Please help me with this question.

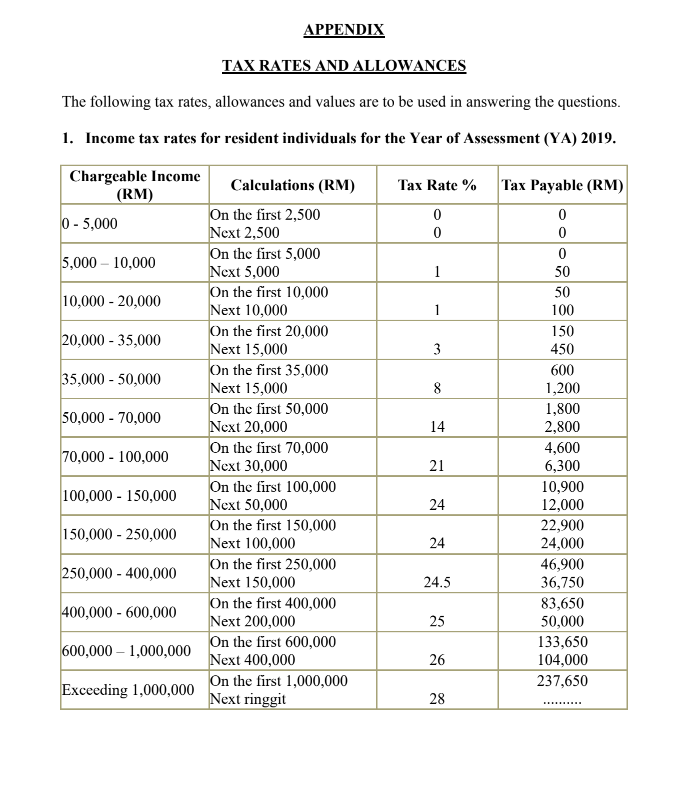

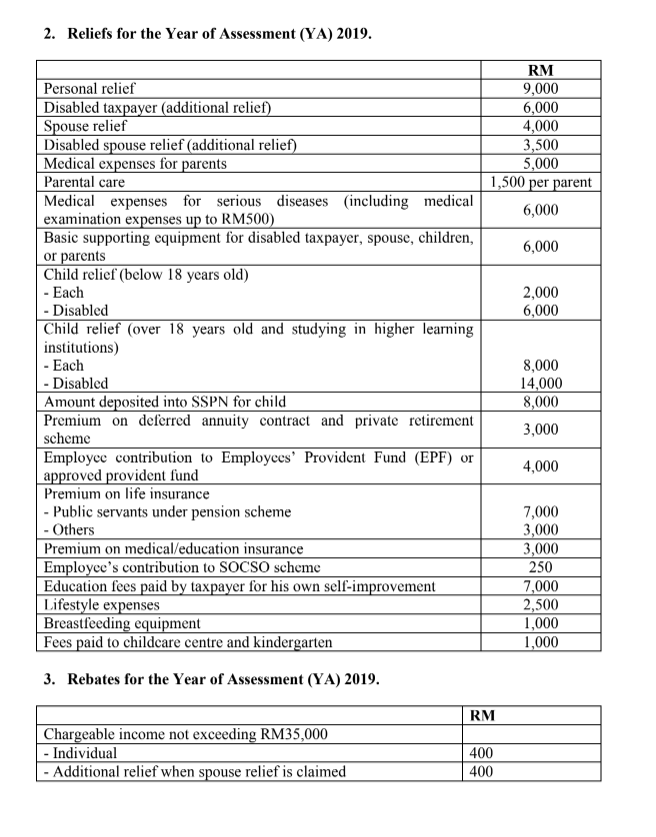

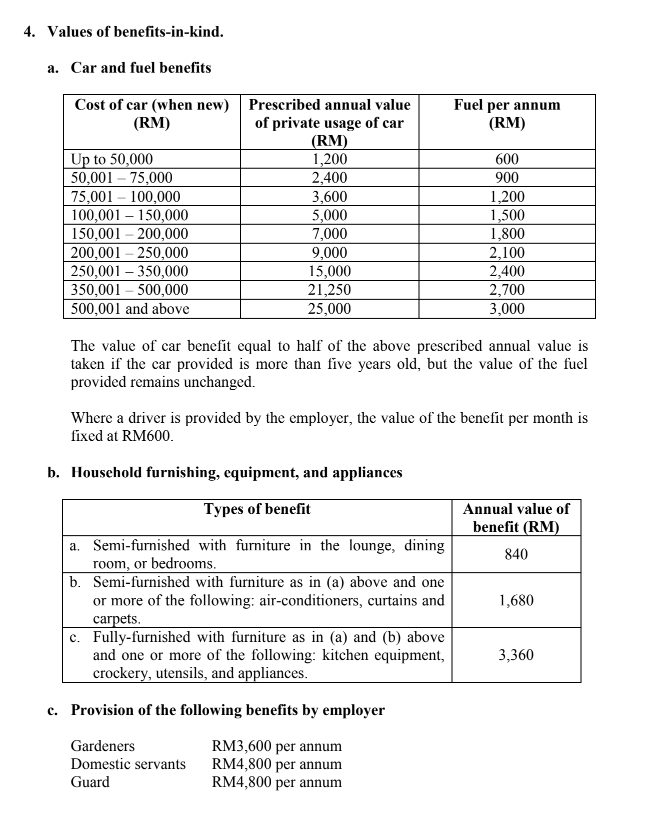

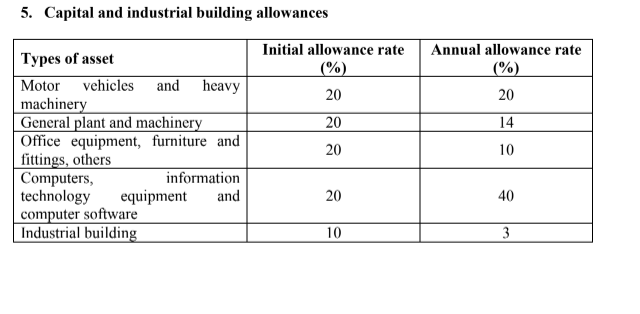

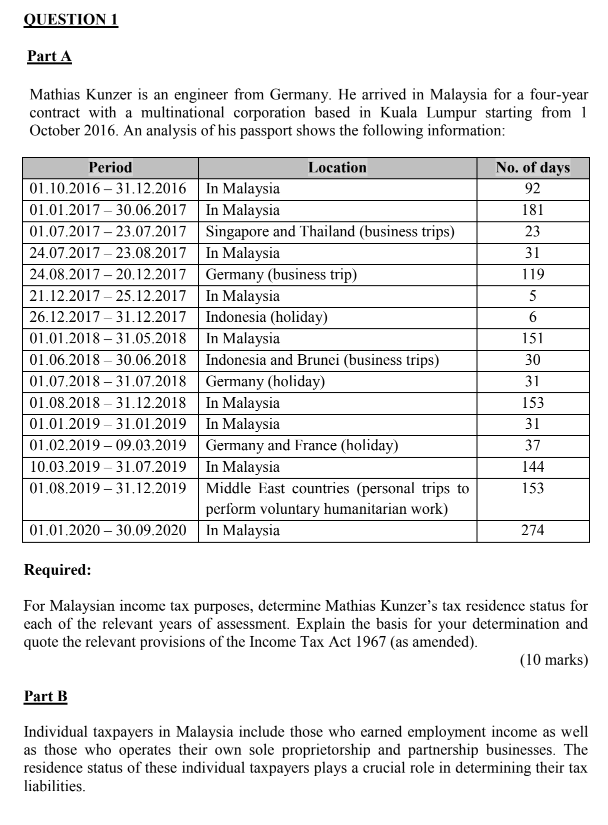

APPENDIX TAX RATES AND ALLOWANCES The following tax rates, allowances and values are to be used in answering the questions. 1. Income tax rates for resident individuals for the Year of Assessment (YA) 2019. Chargeable Income (RM) Calculations (RM) Tax Rate % Tax Payable (RM) 0 - 5,000 On the first 2,500 Next 2,500 5,000 - 10,000 On the first 5,000 0 Next 5,000 50 10,000 - 20,000 On the first 10,000 50 Next 10,000 1 100 20,000 - 35,000 On the first 20,000 150 Next 15,000 3 450 35,000 - 50,000 On the first 35,000 600 Next 15,000 8 1,200 50,000 - 70,000 On the first 50,000 1,800 Next 20,000 14 2,800 70,000 - 100,000 On the first 70,000 4,600 Next 30,000 21 6,300 100,000 - 150,000 On the first 100,000 10,900 Next 50,000 24 12,000 150,000 - 250,000 On the first 150,000 22,900 Next 100,000 24 24,000 250,000 - 400,000 On the first 250,000 46,900 Next 150,000 24.5 36,750 400,000 - 600,000 On the first 400,000 83,650 Next 200,000 25 50,000 600,000 - 1,000,000 On the first 600,000 133,650 Next 400,000 26 104,000 Exceeding 1,000,000 On the first 1,000,000 237,650 Next ringgit 282. Reliefs for the Year of Assessment (YA) 2019. RM Personal relief 9,000 Disabled taxpayer (additional relief) 6,000 Spouse relief 4,000 Disabled spouse relief (additional relief) 3,500 Medical expenses for parents 5,000 Parental care 1,500 per parent Medical expenses for serious diseases (including medical examination expenses up to RM500) 6,000 Basic supporting equipment for disabled taxpayer, spouse, children, or parents 6,000 Child relief (below 18 years old) . Each 2,000 - Disabled 6.000 Child relief (over 18 years old and studying in higher learning institutions) - Each 8,000 - Disabled 14,000 Amount deposited into SSPN for child 8,000 Premium on deferred annuity contract and private retirement scheme 3,000 Employee contribution to Employees' Provident Fund (EPF) or approved provident