please help me with this. Thank You.

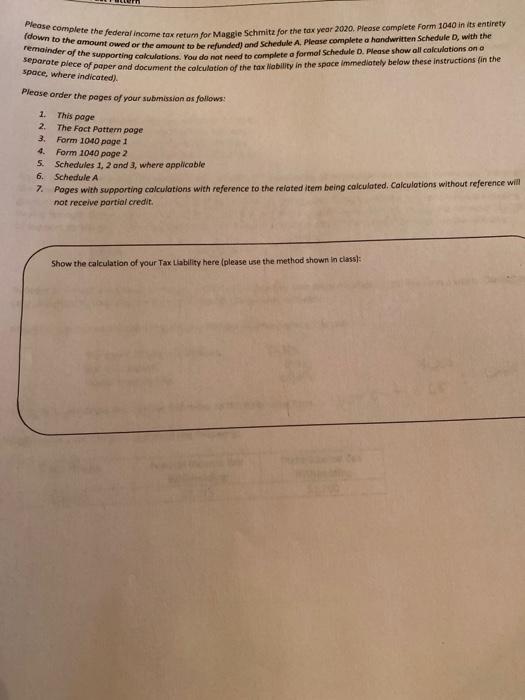

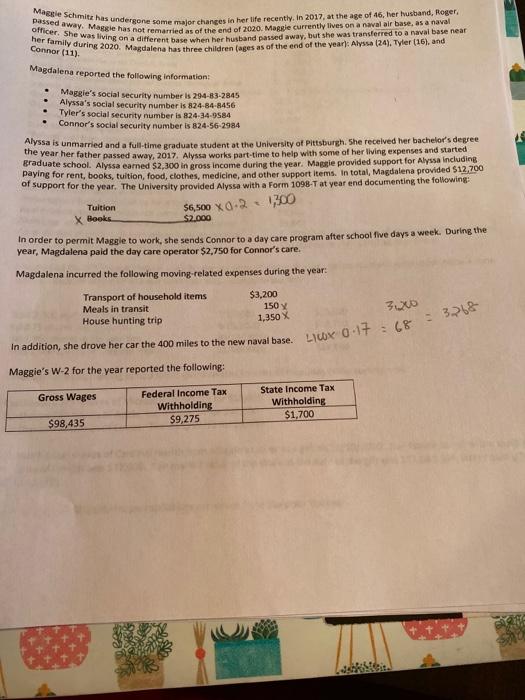

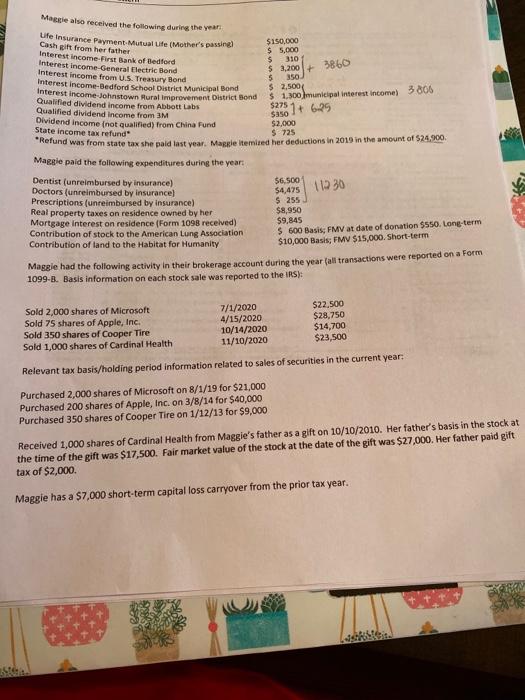

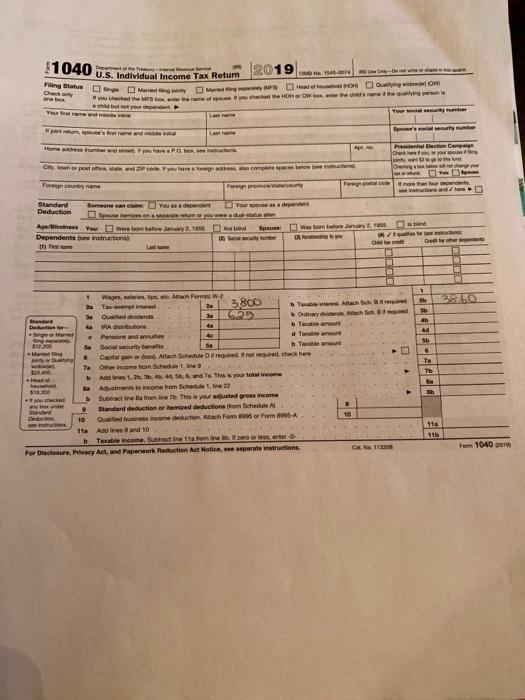

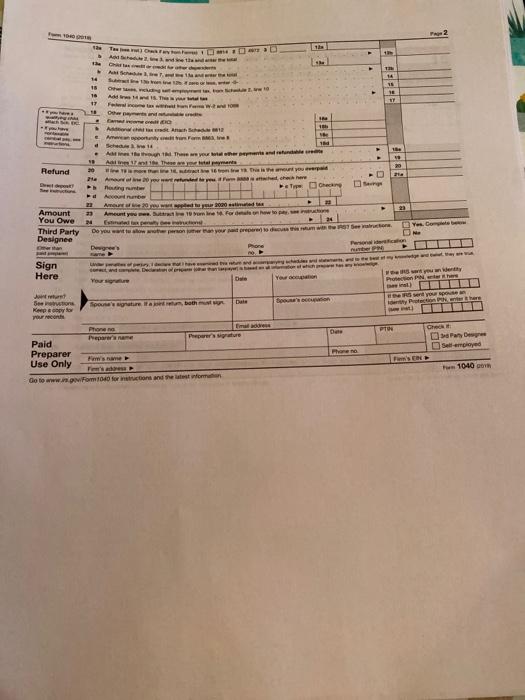

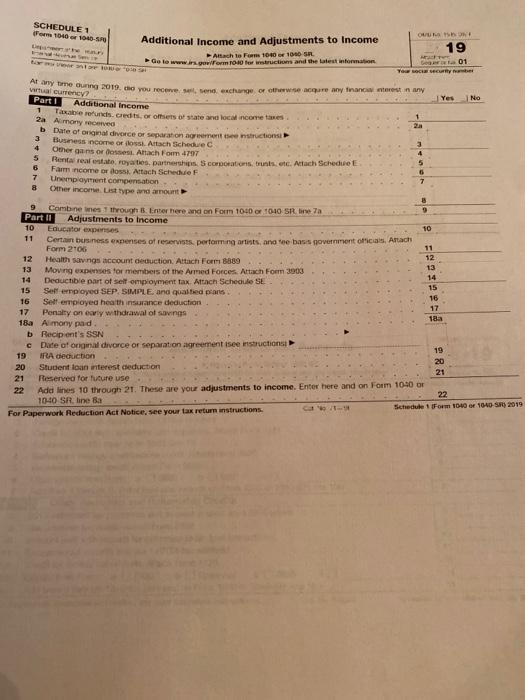

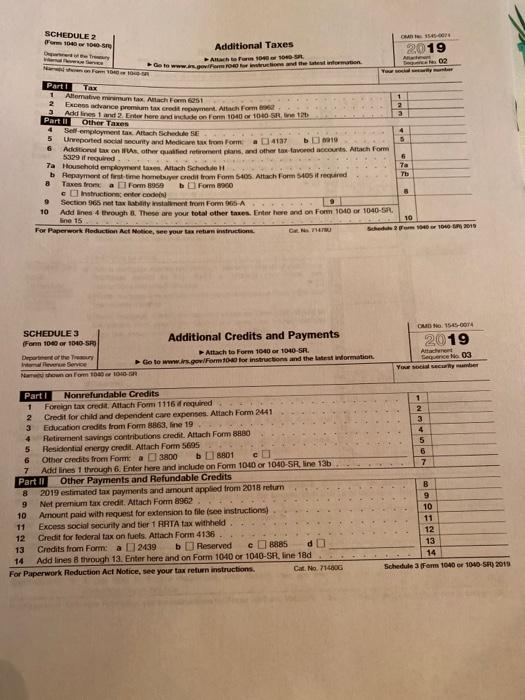

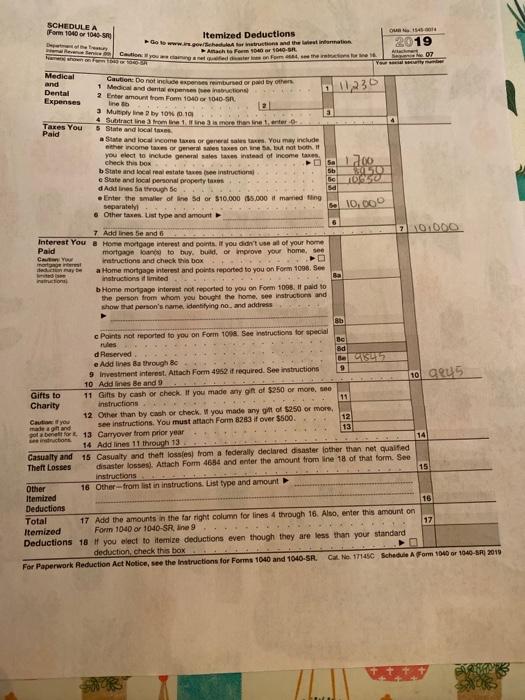

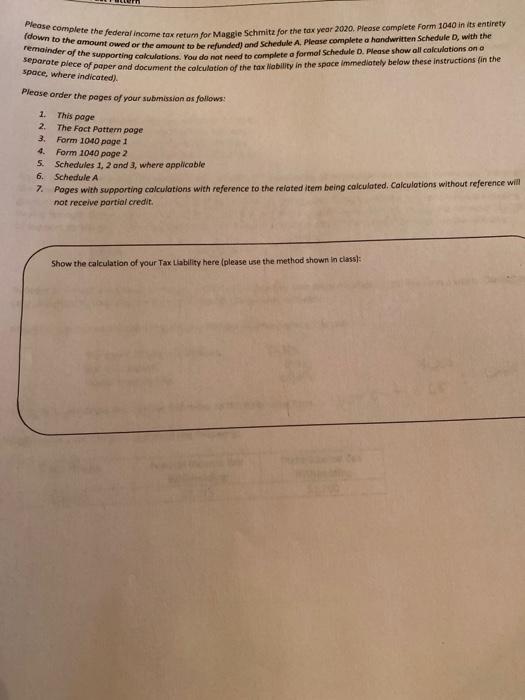

Please complete the federal income tax return for Maggie Schmitz for the tax year 2020. Please complete Form 1040 in its entirety (down to the amount owed or the amount to be refunded) and schedule A, Please complete handwritten Schedule, with the remainder of the supporting calculations. You do not need to complete a formal Schedule D. Please show all calculations on a separate piece of paper and document the calculation of the tax Nobility in the space immediately below these instructions in the space, where indicated). Please order the pages of your submission as follows: This page The Foct Pattern page 1. 2. 3. Form 1040 page 1 4. Form 1040 page 2 5. Schedules 1, 2 and 3, where applicable 6. Schedule A 7. Poges with supporting calculations with reference to the related item being calculated. Colculations without reference will not receive portiol credit Show the calculation of your Tax Liability here (please use the method shown in class: passed away. Maggie has not remarried as of the end of 2020. Maple currently lives on anavalir baras anaval Martie Schmitz has undergone some major changes in her life recently in 2017, at the age of 46. her husband, Roger, officer. She was living on a different base when her husband passed away but she was transferred to a naval base near her family during 2020. Magdalena has three children (ages as of the end of the year: Alyssa (24), Tyler (16), and Connor (11) In addition, she drove her car the 400 miles to the new naval base. LUX 0.1+ (R-32 Magdalena reported the following information: Maggie's social security number is 294-83-2845 Alyssa's social security number is 824-84-8456 Tyler's social security number is 824-34-9584 Connor's social security number is 824-56-2984 Alyssa is unmarried and a full-time graduate student at the University of Pittsburgh. She received her bachelor's degree the year her father passed away, 2017. Alyssa works part-time to help with some of her living expenses and started graduate school. Alyssa camned $2,300 in gross income during the year. Maggie provided support for Alyssa including paying for rent, books, tuition, food, clothes, medicine, and other support items. In total, Magdalena provided 512,700 of support for the year. The University provided Alyssa with a Form 1098-Tat year end documenting the following: Tuition X Books $2.000 In order to permit Maggie to work, she sends Connor to a day care program after school five days a week. During the year, Magdalena paid the day care operator $2,750 for Connor's care, Magdalena incurred the following moving-related expenses during the year: Transport of household items $3,200 Meals in transit 150 y House hunting trip 1,350 X $6,500X0-2 1,300 3.00 Maggie's W-2 for the year reported the following: Gross Wages Federal Income Tax Withholding $9,275 State Income Tax Withholding $1,700 $98,435 a Markle also