Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me with these questions and answer in your own words. please don't copy anything. I put references for the questions. Also the reference

Please help me with these questions and answer in your own words. please don't copy anything. I put references for the questions. Also the reference of the article.

Bridge, Jerry. "Retirement and Social Security: An Application of the Time Value of Money." Stocks Insights Investor Letter. January 2002.

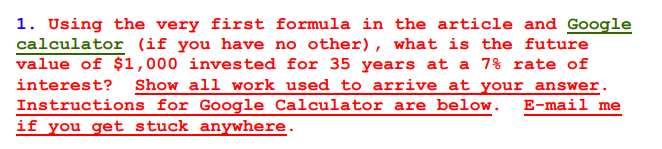

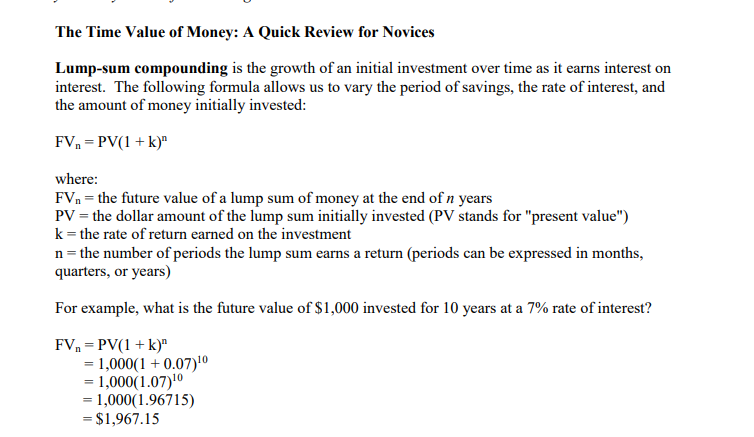

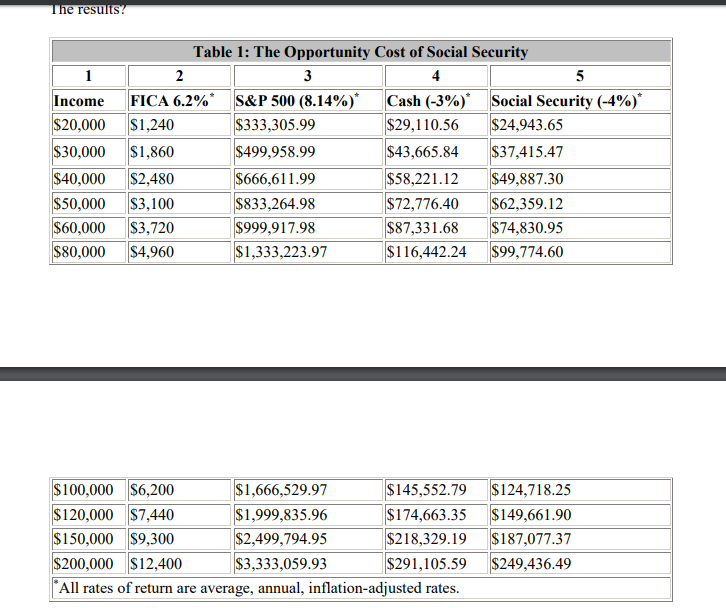

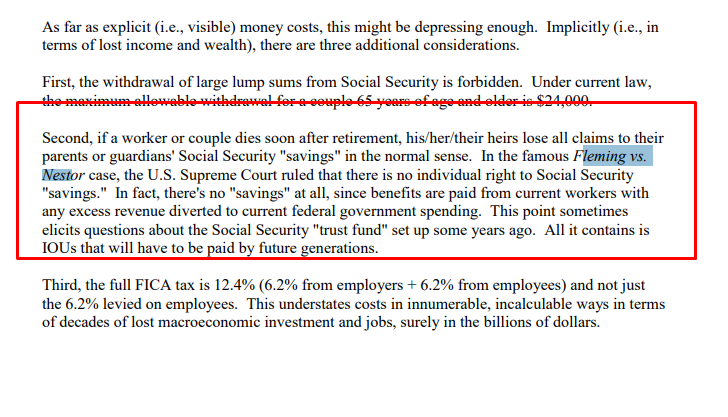

1. Using the very first formula in the article and Google calculator (if you have no other), what is the future value of $1,000 invested for 35 years at a 7% rate of interest? Show all work used to arrive at your answer. Instructions for Google Calculator are below. E-mail me if you get stuck anywhere. The Time Value of Money: A Quick Review for Novices Lump-sum compounding is the growth of an initial investment over time as it earns interest on interest. The following formula allows us to vary the period of savings, the rate of interest, and the amount of money initially invested: FV. = PV(1 + k)" where: FV. = the future value of a lump sum of money at the end of n years PV = the dollar amount of the lump sum initially invested (PV stands for "present value") k=the rate of return earned on the investment n=the number of periods the lump sum earns a return (periods can be expressed in months, quarters, or years) For example, what is the future value of $1,000 invested for 10 years at a 7% rate of interest? FV. = PV(1 + k)" = 1,000(1 + 0.0710 = 1,000(1.07) = 1,000(1.96715) = $1,967.15 2. For some years there have been proposals for raising the retirement age. Assuming a new retirement age of 75 and using the first formula in the "Nest Egg Targeting" section above (where $1,000,000 is still the target), what is the level of yearly payment required for a 7% rate of return and 50-year working career? Show all work used to arrive at your answer. Instructions for Google Calculator are below. E-mail me if you get stuck anywhere Nest Egg Targeting This latter formula is especially useful in financial planning when you have to solve for payment (PMT). Take a look at the following two examples and you'll quickly see why. I. To reach $1 million in net worth by retirement in 40 years, how much money will you have to invest in the market (S&P 500, 7% real return) each year? FVA, = PMT[(1+k)"-1] k 1,000,000 = PMT[(1+0.07)40-1] 0.07 1,000,000 = PMT[14.9745-1] 0.07 1,000,000 = PMT(199.6351) $5,009.14 = PMT In other words, to retire a cash millionaire after a 40-year working career, all that is needed is a yearly investment of a little over $5,000. Hardly out of reach of many wage earners with disciplined saving habits. Indeed, the whole point of Stanley and Danko's famed book The Millionaire Next Door was a smashing of the Hollywood stereotype of most millionaires as living in opulent houses and driving super-expensive cars. What the duo and many others confirmed was that most were business owners who lived well below their means in average houses, drove average cars, and pursued relentless everyday thriftiness. 