Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me with this. What information Exercise 12-14 (Algo) Computation of Gain or Loss on Sale of Asset by Foreign Subsidiary LO 12-4, 12-6

Please help me with this.

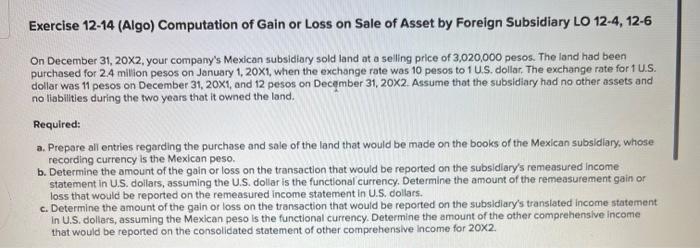

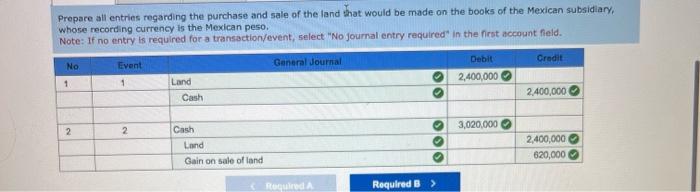

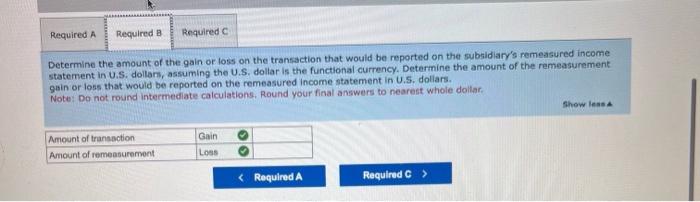

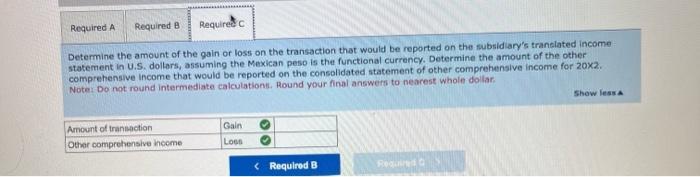

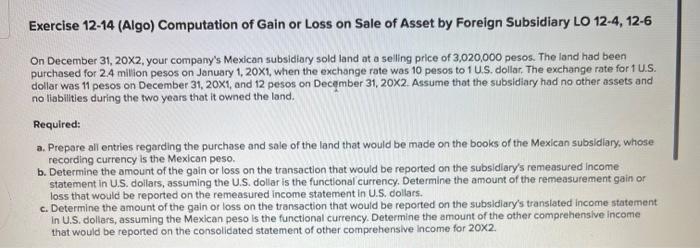

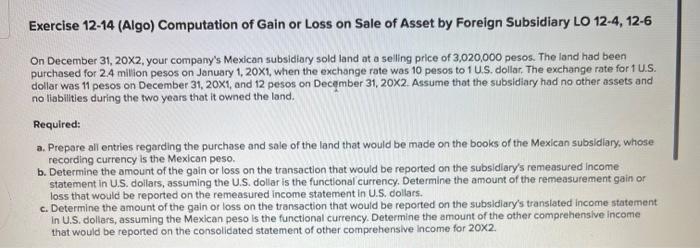

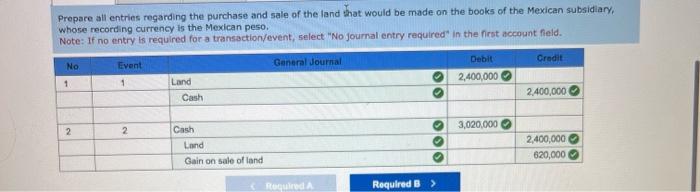

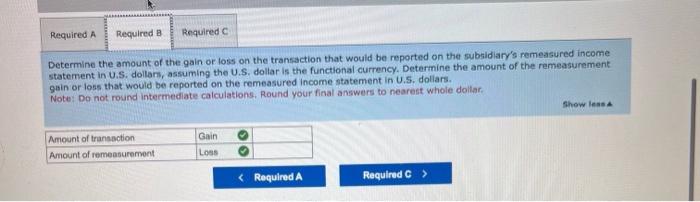

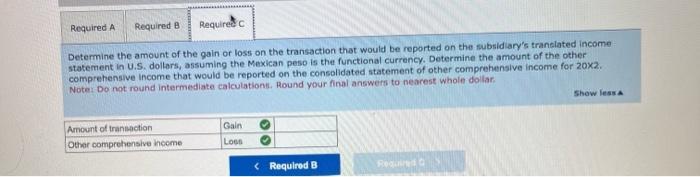

What information Exercise 12-14 (Algo) Computation of Gain or Loss on Sale of Asset by Foreign Subsidiary LO 12-4, 12-6 On December 31, 20X2, your company's Mexican subsidiary sold land ot a selling price of 3,020,000 pesos. The land had been purchased for 2.4 million pesos on January 1, 20X1, when the exchange rate was 10 pesos to 1 U.S, dollar. The exchange rate for 1 U.S. dollar was 11 pesos on December 31, 20X1, and 12 pesos on December 31, 20X2. Assume that the subsidiary had no other assets and no liabilities during the two years that it owned the land. Required: a. Prepare all entries regarding the purchase and sale of the land that would be made on the books of the Mexican subsidiary, whose recording currency is the Mexican peso. b. Determine the amount of the gain or loss on the transaction that would be reported on the subsidiary's remeasured income statement in U.S. doilars, assuming the U.S. dollar is the functional currency. Determine the amount of the remeasurement gain or loss that would be reported on the remeasured income statement in U.S. dollars. c. Determine the amount of the gain or loss on the transaction that would be reported on the subsidiary's translated income statement In U.S. dollars, assuming the Mexican peso is the functional currency. Determine the amount of the other comprehensive income that would be reported on the consolidated statement of other comprehensive income for 202. Prepare all entries regarding the purchase and sale of the land that would be made on the books of the Mexican subsidiary, whose recording currency is the Mexican peso. Note: if no entry is required for a transaction/event, select "No journal entry required" in the first account feld. Determine the amount of the gain or loss on the transaction that would be reported on the subsidiary's remeasured income statement in U.S. dollarn, assuming the U.S. dollar is the functional currency. Determine the amount of the remeasurement guin or loss that would be reported on the remeasured income statement in U.S. dollars. Note: Do not round intermediate calculations, Round your final answers to nearest whole doliar. Determine the amount of the gain or loss on the transaction that would be reported on the subsidiary's tranclated income statement in