Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me with these questions, I really struggle with this subject. thank you so much! Master Consulting is busy expanding their current operations. They

please help me with these questions, I really struggle with this subject. thank you so much!

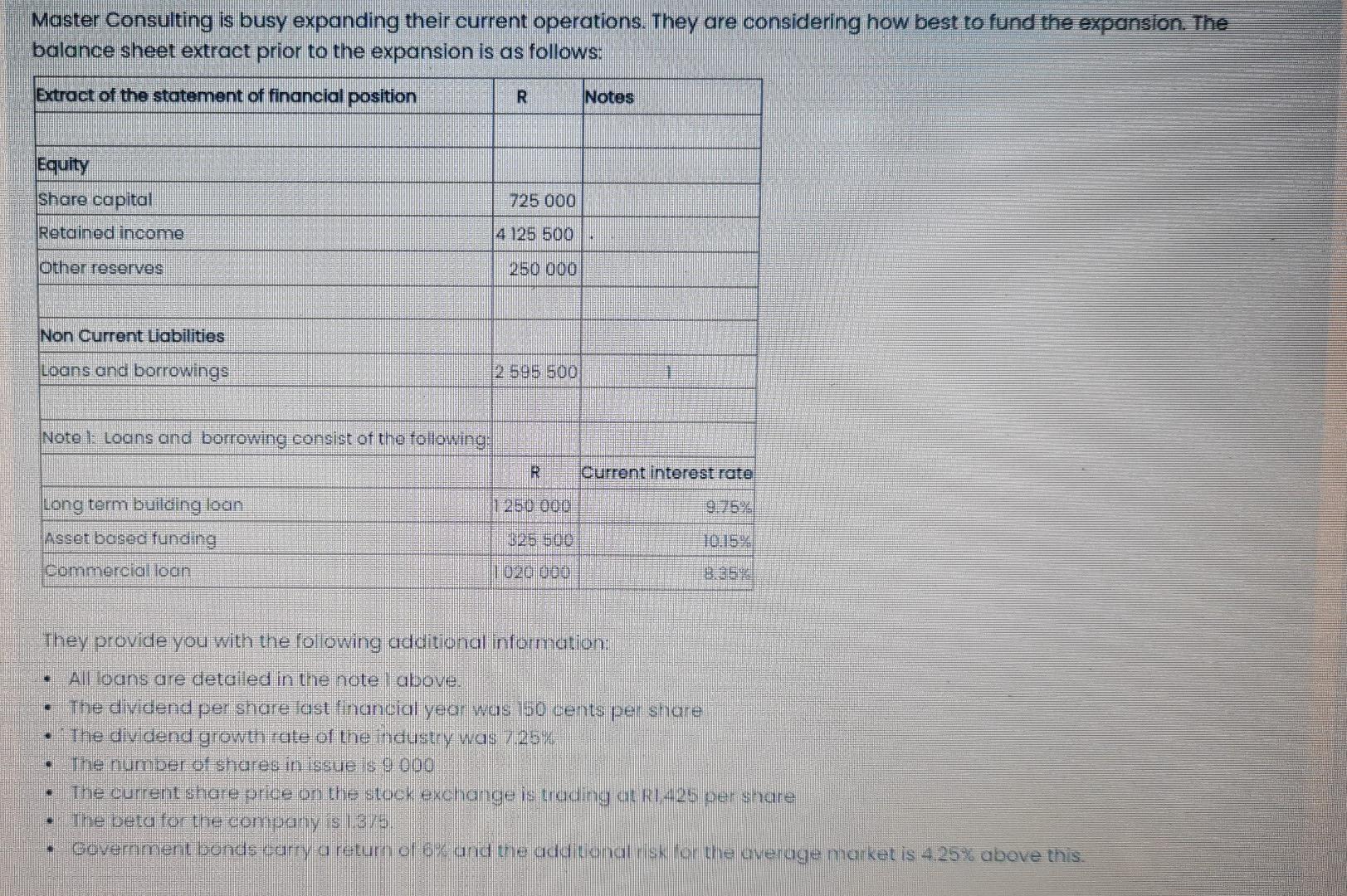

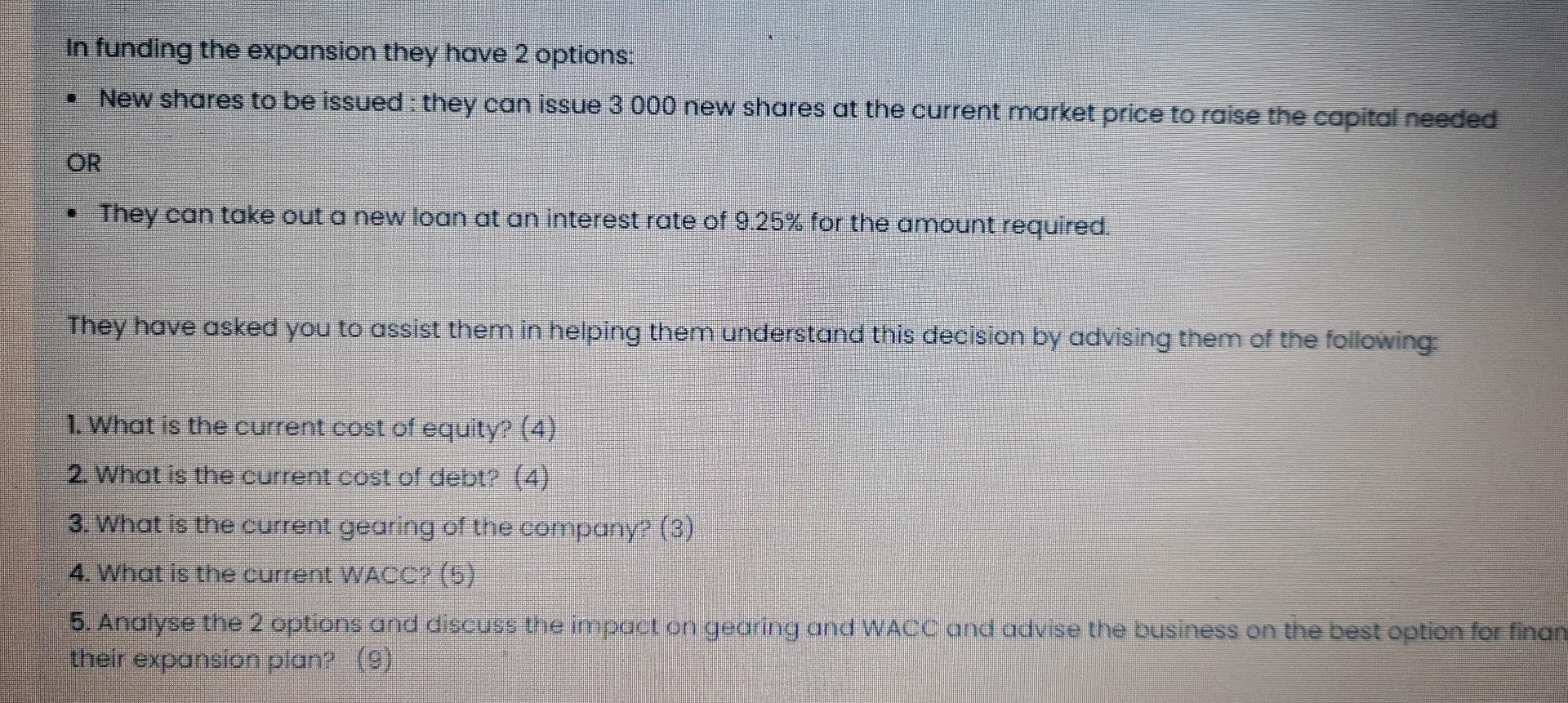

Master Consulting is busy expanding their current operations. They are considering how best to fund the expansion. The balance sheet extract prior to the expansion is as follows: Extract of the statement of financial position R Notes Equity share capital Retained income 725 000 4 125 500 Other reserves 250 000 Non Current Liabilities loans and borrowings 2595 500 Notel: Loans and borrowing consist of the following: R Current interest rate | 250 000 Long term building loan Asset based funding Commercial loan 325 500 020 000 B.359 They provide you with the following additional information: All loans are detailed in the note l above. The dividend per share lost financial yeor was 150 cents per share The dividend growth rate of the industry was 7.25% The number of shares in issue.$ 9000 The current shore price on the stock exchange is trading at R1425 per snare The beta for the company is 1.375. Government bonds carry a return of 64 and the additonal risk for the overuge market is 4.25% above this. In funding the expansion they have 2 options: New shares to be issued: they can issue 3 000 new shares at the current market price to raise the capital needed OR They can take out a new loan at an interest rate of 9.25% for the amount required. They have asked you to assist them in helping them understand this decision by advising them of the following: 1. What is the current cost of equity? (4) 2. What is the current cost of debt? (4) 3. What is the current gearing of the company? (3) 4. What is the current