please help me with the following questions

1.

2.

3.

thank you

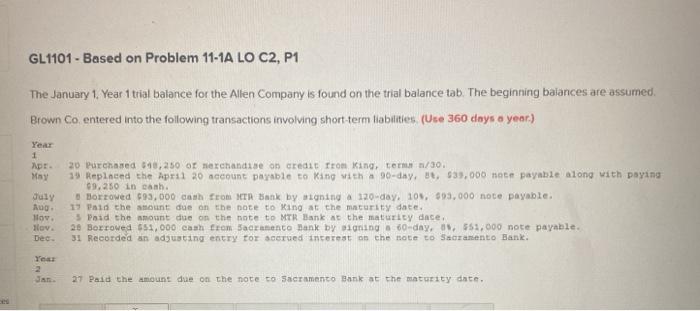

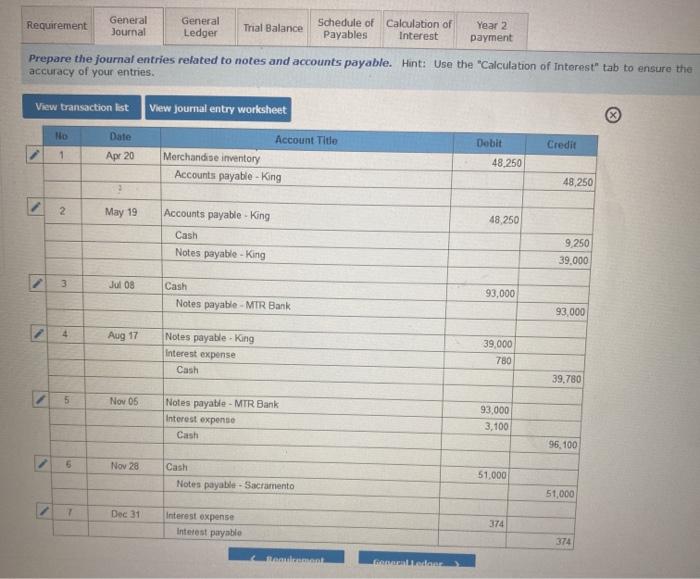

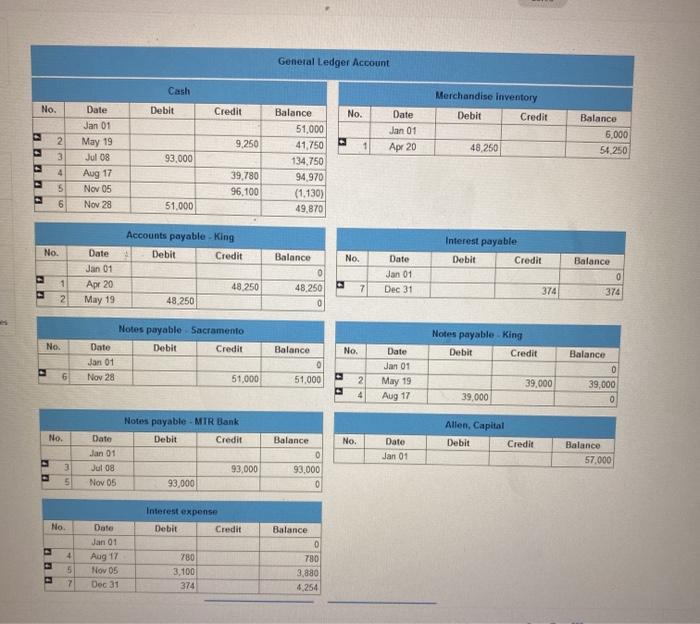

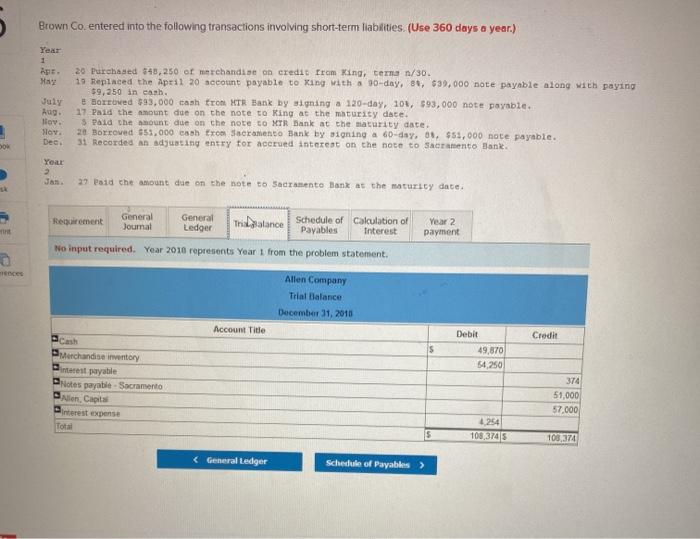

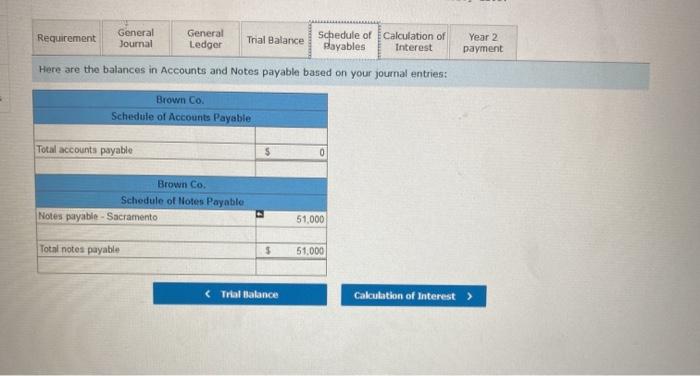

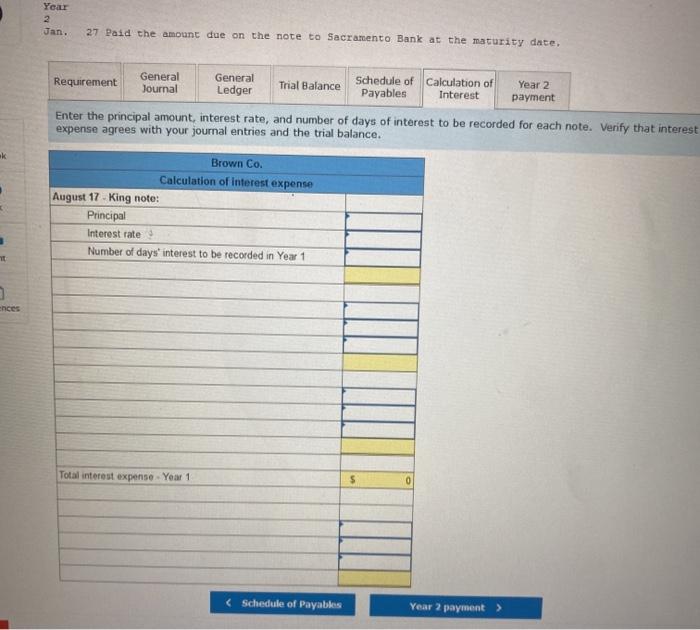

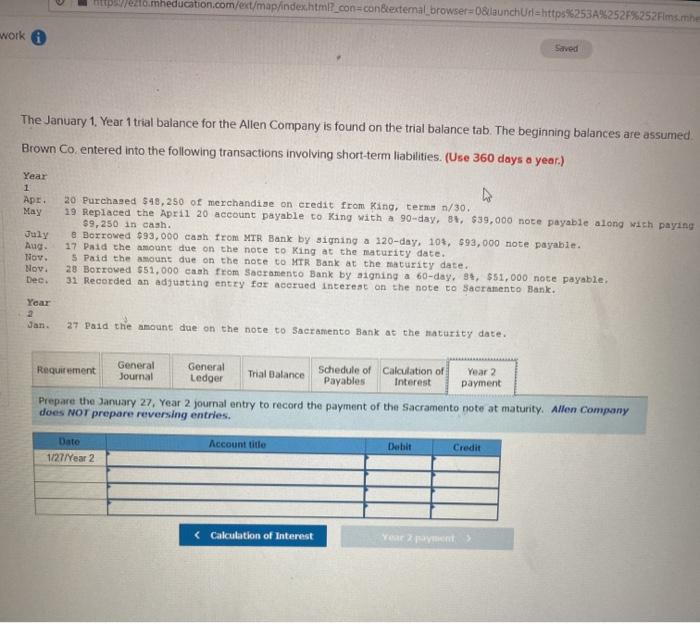

GL1101- Based on Problem 11-1A LO C2, P1 The January 1 Year 1 trial balance for the Allen Company is found on the trial balance tab. The beginning balances are assumed. Brown Co entered into the following transactions involving short-term liabilities (Ure 360 days a year) Year 1 May July Aug Hov lov. 20 Purchased $10,250 Or Nerchandise on credit from King, ter/30. 19 Replaced the April 30 nccount parable to King with a 90-day, B, 639,000 note payable along with paying 69.250 in canh Borrowed 93,000 cash from MTR Bank by signing a 120-day, 105,093.000 note payable. 17 Paid the amount due on the note to King at the maturity date. 5 Poid the amount due on the note to MTR Bank at the maturity dace 26 Borrowed 651,000 cash from Sacramento Bank by signing 60-day. 0.551.000 note payable. 31 Recorded an adjusting entry for accrued interest on the note to Seoramento Bank Dec 27 Paid the amount due on the note to Sacramento Bank at the maturity date. General General Requirement Schedule of Calculation of Year 2 Journal Ledger Trial Balance Payables Interest payment Prepare the journal entries related to notes and accounts payable. Hint: Use the "Calculation of Interest tab to ensure the accuracy of your entries. View transaction list View journal entry worksheet No Account Title Date Apr 20 Debit Credit 1 Merchandise inventory Accounts payable - King 48,250 48,250 2 May 19 48,250 Accounts payable - King Cash Notes payable - King 9 250 39.000 3 Jul 08 93,000 Cash Notes payable - MTR Bank 93.000 4 Aug 17 Notes payable King Interest expense Cash 39,000 780 39.780 5 Nov 05 Notes payable - MTR Bank Interest expense Cash 93,000 3.100 96.100 5 Nov 28 Cash Notes payable - Sacramento 51.000 51,000 7 Dec 31 Interest expense Interest payable 374 374 Boneco Freda General Ledger Account Cash No. Debit Merchandise Inventory Debit Credit Credit No. Date Jan 01 Apr 20 