please help me with this

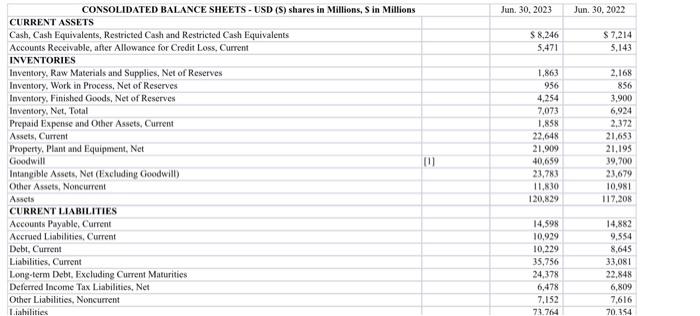

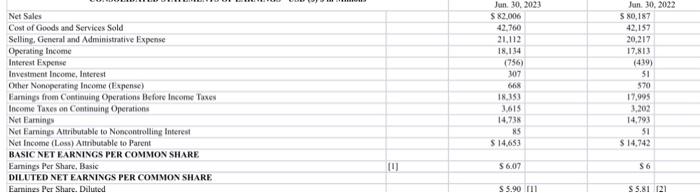

Using Excel formulas, calculate the following financial ratios for the last two years for this company:

a) Inventory Turnover

b) Fixed Assets Turnover

thank you

\begin{tabular}{|c|c|c|c|} \hline \multicolumn{2}{|c|}{ CONSOLIDATED BALANCE SHEETS - USD (S) shares in Millions, S in Millions } & \multirow[t]{2}{*}{ Jan. 30.2023} & \multirow[t]{2}{*}{ Jun. 30.2022} \\ \hline CURRENT ASSETS & & & \\ \hline Cash, Cash Equivalents, Restricted Cash and Restricted Cash Equivalents & & $8,246 & $7,214 \\ \hline Accounts Receivable, after Allowance for Credit Loss, Current & & 5.471 & 5,143 \\ \hline \multicolumn{4}{|l|}{ INVENTORIES } \\ \hline Inventory, Raw Materials and Supplies, Net of Reserves & & 1,863 & 2,168 \\ \hline Inventory. Work in Process, Net of Reserves & & 956 & 856 \\ \hline Inventory, Finished Goods, Net of Reserves & & 4,254 & 3,900 \\ \hline Inventory, Net, Total & & 7.073 & 6,924 \\ \hline Prepaid Expense and Other Assets, Current & & 1,858 & 2,372 \\ \hline Assets, Current & & 22,648 & 21,653 \\ \hline Property, Plant and Equipment, Net & & 21,909 & 21,195 \\ \hline Goodwill & {[1]} & 40,659 & 39,700 \\ \hline Intangible Assets, Net (Excluding Goodwill) & & 23,783 & 23,679 \\ \hline Other Assets, Noncurrent & & 11,830 & 10,981 \\ \hline Assets & & 120.829 & 117,208 \\ \hline \multicolumn{4}{|l|}{ CURRENT LABBLITIES } \\ \hline Accounts Payable, Current & & 14,598 & 14,882 \\ \hline Acerued Liabilities, Current & & 10,929 & 9,554 \\ \hline Debt, Current & & 10,229 & 8,645 \\ \hline Liabilities, Cument & & 35,756 & 33,081 \\ \hline Long-term Debt, Excluding Current Maturities & & 24,378 & 22,848 \\ \hline Deferred Income Tax Liabilities, Net & & 6,478 & 6,809 \\ \hline Other Liabilities, Noncurrent & & 7,152 & 7,616 \\ \hline I. iahalities & & 73.764 & 70.354 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline & Jun. 30.2023 & \multicolumn{2}{|c|}{Jan.30,2022} \\ \hline Net Sales & & $82.006 & 580,187 & \\ \hline Cost of Goods and Services Sold & & 42,760 & 42,157 & \\ \hline Selling, General and Administrative Expense & & 21,112 & 20,217 & \\ \hline Operating Income & & 18,134 & 17,813 & \\ \hline Interest Expentie & & (756) & (439) & \\ \hline Investment Income, Interest & & 307 & 51 & \\ \hline Other Nonoperating Income (1-spense) & & 668 & 570 & \\ \hline Famings from Continuing Operations Befoes lacome Taxes & & 18,353 & 17,995 & \\ \hline Income Taxes on Continuing Operations & & 3,615 & 3,202 & \\ \hline Net Earnings & & 14,738 & 14,793 & \\ \hline Net Earnings Atributable to Noncontrolliegs Interest & & 85 & 51 & \\ \hline Net Income (Less) Annbutable to Parent & & $14,653 & $14,742 & \\ \hline \multicolumn{4}{|l|}{ BASIC NET EARNINGS PER COMNON SHARE. } & \\ \hline Eamings Per Share, Basic & (II) & 56.07 & $6 & \\ \hline \multicolumn{4}{|l|}{ DILUTED NET EARNINGS PER COMYON SHARE. } & \\ \hline Eaminzs Per Shatc. Diluted & & $5.90 & $5.81 & \\ \hline \end{tabular}