Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On December 31, 2024, Oriole Inc. completed its fourth year of operations. Christina Georgiou is an aspiring CPA working part-time as a clerk in

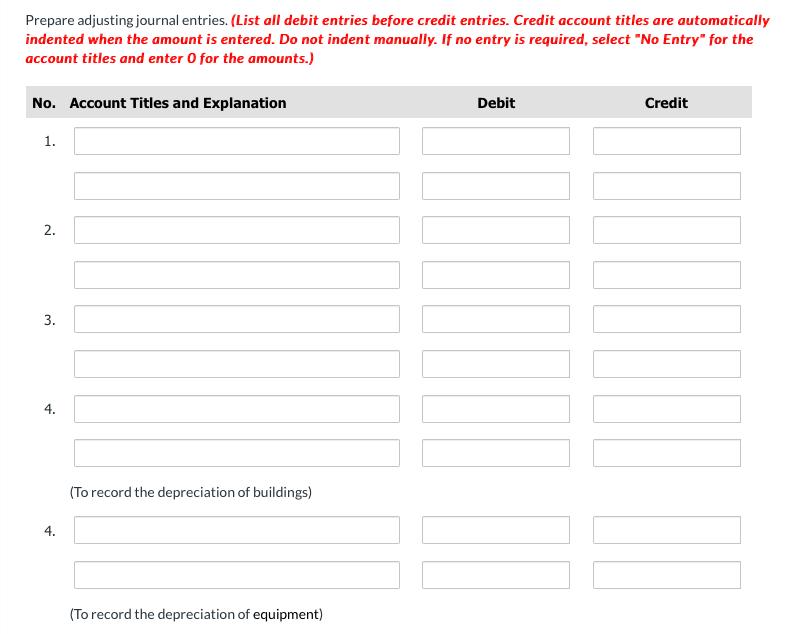

On December 31, 2024, Oriole Inc. completed its fourth year of operations. Christina Georgiou is an aspiring CPA working part-time as a clerk in the company's accounting office. Christina assembled the following list of account balances, which are not arranged in any particular order: Accounts Payable $45,600 Advertising Expense $66,000 Deferred Revenue Note Receivable 18,720 Cash 15,000 60,000 Land 200,000 Cost of Goods Sold 525,000 Dividends Declared 15,000 Equipment 220,000 Insurance Expense 6,000 Buildings 290,000 Interest Expense 2,500 Retained Earnings 268,380 Accumulated Depreciation, 15,000 (as at January 1, 2024) Equipment Inventory 190,000 Common Shares 526,000 Accumulated Depreciation, Buildings 25,000 Miscellaneous Expense 8,000 Wages Expense 118,000 Accounts Receivable 175,000 Supplies 3,200 Sales Revenue 954,000 Notes Payable 45,000 Utilities Expense 4,000 These account amounts are correct; however, Christina did not consider the following information: 1. As at December 31, 2024, the supplies still on hand had a cost of $1,150. 2. 3. On September 1, 2024, the company rented surplus space in one of its warehouses to a tenant for $3,120 per month. The tenant paid for six months in advance, which was recorded as deferred revenue. Employees earned $5,120 of wages in December 2024 that will not be paid until the first scheduled payday in 2025. 4. Depreciation for 2024 is $12,480 on the buildings and $25,600 on the equipment. 5. Additional dividends of $10,240 were declared in December 2024 but will not be paid until January 2025. 6. The note receivable is a six-month note that has been outstanding since October 1, 2024 (three months). The interest rate is 7. 5% per year. The interest will be received by the company when the note becomes due at the end of March 2025. The amount shown as insurance expense includes $1,200 for coverage over the first three months of 2025. Prepare adjusting journal entries. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) No. Account Titles and Explanation 1. Debit Credit 2. 3. 4. (To record the depreciation of buildings) (To record the depreciation of equipment)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Okay lets address the adjustments that Christina Georgiou did not consider Here are the necessary jo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started