received the following during the year Life Insurance Payment Mutual uite (Mother's passing Cash gift from her father Interest income-First Bank of Bedford Interest income-General Electric Blond Interest income from US Treasury Bond Interest income-Bedford School District Municipal Bond Interest income Johnstown Mural improvement District Bond Qualified dividend income from Abbott Labs Qualified dividend income from 3M Dividend income (not qualified) from China Fund State income tax refund $150,000 $ 5,000 $ 310 $ 3.2003860 5 $ 2,500 $ 1.300)municipal interest income) 3806 $275 1 + 4.25 10 30 $2,000 $ 725 Refund was from state tax she paid last year. Maggle itemired her deductions in 2019 in the amount of 24,900 Maggie paid the following expenditures during the year: Dentist (unreimbursed by Insurance) $6,500 Doctors (unreimbursed by insurance) $4,475 Prescriptions (unreimbursed by Insurance) $ 255 Real property taxes on residence owned by her $8,950 Mortgage Interest on residence (Form 1098 received) $9,845 Contribution of stock to the American Lung Association $ 600 Basis, FMV at date of donation $550. Long-term Contribution of land to the Habitat for Humanity $10,000 Basis, FMV $15,000. Short-term Maggie had the following activity in their brokerage account during the year (all transactions were reported on a Form 1099-B. Basis information on each stock sale was reported to the IRS): Sold 2,000 shares of Microsoft 7/1/2020 $22.500 Sold 75 shares of Apple, Inc. 4/15/2020 $28,750 Sold 350 shares of Cooper Tire 10/14/2020 $14,700 Sold 1,000 shares of Cardinal Health 11/10/2020 $23.500 Relevant tax basis/holding period information related to sales of securities in the current year: Purchased 2,000 shares of Microsoft on 8/1/19 for $21,000 Purchased 200 shares of Apple, Inc. on 3/8/14 for $40,000 Purchased 350 shares of Cooper Tire on 1/12/13 for $9,000 Received 1,000 shares of Cardinal Health from Maggie's father as a gift on 10/10/2010. Her father's basis in the stock at the time of the gift was $17,500. Fair market value of the stock at the date of the gift was $27,000. Her father paid gift tax of $2,000. Maggie has a $7,000 short-term capital loss carryover from the prior tax year. 9 51040 Down U.S. Individual Income Tax Return 2019 Sinu er mwy w wyn www.OM you reached the war berechea HOROW we nare the line You are we Sp's Home for you POR Pential Election Camp Duty ng Chrwerpe www.your.com www. Dhe Foron country Foreign county more www.to/ Standard Serene and you dont e dependent Deduction Awie You Were before Juny 2.1955 A. Dependents de instruction yu Om 3800 4 A a Ah Ad Wages, www.ch Form w Tab Anath Que dividends Ordinary. Achh Abouton Tautant gear Persons and 44 data Se Sealyben b Town med nel Capital gain or Altach per te checker Ta Oh nonton Schedule 1, Ines b Aadres 1 ...... 6, and This is you to come sto Amers to come from Schedule tre 72 Suteractine Matroes into. This is youd gross income . Standard deduction of emred desetions from Schedule . Dede 10 Od tu income deduction Anach Form 995 or Form 95-A 10 11a Aines and 10 h Texable income. But inetta bonne le foto For Discure, Privacy Act, and Paperwork Reduction Act Notice, se separate intruction 118000 TA Th Ba hib 115 fom 10400 . 