Balance 6,000 54.250 9.250 1 48250 93,000 DEL Date Jan 01 May 19 Jul 08 Aug 17 Nov 05 Nov 28 2 3 4 5 6 Balance 51,000 41.750 134.750 94.970 (1.130) 49,870 39.780 96,100 51.000 Accounts payable - King Debit Credit Interest payable No. Balance No. Debit Credit 0 Date Jan 01 Apr 20 May 19 Date Jan 01 Dec 31 Balance 0 1 48.250 7 374 48.250 0 374 2 48.250 Notes payable Sacramento No. Notes payable King Debit Credit Debit Credit Balance No. Date Jan 01 Nov 28 6 51.000 Date Jan 01 May 19 Aug 17 51.000 2 4 Balance 0 39,000 0 39,000 39,000 Notes payable - MIR Bank Debit Credit No. Allen, Capital Debit Credit No. Date Jan 01 Jul 08 Nov 05 Balance 0 93.000 Date Jan 01 Balance 57.000 3 93,000 5 93,000 Interest expense Debit Credit No Date Jan 01 Aug 17 4 5 7 Balance 0 780 3,880 4.254 780 3,100 374 Nov 05 Dec 31 Brown Co. entered into the following transactions involving short-term liabilities. (Use 360 days a year.) Year As. Hay July Aug lov. Nov. Dec. 20 Purchased 348,250 of merchandise on credit from King, teran/30. 19 Replaced the April 20 account payable to King with a 10-day, 80, 639,000 note payable along with paying $9,250 in cash. Borrowed $3,000 cash tro MTR Bank by signing a 120-day, 103, 93, 000 note payable. 17 Paid the amount due on the note to King at the maturity date. 5 Paid the amount due on the note to MTR Bank at the maturity date. 2 Boroved $53.000 cash from Sacramento Bank by signing a 60-day, 09, $5,000 note payable. 31 Recorded an adjusting entry for accrued interest on the note to Sacramento Bank SO Year 2 27 Paid the amount due on the note to Sacramento Bank at the maturity date. Requirement General Journal General Ledger Trabaratance Schedule of Calculation of Interest Year 2 payment No input required. Year 2010 represents Year 1 from the problem statement Allen Company Trial Balance December 31, 2018 Account Title Credit S Debit 49,870 54,250 Cash Merchandise inventory interest payable Notes payable - Sacramento in Capita interest expense Total 374 51,000 57.000 4.254 108,3745 103,374 Requirement General Journal General Ledger Trial Balance Schedule of Calculation of Payables Interest Year 2 payment Here are the balances in Accounts and Notes payable based on your journal entries: Brown