Question: Please help me with this question! Thank you! Replace B/C Ratio values in the image below with newly calculated individuals IRR (A1 through A6). After

Please help me with this question! Thank you!

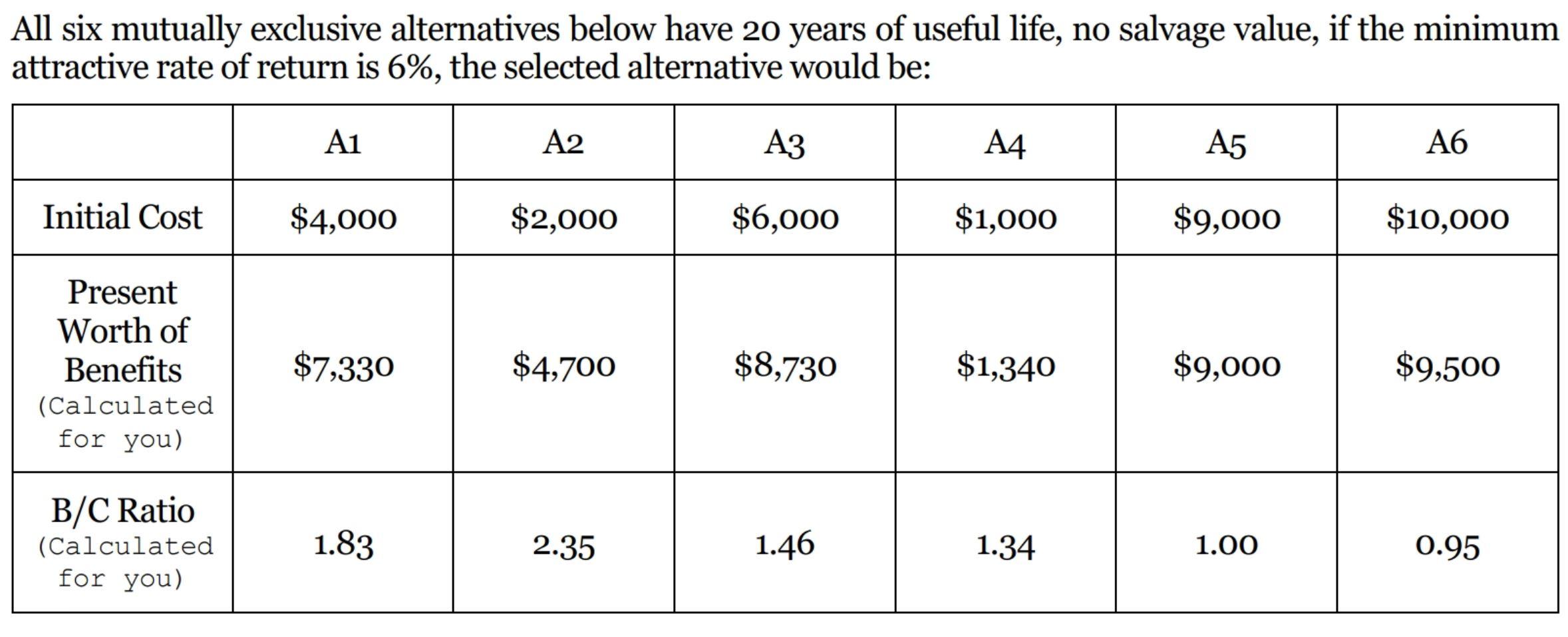

Replace B/C Ratio values in the image below with newly calculated individuals IRR (A1 through A6). After that use Incremental Analysis to bring out a winner. Also what is the ROR if you invest $4,000 and get $7,330 immediately? Will the ROR be over %6 or under %6?

{Hint} Since the benefits have been converted for you at time 0, you don't have other branches on the 20-year time axis. You just need to focus on time 0. For example A1 is at time 0.

All six mutually exclusive alternatives below have 20 years of useful life, no salvage value, if the minimum attractive rate of return is 6%, the selected alternative would be: A1 A2 A3 A4 A5 A6 Initial Cost $4,000 $2,000 $6,000 $1,000 $9,000 $10,000 Present Worth of Benefits (Calculated $7,330 $4,700 $8,730 $1,340 $9,000 $9,500 for you) B/C Ratio (Calculated 1.83 2.35 1.46 1.34 1.00 0.95 for you) All six mutually exclusive alternatives below have 20 years of useful life, no salvage value, if the minimum attractive rate of return is 6%, the selected alternative would be: A1 A2 A3 A4 A5 A6 Initial Cost $4,000 $2,000 $6,000 $1,000 $9,000 $10,000 Present Worth of Benefits (Calculated $7,330 $4,700 $8,730 $1,340 $9,000 $9,500 for you) B/C Ratio (Calculated 1.83 2.35 1.46 1.34 1.00 0.95 for you)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts