please help me with these

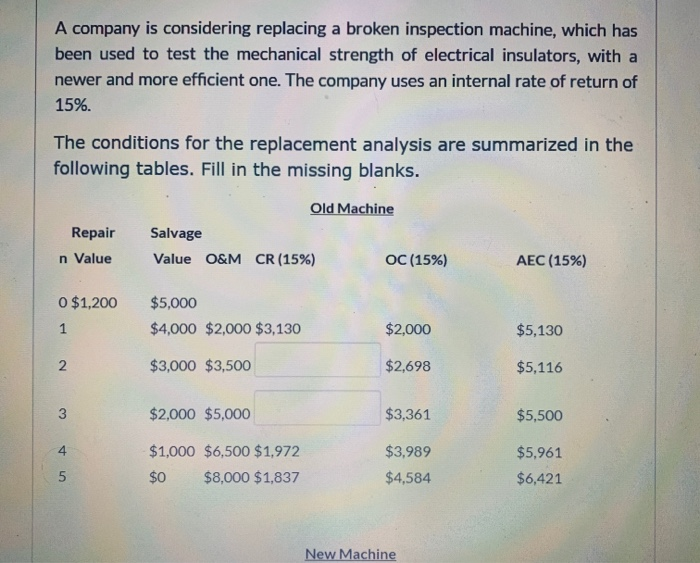

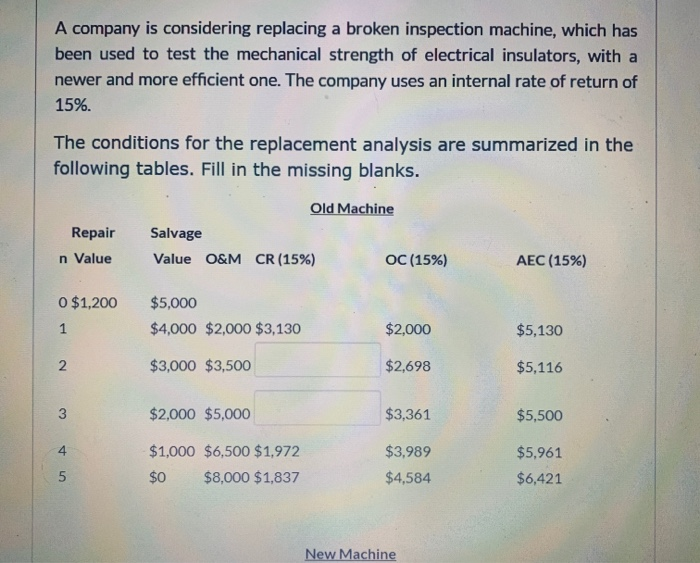

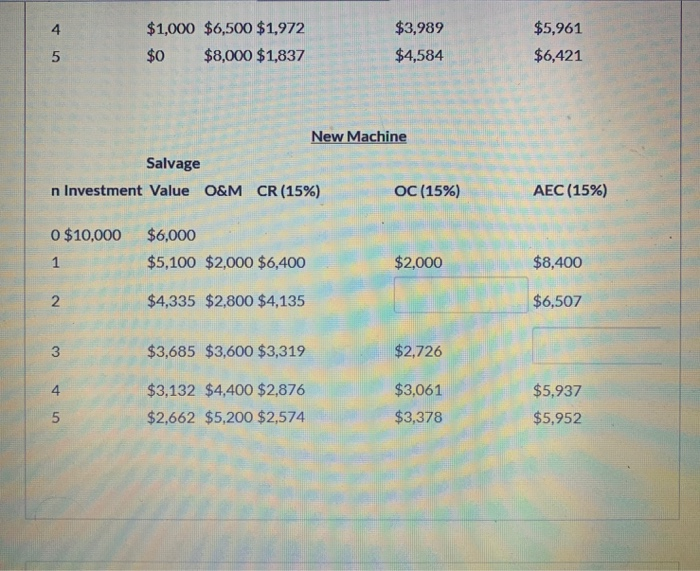

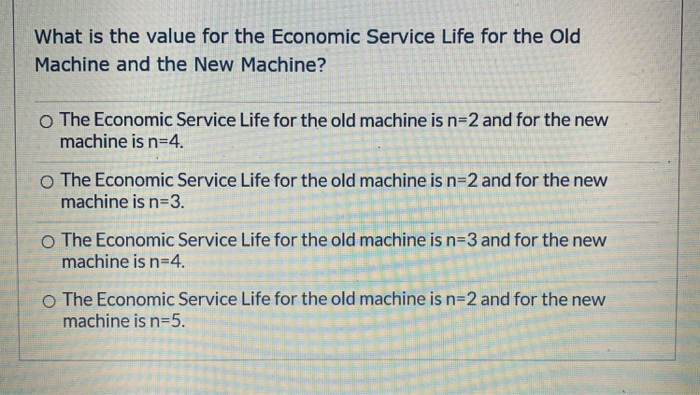

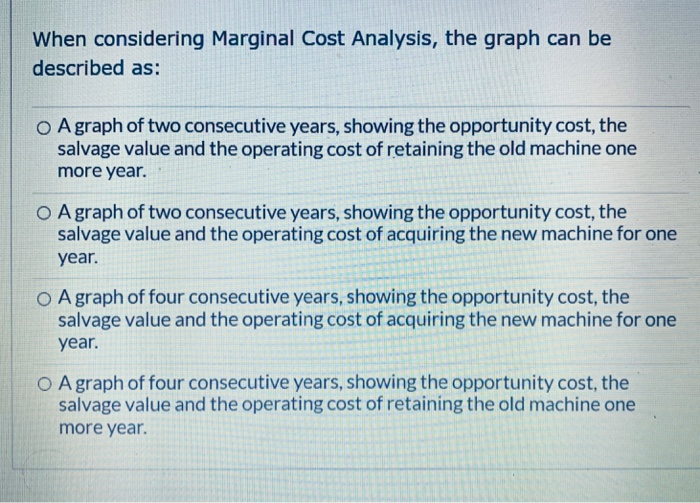

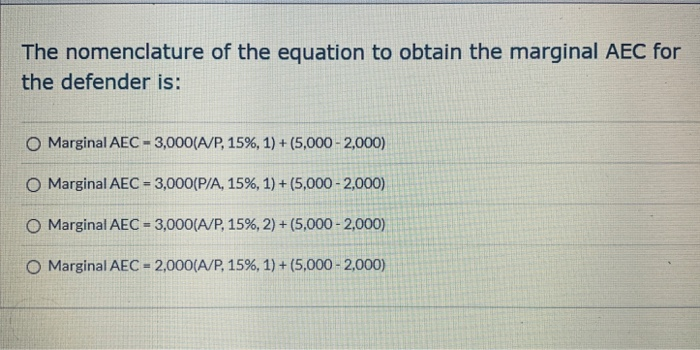

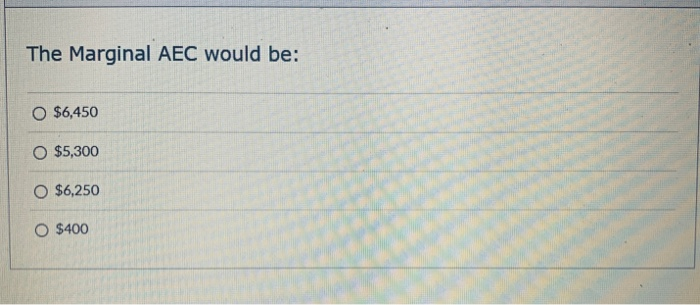

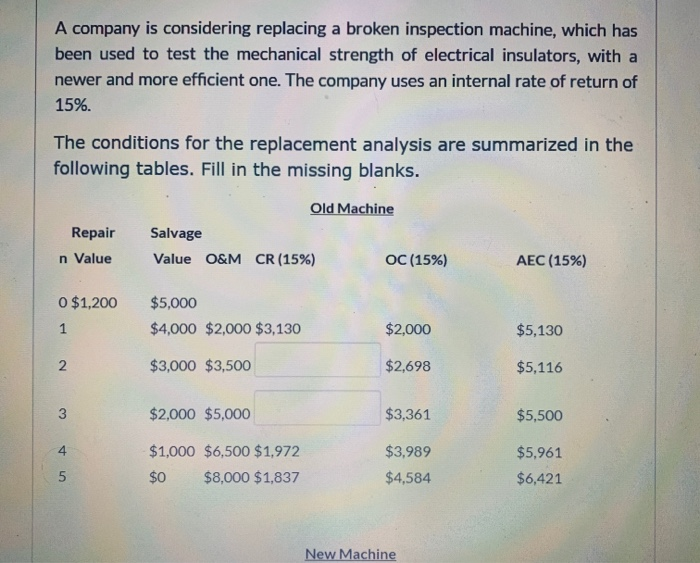

A company is considering replacing a broken inspection machine, which has been used to test the mechanical strength of electrical insulators, with a newer and more efficient one. The company uses an internal rate of return of 15%. The conditions for the replacement analysis are summarized in the following tables. Fill in the missing blanks. Old Machine Repair n Value Salvage Value O&M CR (15%) OC (15%) AEC (15%) 0 $1,200 $5,000 $4,000 $2,000 $3,130 $2,000 $5,130 N $3,000 $3,500 $2,698 $5,116 w $2,000 $5,000 $3,361 $5,500 - $1,000 $6,500 $1,972 $0 $8,000 $1,837 $3,989 $4,584 $5,961 $6,421 in New Machine $1,000 $6,500 $1,972 $0 $8,000 $1,837 $3,989 $4,584 $5,961 $6,421 New Machine Salvage n Investment Value O&M CR(15%) OC (15%) AEC (15%) o $10,000 1 $6,000 $5,100 $2,000 $6,400 $2,000 $8,400 $4,335 $2,800 $4,135 $6,507 $3,685 $3,600 $3,319 $2,726 w 2./26 $3,132 $4,400 $2,876 $2,662 $5,200 $2,574 $3,061 $3,378 $5,937 $5,952 What is the value for the Economic Service Life for the Old Machine and the New