the President of the corporation, Abe Nakajima."Your First Name" Inc. was incorporated in Ontario on January 1, 2007. It has a December 31fiscal year end.

"Your First Name" Inc. is a supermarket chain operating only in the Province of Ontario. Most of its income is earned from an active business.Its main revenue generating business activity is 445110.

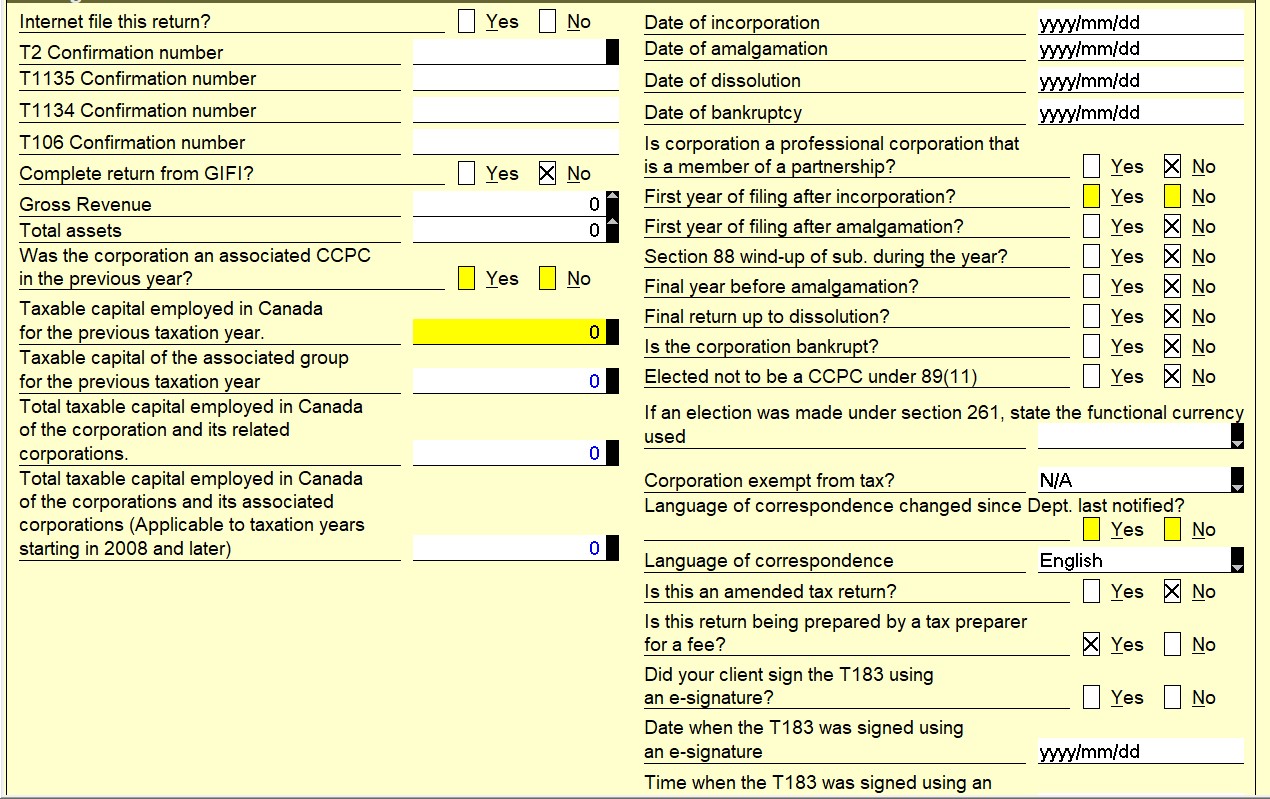

"Your First Name" Inc. is associated with its subsidiary, Good Foods Inc., which is also a CCPC and has a December 31 fiscal year end. Good Foods Inc.'s Taxable Capital Employed in Canada in 2020 was $3,000,000.At the end of 2020, Good Foods Inc.'sadjusted aggregate investment income (AAII) was $10,000.The small business deduction is allocated 35% to Good Foods Inc. and 65% to "Your First Name" Inc. "Your First Name" Inc. owns 70% of the common voting shares of Good Foods Inc.Use NR for Good Foods Inc.'s corporation business number.

As at December 31, 2020, the following information applied to "Your First Name" Inc.:

Adjusted Aggregate Investment Income $110,000

Taxable Capital Employed in Canada $4,000,000

Non-Eligible RDTOH as at December 31, 2020 $25,000

Eligible RDTOH as at December 31, 2020 $15,000

Eligible Dividends Declared and Paid during 2020 NIL

GRIP Balance $100,000

During the taxation year ending December 31, 2021, the condensed before tax Income Statement of "Your First Name" Inc. was prepared in accordance with the International Reporting Standards (IFRS).In condensed form it is as follows:

"Your First Name" Inc.

