please help me with these questions. Thank you.

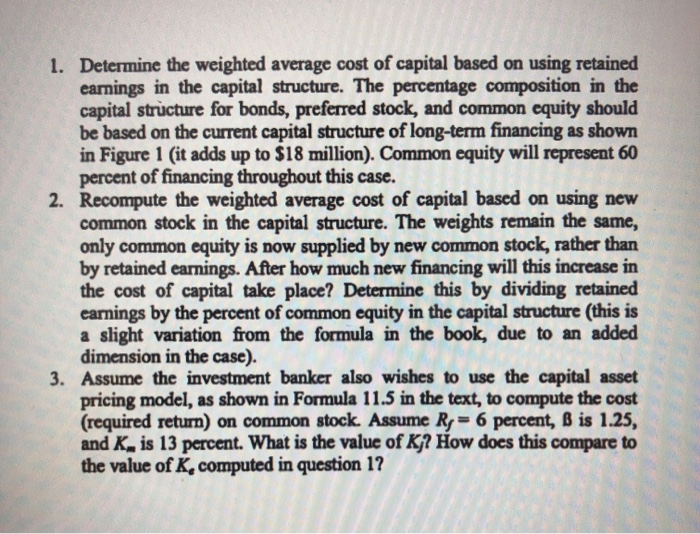

1. Determine the weighted average cost of capital based on using retained earnings in the capital structure. The percentage composition in the capital structure for bonds, preferred stock, and common equity should be based on the current capital structure of long-term financing as shown in Figure 1 (it adds up to $18 million). Common equity will represent 60 percent of financing throughout this case. 2. Recompute the weighted average cost of capital based on using new common stock in the capital structure. The weights remain the same, only common equity is now supplied by new common stock, rather than by retained earnings. After how much new financing will this increase in the cost of capital take place? Determine this by dividing retained earnings by the percent of common equity in the capital structure (this is a slight variation from the formula in the book, due to an added dimension in the case). 3. Assume the investment banker also wishes to use the capital asset pricing model, as shown in Formula 11.5 in the text, to compute the cost (required return) on common stock. Assume Ry = 6 percent, B is 1.25, and K. is 13 percent. What is the value of Kj? How does this compare to the value of K, computed in question 1? $ 400,000 200,000 $ 2,600,000 300.000 2,300,000 5.500.000 $ 8,400,000 30,700,000 13.200.000 Assets Current assets: Cash... Marketable securities Accounts receivable.. Less: Allowance for bad debts Inventory...... Total current assets Fixed Assets: Plant and equipment, original cost. Less: Accumulated depreciation. Net plant and equipment...... Total assets Liabilities and Stockholders' Equity Current liabilities:... Accounts payable. Accrued expenses Total current liabilities... Long-term financing: Bonds payable.... Preferred stock... Common stock 17.500.000 $25.900.000 $ 6,200,000 1.700.000 7,900,000 + $ 6,120,000 + 1,080,000 Retained carnings } Common equity { 6,300,000 4.500.000 10,800,000 - 18.000.000 $25,900.000 Total common equity ....... Total long-term financing - Total liabilities and stockholders' equity. ed Security Bond Bond Bond. Preferred stock Preferred stock Year of Issue 1992 1996 2002 1997 2000 Amount $1,120,000 3,000,000 2,000,000 600,000 480,000 Yield 6.1% 13.8 8.3 12.0 7.9 *** 1. Determine the weighted average cost of capital based on using retained earnings in the capital structure. The percentage composition in the capital structure for bonds, preferred stock, and common equity should be based on the current capital structure of long-term financing as shown in Figure 1 (it adds up to $18 million). Common equity will represent 60 percent of financing throughout this case. 2. Recompute the weighted average cost of capital based on using new common stock in the capital structure. The weights remain the same, only common equity is now supplied by new common stock, rather than by retained earnings. After how much new financing will this increase in the cost of capital take place? Determine this by dividing retained earnings by the percent of common equity in the capital structure (this is a slight variation from the formula in the book, due to an added dimension in the case). 3. Assume the investment banker also wishes to use the capital asset pricing model, as shown in Formula 11.5 in the text, to compute the cost (required return) on common stock. Assume Ry = 6 percent, B is 1.25, and K. is 13 percent. What is the value of Kj? How does this compare to the value of K, computed in question 1? $ 400,000 200,000 $ 2,600,000 300.000 2,300,000 5.500.000 $ 8,400,000 30,700,000 13.200.000 Assets Current assets: Cash... Marketable securities Accounts receivable.. Less: Allowance for bad debts Inventory...... Total current assets Fixed Assets: Plant and equipment, original cost. Less: Accumulated depreciation. Net plant and equipment...... Total assets Liabilities and Stockholders' Equity Current liabilities:... Accounts payable. Accrued expenses Total current liabilities... Long-term financing: Bonds payable.... Preferred stock... Common stock 17.500.000 $25.900.000 $ 6,200,000 1.700.000 7,900,000 + $ 6,120,000 + 1,080,000 Retained carnings } Common equity { 6,300,000 4.500.000 10,800,000 - 18.000.000 $25,900.000 Total common equity ....... Total long-term financing - Total liabilities and stockholders' equity. ed Security Bond Bond Bond. Preferred stock Preferred stock Year of Issue 1992 1996 2002 1997 2000 Amount $1,120,000 3,000,000 2,000,000 600,000 480,000 Yield 6.1% 13.8 8.3 12.0 7.9 ***