Answered step by step

Verified Expert Solution

Question

1 Approved Answer

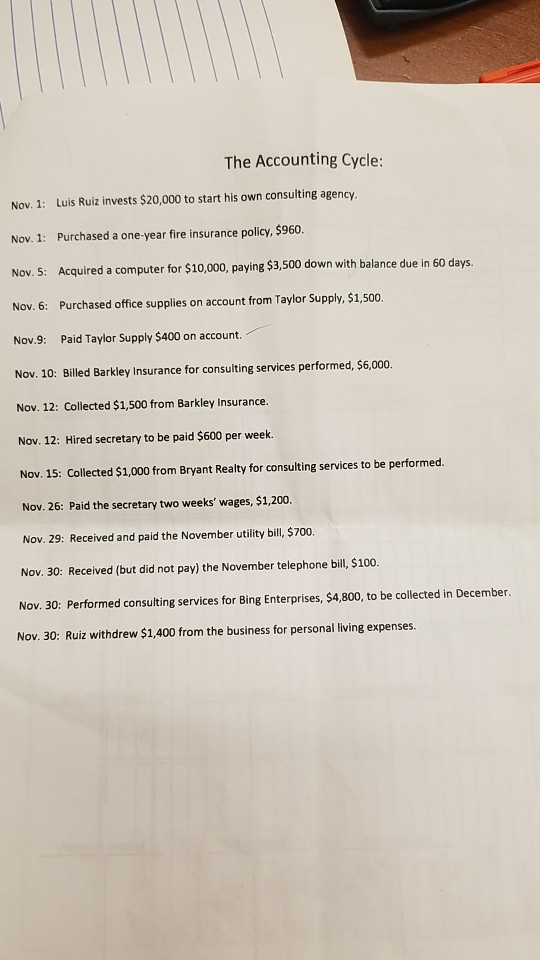

Please help me with these! thank you! The Accounting Cycle: Nov. 1: Luis Ruiz invests $20,000 to start his own consulting agency. Nov. 1: Purchased

Please help me with these! thank you!

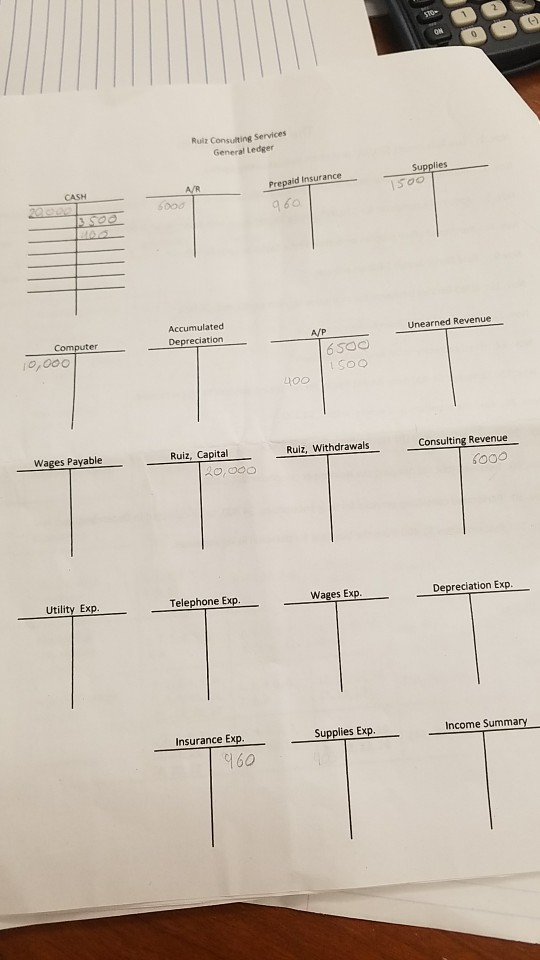

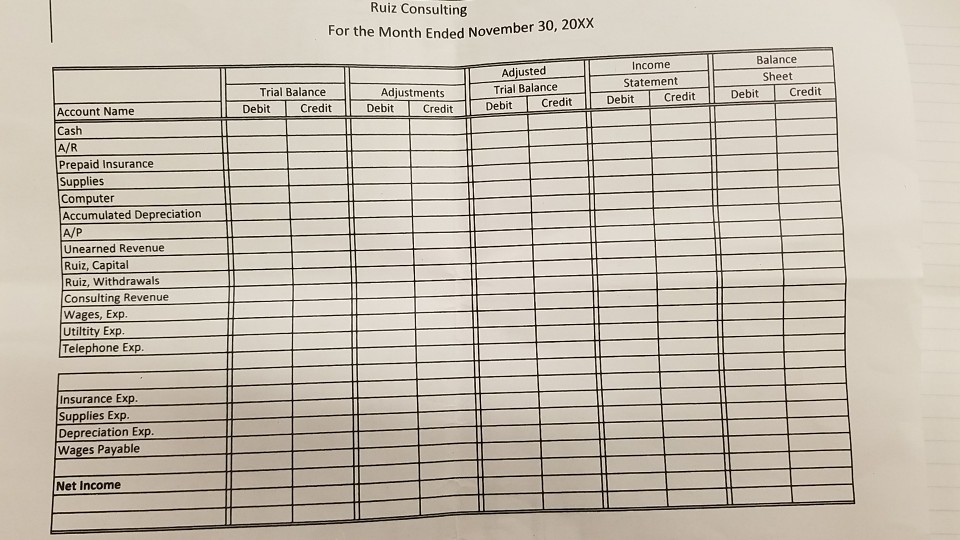

The Accounting Cycle: Nov. 1: Luis Ruiz invests $20,000 to start his own consulting agency. Nov. 1: Purchased a one-year fire insurance policy, $960 Nov.s: Acquired a computer for $10,000, paying $3,500 down with balance due in 60 days Nov. 6: Purchased office supplies on account from Taylor Supply, $1,500 Nov.9: Paid Taylor Supply $400 on account. Nov. 10: Billed Barkley Insurance for consulting services performed, $6,000. Nov. 12: Collected $1,500 from Barkley Insurance Nov. 12: Hired secretary to be paid $600 per week. Nov. 15: Collected $1,000 from Bryant Realty for consulting services to be performed. Nov. 26: Paid the secretary two weeks' wages, $1,200. Nov. 29: Received and paid the November utility bill $700. Nov. 30: Received (but did not pay) the November telephone bill, $100. Nov. 30: Performed consulting services for Bing Enterprises, $4,800, to be collected in December. Nov. 30: Ruiz withdrew $1,400 from the business for personal living expensesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started