Answered step by step

Verified Expert Solution

Question

1 Approved Answer

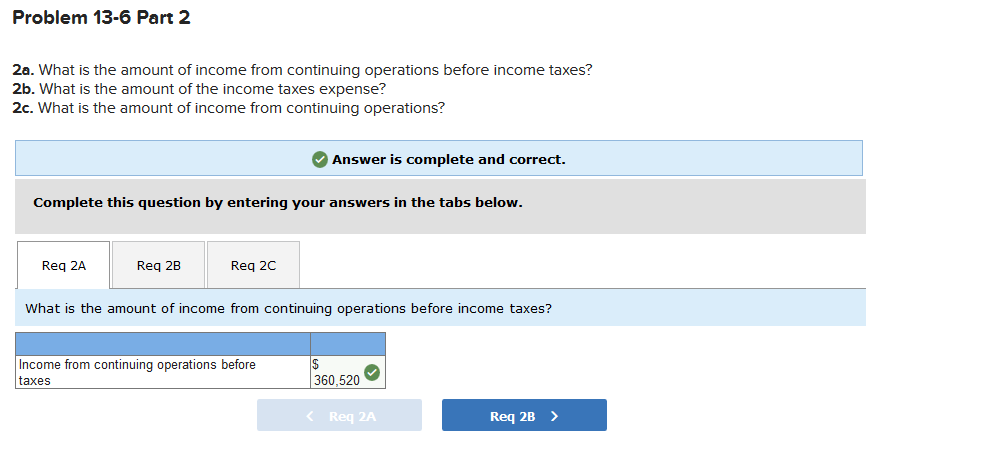

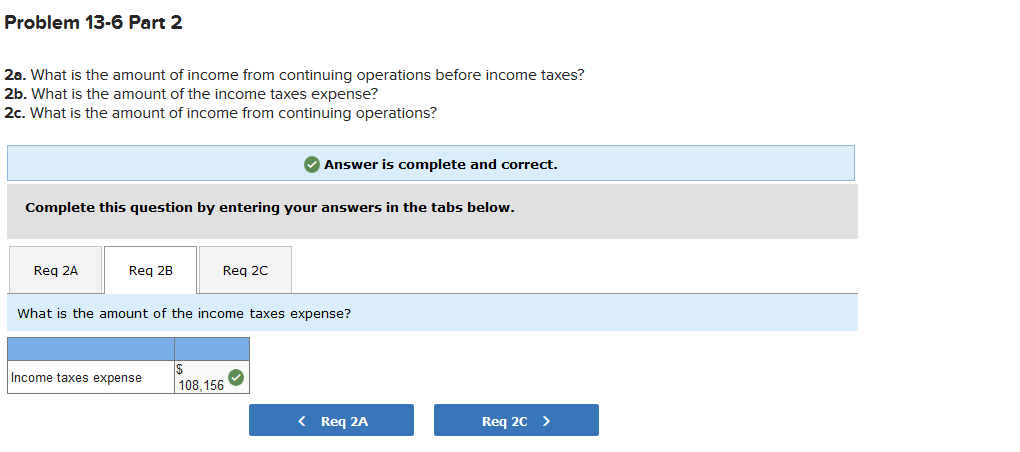

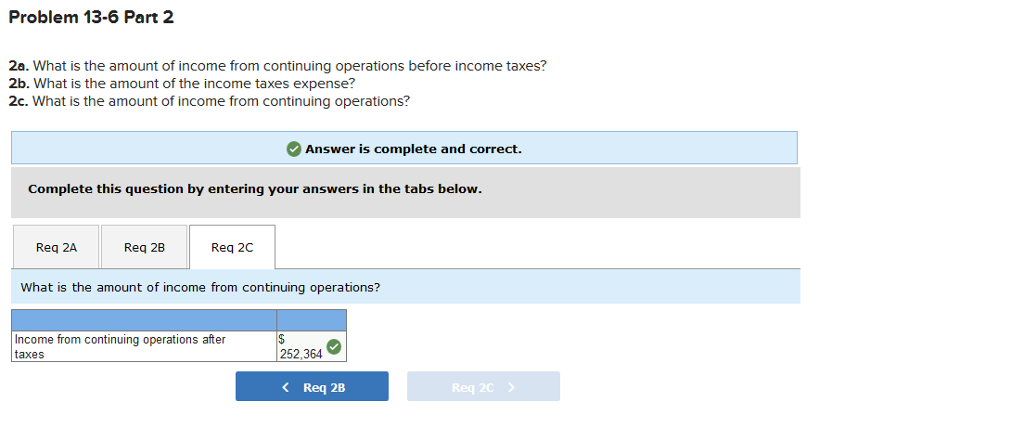

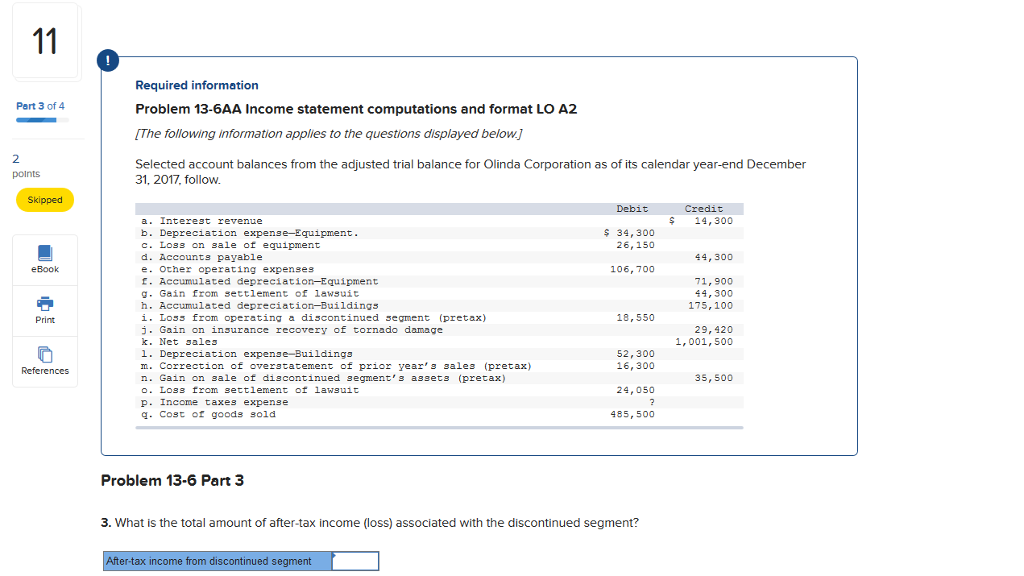

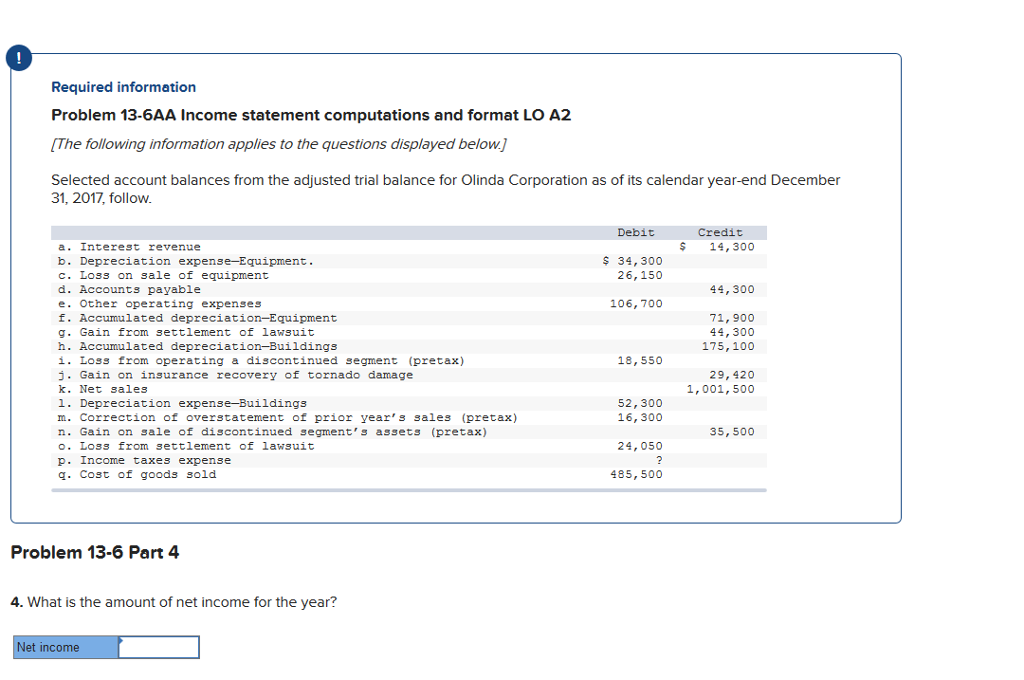

