Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me with this problems 8) (Related to Checkpoint 11.1 and Checkpoint 11.4) (IRR and NPV calculation) The cash flows for three independent projects

please help me with this problems

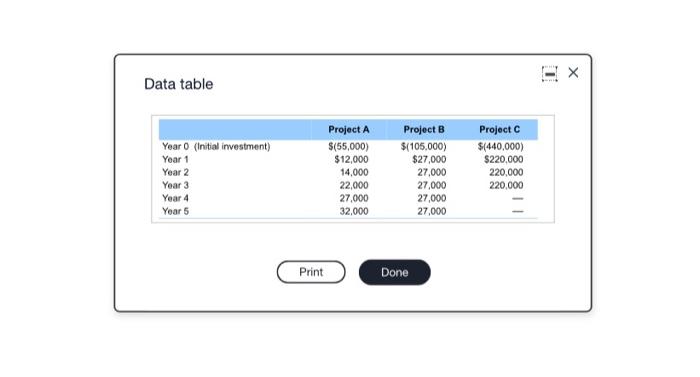

(Related to Checkpoint 11.1 and Checkpoint 11.4) (IRR and NPV calculation) The cash flows for three independent projects are found below a. Calculate the IRR for each of the projects b. If the discount rate for all three projects in 21 poroont, which project or projects would you want to undertake? c. What is the net present value of each of the projects where the appropriate discount rate is 21 percent? a. The IRR of Project Ais I. (Round to two decimal places.) Data table Year O (Initial investment) Year 1 Project A $(55,000) $12,000 14,000 22,000 27,000 32,000 Year 2 Project B $(105.000) $27,000 27,000 27,000 27,000 27,000 Project $(440,000) $220.000 220,000 220,000 Year 3 Year 4 Year 5 Print Done 8)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started