Machine? The Economic Service Life for the old machine is n=2 and for the new machine is n=4. o The Economic Service Life for the old machine is n=2 and for the new machine is n=3. o The Economic Service Life for the old machine is n=3 and for the new machine is n=4. o The Economic Service Life for the old machine is n=2 and for the new machine is n=5. When considering Marginal Cost Analysis, the graph can be described as: O Agraph of two consecutive years, showing the opportunity cost, the salvage value and the operating cost of retaining the old machine one more year. O A graph of two consecutive years, showing the opportunity cost, the salvage value and the operating cost of acquiring the new machine for one year. O Agraph of four consecutive years, showing the opportunity cost, the salvage value and the operating cost of acquiring the new machine for one year. O A graph of four consecutive years, showing the opportunity cost, the salvage value and the operating cost of retaining the old machine one more year. The nomenclature of the equation to obtain the marginal AEC for the defender is: O Marginal AEC - 3,000(A/P, 15%, 1) + (5,000 - 2,000) O Marginal AEC = 3,000(P/A, 15%, 1)+(5,000 -2,000) O Marginal AEC - 3,000(A/P, 15%, 2) + (5,000 - 2,000) O Marginal AEC = 2,000(A/P, 15%, 1) + (5,000 - 2,000) The Marginal AEC would be: O $6,450 O $5,300 O $6,250 O $400