Question: Please help me with the tax return info. Please note that all of the boxes on the tax forms does NOT have to be filled,

Please help me with the tax return info. Please note that all of the boxes on the tax forms does NOT have to be filled, only the relevant ones to this question. I apologize for any inconveniences. I have all the information needed in here. (No seriously I do. This is literally everything I can gather.)

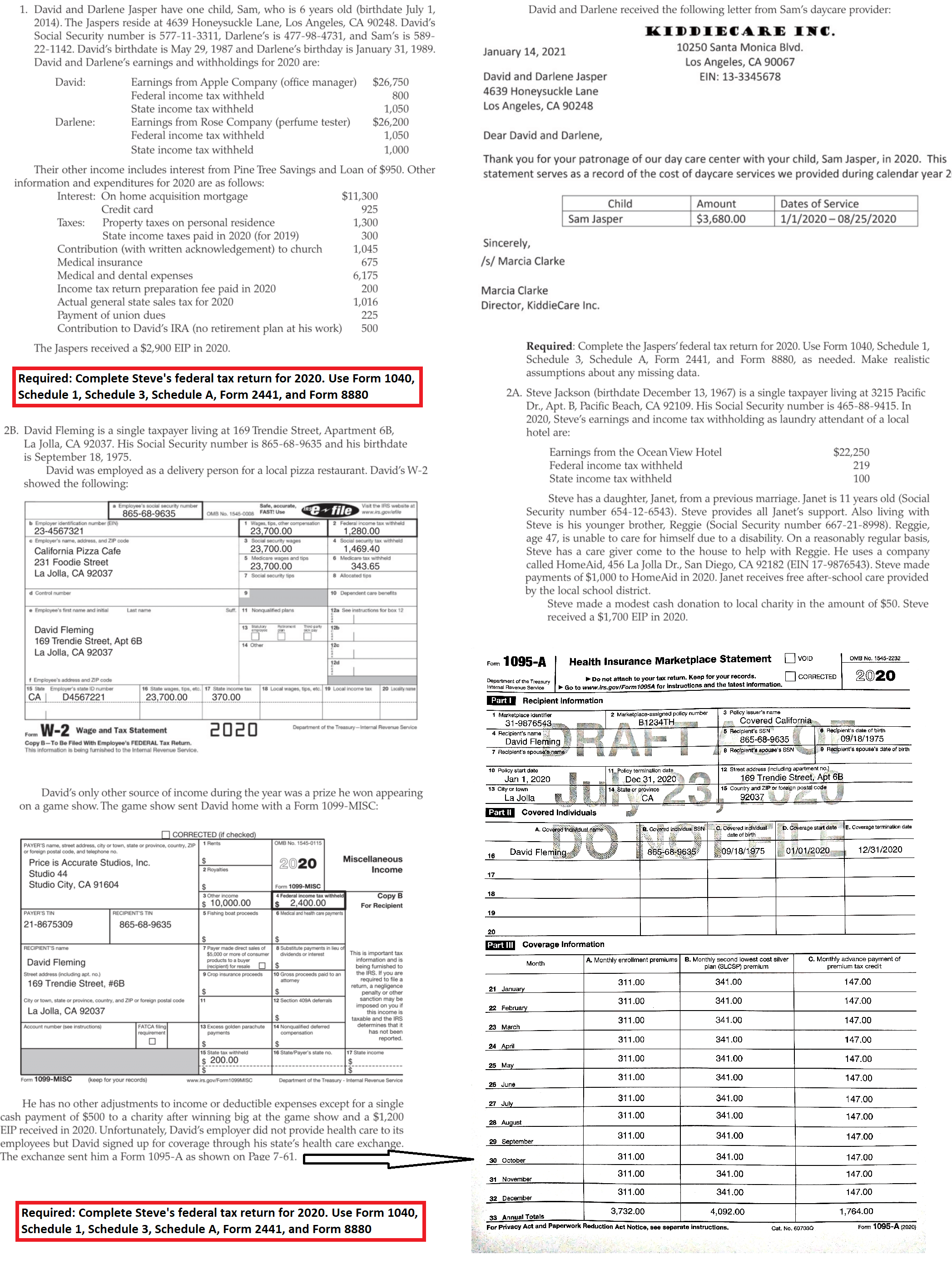

David and Darlene received the following letter from Sam's daycare provider: KIDDIECARE INC. January 14, 2021 10250 Santa Monica Blvd. Los Angeles, CA 90067 David and Darlene Jasper EIN: 13-3345678 4639 Honeysuckle Lane Los Angeles, CA 90248 1. David and Darlene Jasper have one child, Sam, who is 6 years old (birthdate July 1, 2014). The Jaspers reside at 4639 Honeysuckle Lane, Los Angeles, CA 90248. David's Social Security number is 577-11-3311, Darlene's is 477-98-4731, and Sams is 589- 22-1142. David's birthdate is May 29, 1987 and Darlene's birthday is January 31, 1989. David and Darlene's earnings and withholdings for 2020 are: David: Earnings from Apple Company (office manager) $26,750 Federal income tax withheld 800 State income tax withheld 1,050 Darlene: Earnings from Rose Company (perfume tester) $26,200 Federal income tax withheld 1,050 State income tax withheld 1,000 Their other income includes interest from Pine Tree Savings and Loan of $950. Other information and expenditures for 2020 are as follows: Interest: On home acquisition mortgage $11,300 Credit card 925 Taxes: Property taxes on personal residence 1,300 State income taxes paid in 2020 (for 2019) 300 Contribution (with written acknowledgement) to church 1,045 Medical insurance 675 Medical and dental expenses 6,175 Income tax return preparation fee paid in 2020 200 Actual general state sales tax for 2020 1,016 Payment of union dues 225 Contribution to David's IRA (no retirement plan at his work) 500 The Jaspers received a $2,900 EIP in 2020. Dear David and Darlene, Thank you for your patronage of our day care center with your child, Sam Jasper, in 2020. This statement serves as a record of the cost of daycare services we provided during calendar year 2 Child Sam Jasper Amount $3,680.00 Dates of Service 1/1/2020 - 08/25/2020 Sincerely, /s/ Marcia Clarke Marcia Clarke Director, KiddieCare Inc. Required: Complete Steve's federal tax return for 2020. Use Form 1040, Schedule 1, Schedule 3, Schedule A, Form 2441, and Form 8880 2B. David Fleming is a single taxpayer living at 169 Trendie Street, Apartment 6B, La Jolla, CA 92037. His Social Security number is 865-68-9635 and his birthdate is September 18, 1975. David was employed as a delivery person for a local pizza restaurant. David's W-2 showed the following: Required: Complete the Jaspers' federal tax return for 2020. Use Form 1040, Schedule 1, Schedule 3, Schedule A, Form 2441, and Form 8880, as needed. Make realistic assumptions about any missing data. 2A. Steve Jackson (birthdate December 13, 1967) is a single taxpayer living at 3215 Pacific Dr., Apt. B, Pacific Beach, CA 92109. His Social Security number is 465-88-9415. In 2020, Steve's earnings and income tax withholding as laundry attendant of a local hotel are: Earnings from the Ocean View Hotel $22,250 Federal income tax withheld 219 State income tax withheld 100 Steve has a daughter, Janet, from a previous marriage. Janet is 11 years old (Social Security number 654-12-6543). Steve provides all Janet's support. Also living with Steve is his younger brother, Reggie (Social Security number 667-21-8998). Reggie, age 47, is unable to care for himself due to a disability. On a