IncomeStatement

YearEndingDecember31,2021

Sales Revenue | $4,000,000 | |

Gainon Sale of Building | 300,000 | $4,300,000 |

Cost of Goods Sold | $ 700,000 | |

Amortization Expense | 200,000 | |

Other Expenses Excluding Taxes | 1,700,000 | 2,600,000 |

AccountingIncome BeforeTaxes | $1,700,000 |

Other information:

- Other Expenses included $4,000 in parking tickets incurred in 2021 while delivering groceries to homes in Ontario.

- Other Expenses also include a deduction for charitable donations to the United Way of $30,000.

- Other expenses also include a deduction for meals and entertainment of $8,000 and a deduction for membership dues at a Golf and Country Club of $13,000.

- Sales Revenue includes an eligible dividend of $35,000 received from the Bank of Montreal, a taxable Canadian Corporation."Your First Name" Inc. is neither associated nor connected with the Bank of Montreal. The dividend received from the Bank is considered a portfolio dividend.It is also an eligible dividend.

- Sales Revenue also includes a non-eligible dividend of $105,000 received from Good Foods Inc. Good Foods Inc. received a dividend refund of $40,000 when it paid total dividends of $150,000. The $105,000 that "Your First Name" Inc. received is 70% of the total non-eligible dividend paid.

- "Your First Name" Inc. paid a taxable non-eligible dividend of $25,000.

- During 2021 "Your First Name" Inc. earned $110,000 of interest income on CP Rail bonds purchased in 2014 that mature in 2027.

- "Your First Name" Inc. has available a non-capital loss carry-over of $30,000 from the previous year. It also has a net-capital loss carry-over from 2015 of $25,000 (1/2 of $50,000).

- On January 1, 2021, "Your First Name" Inc. had the following UCC balances:

Class 1 $400,000

Class 8 $575,000

Class 10 45,000

10. The Gain on the Sale of Building resulted from the sale of the building for proceeds of $850,000 of which $150,000 was allocated to the land upon which the building was situated. The building was acquired on July 1, 2006, for $700,000 of which $100,000 was allocated to the land. This was the only asset in Class 1.

11. There were no dispositions in Class 8 during the year, but there was an addition of $125,000 to Class 8. This addition is eligible for Accelerated Investment Incentive Treatment.The addition occurred on July 1, 2021.

12. "Your First Name" Inc. has decided to lease all of its vehicles in the future, and so all of the assets in Class 10 are sold during the year. The capital cost of these assets was $75,000 and the proceeds of disposition was $20,000.The net book value of these assets was $60,000, and the resulting accounting loss of $40,000 was included in Other Expenses.

13. All of the common shares of "Your First Name" Inc. were owned by Barbara Franklin whose SIN # is 527-000-582.

14. The beginning balance in "Your First Name" Inc.'s capital dividend account is nil.

15. "Your First Name" Inc. paid one federal tax instalment of $250,000 on March 1, 2021.

REQUIRED:The federal corporate tax return for "Your First Name" Inc. for the 2021 taxation year using the ProFile T2 software program needs to be prepared. Make sure that also complete the GIFI and the notes to GIFI. In completing the GIFI, make sure that you put the amount given for Cost of Goods Sold on the Condensed Income Statement under Cost of Sales in Schedule 125. In doing this, please use Code 8320 which is "Purchases/Cost of Materials". See the following listing of some of the Schedules for the Income Tax Return.

| SCHEDULE | DESCRIPTION |

| Schedule 1 | Net Income (Loss) for Income Tax Purposes |

| Schedule 2 | Charitable Donations |

| Schedule 3 | Dividends Received, Taxable Dividends Paid, and Part IV Tax Calculation |

| Schedule 4 and Schedule 4 Supplemental | Non-Capital and Capital Carryforwards |

| Schedule 5 | Tax Calculation Supplementary - Corporations (Permanent Establishment Location) |

| Schedule 6 | Summary of Dispositions of Capital Property |

| Schedule 7 | Aggregate Investment Income, Adjusted Aggregate Investment Income, and Active Business Income |

| Schedule 8 | Capital Cost Allowance |

| Schedule 9 | Related and Associated Corporations |

| Schedule 13 | Reserves |

| Schedule 21 | Foreign Tax Credits |

| Schedule 23 | Associated CCPC's - Business Limit Allocation |

| Schedule 27 | Manufacturing and Processing Profits Calculation |

| Schedule 50 | Shareholder Information |

| Schedule 53 | General Rate Income Pool (GRIP) Calculation |

| Schedule 100 | GIFI Balance Sheet Income |

| Schedule 125 | GIFI Income Statement Information |

| Schedule 141 | GIFI Notes Checklist |

| TaxPaid | Tax Instalments Paid |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started