Answered step by step

Verified Expert Solution

Question

1 Approved Answer

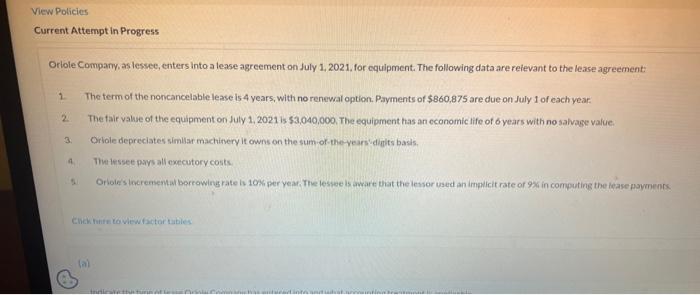

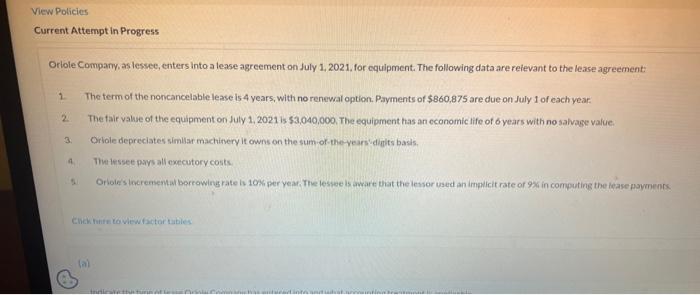

please help me with this question, i dont understand it. Orlole Company, as lessee, enters into a lease agreement on July 1, 2021, for oquipment.

please help me with this question, i dont understand it.

