Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me with this question Q5. Using the information in the Balance Sheet and Profit and Loss Statement below, calculate the following ratios and

Please help me with this question

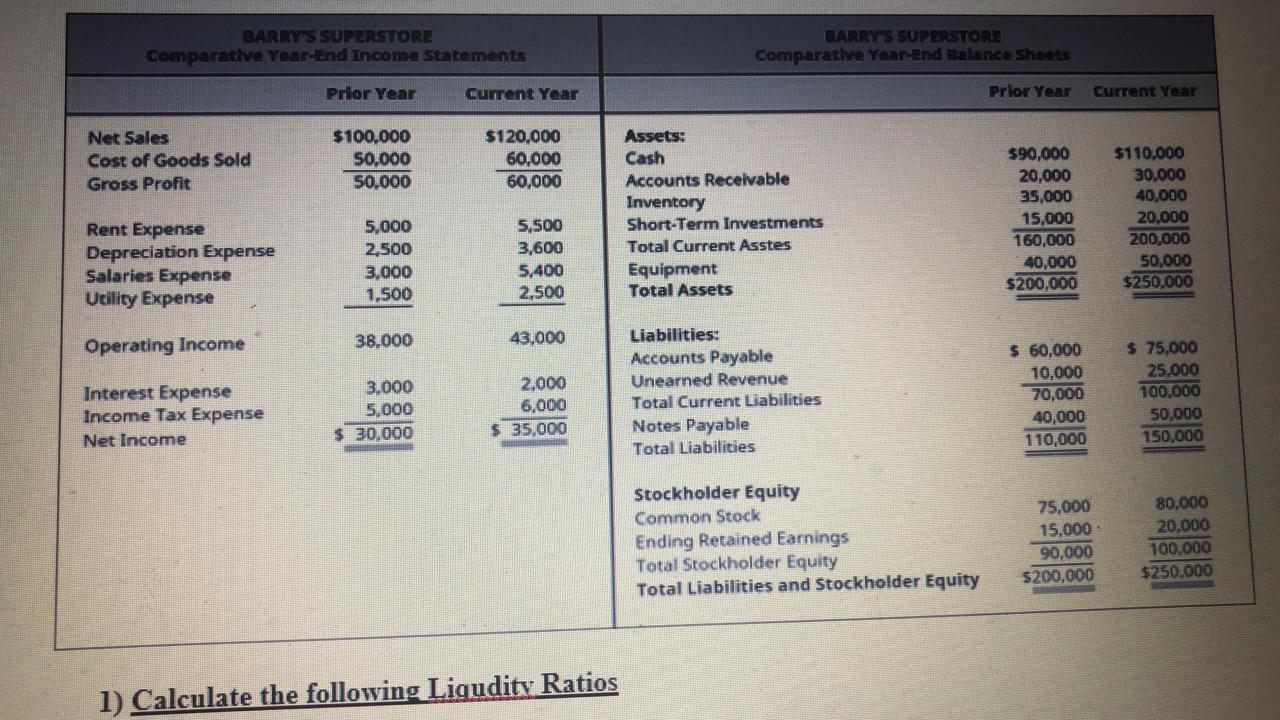

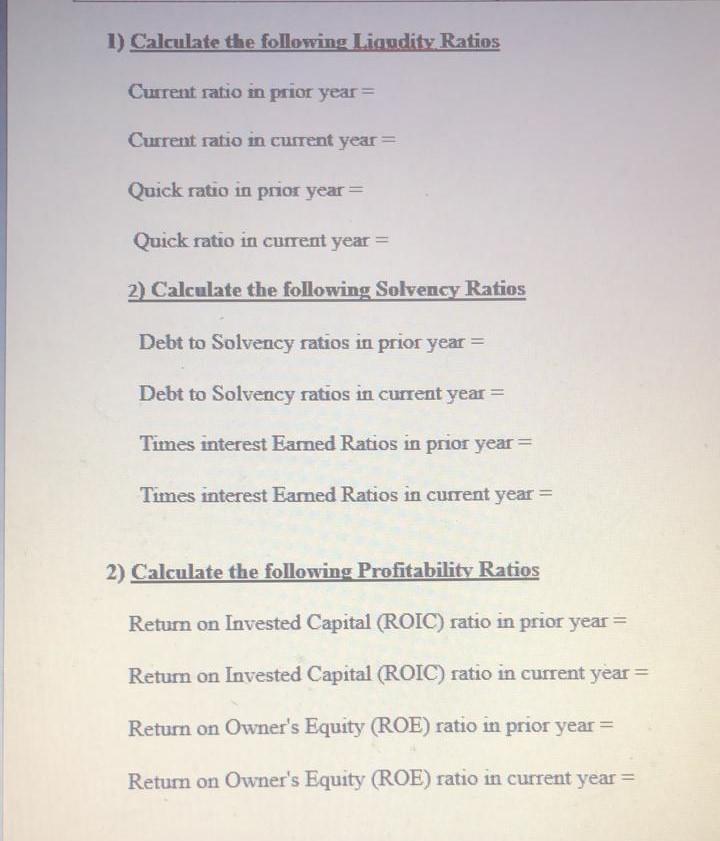

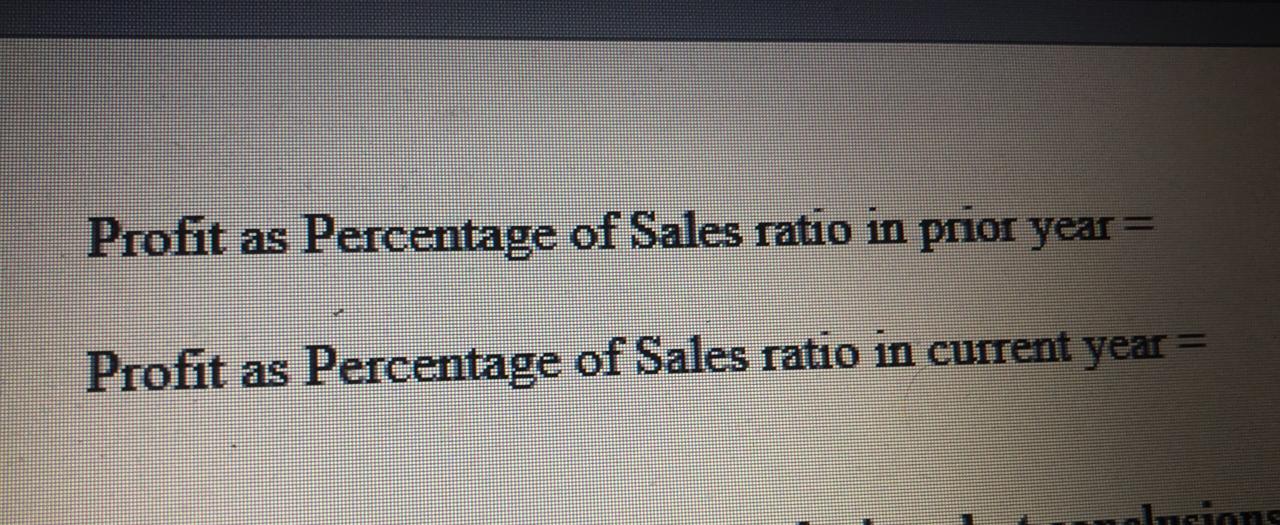

Q5. Using the information in the Balance Sheet and Profit and Loss Statement below, calculate the following ratios and answer the questions (8 points in total) BARRY'S SUPERSTORE Comparative Year-End Income Statements BARRY'S SUPERSTORE Comparative Year-End Balance Sheets Prior Year Current Year Prior Year Current Year $120.000 Assets: no 000 $110.000 BARRY'S SUPERSTORE Comparative Year-End Income Statements BARRY'S SUPERSTORE Comparative Year-End Balance Sheets Prior Year Current Year Prior Year Current Year Net Sales Cost of Goods Sold Gross Profit $100,000 50,000 50.000 $120,000 60,000 60,000 Assets: Cash Accounts Receivable Inventory Short-Term Investments Total Current Asstes Equipment Total Assets $90,000 20,000 35,000 15,000 160,000 40,000 $200,000 $110,000 30.000 40,000 20,000 200,000 50,000 $250.000 Rent Expense Depreciation Expense Salaries Expense Ucility Expense 5,500 3,600 5.400 2,500 5,000 2.500 3,000 1,500 Operating Income 38.000 