Please help me with this

Thank u

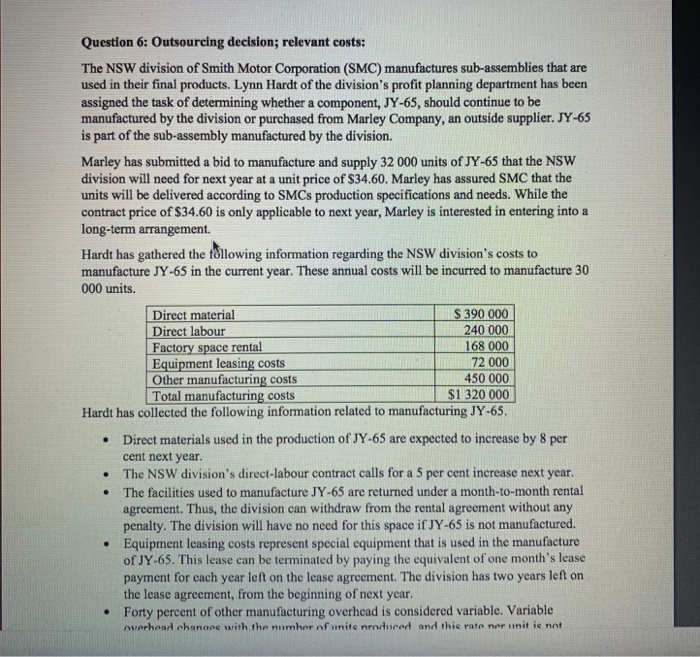

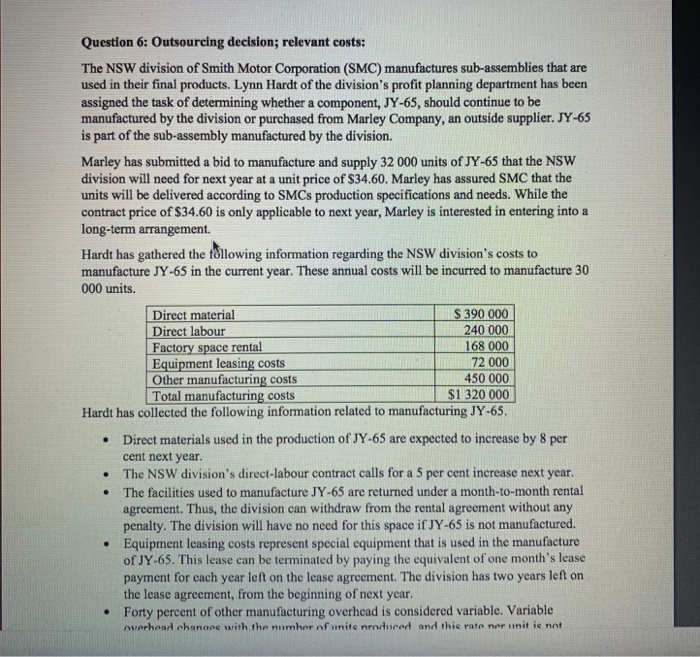

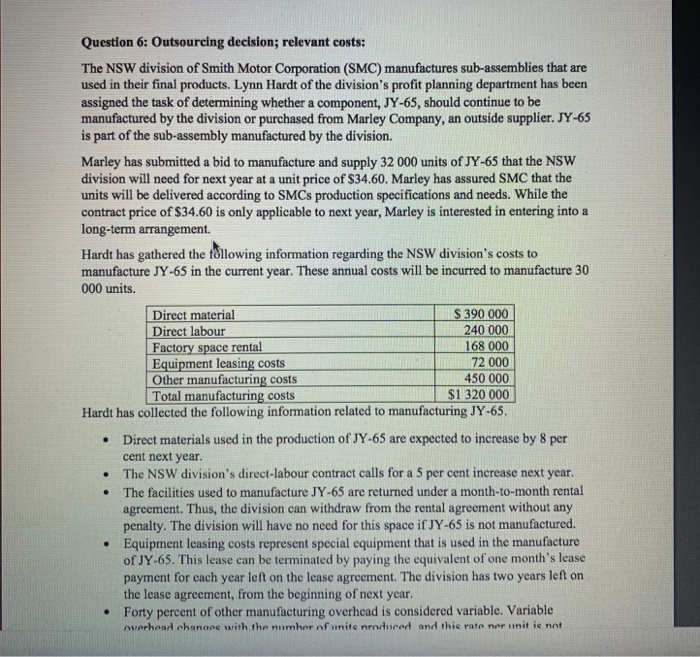

Question 6: Outsourcing decision; relevant costs: The NSW division of Smith Motor Corporation (SMC) manufactures sub-assemblies that are used in their final products. Lynn Hardt of the division's profit planning department has been assigned the task of determining whether a component, JY-65, should continue to be manufactured by the division or purchased from Marley Company, an outside supplier. JY-65 is part of the sub-assembly manufactured by the division. Marley has submitted a bid to manufacture and supply 32 000 units of JY-65 that the NSW division will need for next year at a unit price of $34.60. Marley has assured SMC that the units will be delivered according to SMCs production specifications and needs. While the contract price of $34.60 is only applicable to next year, Marley is interested in entering into a long-term arrangement. Hardt has gathered the following information regarding the NSW division's costs to manufacture JY-65 in the current year. These annual costs will be incurred to manufacture 30 000 units. Direct material S 390 000 Direct labour 240 000 Factory space rental 168 000 Equipment leasing costs 72 000 Other manufacturing costs 450 000 Total manufacturing costs $1 320 000 Hardt has collected the following information related to manufacturing JY-65. Direct materials used in the production of JY-65 are expected to increase by 8 per cent next year. The NSW division's direct-labour contract calls for a 5 per cent increase next year. The facilities used to manufacture JY-65 are returned under a month-to-month rental agreement. Thus, the division can withdraw from the rental agreement without any penalty. The division will have no need for this space if JY-65 is not manufactured. Equipment leasing costs represent special equipment that is used in the manufacture of JY-65. This lease can be terminated by paying the equivalent of one month's lease payment