3. Consult Table 1 in the article. For a $120,000 level of income, what is the difference between what a worker would earn from the S&P 500 (column 3) and Social Security (column 5) ? Show all work used to arrive at your answer. Instructions for Google Calculator are below. E-mail me if you get stuck anywhere. The results Income $20,000 $30,000 $40,000 $50,000 $60,000 $80,000 Table 1: The Opportunity Cost of Social Security 2 3 4 5 FICA 6.2%* S&P 500 (8.14%)* Cash (-3%)* Social Security (-4%)* $1,240 $333,305.99 $29,110.56 $24,943.65 $1,860 $499,958.99 $43,665.84 $37,415.47 $2,480 $666,611.99 $58,221.12 $49,887.30 $3,100 $833,264.98 $72,776.40 $62,359.12 $3,720 $999,917.98 $87,331.68 $74,830.95 $4,960 $1,333,223.97 $116,442.24 $99,774.60 $100,000 $6,200 $1,666,529.97 $145,552.79 $120,000 $7,440 $1,999,835.96 $174,663.35 $150,000 $9,300 $2,499,794.95 $218,329.19 $200,000 $12,400 $3,333,059.93 $291,105.59 *All rates of return are average, annual, inflation-adjusted rates. $124,718.25 $149,661.90 $187,077.37 $249,436.49 4. In Fleming vs. Nestor, the U.S. Supreme Court decided that there is no Fill in the blank first, then explain. As far as explicit (i.e., visible) money costs, this might be depressing enough. Implicitly (i.e., in terms of lost income and wealth), there are three additional considerations. First, the withdrawal of large lump sums from Social Security is forbidden. Under current law, the maximum loeblo-withdrewal fort couple 65 years of age and elder is $24,000. Second, if a worker or couple dies soon after retirement, his/her/their heirs lose all claims to their parents or guardians' Social Security "savings" in the normal sense. In the famous Fleming vs. Nestor case, the U.S. Supreme Court ruled that there is no individual right to Social Security "savings." In fact, there's no "savings" at all, since benefits are paid from current workers with any excess revenue diverted to current federal government spending. This point sometimes elicits questions about the Social Security "trust fund" set up some years ago. All it contains is IOUs that will have to be paid by future generations. Third, the full FICA tax is 12.4% (6.2% from employers +6.2% from employees) and not just the 6.2% levied on employees. This understates costs in innumerable, incalculable ways in terms of decades of lost macroeconomic investment and jobs, surely in the billions of dollarsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started