43,000 Interest Expense Income Tax Expense Net Income 3.000 5,000 $ 30,000 2.000 6,000 $ 35,000 Liabilities: Accounts Payable Unearned Revenue Total Current Liabilities Notes Payable Total Liabilities $ 60,000 10,000 70,000 40,000 110,000 $ 75,000 125.000 100.000 50,000 150,000 Stockholder Equity Common Stock Ending Retained Earnings Total Stockholder Equity Total Liabilities and Stockholder Equity 75,000 15,000 90,000 5200,000 80,000 20.000 100,000 $250.000 1) Calculate the following Ligudity Ratios 1) Calculate the following Ligudity Ratios Curent ratio in prior year= Current ratio in current year= Quick ratio in prior year= Quick ratio in current year = 2) Calculate the following Solvency Ratios Debt to Solvency ratios in prior year = Debt to Solvency ratios in current year = Times interest Eamed Ratios in prior year= Times interest Earned Ratios in current year = 2) Calculate the following Profitability Ratios Return on Invested Capital (ROIC) ratio in prior year= Return on Invested Capital (ROIC) ratio in current year= Return on Owner's Equity (ROE) ratio in prior year= Retum on Owner's Equity (ROE) ratio in current year = Profit as Percentage of Sales ratio in prior year= Profit as Percentage of Sales ratio in current year= haioneStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started