Co. Schedule of Accounts Payable Total accounts payable $ Brown Co. Schedule of Notes Payable Notes payable - Sacramento 51.000 Total notes payable $ 51.000 (Trial Balance Calculation of Interest Year 2 Jan. 27 Paid the amount due on the note to Sacramento Bank at the maturity date. General General Requirement Schedule of Calculation of Journal Trial Balance Year 2 Ledger Payables Interest payment Enter the principal amount interest rate, and number of days of interest to be recorded for each note. Verify that interest expense agrees with your journal entries and the trial balance. ak Brown Co. Calculation of interest expense August 17. King note: Principal Interest rate Number of days interest to be recorded in Year 1 ences Total interest expense . Year 1 Veomheducation.com/ext/map/index.html?_con-con&external browser=08daunchUrl=http%253A%252F%252Flms.me wwork Saved The January 1. Year 1 trial balance for the Allen Company is found on the trial balance tab. The beginning balances are assumed Brown Co. entered into the following transactions involving short-term liabilities. (Use 360 days a year.) Year 1 Apr. May July Aug. Nov Nov. Dec. 20 Purchased $48, 250 of merchandise on credit from Ring, term n/30. 19 Replaced the April 20 account payable to King with a 90-day, 81, $39,000 note payable along with paying $9, 250 in cash e Borrowed 93,000 cash from MTR Bank by signing a 120-day, 10%, 593, 000 note payable. 17 Paid the amount due on the note to King at the maturity date. 5 Paid the amount due on the note to MTR Bank at the maturity date. 28 Borrowed $51.000 cash from Sacramento Bank by signing a 60-day, 94, $51,000 note payable. 31 Recorded an adjusting entry for accrued interest on the note to Sacramento Bank. Year 27 Paid the amount due on the note to Sacramento Bank at the natursty date. Year 2 General General Requirement Schedule of Calculation of Journal Trial Balance Ledger Payables Interest payment Prepare the January 27, Year 2 journal entry to record the payment of the Sacramento note at maturity. Allen Company does NOT prepare reversing entries. Date 1/27/Year 2 Account title Debit Credit Requirement General Journal General Ledger Trial Balance Schedule of Calculation of Payables Interest