14 18 16 TY - AS 14 15 OR 10 A 14T 17 Felicon Other payment 13 At Anh Apportunity Form d . Adress Theme you are NE Ad17 Theme 30 Whether Anwar here Cheng A Add to 2000 23 Amortyment for : Refund 23 Amount You Owe Third Party Designee vo Do you tu www person Dewg Land Sign Here You Jet sen Kepent Send you Percher Spoussett P1 Pheerse Pa Dew Semployed Phone Preparera Paid Preparer Use Only Go to www.now for actions and the w 1040 SCHEDULE 1 10 V-SP Additional Income and Adjustments to Income Attach to Fm 1040 1000 SRL Go to www.ingem Tod ferestruction and the latest information 19 MA 01 YOU WOCHER Yes No 1 At any time during 2019. Cho you recensene, exchange or otherwise gore any financiare in any w currency? Part 1 Additional Income 1 Table refundiscrets, or others of state and local incorretones 2. 2a Amony recered b Date of original divorce or separation agrement sections 3 Business income or oss. Artach schedule Omer gans or coses. Attach Form 79 Rental real estate, royais partners Corporations, brutsetelach Schede E 6 Farm income or oss. Attach Schedule 7 7 Unemployment compensation 8 Other income List Type and amount 4 5 3 4 5 6 9 Combine wes through Enter here and on Form 1040 1040 SR. Ta Part II Adjustments to Income 10 Educator expenses 10 11 Certain business expenses of reservists, performing artists, and to bass government officials, Artach Form 2106 12 Health savings account deduction Attach Form 6889 12 13 13 Moving expenses for members of the Armed Forces. Attach Form 3903 14 14 Deductible part of self-omployment tax Attach Schedule SE 15 Self employed SEP, SIMPLE, and qualid pants 15 16 16 Self employed health insurance deduction 17 17 Penalty on earty withdrawal of savings 18a Amony pad b Recipent's SSN c Date of original divorce or separation agreement is instructions 19 19 IRA deduction 20 20 Student loan interest deduction 21 21 Reserved for future use 22 Add lines 10 through 21. These are your adjustments to income. Enter here and on Form 1040 22 1040 SR line Ba Schedule Form 1040 1040 SWE 2019 For Paperwork Reduction Act Notice, see your tax return instructions. 18 SCHEDULE 2 1040 154 2019 Additional Taxes Alte Por 10-S Go to www.powtime and the motion 2 1 3 3 Parti Tax 1 Alternative mumtax. Attach Form St 2 Excewance promatx credit repayment. Alt Form Part 11 Add lines 1 and 2 new here and enfonn 1040 1040 SR 120 Other Takes 4 Self-employment tax. Altach Sched 5 5 Ureported social security and Medicare tax from Form - 4137 b 19 6 Addition tax on As, other qualified reforment and other tax tavored accounts. Attach Form 6 5329 if required 7a Household employment Altach Schedule b Hepayment of first time hormer credit from Forn 5405. Attach Form 510s it required B Taxes from all Form 1959 h Form cliction enter Section 965 metaistalent from Form 36-A 10 Add lines 4 though. These are your total other taxes. Enter here and on Form 1010 or 1040-SR. line 15 Schede 200 101 2018 For Paperwork Hoduction Act Notice, see your tax retien instruction TA TE 9 9 10 CMD No. 1545-OOT 2019 SCHEDULE 3 For 1049 or 1040 SRO Department of the Inice Na hown on Form 100 1016- Additional Credits and Payments Attach to Form 1040 1040 SR. Go to www.in.gov/Form 100 for instructions and the wormation Sunce No 03 1 2 3 4 5 6 7 Part Nonrefundable Credits 1 Foreign tax credt. Altach