fund 4,000 Premium on life insurance - Public servants under pension scheme 7,000 - Others 3,000 Premium on medical/education insurance 3,000 Employee's contribution to SOCSO scheme 250 Education fees paid by taxpayer for his own self-improvement 7,000 Lifestyle expenses 2,500 Breastfeeding equipment 1,000 Fees paid to childcare centre and kindergarten 1,000 3. Rebates for the Year of Assessment (YA) 2019. RM Chargeable income not exceeding RM35,000 - Individual 400 - Additional relief when spouse relief is claimed 4004. Values of benefits-in-kind. a. Car and fuel benefits Cost of car (when new) Prescribed annual value Fuel per annum (RM) of private usage of car (RM) (RM) Up to 50,000 1,200 500 50,001 - 75,000 2,400 900 75.001 - 100,000 3,600 1,200 100,001 150,000 5,000 1,500 150,001 - 200,000 7,000 1,800 200,001 - 250,000 9,000 2,100 250,001 - 350,000 15,000 2,400 350,001 - 500,000 21,250 2,700 500,001 and above 25,000 3,000 The value of car benefit equal to half of the above prescribed annual value is taken if the car provided is more than five years old, but the value of the fuel provided remains unchanged. Where a driver is provided by the employer, the value of the benefit per month is fixed at RM600. b. Household furnishing, equipment, and appliances Types of benefit Annual value of benefit (RM) a. Semi-furnished with furniture in the lounge, dining room, or bedrooms. 840 b. Semi-furnished with furniture as in (@) above and one or more of the following: air-conditioners, curtains and 1,680 carpets. C. Fully-furnished with furniture as in (a) and (b) above and one or more of the following: kitchen equipment, 3,360 crockery, utensils, and appliances. c. Provision of the following benefits by employer Gardeners RM3,600 per annum Domestic servants RM4,800 per annum Guard RM4,800 per annum5. Capital and industrial building allowances Types of asset Initial allowance rate Annual allowance rate (%) (%) Motor vehicles and heavy machinery 20 20 General plant and machinery 20 14 Office equipment, furniture and fittings, others 20 10 Computers, information technology equipment and 20 40 computer