Please help me with these question:14,34,35,38

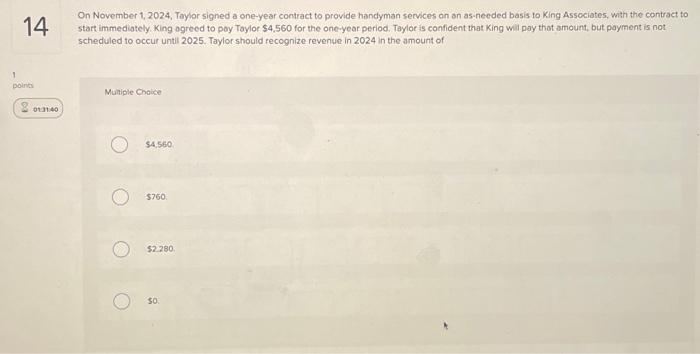

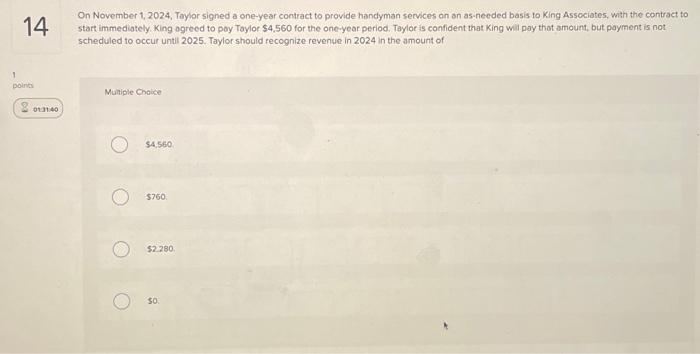

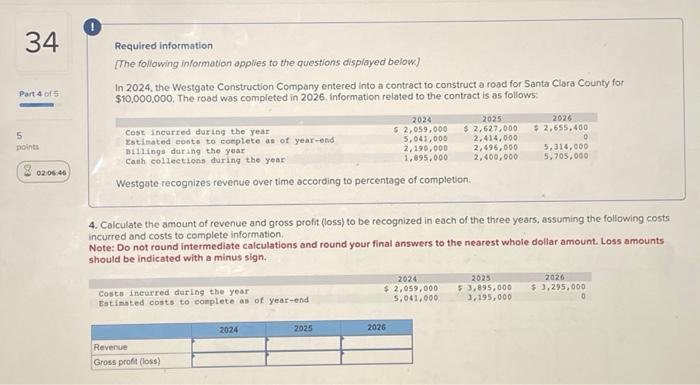

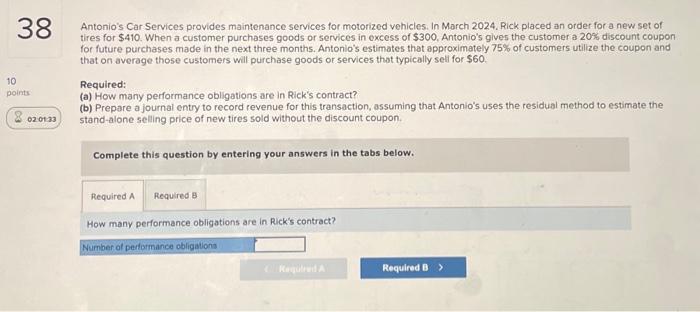

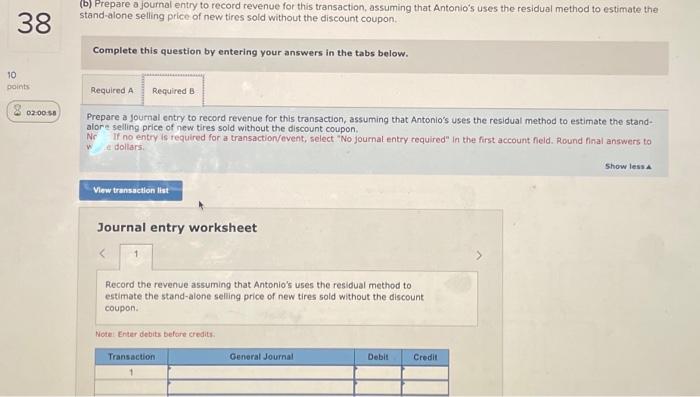

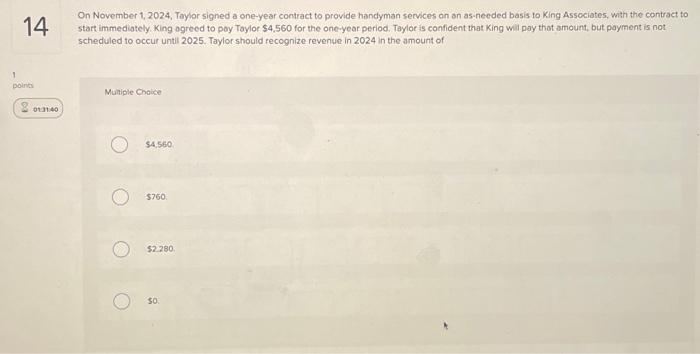

On November 1,2024, Toylor signed a one-year contract to provide handyman services on an as-needed basis to King Associates, with the contract to start immediately. King agreed to poy Taylor $4,560 for the one-year period. Taylot is confident that King wil pay that amount, but payment is not scheduled to occur until 2025. Taylor should recognize revenue in 2024 in the amount of Muniple Chaice 54,560 5760 $2280 50. Required information [The following information applies to the questions displayed below] In 2024, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2026. Information related to the contract is as follows: Westgate recognizes revenue over time according to percentage of completion. 4. Calculate the amount of revenue and gross profit (loss) to be recognized in each of the three years, assuming the following costs ncurred and costs to complete information. Note: Do not round intermediate calculations and round your final answers to the nearest whole dollar amount. Loss amounts hould be indicated with a minus sign. Required information [The following information applies to the questions displayed below] In 2024, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2026. Information related to the contract is as follows: Westgate recognizes revenue over time according to percentage of completion. Calculate the amount of revenue and gross profit (loss) to be recognized in each of the three years, assuming the following cos: curred and costs to complete information. lote: Do not round intermediate calculations and round your final answers to the nearest whole dollar amount. Loss amounts hould be indicated with a minus sign. Antonio's Car Services provides maintenance services for motorized vehicles. In March 2024. Rick placed an order for a new set of tires for $410. When a customer purchases goods or services in excess of $300, Antonio's gives the customer a 20% discount coupon for future purchases made in the next three months. Antonio's estimates that approximately 75% of customers utilize the coupon and that on average those customers will purchase goods or services that typically sell for $60. Required: (a) How many performance obligations are in Rick's contract? (b) Prepare a journal entry to record revenue for this transaction, assuming that Antonio's uses the residual method to estimate the stand-alone selling price of new tires sold without the discount coupon. Complete this question by entering your answers in the tabs below. How many performance obligations are in Rick's contract? b) Prepare a joumal entry to record revenue for this transaction, assuming that Antonio's uses the residual method to estimate the stand-alone selling price of new tires sold without the discount coupon. Complete this question by entering your answers in the tabs below. Prepare a fournal entry to record revenue for this transaction, assuming that Antonio's uses the residual method to estimate the standalore selling price of new tires sold without the discount coupon. Nr If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round final answers to ve do dollars: Show lessa Journal entry worksheet Record the revenue assuming that Antonio's uses the residual method to estimate the stand-alone selling price of new tires sold without the discount coupon. Note: Enter debits befare credits