Form 1116 d required 2 Credit for child and dependente expenses. Attach Form 2441 3 Education credits from Form 8863, line 19 4 Retirement savings contributions credit. Attach Form 8880 5 Residential energy credit. Attach Form 5695 Other credits from Foma 3800 b8801 co 7 Add lines 1 through 6. Enter here and include on Form 1040 or 1040-SR, line 13 Part II Other Payments and Refundable Credits 8 2019 estimated tax payments and amount applied from 2018 return 9 Net premium tax credit. Attach Form 8962 10 Amount paid with request for extension to file (see instructions) 11 Excess social security and tier 1 RATA tax withheld 12 Credit for federal tax on luels. Attach Form 4136 13 Credits from Form: a 2439 b Reserved c] Bags do 14 Add lines through 13. Enter here and on Form 1040 or 1040-SR line 180 For Paperwork Reduction Act Notice, see your tax return instructions Cat No. 71480G B 9 10 11 12 13 14 Schedule Form 1040 1040 SF) 2015 SCHEDULE A Form 1040 1040 14. Itemized Deductions Go to www.goch rutina d the west intention Caution you came the close Anache Form 1046 1040-SR. 2019 You Medical and Dental Expenses 01123 Takes You Paid Caution. Do not include expenses reimbursed or paid by the 1 Medical and dental expansion 2 Enter amount from For 1040 1040 3 Multiply line by 10% 0.10 4 Subtract line from line 1 fine mere interfero 5 State and locales State and local income taxes or generales You may include the income tax romera ses taxes on in SA but not to you efect to include general sales taxen instead of income taxe check this DO sh b State and local real estate tree instruction e State and local personal property Sa dadines Sa through 50 Enter the smaller of the Sd or $10.000 55.000 med ting separatelyt & Other taxes List type and amount O doo SALTO TOOD GID. DO DOO 7 Add lines 5e and 6 Interest You & Home mortgage interest and points. If you didn't use all of your home Paid mortgage loan to buy, bud, or improve your home. See Cat morge Instructions and check the box ede a Home mortgage interest and points reported to you on Form 1098. See Pro instructions med b Home mortgage interest not reported to you on Form 1095. i Dald to the person from whom you bought the home see instructions and show that person's Identifying no. and address 8 10 RU 5 c Points not reported to you on Form 10. See notructions for special tutes d Reserved Sd e Add lines Bathough 8c Base 9 Investment interest. Attach Form 4952 is required. See instructions 9 10 Add lines Be and 9 Gifts to 11 Gifts by cash or check. If you made anyon of $250 or more, see Charity instructions 11 12 Other than by cash or check you made any of $250 or more Caut you 12 made and see instructions. You must attach Form 8283 if over $500. for 13 Carryover from prior year 13 14 Add lines 11 through 13 14 Casualty and 15 Casualty and theft lossles from a federally declared disaster other than net qualified Theft Losses disaster losses. Attach Form 4654 and enter the amount from line 18 of that form. See instructions 15 Other 16 Other from list in instructions. List type and amount Itemired Deductions 16 Total 17 Add the amounts in the far right column for lines 4 through 16. Also, enter this amount on Itemized Forin 1040 or 1040-SR, line 9 Deductions 18 you elect to itemize