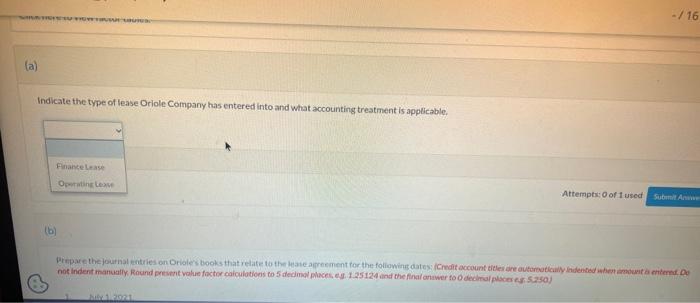

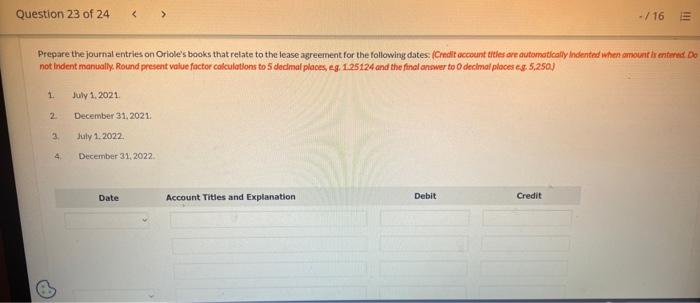

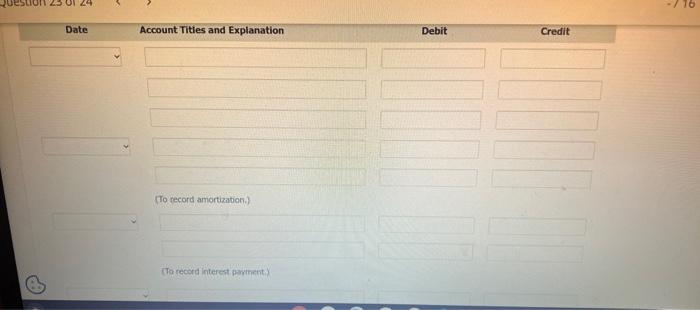

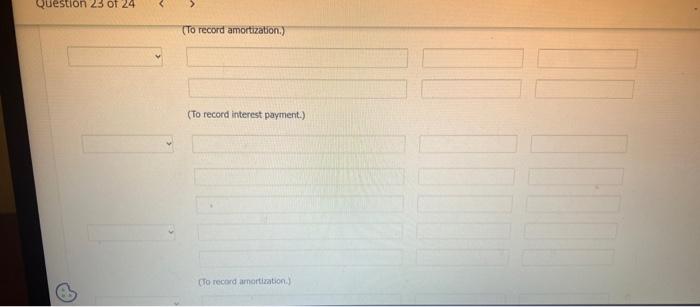

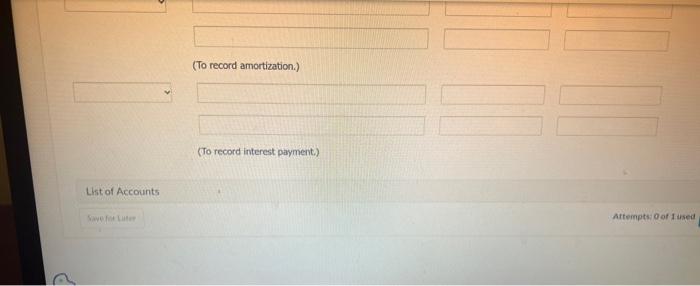

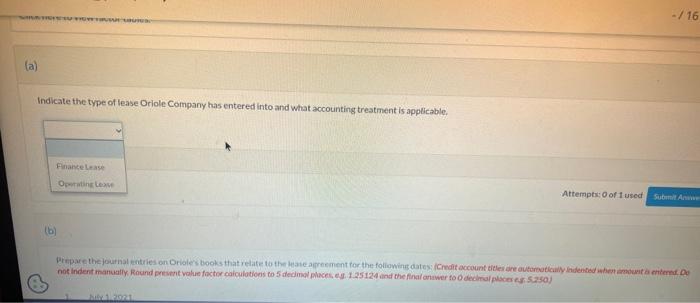

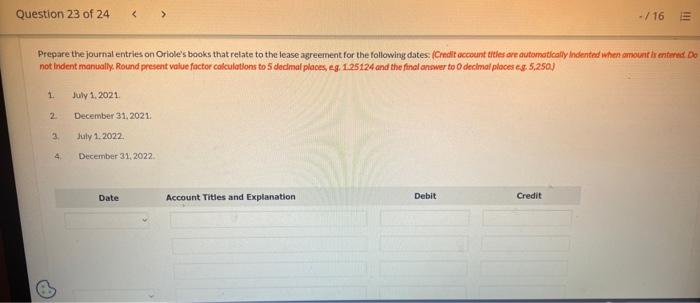

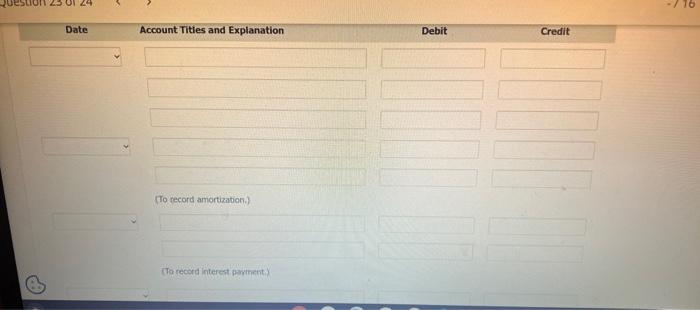

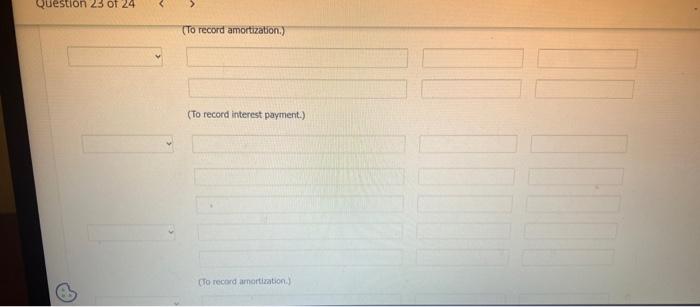

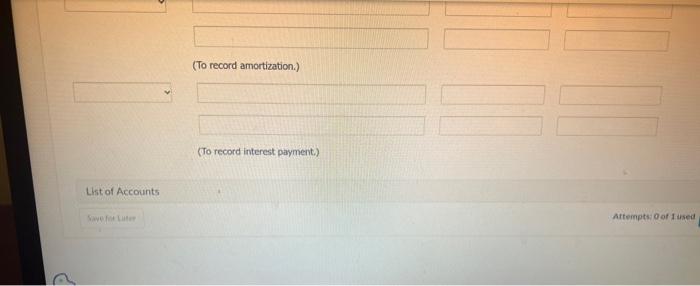

Orlole Company, as lessee, enters into a lease agreement on July 1, 2021, for oquipment. The following data are reievant to the lease agreement: 1. The term of the noncancelable lease is 4 years, with no renewal option. Payments of $860,875 are due on July 1 of each year. 2. The fair value of the equipment on July 1, 2021 is $3,040,000. The equipment has an economic life of 6 years with no salvage value. 3. Oriole depreciates simllar machinery it owns on the sum of - the-vearividigits basis. 4. Theiessee paysall executory costs. chak hine coviewfactor tabies Indicate the type of lease Oriole Company has entered into and what accounting treatment is applicable. Filancelease Attempts: o of t used (6) Prepare the journal entries on Oriole's books that relate to the lease agreenent for the following dates. (Credit account tities are autamotically lndented iwhen amsout ir entand Oe not indent manually. Round present value factor calculations to 5 decimal places, 29.125124 and the final onsuer to 0 decimai places es. 5.250. 1. July 1,2021 2. December 31,2021 3. July 1.2022 4. December 31. 2022 Date Account Tities and Explanation (To record amortization.) (To record interest porthent? (To record amortizaton.) (To record interest payment.) (fo record amertization.) (To record amortization.) (To record interest payment.) Llst of Accounts Sweye fue Gutor Aftemptsi 0 of 1 insed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started