reasonably regular basis, Steve has a care giver come to the house to help with Reggie. He uses a company called HomeAid, 456 La Jolla Dr., San Diego, CA 92182 (EIN 17-9876543). Steve made payments of $1,000 to HomeAid in 2020. Janet receives free after-school care provided by the local school district. Steve made a modest cash donation to local charity in the amount of $50. Steve received a $1,700 EIP in 2020. a Employee's social security number 865-68-9635 b Employer identification number (EIN) 23-4567321 c Employer's name, address, and ZIP code California Pizza Cafe 231 Foodie Street La Jolla, CA 92037 Safe, accurate, unse-file www.rs.goviefile Visit the IRS website at OMB No 1545-0008 FAST! Use 1 Wages, tips, other compensation 2 Federal income tax withheld 23,700.00 1,280.00 3 Social security wages 4 Social security tax withheld 23,700.00 1,469.40 5 Medicare wages and tips 6 Medicare tax withheld 23,700.00 343.65 7 Social security tips 8 Allocated tips d Control number 9 10 Dependent care benefits e Employee's first name and initial Last name Sutt. 11 Nonqualified plans 12a See instructions for box 12 13 Sunton enge Retromen Third party 12b 8 David Fleming 169 Trendie Street, Apt 6B La Jolla, CA 92037 14 Other 12c 8 VOID OMD No, 1545-2232 12d Form 1095-A Health Insurance Marketplace Statement 2020 f Employee's address and ZIP code 15 State Employer's state ID number | D4567221 18 Local wages, tips, etc. 19 Local income tax 20 Localitate 16 State wages, tips, etc. 17 State income tax 23,700.00 370.00 Department of the Treasury Do not attach to your tax retum. Keep for your records, CORRECTED Internal Revenue Service Go to www.irs.gov/Form 1095A for instructions and the latest Information. Partl Recipient Information 1 Marketplace Identifier 2 Marketplace-assigned pollcy number 3 Policy issuer's name 31-9876543 B1234TH Covered California 4 Recipient's name 6 Recipient's SSN 6 Recipient's date of birth David Fleming 865-68-9635 09/18/1975 7 Reciplent's spouso's name 8 Recipient's spouse's SSN 0 Recipient's spouse's date of birth Form W-2 Wage and Tax Statement 2020 Department of the Treasury - Internal Revenue Service Copy B-To Be Filed With Employee's FEDERAL Tax Return This information is being furnished to the Internal Revenue Service. ORARE 23 10 Policy start date Jan 1, 2020 13 City or town La Jolla 11 Policy termination date Dec 31, 2020 14 State or province CA 12 Street address (including apartment no.) 169 Trendie Street, Apt 6B 15 Country and ZIP or foreign postal code 92037 David's only other source of income during the year was a prize he won appearing on a game show. The game show sent David home with a Form 1099-MISC: Part 11 Covered Individuals A. Covered individual name B. Covered individual SSN C. Covered individual date of birth D. Coverage start date E. Coverage termination date OMB No. 1545-0115 David Fleming 865-68-9635 09/18/1975 01/01/2020 16 12/31/2020 2020 Miscellaneous Income 17 CORRECTED (if checked) PAYER'S name, street address, city or town, state or province, country, ZIP 1 Rents or foreign postal code, and telephone no. Price is Accurate Studios, Inc. $ 2 Royalties Studio 44 Studio City, CA 91604 3 Other income $ 10,000.00 PAYER'S TIN RECIPIENT'S TIN 5 Fishing boat proceeds 21-8675309 865-68-9635 18 Form 1099-MISC 4 Federal income tax withheld $ 2,400.00 6 Medical and health care payments Copy B For Recipient 19 20 Part III Coverage Information Month A. Monthly enrollment premiums B. Monthly second lowest cost silver plan (SLCSP) premium C. Monthly advance payment of premium tax credit 311.00 341.00 147.00 21 January 311.00 341.00 147.00 $ $ RECIPIENT'S name 7 Payer made direct sales of 8 