deductions even though they are less than your standard deduction, check this box For Paperwork Reduction Act Notice, see the instructions for Forms 1040 and 1040-SR. Cale 171450 Schedule A Form 1046 or 1040-52019 Please complete the federal income tax return for Maggie Schmitz for the tax year 2020. Please complete Form 1040 in its entirety (down to the amount owed or the amount to be refunded) and schedule A, Please complete handwritten Schedule, with the remainder of the supporting calculations. You do not need to complete a formal Schedule D. Please show all calculations on a separate piece of paper and document the calculation of the tax Nobility in the space immediately below these instructions in the space, where indicated). Please order the pages of your submission as follows: This page The Foct Pattern page 1. 2. 3. Form 1040 page 1 4. Form 1040 page 2 5. Schedules 1, 2 and 3, where applicable 6. Schedule A 7. Poges with supporting calculations with reference to the related item being calculated. Colculations without reference will not receive portiol credit Show the calculation of your Tax Liability here (please use the method shown in class: passed away. Maggie has not remarried as of the end of 2020. Maple currently lives on anavalir baras anaval Martie Schmitz has undergone some major changes in her life recently in 2017, at the age of 46. her husband, Roger, officer. She was living on a different base when her husband passed away but she was transferred to a naval base near her family during 2020. Magdalena has three children (ages as of the end of the year: Alyssa (24), Tyler (16), and Connor (11) In addition, she drove her car the 400 miles to the new naval base. LUX 0.1+ (R-32 Magdalena reported the following information: Maggie's social security number is 294-83-2845 Alyssa's social security number is 824-84-8456 Tyler's social security number is 824-34-9584 Connor's social security number is 824-56-2984 Alyssa is unmarried and a full-time graduate student at the University of Pittsburgh. She received her bachelor's degree the year her father passed away, 2017. Alyssa works part-time to help with some of her living expenses and started graduate school. Alyssa camned $2,300 in gross income during the year. Maggie provided support for Alyssa including paying for rent, books, tuition, food, clothes, medicine, and other support items. In total, Magdalena provided 512,700 of support for the year. The University provided Alyssa with a Form 1098-Tat year end documenting the following: Tuition X Books $2.000 In order to permit Maggie to work, she sends Connor to a day care program after school five days a week. During the year, Magdalena paid the day care operator $2,750 for Connor's care, Magdalena incurred the following moving-related expenses during the year: Transport of household items $3,200 Meals in transit 150 y House hunting trip 1,350 X $6,500X0-2 1,300 3.00 Maggie's W-2 for the year reported the following: Gross Wages Federal Income Tax Withholding $9,275 State Income Tax Withholding $1,700 $98,435 a Markle also received the following during the year Life Insurance Payment Mutual uite (Mother's passing Cash gift from her father Interest income-First Bank of Bedford Interest income-General Electric Blond Interest