WACC? (5) 5. Analyse the 2 options and discuss the impact on gearing and wacc and advise the business on the best option for finan their expansion plan? (9) Master Consulting is busy expanding their current operations. They are considering how best to fund the expansion. The balance sheet extract prior to the expansion is as follows: Extract of the statement of financial position R Notes Equity share capital Retained income 725 000 4 125 500 Other reserves 250 000 Non Current Liabilities loans and borrowings 2595 500 Notel: Loans and borrowing consist of the following: R Current interest rate | 250 000 Long term building loan Asset based funding Commercial loan 325 500 020 000 B.359 They provide you with the following additional information: All loans are detailed in the note l above. The dividend per share lost financial yeor was 150 cents per share The dividend growth rate of the industry was 7.25% The number of shares in issue.$ 9000 The current shore price on the stock exchange is trading at R1425 per snare The beta for the company is 1.375. Government bonds carry a return of 64 and the additonal risk for the overuge market is 4.25% above this. In funding the expansion they have 2 options: New shares to be issued: they can issue 3 000 new shares at the current market price to raise the capital needed OR They can take out a new loan at an interest rate of 9.25% for the amount required. They have asked you to assist them in helping them understand this decision by advising them of the following: 1. What is the current cost of equity? (4) 2. What is the current cost of debt? (4) 3. What is the current gearing of the company? (3) 4. What is the current WACC? (5) 5. Analyse the 2 options and discuss the impact on gearing and wacc and advise the business on the best option for finan their expansion plan? (9)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started