Please help me with this two part question. The questions I need help with is the last two screenshots (part 3 & part 4). Please

Please help me with this two part question. The questions I need help with is the last two screenshots (part 3 & part 4). Please provide steps to answers, thanks!

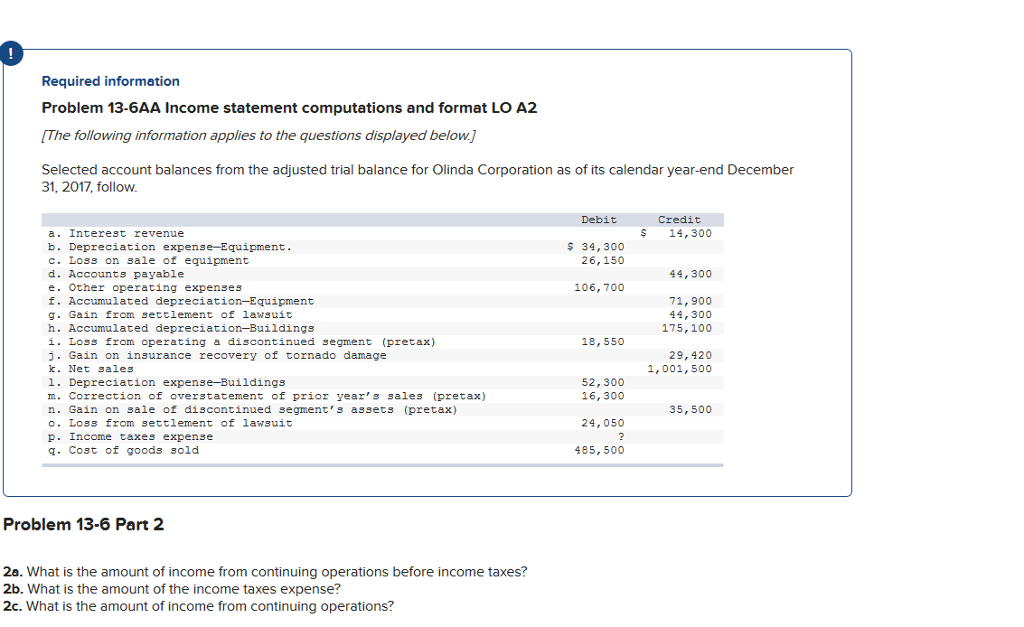

Problem 13-6AA Income statement computations and format LO A2

[The following information applies to the questions displayed below.] Selected account balances from the adjusted trial balance for Olinda Corporation as of its calendar year-end December 31, 2017, follow.

I need help starting from here, down.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started