U.S. doltars, assuming the Mexican peso is the functional currency. Determine the amount of the other comprehensive Income that would be reported on the consolidated statement of other comprehensive income for 20x2. Note: Do not round intermediate calculation:. Round your final answers to nearest whole dollar: Exercise 12-14 (Algo) Computation of Gain or Loss on Sale of Asset by Foreign Subsidiary LO 12-4, 12-6 On December 31, 20X2, your company's Mexican subsidiary sold land ot a selling price of 3,020,000 pesos. The land had been purchased for 2.4 million pesos on January 1, 20X1, when the exchange rate was 10 pesos to 1 U.S, dollar. The exchange rate for 1 U.S. dollar was 11 pesos on December 31, 20X1, and 12 pesos on December 31, 20X2. Assume that the subsidiary had no other assets and no liabilities during the two years that it owned the land. Required: a. Prepare all entries regarding the purchase and sale of the land that would be made on the books of the Mexican subsidiary, whose recording currency is the Mexican peso. b. Determine the amount of the gain or loss on the transaction that would be reported on the subsidiary's remeasured income statement in U.S. doilars, assuming the U.S. dollar is the functional currency. Determine the amount of the remeasurement gain or loss that would be reported on the remeasured income statement in U.S. dollars. c. Determine the amount of the gain or loss on the transaction that would be reported on the subsidiary's translated income statement In U.S. dollars, assuming the Mexican peso is the functional currency. Determine the amount of the other comprehensive income that would be reported on the consolidated statement of other comprehensive income for 202. Prepare all entries regarding the purchase and sale of the land that would be made on the books of the Mexican subsidiary, whose recording currency is the Mexican peso. Note: if no entry is required for a transaction/event, select "No journal entry required" in the first account feld. Determine the amount of the gain or loss on the transaction that would be reported on the subsidiary's remeasured income statement in U.S. dollarn, assuming the U.S. dollar is the functional currency. Determine the amount of the remeasurement guin or loss that would be reported on the remeasured income statement in U.S. dollars. Note: Do not round intermediate calculations, Round your final answers to nearest whole doliar. Determine the amount of the gain or loss on the transaction that would be reported on the subsidiary's tranclated income statement in U.S. doltars, assuming the Mexican peso is the functional currency. Determine the amount of the other comprehensive Income that would be reported on the consolidated statement of other comprehensive income for 20x2. Note: Do not round intermediate calculation:. Round your final answers to nearest whole dollar

