Answered step by step

Verified Expert Solution

Question

1 Approved Answer

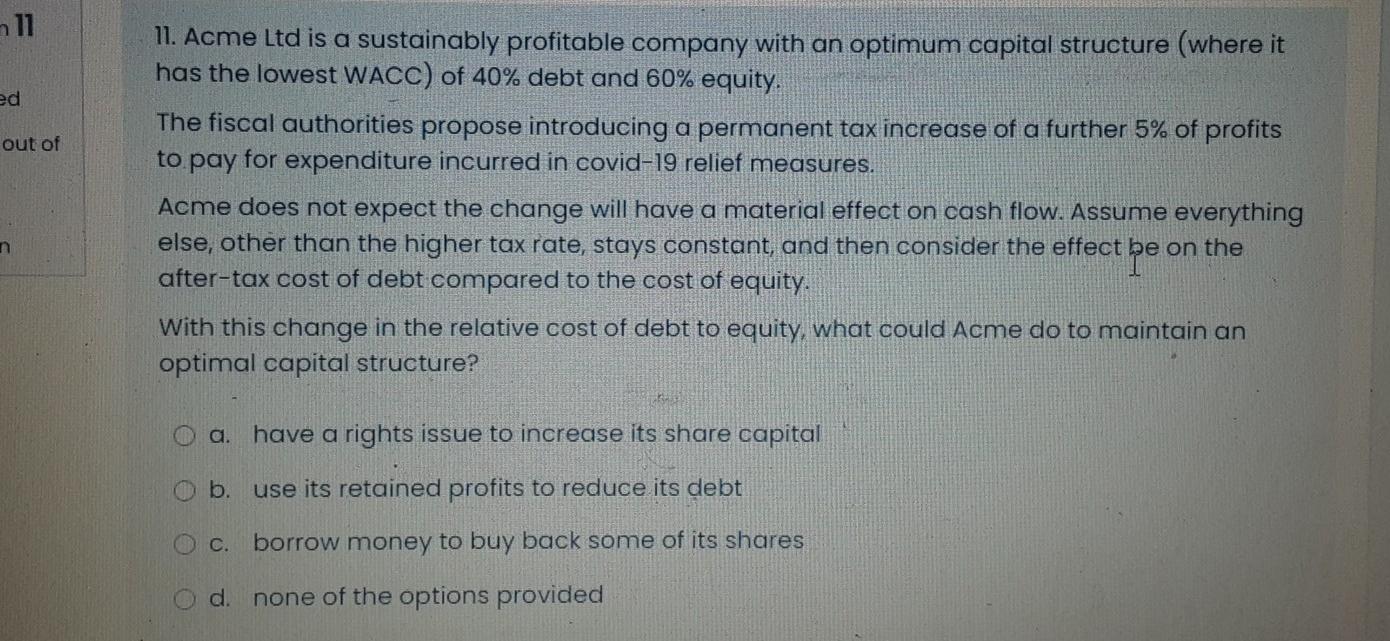

please help me with these two questions! thanks! ed out of 11. Acme Ltd is a sustainably profitable company with an optimum capital structure (where

please help me with these two questions! thanks!

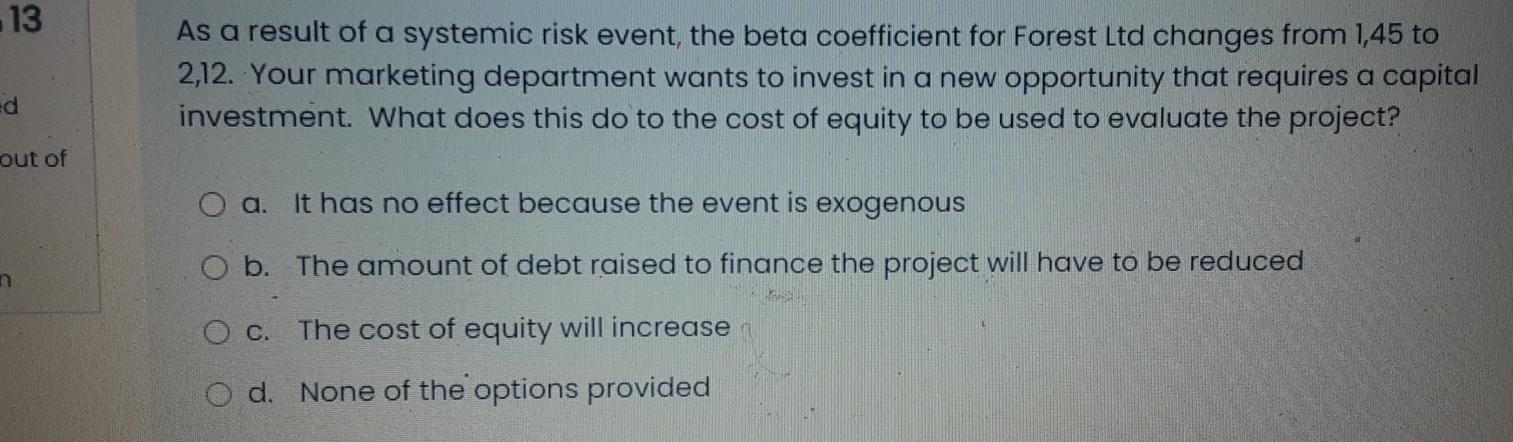

ed out of 11. Acme Ltd is a sustainably profitable company with an optimum capital structure (where it has the lowest WACC) of 40% debt and 60% equity. The fiscal authorities propose introducing a permanent tax increase of a further 5% of profits to pay for expenditure incurred in covid-19 relief measures. Acme does not expect the change will have a material effect on cash flow. Assume everything else, other than the higher tax rate, stays constant, and then consider the effect be on the after-tax cost of debt compared to the cost of equity. With this change in the relative cost of debt to equity, what could Acme do to maintain an optimal capital structure? n a. have a rights issue to increase its share capital Ob. use its retained profits to reduce its debt O c. borrow money to buy back some of its shares O d. none of the options provided -13 As a result of a systemic risk event, the beta coefficient for Forest Ltd changes from 1,45 to 2,12. Your marketing department wants to invest in a new opportunity that requires a capital investment. What does this do to the cost of equity to be used to evaluate the project? ed out of O a. It has no effect because the event is exogenous O b. The amount of debt raised to finance the project will have to be reduced n O c. The cost of equity will increase O d. None of the options providedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started