income from US Treasury Bond Interest income-Bedford School District Municipal Bond Interest income Johnstown Mural improvement District Bond Qualified dividend income from Abbott Labs Qualified dividend income from 3M Dividend income (not qualified) from China Fund State income tax refund $150,000 $ 5,000 $ 310 $ 3.2003860 5 $ 2,500 $ 1.300)municipal interest income) 3806 $275 1 + 4.25 10 30 $2,000 $ 725 Refund was from state tax she paid last year. Maggle itemired her deductions in 2019 in the amount of 24,900 Maggie paid the following expenditures during the year: Dentist (unreimbursed by Insurance) $6,500 Doctors (unreimbursed by insurance) $4,475 Prescriptions (unreimbursed by Insurance) $ 255 Real property taxes on residence owned by her $8,950 Mortgage Interest on residence (Form 1098 received) $9,845 Contribution of stock to the American Lung Association $ 600 Basis, FMV at date of donation $550. Long-term Contribution of land to the Habitat for Humanity $10,000 Basis, FMV $15,000. Short-term Maggie had the following activity in their brokerage account during the year (all transactions were reported on a Form 1099-B. Basis information on each stock sale was reported to the IRS): Sold 2,000 shares of Microsoft 7/1/2020 $22.500 Sold 75 shares of Apple, Inc. 4/15/2020 $28,750 Sold 350 shares of Cooper Tire 10/14/2020 $14,700 Sold 1,000 shares of Cardinal Health 11/10/2020 $23.500 Relevant tax basis/holding period information related to sales of securities in the current year: Purchased 2,000 shares of Microsoft on 8/1/19 for $21,000 Purchased 200 shares of Apple, Inc. on 3/8/14 for $40,000 Purchased 350 shares of Cooper Tire on 1/12/13 for $9,000 Received 1,000 shares of Cardinal Health from Maggie's father as a gift on 10/10/2010. Her father's basis in the stock at the time of the gift was $17,500. Fair market value of the stock at the date of the gift was $27,000. Her father paid gift tax of $2,000. Maggie has a $7,000 short-term capital loss carryover from the prior tax year. 9 51040 Down U.S. Individual Income Tax Return 2019 Sinu er mwy w wyn www.OM you reached the war berechea HOROW we nare the line You are we Sp's Home for you POR Pential Election Camp Duty ng Chrwerpe www.your.com www. Dhe Foron country Foreign county more www.to/ Standard Serene and you dont e dependent Deduction Awie You Were before Juny 2.1955 A. Dependents de instruction yu Om 3800 4 A a Ah Ad Wages, www.ch Form w Tab Anath Que dividends Ordinary. Achh Abouton Tautant gear Persons and 44 data Se Sealyben b Town med nel Capital gain or Altach per te checker Ta Oh nonton Schedule 1, Ines b Aadres 1 ...... 6, and This is you to come sto Amers to come from Schedule tre 72 Suteractine Matroes into. This is youd gross income . Standard deduction of emred desetions from Schedule . Dede 10 Od tu income deduction Anach Form 995 or Form 95-A 10 11a Aines and 10 h Texable income. But inetta bonne le foto For Discure, Privacy Act, and Paperwork Reduction Act Notice, se separate intruction 118000 TA Th Ba hib 115 fom 10400 . 