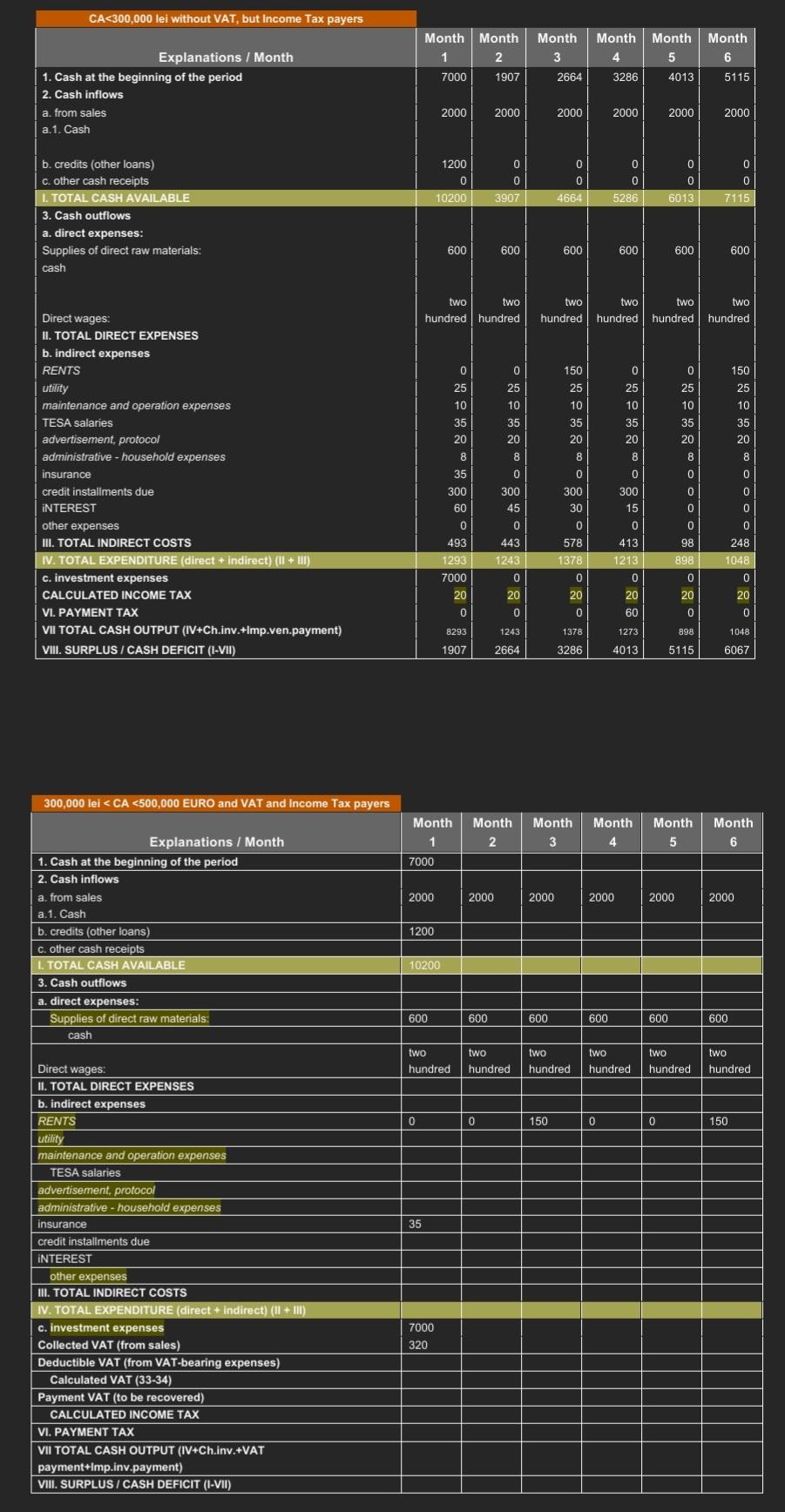

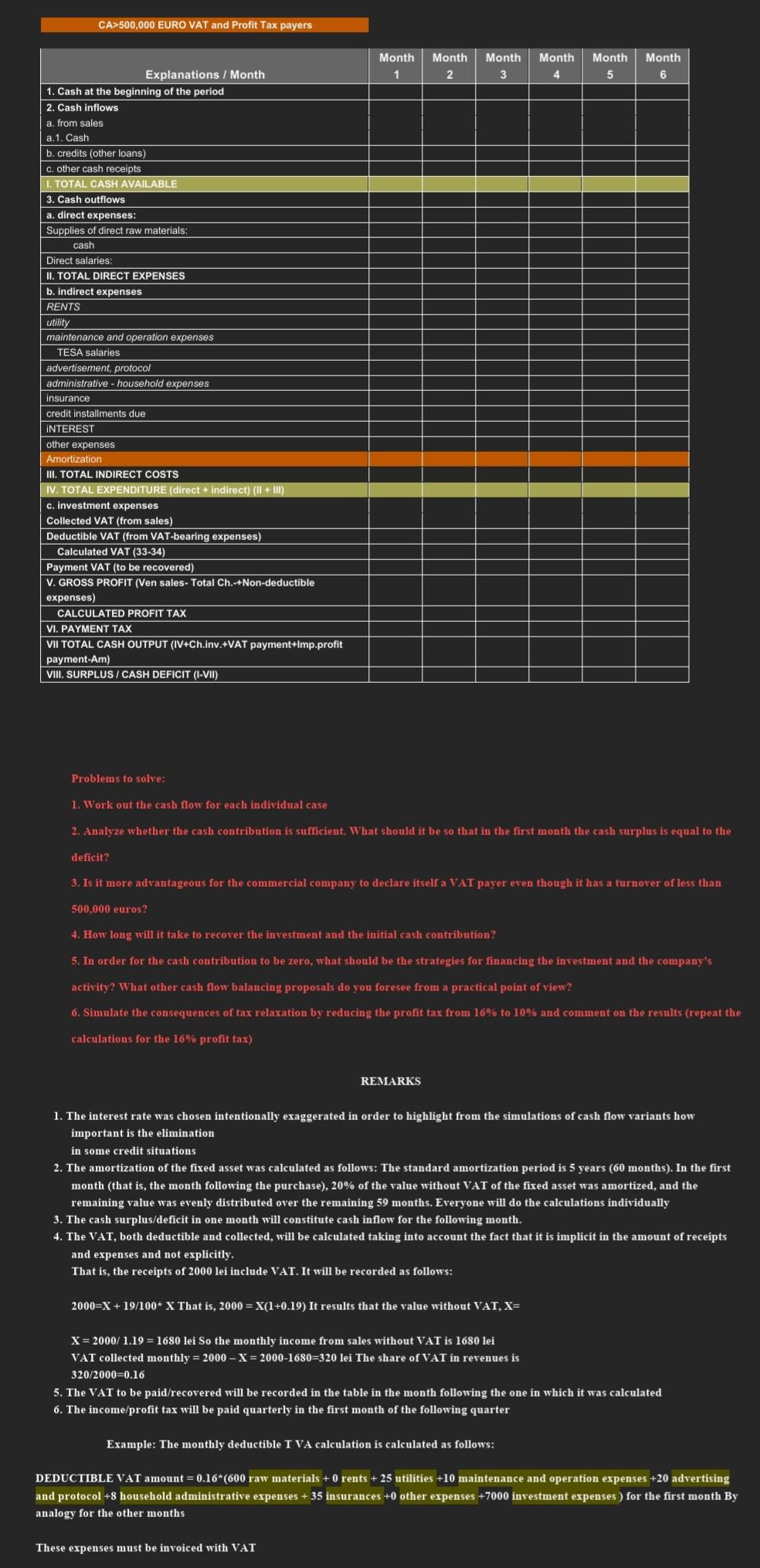

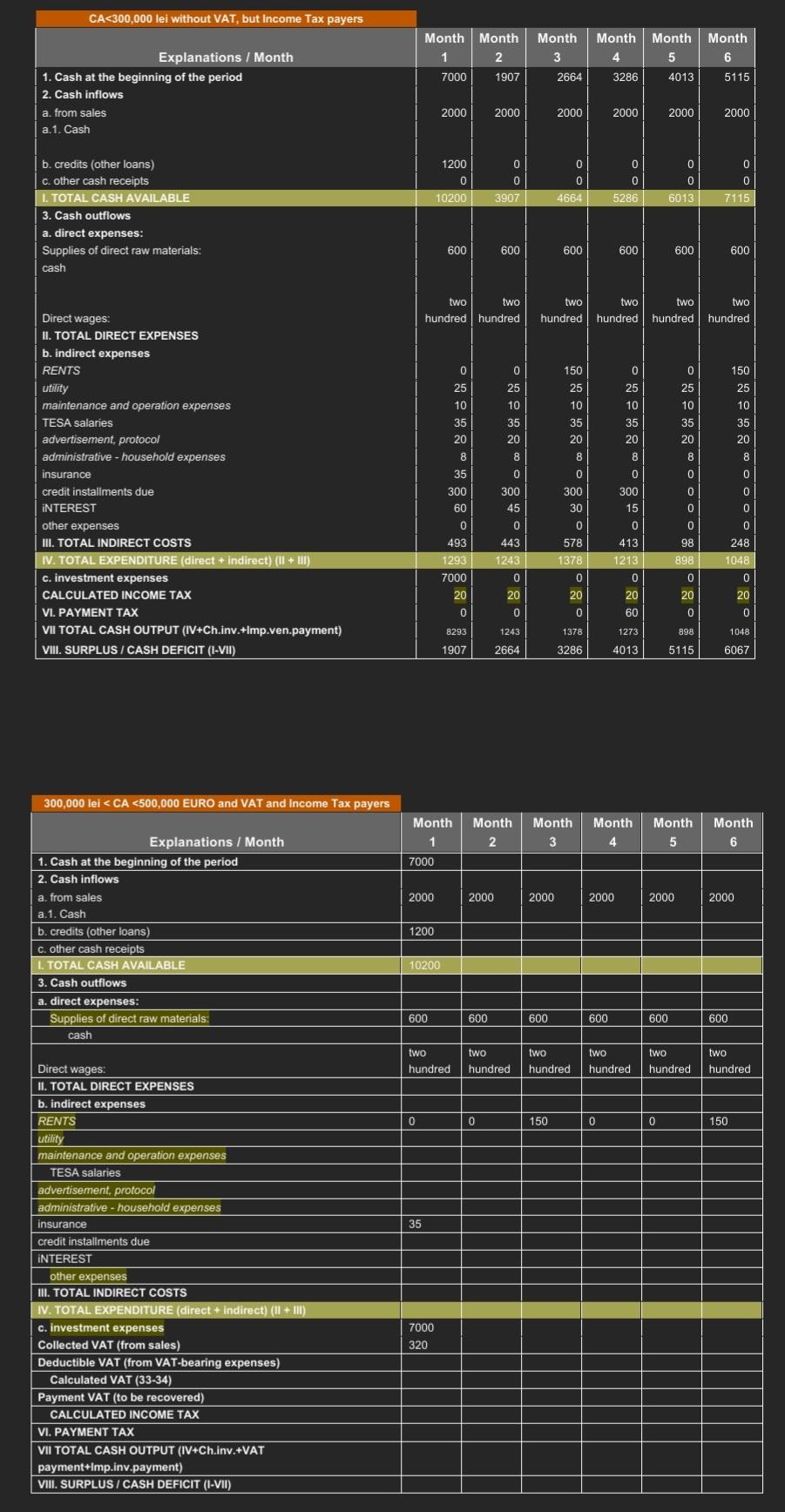

Please help me with this Finance assignment. I must fill out tables 2 and 3. Please note that the information has been translated from Romanian so some terms might not be translated 100% accurately.

