Answered step by step

Verified Expert Solution

Question

1 Approved Answer

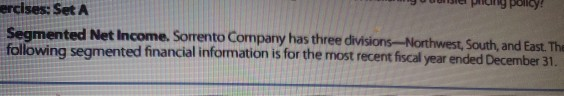

please help me with this problem. thanks in advance. dng poltcy! ercises: Set A Segmented Net Income. Sorrento Company has three divisions--Northwest, South, and East.

please help me with this problem. thanks in advance.

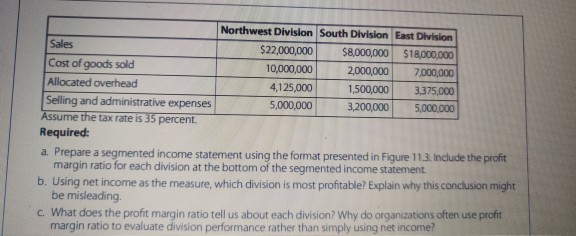

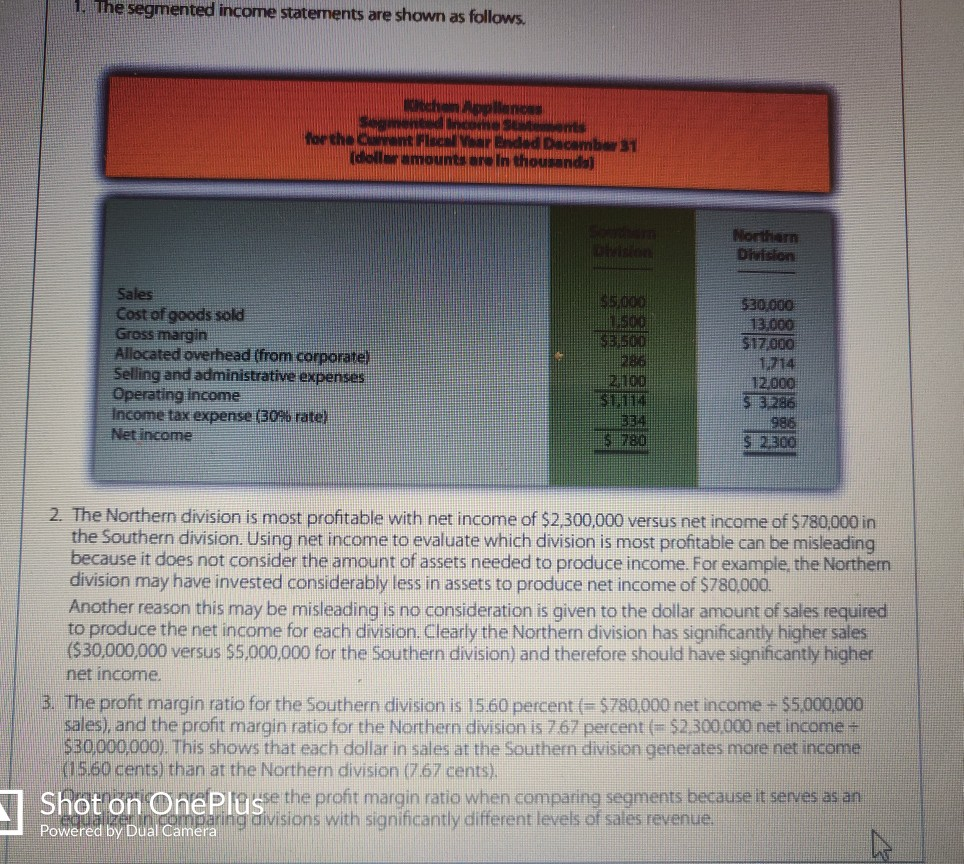

dng poltcy! ercises: Set A Segmented Net Income. Sorrento Company has three divisions--Northwest, South, and East. The following segmented financial information is for the most recent fiscal year ended December 31. Northwest Division South Division East Division Sales $22,000,000 $8,000,000 $18,000,000 Cost of goods sold 10,000,000 2,000,000 7,000,000 Allocated overhead 3375,000 4,125,000 1,500,000 Selling and administrative expenses Assume the tax rate is 35 percent 5,000,000 3,200,000 5,000,000 Required: a. Prepare a segmented income statement using the format presented in Figure 11.3. Include the profit margin ratio for each division at the bottom of the segmented income statement. b. Using net income as the measure, which division is most profitable? Explain why this conclusion might be misleading. c. What does the profit margin ratio tell us about each division? Why do organizations often use profit margin ratio to evaluate division performance rather than simply using net income? 1. The segmented income statenents are shown as follows Obchan Applienoss Segmented income Statents orthe Current Flscal Vear Ended December 31 (dollar amounts are In thousands) Northern Division Dison Sales Cost of goods sold Gross margin Allocated overhead (from corporate) Selling and administrative expenses Operating income Income tax expense (30% rate) Net income $5,000 1500 93 500 236 2100 s1,114 334 s 780 $30,000 13.000 $17,000 1,714 12.000 $ 3,286 986 $ 2.300 2. The Northern division is most profitable with net income of $2,300,000 versus net income of $780,000 in the Southern division. Using net income to evaluate which division is most profitable can be misleading because it does not consider the amount of assets needed to produce income. For example, the Northerm division may have invested considerably less in assets to produce net income of $780,000. Another reason this may be misleading is no consideration is given to the dollar amount of sales required to produce the net income for each division. Clearly the Northern division has significantly higher sales ($30,000,000 versus $5,000,000 for the Southern division) and therefore should have significantly higher net income. 3. The profit margin ratio for the Southern division is 15.60 percent ($780,000 net income $5,000,000 sales), and the profit margin ratio for the Northern division is 7.67 percent (- $2.300,000 net income + $30,000,000). This shows that each dollar in sales at the Southern division generates more net income (1560 cents) than at the Northern division (7.67 cents) Shot on OnePlus the profit margin ratio when comparing segments because it serves as an oomparing divisions with significantly different levels of sales revenue Powered by Dual Camera Segmented Net Income a. Segmented income statements are shown below Sorrento Company Segmented Income Statements For the Current Fiscal Year Ended December 31 Northwest South East Division Division Division Sales Cost of goods sold Gross margin Allocated overhead Selling and administrative expenses Operating income Income tax expense (35% rate) $ 1,868.750 Net income 8.5% Profit margin ratio Shot on OnePlus Powered by Dual Camera D G b. . Shot on OnePlus Pawered by Dual CameraStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started