14 18 16 TY - AS 14 15 OR 10 A 14T 17 Felicon Other payment 13 At Anh Apportunity Form d . Adress Theme you are NE Ad17 Theme 30 Whether Anwar here Cheng A Add to 2000 23 Amortyment for : Refund 23 Amount You Owe Third Party Designee vo Do you tu www person Dewg Land Sign Here You Jet sen Kepent Send you Percher Spoussett P1 Pheerse Pa Dew Semployed Phone Preparera Paid Preparer Use Only Go to www.now for actions and the w 1040 SCHEDULE 1 10 V-SP Additional Income and Adjustments to Income Attach to Fm 1040 1000 SRL Go to www.ingem Tod ferestruction and the latest information 19 MA 01 YOU WOCHER Yes No 1 At any time during 2019. Cho you recensene, exchange or otherwise gore any financiare in any w currency? Part 1 Additional Income 1 Table refundiscrets, or others of state and local incorretones 2. 2a Amony recered b Date of original divorce or separation agrement sections 3 Business income or oss. Artach schedule Omer gans or coses. Attach Form 79 Rental real estate, royais partners Corporations, brutsetelach Schede E 6 Farm income or oss. Attach Schedule 7 7 Unemployment compensation 8 Other income List Type and amount 4 5 3 4 5 6 9 Combine wes through Enter here and on Form 1040 1040 SR. Ta Part II Adjustments to Income 10 Educator expenses 10 11 Certain business expenses of reservists, performing artists, and to bass government officials, Artach Form 2106 12 Health savings account deduction Attach Form 6889 12 13 13 Moving expenses for members of the Armed Forces. Attach Form 3903 14 14 Deductible part of self-omployment tax Attach Schedule SE 15 Self employed SEP, SIMPLE, and qualid pants 15 16 16 Self employed health insurance deduction 17 17 Penalty on earty withdrawal of savings 18a Amony pad b Recipent's SSN c Date of original divorce or separation agreement is instructions 19 19 IRA deduction 20 20 Student loan interest deduction 21 21 Reserved for future use 22 Add lines 10 through 21. These are your adjustments to income. Enter here and on Form 1040 22 1040 SR line Ba Schedule Form 1040 1040 SWE 2019 For Paperwork Reduction Act Notice, see your tax return instructions. 18 SCHEDULE 2 1040 154 2019 Additional Taxes Alte Por 10-S Go to www.powtime and the motion 2 1 3 3 Parti Tax 1 Alternative mumtax. Attach Form St 2 Excewance promatx credit repayment. Alt Form Part 11 Add lines 1 and 2 new here and enfonn 1040 1040 SR 120 Other Takes 4 Self-employment tax. Altach Sched 5 5 Ureported social security and Medicare tax from Form - 4137 b 19 6 Addition tax on As, other qualified reforment and other tax tavored accounts. Attach Form 6 5329 if required 7a Household employment Altach Schedule b Hepayment of first time hormer credit from Forn 5405. Attach Form 510s it required B Taxes from all Form 1959 h Form cliction enter Section 965 metaistalent from Form 36-A 10 Add lines 4 though. These are your total other taxes. Enter here and on Form 1010 or 1040-SR. line 15 Schede 200 101 2018 For Paperwork Hoduction Act Notice, see your tax retien instruction TA TE 9 9 10 CMD No. 1545-OOT 2019 SCHEDULE 3 For 1049 or 1040 SRO Department of the Inice Na hown on Form 100 1016- Additional Credits and Payments Attach to Form 1040 1040 SR. Go to www.in.gov/Form 100 for instructions and the wormation Sunce No 03 1 2 3 4 5 6 7 Part Nonrefundable Credits 1 Foreign tax credt. Altach Form 1116 d required 2 Credit for child and dependente expenses. Attach Form 2441 3 Education credits from Form 8863, line 19 4 Retirement savings contributions credit. Attach Form 8880 5 Residential