Substitute payments in lieu of $5,000 or more of consumer dividends or interest This is important tax David Fleming products to a buyer information and is (recipient) for resale D$ being furnished to Street address (including apt. no.) 9 Crop Insurance proceeds 10 Gross proceeds paid to an the IRS. If you are 169 Trendie Street, #6B attorney required to file a return, a negligence $ $ penalty or other City or town, state or province, country, and ZIP or foreign postal code 11 12 Section 409A deferrals sanction may be imposed on you if La Jolla, CA 92037 this income is $ taxable and the IRS Account number (see instructions) FATCA filing 13 Excess golden parachute 14 Nonqualified deferred determines that it requirement payments compensation has not been D reported. $ $ 15 State tax withheld 16 State/Payer's state no. 17 State income $ 200.00 $ $ Form 1099-MISC (keep for your records) www.irs.gov/Form1099MISC Department of the Treasury - Internal Revenue Service 22 February 311.00 341.00 147.00 23 March 311.00 341.00 147.00 24 April 311.00 341.00 147.00 25 May 311.00 341.00 147.00 26 June 311.00 341.00 147.00 27 July 311.00 341.00 147.00 28 August He has no other adjustments to income or deductible expenses except for a single cash payment of $500 to a charity after winning big at the game show and a $1,200 EIP received in 2020. Unfortunately, David's employer did not provide health care to its employees but David signed up for coverage through his state's health care exchange. The exchange sent him a Form 1095-A as shown on Page 7-61. 311.00 341.00 147.00 29 September 311.00 341.00 30 October 147.00 311.00 341.00 147.00 31 November 311.00 341.00 147.00 32 December 1,764.00 Required: Complete Steve's federal tax return for 2020. Use Form 1040, Schedule 1, Schedule 3, Schedule A, Form 2441, and Form 8880 3,732.00 4,092.00 33 Annual Totals For Privacy Act and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 60703Q Form 1095-A (2020) David and Darlene received the following letter from Sam's daycare provider: KIDDIECARE INC. January 14, 2021 10250 Santa Monica Blvd. Los Angeles, CA 90067 David and Darlene Jasper EIN: 13-3345678 4639 Honeysuckle Lane Los Angeles, CA 90248 1. David and Darlene Jasper have one child, Sam, who is 6 years old (birthdate July 1, 2014). The Jaspers reside at 4639 Honeysuckle Lane, Los Angeles, CA 90248. David's Social Security number is 577-11-3311, Darlene's is 477-98-4731, and Sams is 589- 22-1142. David's birthdate is May 29, 1987 and Darlene's birthday is January 31, 1989. David and Darlene's earnings and withholdings for 2020 are: David: Earnings from Apple Company (office manager) $26,750 Federal income tax withheld 800 State income tax withheld 1,050 Darlene: Earnings from Rose Company (perfume tester) $26,200 Federal income tax withheld 1,050 State income tax withheld 1,000 Their other income includes interest from Pine Tree Savings and Loan of $950. Other information and expenditures for 2020 are as follows: Interest: On home acquisition mortgage $11,300 Credit card 925 Taxes: Property taxes on personal residence 1,300 State income taxes paid in 2020 (for 2019) 300 Contribution (with written acknowledgement) to church 1,045 Medical insurance 675 Medical and dental expenses 6,175 Income tax return preparation fee paid in 2020 200 Actual general state sales tax for 2020 1,016 Payment of union dues 225 Contribution to David's IRA (no retirement plan at his work) 500 The Jaspers received a $2,900 EIP in 2020. Dear David and Darlene, Thank you for your patronage of our day care center with your child, Sam Jasper, in 2020. This statement serves as a record of the cost of daycare services we provided