Year 2 payment Here are the balances in Accounts and Notes payable based on your journal entries: Brown Co. Schedule of Accounts Payable Total accounts payable $ Brown Co. Schedule of Notes Payable Notes payable - Sacramento 51.000 Total notes payable $ 51.000 (Trial Balance Calculation of Interest Year 2 Jan. 27 Paid the amount due on the note to Sacramento Bank at the maturity date. General General Requirement Schedule of Calculation of Journal Trial Balance Year 2 Ledger Payables Interest payment Enter the principal amount interest rate, and number of days of interest to be recorded for each note. Verify that interest expense agrees with your journal entries and the trial balance. ak Brown Co. Calculation of interest expense August 17. King note: Principal Interest rate Number of days interest to be recorded in Year 1 ences Total interest expense . Year 1 Veomheducation.com/ext/map/index.html?_con-con&external browser=08daunchUrl=http%253A%252F%252Flms.me wwork Saved The January 1. Year 1 trial balance for the Allen Company is found on the trial balance tab. The beginning balances are assumed Brown Co. entered into the following transactions involving short-term liabilities. (Use 360 days a year.) Year 1 Apr. May July Aug. Nov Nov. Dec. 20 Purchased $48, 250 of merchandise on credit from Ring, term n/30. 19 Replaced the April 20 account payable to King with a 90-day, 81, $39,000 note payable along with paying $9, 250 in cash e Borrowed 93,000 cash from MTR Bank by signing a 120-day, 10%, 593, 000 note payable. 17 Paid the amount due on the note to King at the maturity date. 5 Paid the amount due on the note to MTR Bank at the maturity date. 28 Borrowed $51.000 cash from Sacramento Bank by signing a 60-day, 94, $51,000 note payable. 31 Recorded an adjusting entry for accrued interest on the note to Sacramento Bank. Year 27 Paid the amount due on the note to Sacramento Bank at the natursty date. Year 2 General General Requirement Schedule of Calculation of Journal Trial Balance Ledger Payables Interest payment Prepare the January 27, Year 2 journal entry to record the payment of the Sacramento note at maturity. Allen Company does NOT prepare reversing entries. Date 1/27/Year 2 Account title Debit Credit