energy credit. Attach Form 5695 Other credits from Foma 3800 b8801 co 7 Add lines 1 through 6. Enter here and include on Form 1040 or 1040-SR, line 13 Part II Other Payments and Refundable Credits 8 2019 estimated tax payments and amount applied from 2018 return 9 Net premium tax credit. Attach Form 8962 10 Amount paid with request for extension to file (see instructions) 11 Excess social security and tier 1 RATA tax withheld 12 Credit for federal tax on luels. Attach Form 4136 13 Credits from Form: a 2439 b Reserved c] Bags do 14 Add lines through 13. Enter here and on Form 1040 or 1040-SR line 180 For Paperwork Reduction Act Notice, see your tax return instructions Cat No. 71480G B 9 10 11 12 13 14 Schedule Form 1040 1040 SF) 2015 SCHEDULE A Form 1040 1040 14. Itemized Deductions Go to www.goch rutina d the west intention Caution you came the close Anache Form 1046 1040-SR. 2019 You Medical and Dental Expenses 01123 Takes You Paid Caution. Do not include expenses reimbursed or paid by the 1 Medical and dental expansion 2 Enter amount from For 1040 1040 3 Multiply line by 10% 0.10 4 Subtract line from line 1 fine mere interfero 5 State and locales State and local income taxes or generales You may include the income tax romera ses taxes on in SA but not to you efect to include general sales taxen instead of income taxe check this DO sh b State and local real estate tree instruction e State and local personal property Sa dadines Sa through 50 Enter the smaller of the Sd or $10.000 55.000 med ting separatelyt & Other taxes List type and amount O doo SALTO TOOD GID. DO DOO 7 Add lines 5e and 6 Interest You & Home mortgage interest and points. If you didn't use all of your home Paid mortgage loan to buy, bud, or improve your home. See Cat morge Instructions and check the box ede a Home mortgage interest and points reported to you on Form 1098. See Pro instructions med b Home mortgage interest not reported to you on Form 1095. i Dald to the person from whom you bought the home see instructions and show that person's Identifying no. and address 8 10 RU 5 c Points not reported to you on Form 10. See notructions for special tutes d Reserved Sd e Add lines Bathough 8c Base 9 Investment interest. Attach Form 4952 is required. See instructions 9 10 Add lines Be and 9 Gifts to 11 Gifts by cash or check. If you made anyon of $250 or more, see Charity instructions 11 12 Other than by cash or check you made any of $250 or more Caut you 12 made and see instructions. You must attach Form 8283 if over $500. for 13 Carryover from prior year 13 14 Add lines 11 through 13 14 Casualty and 15 Casualty and theft lossles from a federally declared disaster other than net qualified Theft Losses disaster losses. Attach Form 4654 and enter the amount from line 18 of that form. See instructions 15 Other 16 Other from list in instructions. List type and amount Itemired Deductions 16 Total 17 Add the amounts in the far right column for lines 4 through 16. Also, enter this amount on Itemized Forin 1040 or 1040-SR, line 9 Deductions 18 you elect to itemize deductions even though they are less than your standard deduction, check this box For Paperwork Reduction Act Notice, see the instructions for Forms 1040 and 1040-SR. Cale 171450 Schedule A Form 1046 or 1040-52019