Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me with this question, thank you. Alan and Zeta carry on a consultancy business A - Z Solutions in partnership. An agreement dated

Please help me with this question, thank you.

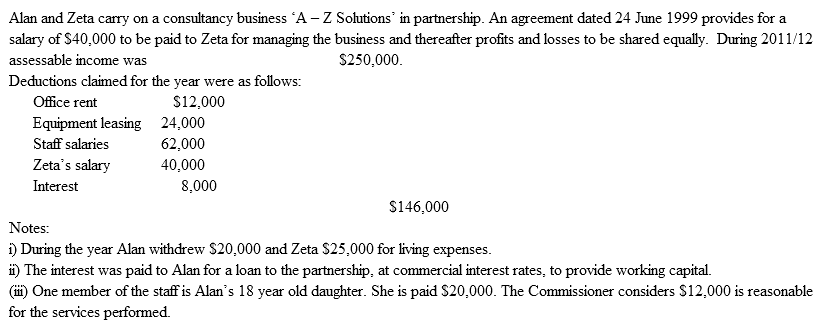

Alan and Zeta carry on a consultancy business A - Z Solutions in partnership. An agreement dated 24 June 1999 provides for a salary of $40,000 to be paid to Zeta for managing the business and thereafter profits and losses to be shared equally. During 2011/12 assessable income was $250.000 Deductions claimed for the year were as follows: Office rent $12,000 Equipment leasing 24.000 Staff salaries 62.000 Zeta's salary 40,000 Interest 8,000 $146,000 Notes: i) During the year Alan withdrew $20,000 and Zeta $25,000 for living expenses. i) The interest was paid to Alan for a loan to the partnership, at commercial interest rates, to provide working capital. (ii) One member of the staff is Alan's 18 year old daughter. She is paid $20,000. The Commissioner considers $12.000 is reasonable for the services performed Alan and Zeta carry on a consultancy business A - Z Solutions in partnership. An agreement dated 24 June 1999 provides for a salary of $40,000 to be paid to Zeta for managing the business and thereafter profits and losses to be shared equally. During 2011/12 assessable income was $250.000 Deductions claimed for the year were as follows: Office rent $12,000 Equipment leasing 24.000 Staff salaries 62.000 Zeta's salary 40,000 Interest 8,000 $146,000 Notes: i) During the year Alan withdrew $20,000 and Zeta $25,000 for living expenses. i) The interest was paid to Alan for a loan to the partnership, at commercial interest rates, to provide working capital. (ii) One member of the staff is Alan's 18 year old daughter. She is paid $20,000. The Commissioner considers $12.000 is reasonable for the services performedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started