Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me with this question, Thank you very much for helping. Problem GrwnPwr, a privately held startup company, designs and manufacturers patented electrodes for

Please help me with this question, Thank you very much for helping.

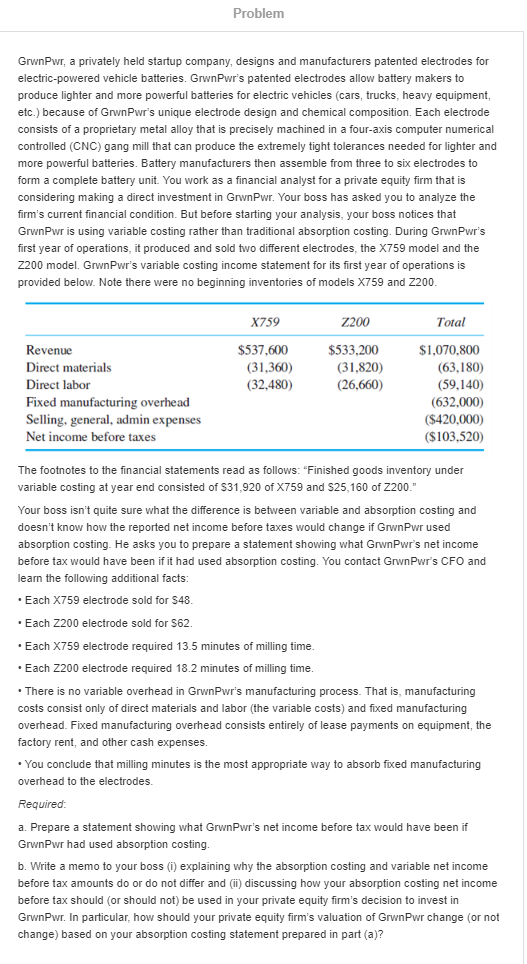

Problem GrwnPwr, a privately held startup company, designs and manufacturers patented electrodes for electric-powered vehicle batteries. GrwnPwr's patented electrodes allow battery makers to produce lighter and more powerful batteries for electric vehicles (cars, trucks, heavy equipment, etc.) because of GrwnPwr's unique electrode design and chemical composition. Each electrode consists of a proprietary metal alloy that is precisely machined in a four-axis computer numerical controlled (CNC) gang mill that can produce the extremely tight tolerances needed for lighter and more powerful batteries. Battery manufacturers then assemble from three to six electrodes to form a complete battery unit. You work as a financial analyst for a private equity firm that is considering making a direct investment in GrwnPwr. Your boss has asked you to analyze the firm's current financial condition. But before starting your analysis, your boss notices that GrwnPwr is using variable costing rather than traditional absorption costing. During Grwn Pwr's first year of operations, it produced and sold two different electrodes, the X759 model and the Z200 model. GrwnPwr's variable costing income statement for its first year of operations is provided below. Note there were no beginning inventories of models X759 and Z200. X759 Z200 Total Revenue $537,600 $533,200 $1,070,800 Direct materials (31,360) (31,820) (63,180) Direct labor Fixed manufacturing overhead Selling, general, admin expenses (32,480) (26,660) (59,140) (632,000) ($420,000) ($103,520) Net income before taxes The footnotes to the financial statements read as follows: "Finished goods inventory under variable costing at year end consisted of $31,920 of X759 and $25,160 of Z200." Your boss isn't quite sure what the difference is between variable and absorption costing and doesn't know how the reported net income before taxes would change if GrwnPwr used absorption costing. He asks you to prepare a statement showing what GrwnPwr's net income before tax would have been if it had used absorption costing. You contact GrwnPwr's CFO and learn the following additional facts: Each X759 electrode sold for $48. Each Z200 electrode sold for $62. Each X759 electrode required 13.5 minutes of milling time. Each Z200 electrode required 18.2 minutes of milling time. There is no variable overhead GrwnPwr's manufacturing process. That is, manufacturing costs consist only of direct materials and labor (the variable costs) and fixed manufacturing overhead. Fixed manufacturing overhead consists entirely of lease payments on equipment, the factory rent, and other cash expenses. You conclude that milling minutes is the most appropriate way absorb fixed manufacturing ... overhead to the electrodes. Required a. Prepare a statement showing what GrwnPwr's net income before tax would have been if GrwnPwr had used absorption costing. b. Write a memo to your boss (i0) explaining why the absorption costing and variable net income before tax amounts do or do not differ and (i) discussing how your absorption costing net income before tax should (or should not) be used in your private equity firm's decision to invest in GrwnPwr. In particular, how should your private equity firm's valuation GrwnPwr change (or not change) based on your absorption costing statement prepared in part (a)? Problem GrwnPwr, a privately held startup company, designs and manufacturers patented electrodes for electric-powered vehicle batteries. GrwnPwr's patented electrodes allow battery makers to produce lighter and more powerful batteries for electric vehicles (cars, trucks, heavy equipment, etc.) because of GrwnPwr's unique electrode design and chemical composition. Each electrode consists of a proprietary metal alloy that is precisely machined in a four-axis computer numerical controlled (CNC) gang mill that can produce the extremely tight tolerances needed for lighter and more powerful batteries. Battery manufacturers then assemble from three to six electrodes to form a complete battery unit. You work as a financial analyst for a private equity firm that is considering making a direct investment in GrwnPwr. Your boss has asked you to analyze the firm's current financial condition. But before starting your analysis, your boss notices that GrwnPwr is using variable costing rather than traditional absorption costing. During Grwn Pwr's first year of operations, it produced and sold two different electrodes, the X759 model and the Z200 model. GrwnPwr's variable costing income statement for its first year of operations is provided below. Note there were no beginning inventories of models X759 and Z200. X759 Z200 Total Revenue $537,600 $533,200 $1,070,800 Direct materials (31,360) (31,820) (63,180) Direct labor Fixed manufacturing overhead Selling, general, admin expenses (32,480) (26,660) (59,140) (632,000) ($420,000) ($103,520) Net income before taxes The footnotes to the financial statements read as follows: "Finished goods inventory under variable costing at year end consisted of $31,920 of X759 and $25,160 of Z200." Your boss isn't quite sure what the difference is between variable and absorption costing and doesn't know how the reported net income before taxes would change if GrwnPwr used absorption costing. He asks you to prepare a statement showing what GrwnPwr's net income before tax would have been if it had used absorption costing. You contact GrwnPwr's CFO and learn the following additional facts: Each X759 electrode sold for $48. Each Z200 electrode sold for $62. Each X759 electrode required 13.5 minutes of milling time. Each Z200 electrode required 18.2 minutes of milling time. There is no variable overhead GrwnPwr's manufacturing process. That is, manufacturing costs consist only of direct materials and labor (the variable costs) and fixed manufacturing overhead. Fixed manufacturing overhead consists entirely of lease payments on equipment, the factory rent, and other cash expenses. You conclude that milling minutes is the most appropriate way absorb fixed manufacturing ... overhead to the electrodes. Required a. Prepare a statement showing what GrwnPwr's net income before tax would have been if GrwnPwr had used absorption costing. b. Write a memo to your boss (i0) explaining why the absorption costing and variable net income before tax amounts do or do not differ and (i) discussing how your absorption costing net income before tax should (or should not) be used in your private equity firm's decision to invest in GrwnPwr. In particular, how should your private equity firm's valuation GrwnPwr change (or not change) based on your absorption costing statement prepared in part (a)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started