Please help me with these three problems, once done and correct for all three I'll make sure to vote a thumbs up!!

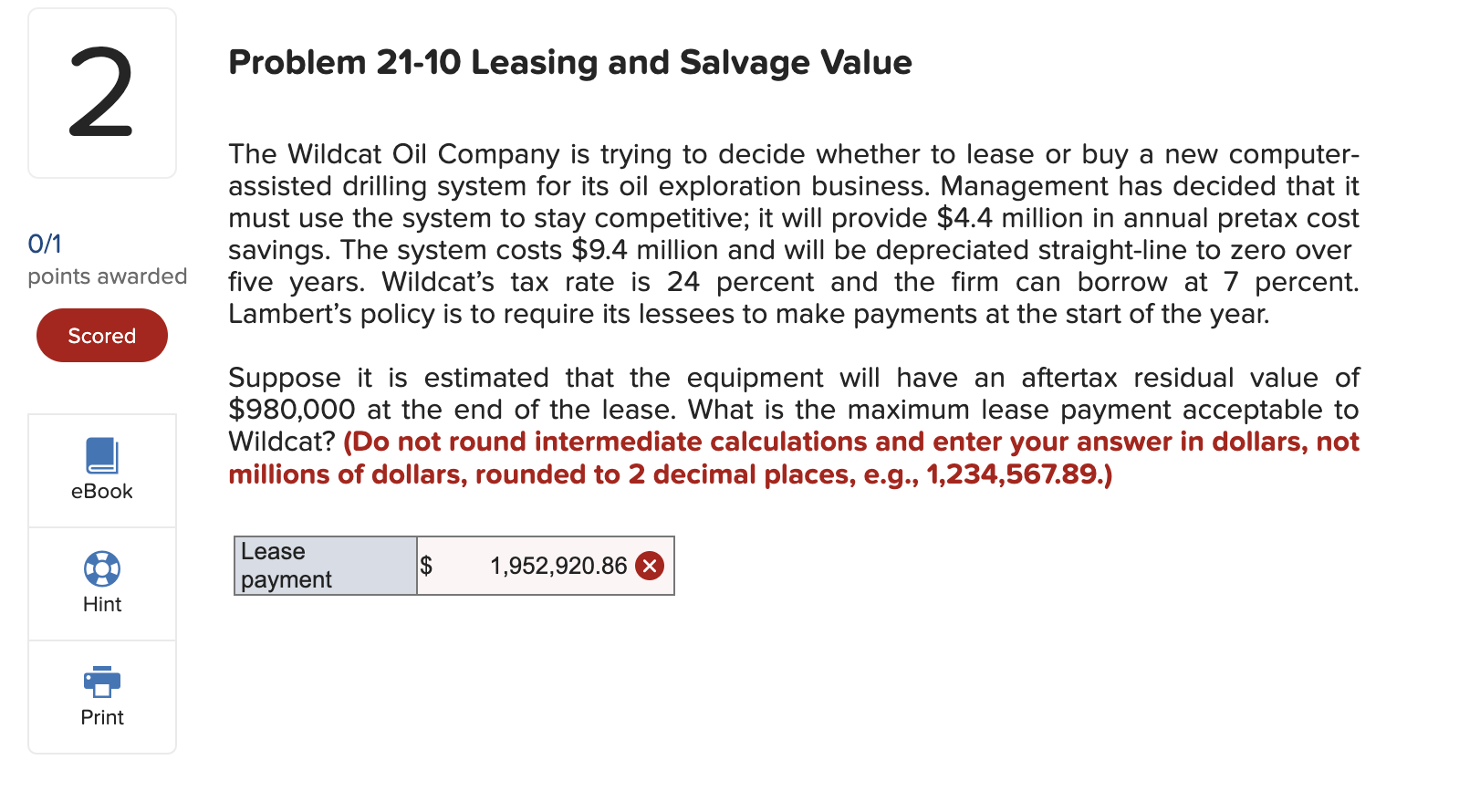

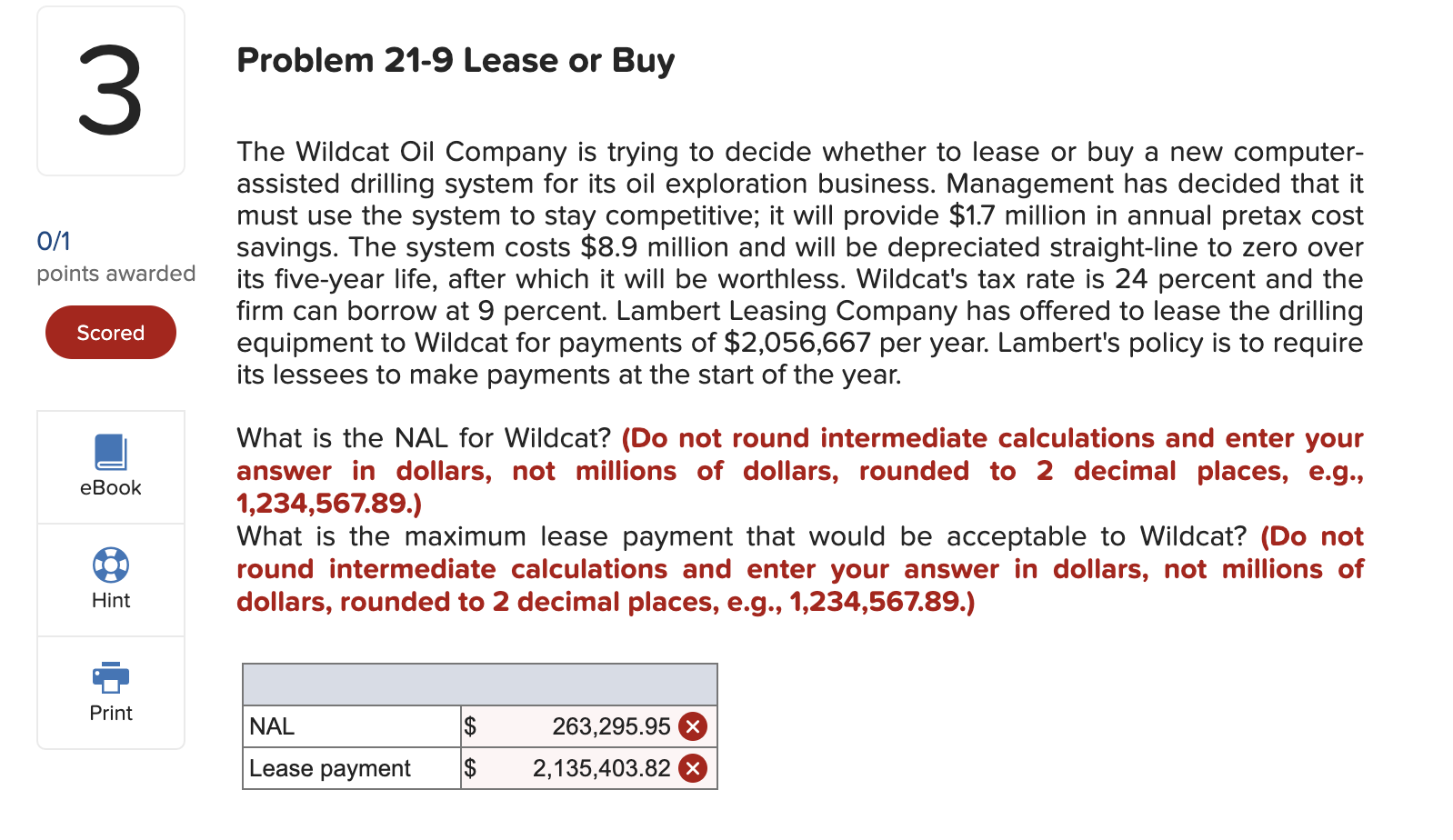

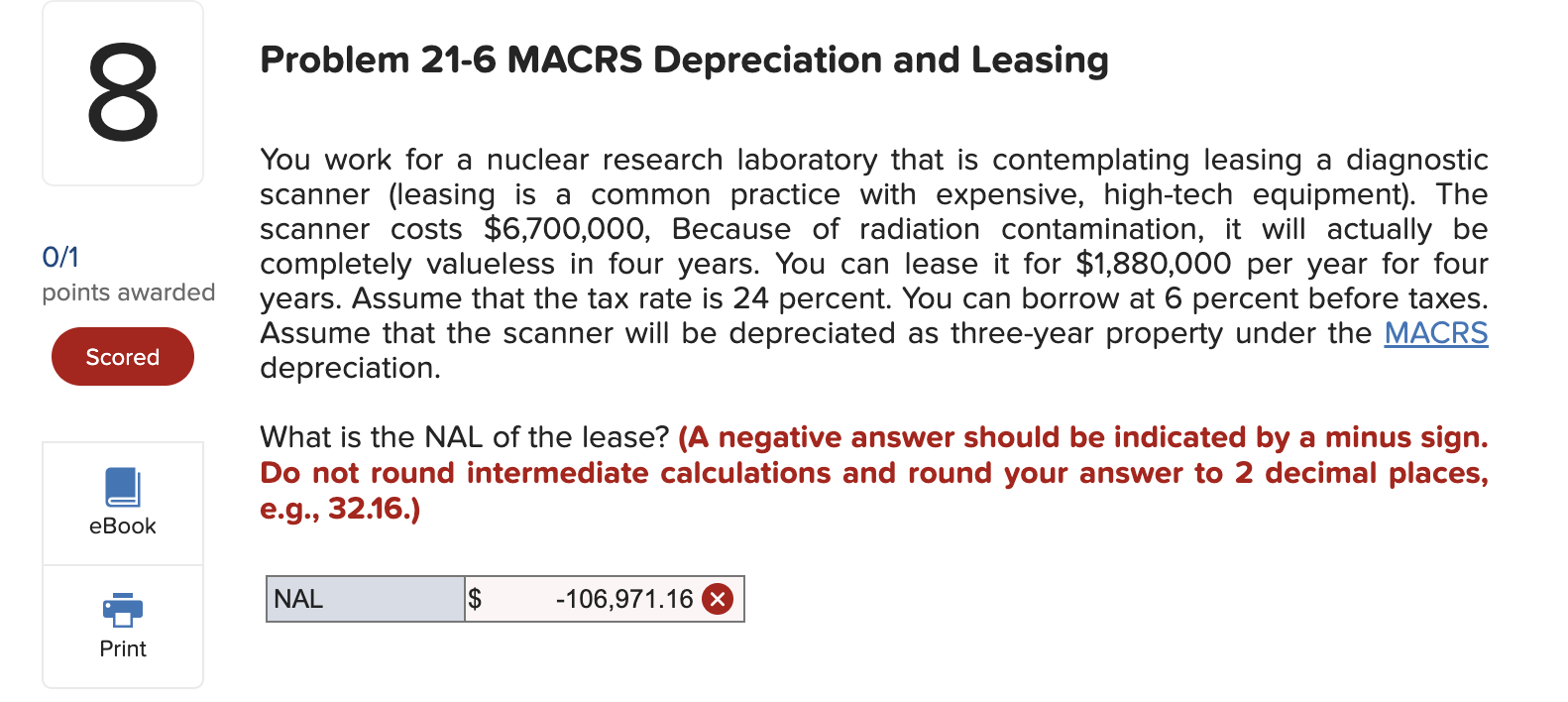

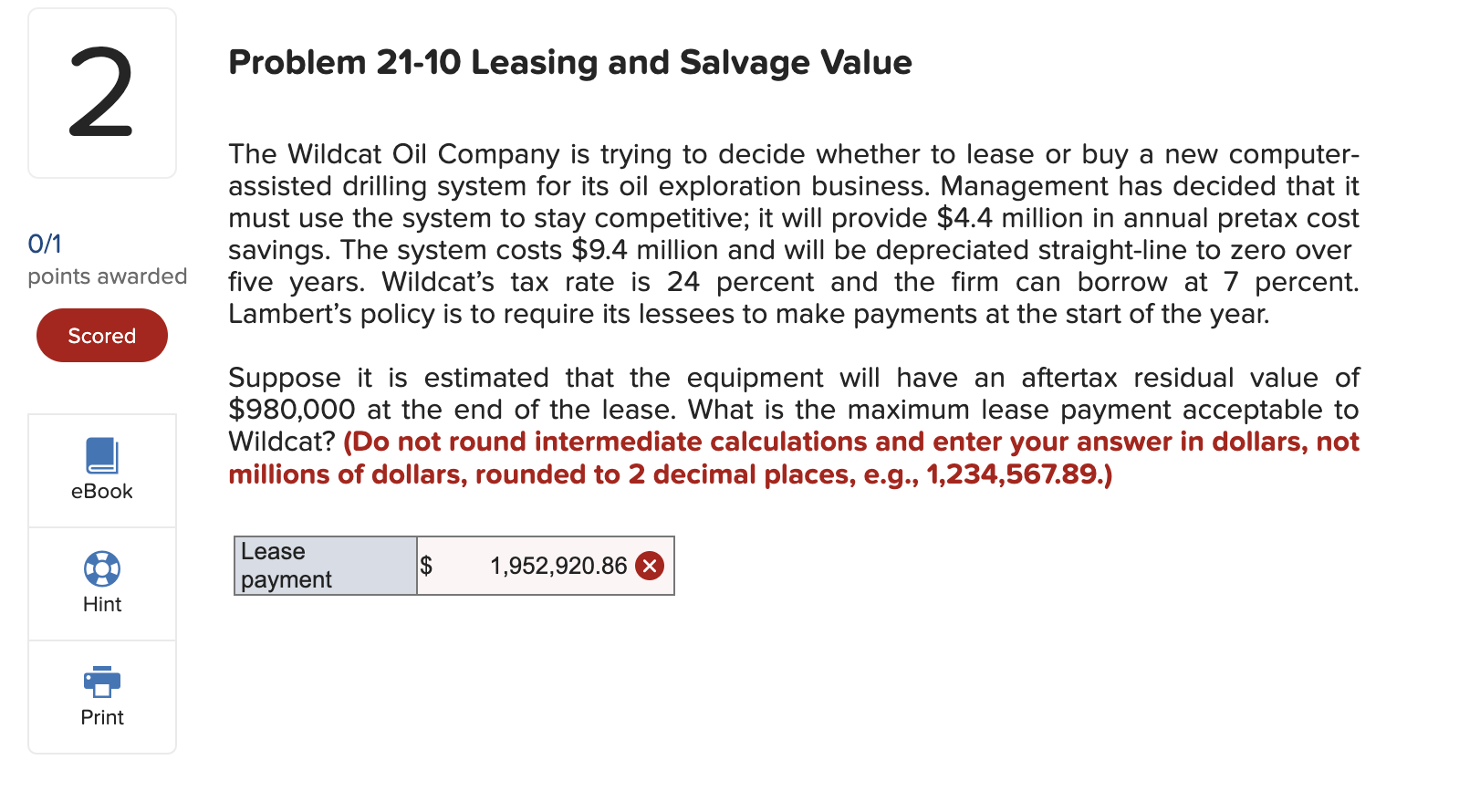

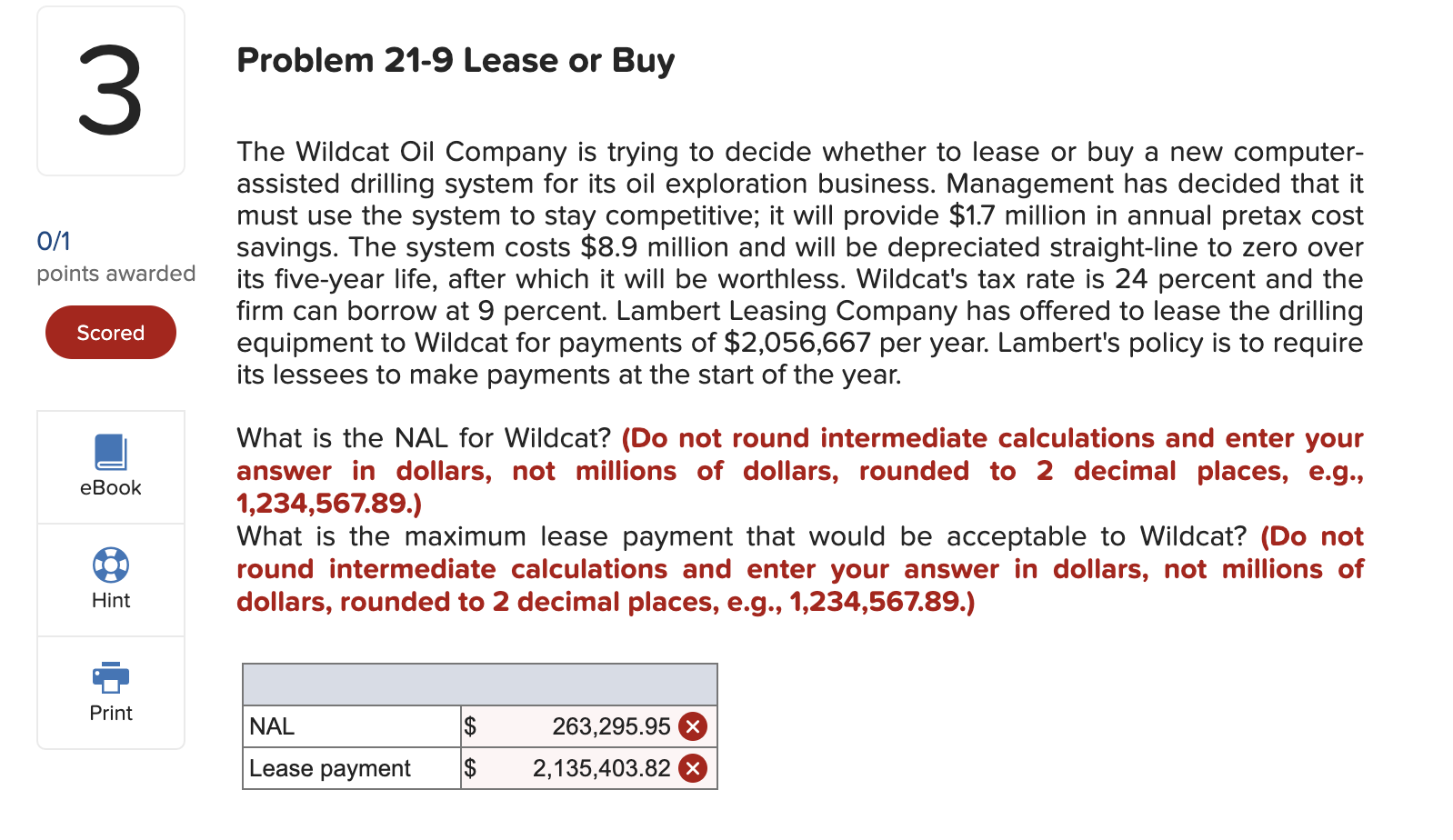

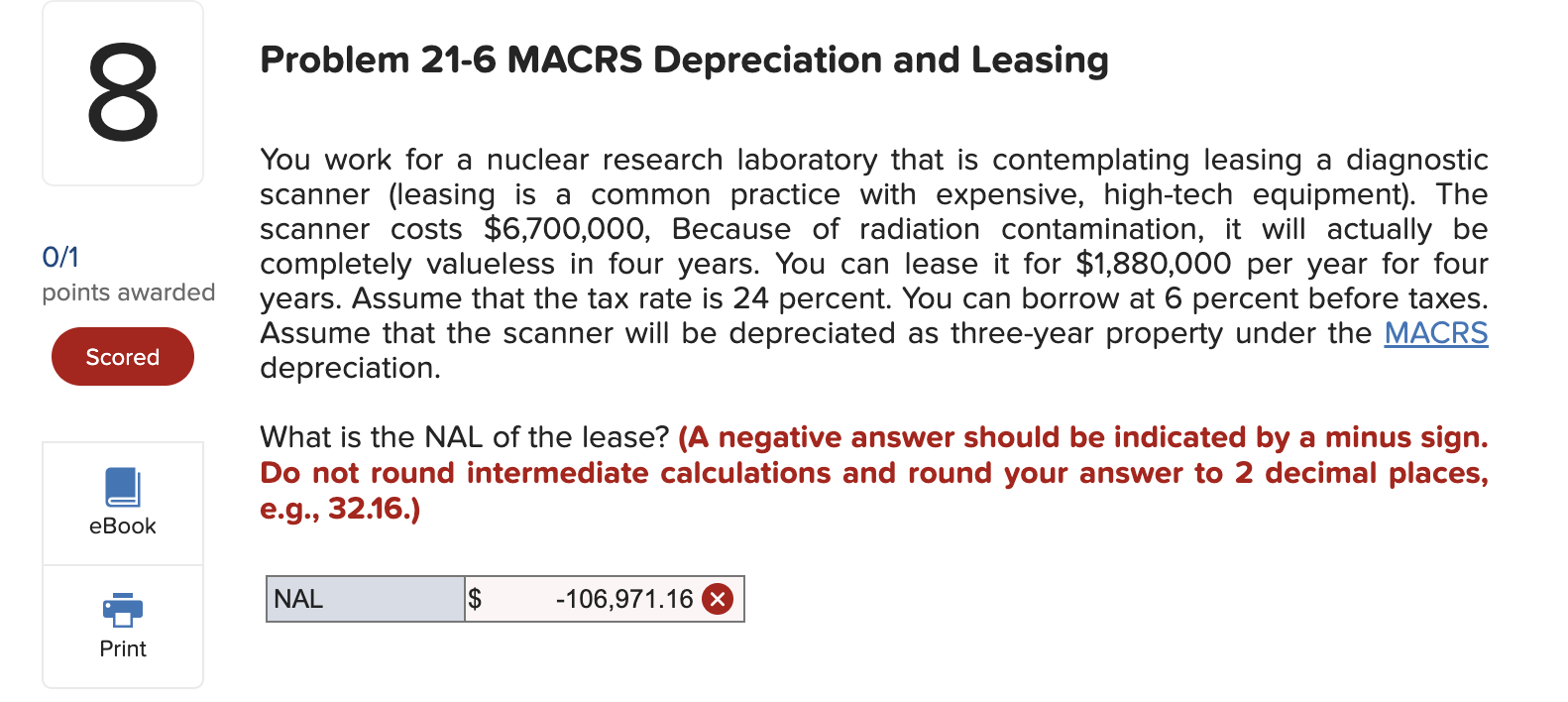

2 0/1 points awarded Scored eBook B Hint Print Problem 21-10 Leasing and Salvage Value The Wildcat Oil Company is trying to decide whether to lease or buy a new computer- assisted drilling system for its oil exploration business. Management has decided that it must use the system to stay competitive; it will provide $4.4 million in annual pretax cost savings. The system costs $9.4 million and will be depreciated straight-line to zero over five years. Wildcat's tax rate is 24 percent and the firm can borrow at 7 percent. Lambert's policy is to require its lessees to make payments at the start of the year. Suppose it is estimated that the equipment will have an aftertax residual value of $980,000 at the end of the lease. What is the maximum lease payment acceptable to Wildcat? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89.) Lease $ 1,952,920.86 payment 3 0/1 points awarded Scored eBook COL Hint Print Problem 21-9 Lease or Buy The Wildcat Oil Company is trying to decide whether to lease or buy a new computer- assisted drilling system for its oil exploration business. Management has decided that it must use the system to stay competitive; it will provide $1.7 million in annual pretax cost savings. The system costs $8.9 million and will be depreciated straight-line to zero over its five-year life, after which it will be worthless. Wildcat's tax rate is 24 percent and the firm can borrow at 9 percent. Lambert Leasing Company has offered to lease the drilling equipment to Wildcat for payments of $2,056,667 per year. Lambert's policy is to require its lessees to make payments at the start of the year. What is the NAL for Wildcat? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89.) What is the maximum lease payment that would be acceptable to Wildcat? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89.) NAL $ 263,295.95 Lease payment $ 2,135,403.82 8 0/1 points awarded Scored eBook Print Problem 21-6 MACRS Depreciation and Leasing You work for a nuclear research laboratory that is contemplating leasing a diagnostic scanner (leasing is a common practice with expensive, high-tech equipment). The scanner costs $6,700,000, Because of radiation contamination, it will actually be completely valueless in four years. You can lease it for $1,880,000 per year for four years. Assume that the tax rate is 24 percent. You can borrow at 6 percent before taxes. Assume that the scanner will be depreciated as three-year property under the MACRS depreciation. What is the NAL of the lease? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) NAL $ -106,971.16