Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me with this question. Thanks Luft Watch Company is considering an investment of $20,000, which produces the following inflows: Year 1 2 3

please help me with this question.

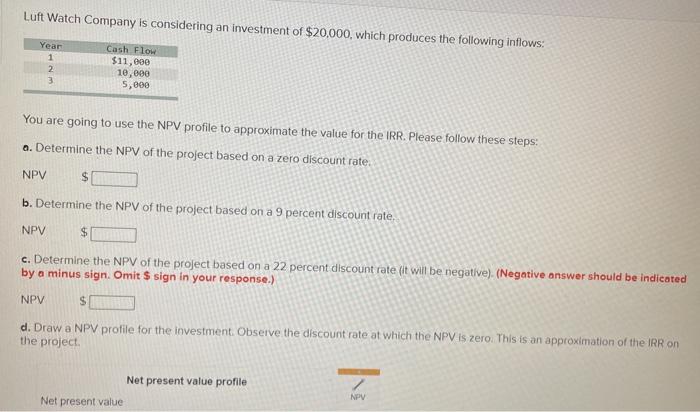

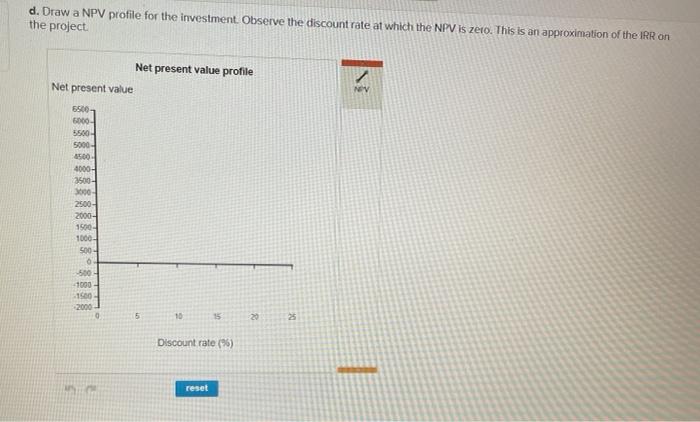

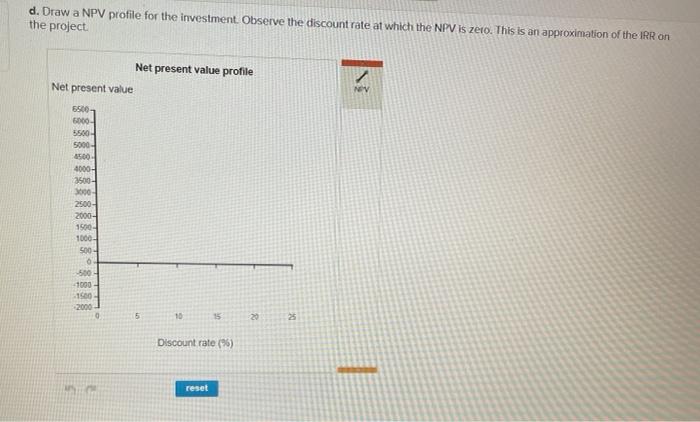

Luft Watch Company is considering an investment of $20,000, which produces the following inflows: Year 1 2 3 Cash Flow $11,000 10,000 5,000 You are going to use the NPV profile to approximate the value for the IRR. Please follow these steps: a. Determine the NPV of the project based on a zero discount rate NPV $ b. Determine the NPV of the project based on a 9 percent discount rate. NPV $ c. Determine the NPV of the project based on a 22 percent discount rate (it will be negative) (Negative answer should be indicated by a minus sign. Omit $ sign in your response.) NPV $ d. Draw a NPV profile for the investment Observe the discount rate at which the NPV is zero. This is an approximation of the IRR on the project Net present value profile Net present value NPV d. Draw a NPV profile for the investment. Observe the discount rate at which the NPV is zero. This is an approximation of the IRR on the project Net present value profile Net present value 6500 6000 5500 5000 - 4500 1000- 3500- 00 2500- 2000- 1900 1000 500 -500 -1000 1600 2000 0 5 10 15 20 Discount rate (96) reset Instruction: 1. Use the line tool (NPV) to draw the Net Present Value. 2. Once all points have been plotted, click on the line (not individual points) and a tool icon will pop up. You can use this to enter exact co-ordinates for your points as needed e. Compute the IRR IRR

Thanks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started