Problems to solve: 1. Work out the cash flow for each individual case 2. Analyze whether the cash contribution is sufficient. What should it be so that in the first month the cash surplus is equal to the deficit? 3. Is it more advantageous for the commercial company to declare itself a VAT payer even though it has a turnover of less than 500,000 euros? 4. How long will it take to recover the investment and the initial cash contribution? 5. In order for the cash contribution to be zero, what should be the strategies for financing the investment and the company's activity? What other cash flow balancing proposals do you foresee from a practical point of view? 6. Simulate the consequences of tax relaxation by reducing the profit tax from 16% to 10% and comment on the results (repeat the calculations for the 16% profit tax) REMARKS 1. The interest rate was chosen intentionally exaggerated in order to highlight from the simulations of cash flow variants how important is the elimination in some credit situations 2. The amortization of the fixed asset was calculated as follows: The standard amortization period is 5 years ( 60 months). In the first month (that is, the month following the purchase), 20% of the value without VAT of the fixed asset was amortized, and the remaining value was evenly distributed over the remaining 59 months. Everyone will do the calculations individually 3. The cash surplus/deficit in one month will constitute cash inflow for the following month. 4. The VAT, both deductible and collected, will be calculated taking into account the fact that it is implicit in the amount of receipts and expenses and not explicitly. That is, the receipts of 2000 lei include VAT. It will be recorded as follows: 2000=X+19/100X That is, 2000=X(1+0.19) It results that the value without VAT,X= X=2000/1.19=1680 lei So the monthly income from sales without VAT is 1680 lei VAT collected monthly =2000X=20001680=320 lei The share of VAT in revenues is 320/2000=0.16 5. The VAT to be paid/recovered will be recorded in the table in the month following the one in which it was calculated 6. The income/profit tax will be paid quarterly in the first month of the following quarter Example: The monthly deductible T VA calculation is calculated as follows: DEDUCTIBLE VAT amount =0.16(600 raw materials +0 rents +25 utilities +10 maintenance and operation expenses +20 advertising and protocol +8 household administrative expenses +35 insurances +0 other expenses +7000 investment expenses ) for the first month By analogy for the other months Problems to solve: 1. Work out the cash flow for each individual case 2. Analyze whether the cash contribution is sufficient. What should it be so that in the first month the cash surplus is equal to the deficit? 3. Is it more advantageous for the commercial company to declare itself a VAT payer even though it has a turnover of less than 500,000 euros? 4. How long will it take to recover the investment and the initial cash contribution? 5. In order for the cash contribution to be zero, what should be the strategies for financing the investment and the company's activity? What other cash flow balancing proposals do you foresee from a practical point of view? 6. Simulate the consequences of tax relaxation by reducing the profit tax from 16% to 10% and comment on the results (repeat the calculations for the 16% profit tax) REMARKS 1. The interest rate was chosen intentionally exaggerated in order to highlight from the simulations of cash flow variants how important is the elimination in some credit situations 2. The amortization of the fixed asset was calculated as follows: The standard amortization period is 5 years ( 60 months). In the first month (that is, the month following the purchase), 20% of the value without VAT of the fixed asset was amortized, and the remaining value was evenly distributed over the remaining 59 months. Everyone will do the calculations individually 3. The cash surplus/deficit in one month will constitute cash inflow for the following month. 4. The VAT, both deductible and collected, will be calculated taking into account the fact that it is implicit in the amount of receipts and expenses and not explicitly. That is, the receipts of 2000 lei include VAT. It will be recorded as follows: 2000=X+19/100X That is, 2000=X(1+0.19) It results that the value without VAT,X= X=2000/1.19=1680 lei So the monthly income from sales without VAT is 1680 lei VAT collected monthly =2000X=20001680=320 lei The share of VAT in revenues is 320/2000=0.16 5. The VAT to be paid/recovered will be recorded in the table in the month following the one in which it was calculated 6. The income/profit tax will be paid quarterly in the first month of the following quarter Example: The monthly deductible T VA calculation is calculated as follows: DEDUCTIBLE VAT amount =0.16(600 raw materials +0 rents +25 utilities +10 maintenance and operation expenses +20 advertising and protocol +8 household administrative expenses +35 insurances +0 other expenses +7000 investment expenses ) for the first month By analogy for the other months