What information Exercise 12-14 (Algo) Computation of Gain or Loss on Sale of Asset by Foreign Subsidiary LO 12-4, 12-6 On December 31, 20X2, your company's Mexican subsidiary sold land ot a selling price of 3,020,000 pesos. The land had been purchased for 2.4 million pesos on January 1, 20X1, when the exchange rate was 10 pesos to 1 U.S, dollar. The exchange rate for 1 U.S. dollar was 11 pesos on December 31, 20X1, and 12 pesos on December 31, 20X2. Assume that the subsidiary had no other assets and no liabilities during the two years that it owned the land. Required: a. Prepare all entries regarding the purchase and sale of the land that would be made on the books of the Mexican subsidiary, whose recording currency is the Mexican peso. b. Determine the amount of the gain or loss on the transaction that would be reported on the subsidiary's remeasured income statement in U.S. doilars, assuming the U.S. dollar is the functional currency. Determine the amount of the remeasurement gain or loss that would be reported on the remeasured income statement in U.S. dollars. c. Determine the amount of the gain or loss on the transaction that would be reported on the subsidiary's translated income statement In U.S. dollars, assuming the Mexican peso is the functional currency. Determine the amount of the other comprehensive income that would be reported on the consolidated statement of other comprehensive income for 202. Prepare all entries regarding the purchase and sale of the land that would be made on the books of the Mexican subsidiary, whose recording currency is the Mexican peso. Note: if no entry is required for a transaction/event, select "No journal entry required" in the first account feld. Determine the amount of the gain or loss on the transaction that would be reported on the subsidiary's remeasured income statement in U.S. dollarn, assuming the U.S. dollar is the functional currency. Determine the amount of the remeasurement guin or loss that would be reported on the remeasured income statement in U.S. dollars. Note: Do not round intermediate calculations, Round your final answers to nearest whole doliar. Determine the amount of the gain or loss on the transaction that would be reported on the subsidiary's tranclated income statement in U.S. doltars, assuming the Mexican peso is the functional currency. Determine the amount of the other comprehensive Income that would be reported on the consolidated statement of other comprehensive income for 20x2. Note: Do not round intermediate calculation:. Round your final answers to nearest whole dollar: Exercise 12-14 (Algo) Computation of Gain or Loss on Sale of Asset by Foreign Subsidiary LO 12-4, 12-6 On December 31, 20X2, your company's Mexican subsidiary sold land ot a selling price of 3,020,000 pesos. The land had been purchased for 2.4 million pesos on January 1, 20X1, when the exchange rate was 10 pesos to 1 U.S, dollar. The exchange rate for 1 U.S. dollar was 11 pesos on December 31, 20X1, and 12 pesos on December 31, 20X2. Assume that the subsidiary had no other assets and no liabilities during the two years that it owned the land. Required: a. Prepare all entries regarding the purchase and sale of the land that would be made on the books of the Mexican subsidiary, whose recording currency is the Mexican peso. b. Determine the amount of the gain or loss on the transaction that would be reported on the subsidiary's remeasured income statement in U.S. doilars, assuming the U.S. dollar is the functional currency. Determine the amount of the remeasurement gain or loss that would be reported on the remeasured income statement in U.S. dollars. c. Determine the amount of the gain or loss on the transaction that would be reported on the subsidiary's translated income statement In U.S. dollars, assuming the Mexican peso is the functional currency. Determine the amount of the other comprehensive income that would be reported on the consolidated statement of other comprehensive income for 202. Prepare all entries regarding the purchase and sale of the land that would be made on the books of the Mexican subsidiary, whose recording currency is the Mexican peso. Note: if no entry is required for a transaction/event, select "No journal entry required" in the first account feld. Determine the amount of the gain or loss on the transaction that would be reported on the subsidiary's remeasured income statement in U.S. dollarn, assuming the U.S. dollar is the functional currency. Determine the amount of the remeasurement guin or loss that would be reported on the remeasured income statement in U.S. dollars. Note: Do not round intermediate calculations, Round your final answers to nearest whole doliar. Determine the amount of the gain or loss on the transaction that would be reported on the subsidiary's tranclated income statement in U.S. doltars, assuming the Mexican peso is the functional currency. Determine the amount of the other comprehensive Income that would be reported on the consolidated statement of other comprehensive income for 20x2. Note: Do not round intermediate calculation:. Round your final answers to nearest whole dollar

Please help me with this.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started