for each year left on the lease agreement. The division has two years left on the lease agreement, from the beginning of next year. Forty percent of other manufacturing overhead is considered variable. Variable Overhead change with the number of unite nendured and thic rate ner unit ie not . . . par Harut nas collected me tonowmg Information related to manufacturmg JY-05. Direct materials used in the production of JY-65 are expected to increase by 8 per cent next year. The NSW division's direct-labour contract calls for a 5 per cent increase next year. The facilities used to manufacture JY-65 are returned under a month-to-month rental agreement. Thus, the division can withdraw from the rental agreement without any penalty. The division will have no need for this space if JY-65 is not manufactured. Equipment leasing costs represent special equipment that is used in the manufacture of JY-65. This lease can be terminated by paying the equivalent of one month's lease payment for each year left on the lease agreement. The division has two years left on the lease agreement, from the beginning of next year. Forty percent of other manufacturing overhead is considered variable. Variable overhead changes with the number of units produced, and this rate per unit is not expected to change next year. The fixed manufacturing overhead costs are not expected to change regardless of whether JY-65 is manufactured or not. Equipment other than the lepse equipment can be used in the division's other manufacturing operations. Required 1 (a) Prepare an analysis of relevant costs that shows whether or not the NSW division of SMC should make JY-65 or purchase it from Marley Company next year. (b) Based solely on financial results, recommended whether the 32 000 units of JY-65 for next year should be made by the division or purchased from Marley. MAF 200116-Session 2, 2020 Group assignment Page 10 of 11 2. Identify and briefly discuss three qualitative factors that the NSW division and SMC should consider before agreeing to purchase JY-65 from Marley Company