software Industrial building 10 3QUESTION 1 Part A Mathias Kunzer is an engineer from Germany. He arrived in Malaysia for a four-year contract with a multinational corporation based in Kuala Lumpur starting from 1 October 2016. An analysis of his passport shows the following information: Period Location No. of days 01.10.2016 - 31.12.2016 In Malaysia 92 01.01.2017 - 30.06.2017 In Malaysia 181 01.07.2017 -23.07.2017 Singapore and Thailand (business trips) 23 24.07.2017-23.08.2017 In Malaysia 31 24.08.2017 - 20.12.2017 Germany (business trip) 119 21.12.2017 - 25.12.2017 In Malaysia 5 26.12.2017 - 31.12.2017 Indonesia (holiday) 6 01.01.2018 - 31.05.2018 In Malaysia 151 01.06.2018 - 30.06.2018 Indonesia and Brunei (business trips) 30 01.07.2018 - 31.07.2018 Germany (holiday) 31 01.08.2018 - 31.12.2018 In Malaysia 153 01.01.2019 -31.01.2019 In Malaysia 31 01.02.2019 - 09.03.2019 Germany and France (holiday) 37 10.03.2019 - 31.07.2019 In Malaysia 144 01.08.2019 - 31.12.2019 Middle East countries (personal trips to 153 perform voluntary humanitarian work) 01.01.2020 - 30.09.2020 In Malaysia 274 Required: For Malaysian income tax purposes, determine Mathias Kunzer's tax residence status for each of the relevant years of assessment. Explain the basis for your determination and quote the relevant provisions of the Income Tax Act 1967 (as amended). (10 marks) Part B Individual taxpayers in Malaysia include those who earned employment income as well as those who operates their own sole proprietorship and partnership businesses. The residence status of these individual taxpayers plays a crucial role in determining their tax liabilities.One of the benefits that resident individual taxpayers of this country enjoy is a scaled tax rate. The current Malaysian income tax brackets applicable to them range from 0% to 28%. In addition, the resident individual taxpayers are also given additional benefits, depending on their source of income, to further reduce their taxes. Required: Explain any FIVE (5) various tax deductions enjoyed by the resident individual taxpayers operating businesses in this country. (10 marks)