during calendar year 2 Child Sam Jasper Amount $3,680.00 Dates of Service 1/1/2020 - 08/25/2020 Sincerely, /s/ Marcia Clarke Marcia Clarke Director, KiddieCare Inc. Required: Complete Steve's federal tax return for 2020. Use Form 1040, Schedule 1, Schedule 3, Schedule A, Form 2441, and Form 8880 2B. David Fleming is a single taxpayer living at 169 Trendie Street, Apartment 6B, La Jolla, CA 92037. His Social Security number is 865-68-9635 and his birthdate is September 18, 1975. David was employed as a delivery person for a local pizza restaurant. David's W-2 showed the following: Required: Complete the Jaspers' federal tax return for 2020. Use Form 1040, Schedule 1, Schedule 3, Schedule A, Form 2441, and Form 8880, as needed. Make realistic assumptions about any missing data. 2A. Steve Jackson (birthdate December 13, 1967) is a single taxpayer living at 3215 Pacific Dr., Apt. B, Pacific Beach, CA 92109. His Social Security number is 465-88-9415. In 2020, Steve's earnings and income tax withholding as laundry attendant of a local hotel are: Earnings from the Ocean View Hotel $22,250 Federal income tax withheld 219 State income tax withheld 100 Steve has a daughter, Janet, from a previous marriage. Janet is 11 years old (Social Security number 654-12-6543). Steve provides all Janet's support. Also living with Steve is his younger brother, Reggie (Social Security number 667-21-8998). Reggie, age 47, is unable to care for himself due to a disability. On a reasonably regular basis, Steve has a care giver come to the house to help with Reggie. He uses a company called HomeAid, 456 La Jolla Dr., San Diego, CA 92182 (EIN 17-9876543). Steve made payments of $1,000 to HomeAid in 2020. Janet receives free after-school care provided by the local school district. Steve made a modest cash donation to local charity in the amount of $50. Steve received a $1,700 EIP in 2020. a Employee's social security number 865-68-9635 b Employer identification number (EIN) 23-4567321 c Employer's name, address, and ZIP code California Pizza Cafe 231 Foodie Street La Jolla, CA 92037 Safe, accurate, unse-file www.rs.goviefile Visit the IRS website at OMB No 1545-0008 FAST! Use 1 Wages, tips, other compensation 2 Federal income tax withheld 23,700.00 1,280.00 3 Social security wages 4 Social security tax withheld 23,700.00 1,469.40 5 Medicare wages and tips 6 Medicare tax withheld 23,700.00 343.65 7 Social security tips 8 Allocated tips d Control number 9 10 Dependent care benefits e Employee's first name and initial Last name Sutt. 11 Nonqualified plans 12a See instructions for box 12 13 Sunton enge Retromen Third party 12b 8 David Fleming 169 Trendie Street, Apt 6B La Jolla, CA 92037 14 Other 12c 8 VOID OMD No, 1545-2232 12d Form 1095-A Health Insurance Marketplace Statement 2020 f Employee's address and ZIP code 15 State Employer's state ID number | D4567221 18 Local wages, tips, etc. 19 Local income tax 20 Localitate 16 State wages, tips, etc. 17 State income tax 23,700.00 370.00 Department of the Treasury Do not attach to your tax retum. Keep for your records, CORRECTED Internal Revenue Service Go to www.irs.gov/Form 1095A for instructions and the latest Information. Partl Recipient Information 1 Marketplace Identifier 2 Marketplace-assigned pollcy number 3 Policy issuer's name 31-9876543 B1234TH Covered California 4 Recipient's name 6 Recipient's SSN 6 Recipient's date of birth David Fleming 865-68-9635 09/18/1975 7 Reciplent's spouso's name 8 Recipient's spouse's SSN 0 Recipient's spouse's date of birth Form W-2 Wage and Tax Statement 2020 Department of the Treasury - Internal Revenue Service Copy B-To Be Filed With Employee's FEDERAL Tax Return