Answered step by step

Verified Expert Solution

Question

1 Approved Answer

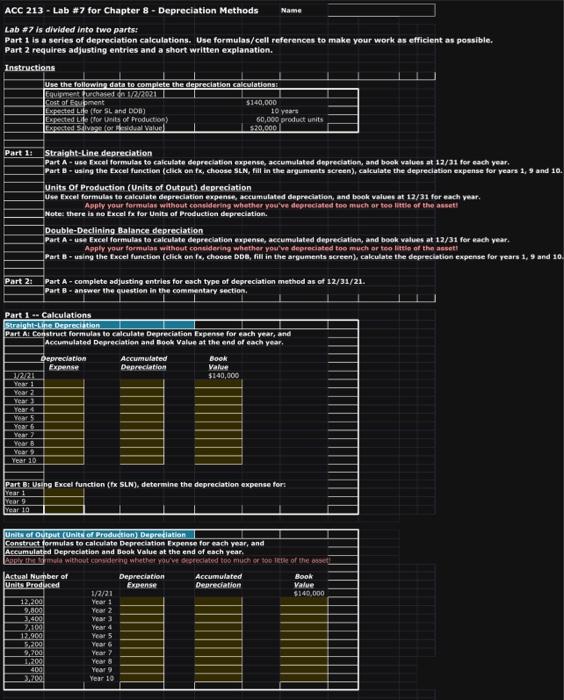

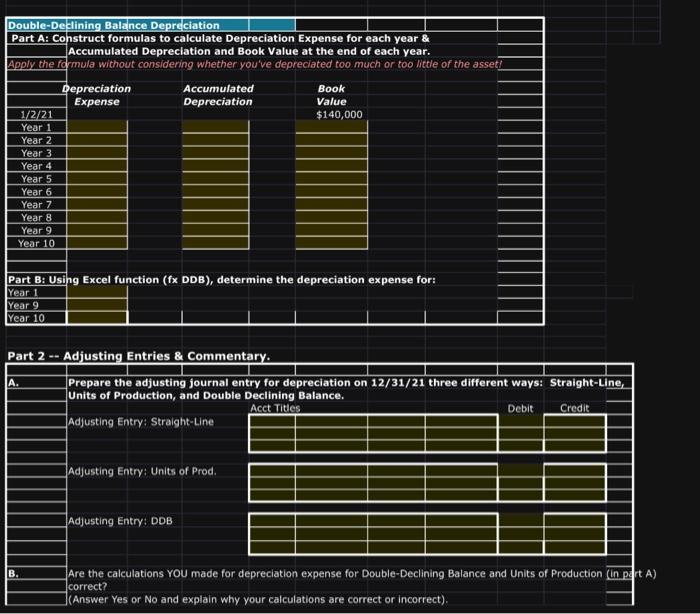

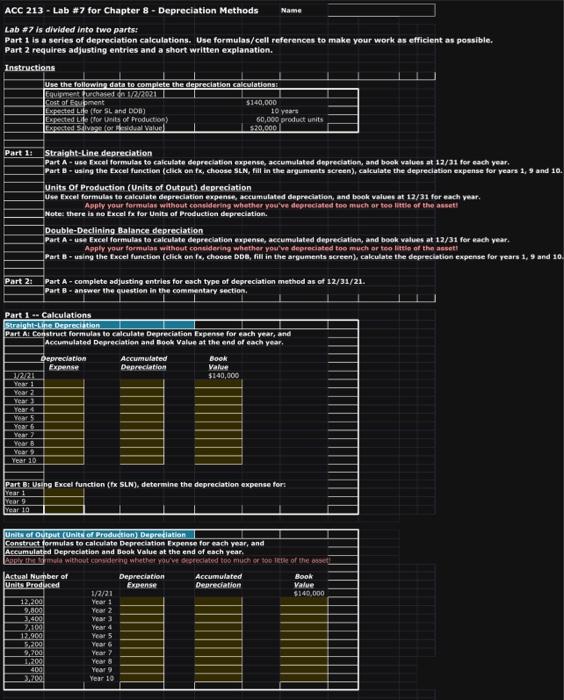

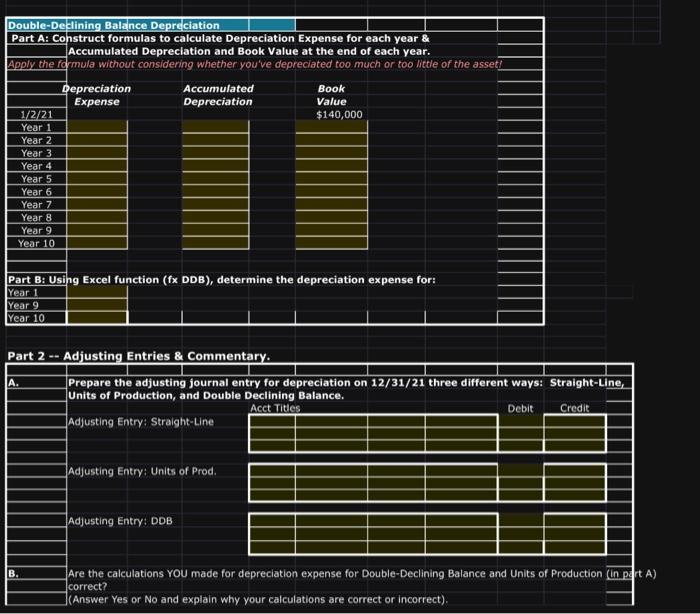

Please help me with this lab. ACC 213 - Lab #7 for Chapter 8 - Depreciation Methods Name Lab7 is divided into two parts: Part

Please help me with this lab.

ACC 213 - Lab #7 for Chapter 8 - Depreciation Methods Name Lab7 is divided into two parts: Part 1 is a series of depreciation calculations. Use formulas/cell references to make your work as efficient as possible. Part 2 requires adjusting entries and a short written explanation. Part 8 - using the Excel function (click on fx, choose sLiN, fill in the arguments screen), calculate the depreciation expense for years 1, 9 and 10. Units of Production (Units of Output) depreciation Use Excel farmulas to calculate depreciation expense, accumutated bepreciation, and book values at 12/31 for each vear. Apply your formulas whahout consldering whether you've depreciated too meich or tee littile of tho asseti Notes there is no Excel fx for Units at Production depreciation. Double-Declining Balance depreciation Part A - use Excel formulas to calculate cepreciation expense, aceumulated depreciation, and boak values at 12/31 for each year. Apply your focmulas without condidering whether you've depreciated too much or teo litth of the assett: Part B- using the Excel function (click on fo, choose DDB, fill in the arguments screen), calculate the depreciation expense for rears 1,9 and 10 . Part 2 - Adjusting Entries \& Commentary

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started