Please help me with the True or False for my homework assignment. thank you

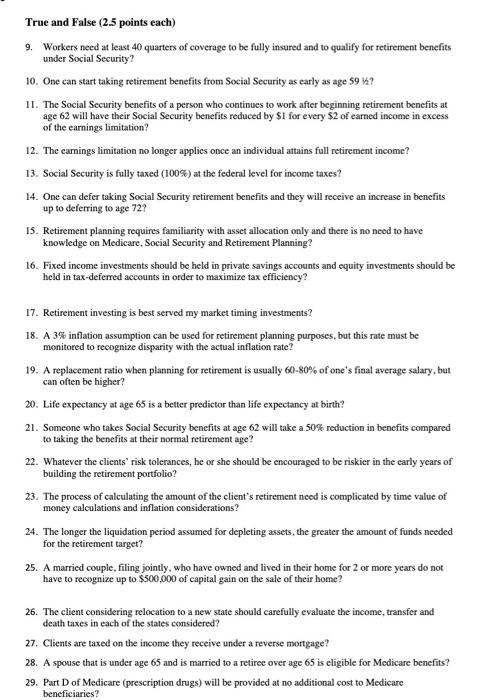

True and False (2.5 points each) 9. Workers need at least 40 quarters of coverage to be fully insured and to qualify for retirement benefits under Social Security ? 10. One can start taking retirement benefits from Social Security as early as age 59 ? 11. The Social Security benefits of a person who continues to work after beginning retirement bencfits at age 62 will have their Social Security benefits reduced by $1 for every $2 of earned income in excess of the earnings limitation? 12. The camings limitation no longer applies once an individual attains full retirement income? 13. Social Security is fully taxed (100%) at the federal level for income taxes? 14. One can defer taking Social Security retirement benefits and they will receive an increase in benefits up to deferring to age 722 15. Retirement planning requires familiarity with asset allocation only and there is no need to have knowledge on Medicare, Social Security and Retirement Planning? 16. Fixed income investments should be held in private savings accounts and equity investments should be held in tax-deferred accounts in order to maximize tax efficiency? 17. Retirement investing is best served my market timing investments? 18. A 3% inflation assumption can be used for retirement planning purposes, but this rate must be monitored to recognize disparity with the actual inflation rate? 19. A replacement ratio when planning for retirement is usually 60-80% of one's final average salary, but can often be higher? 20. Life expectancy at age 65 is a better predictor than life expectancy at birth? 21. Someone who takes Social Security benefits at age 62 will take a 50% reduction in benefits compared to taking the benefits at their normal retirement age? 22. Whatever the clients' risk tolerances, he or she should be encouraged to be riskier in the early years of building the retirement portfolio? 23. The process of calculating the amount of the client's retirement need is complicated by time value of money calculations and inflation considerations? 24. The longer the liquidation period assumed for depleting assets, the greater the amount of funds needed for the retirement target? 25. A married couple, filing jointly, who have owned and lived in their home for 2 or more years do not have to recognize up to $500,000 of capital gain on the sale of their home? 26. The client considering relocation to a new state should carefully evaluate the income, transfer and death taxes in each of the states considered? 27. Clients are taxed on the income they receive under a reverse mortgage? 28. A spouse that is under age 65 and is married to a retiree over age 65 is eligible for Medicare benefits? 29. Part of Medicare (prescription drugs) will be provided at no additional cost to Medicare beneficiaries