This information is being furnished to the Internal Revenue Service. ORARE 23 10 Policy start date Jan 1, 2020 13 City or town La Jolla 11 Policy termination date Dec 31, 2020 14 State or province CA 12 Street address (including apartment no.) 169 Trendie Street, Apt 6B 15 Country and ZIP or foreign postal code 92037 David's only other source of income during the year was a prize he won appearing on a game show. The game show sent David home with a Form 1099-MISC: Part 11 Covered Individuals A. Covered individual name B. Covered individual SSN C. Covered individual date of birth D. Coverage start date E. Coverage termination date OMB No. 1545-0115 David Fleming 865-68-9635 09/18/1975 01/01/2020 16 12/31/2020 2020 Miscellaneous Income 17 CORRECTED (if checked) PAYER'S name, street address, city or town, state or province, country, ZIP 1 Rents or foreign postal code, and telephone no. Price is Accurate Studios, Inc. $ 2 Royalties Studio 44 Studio City, CA 91604 3 Other income $ 10,000.00 PAYER'S TIN RECIPIENT'S TIN 5 Fishing boat proceeds 21-8675309 865-68-9635 18 Form 1099-MISC 4 Federal income tax withheld $ 2,400.00 6 Medical and health care payments Copy B For Recipient 19 20 Part III Coverage Information Month A. Monthly enrollment premiums B. Monthly second lowest cost silver plan (SLCSP) premium C. Monthly advance payment of premium tax credit 311.00 341.00 147.00 21 January 311.00 341.00 147.00 $ $ RECIPIENT'S name 7 Payer made direct sales of 8 Substitute payments in lieu of $5,000 or more of consumer dividends or interest This is important tax David Fleming products to a buyer information and is (recipient) for resale D$ being furnished to Street address (including apt. no.) 9 Crop Insurance proceeds 10 Gross proceeds paid to an the IRS. If you are 169 Trendie Street, #6B attorney required to file a return, a negligence $ $ penalty or other City or town, state or province, country, and ZIP or foreign postal code 11 12 Section 409A deferrals sanction may be imposed on you if La Jolla, CA 92037 this income is $ taxable and the IRS Account number (see instructions) FATCA filing 13 Excess golden parachute 14 Nonqualified deferred determines that it requirement payments compensation has not been D reported. $ $ 15 State tax withheld 16 State/Payer's state no. 17 State income $ 200.00 $ $ Form 1099-MISC (keep for your records) www.irs.gov/Form1099MISC Department of the Treasury - Internal Revenue Service 22 February 311.00 341.00 147.00 23 March 311.00 341.00 147.00 24 April 311.00 341.00 147.00 25 May 311.00 341.00 147.00 26 June 311.00 341.00 147.00 27 July 311.00 341.00 147.00 28 August He has no other adjustments to income or deductible expenses except for a single cash payment of $500 to a charity after winning big at the game show and a $1,200 EIP received in 2020. Unfortunately, David's employer did not provide health care to its employees but David signed up for coverage through his state's health care exchange. The exchange sent him a Form 1095-A as shown on Page 7-61. 311.00 341.00 147.00 29 September 311.00 341.00 30 October 147.00 311.00 341.00 147.00 31 November 311.00 341.00 147.00 32 December 1,764.00 Required: Complete Steve's federal tax return for 2020. Use Form 1040, Schedule 1, Schedule 3, Schedule A, Form 2441, and Form 8880 3,732.00 4,092.00 33 Annual Totals For Privacy Act and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 60703Q Form 1095-A (2020)

Step by Step Solution

There are 3 Steps involved in it

To complete Steves federal tax return for 2020 well need to fill out Form 1040 Schedule 1 Schedule 3 ... View full answer

Get step-by-step solutions from verified subject matter experts