Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me with what to put in the highlighted cells Exercise 8-49 (Algo) Prepare a Production Cost Report: FIFO Method (LO 8-2, 4, 5)

Please help me with what to put in the highlighted cells

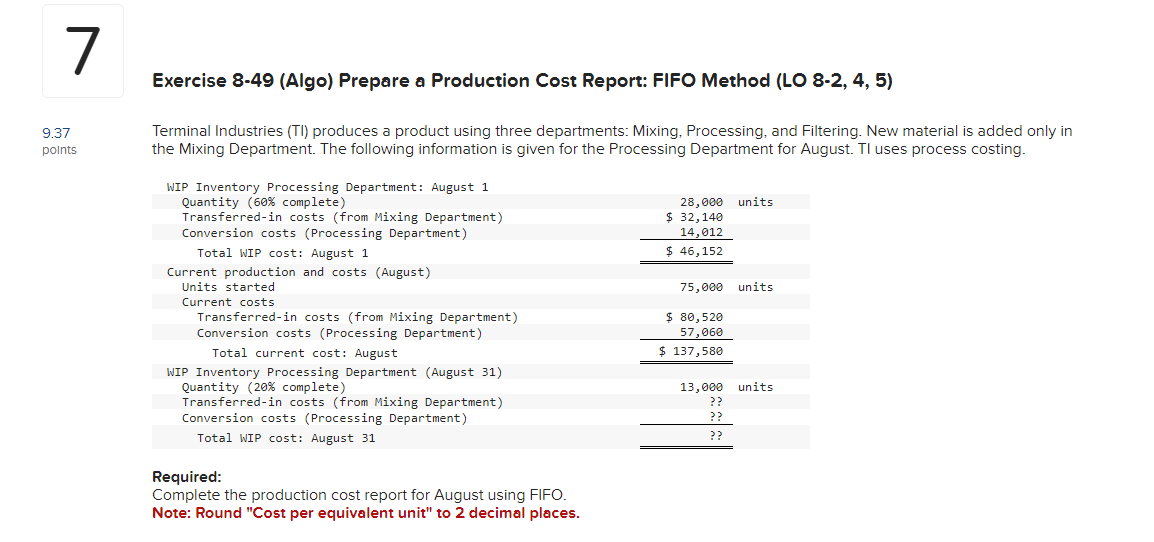

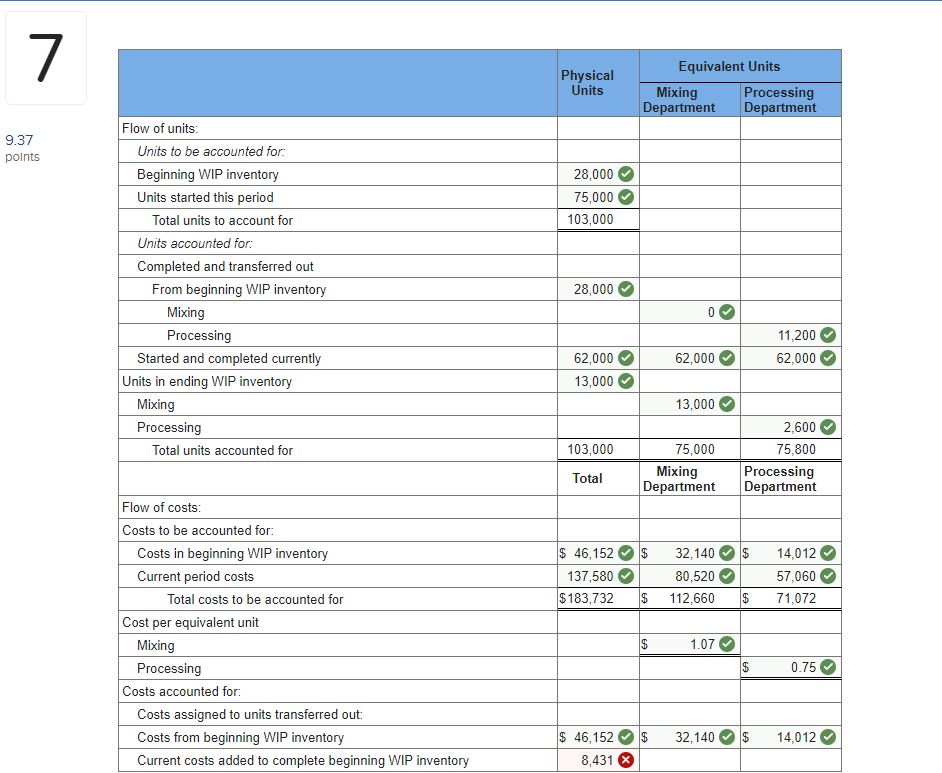

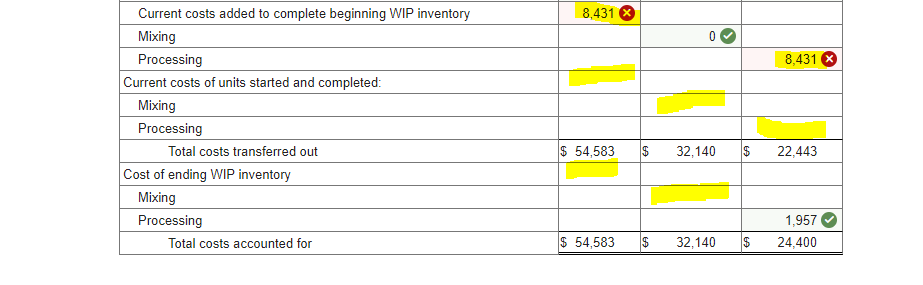

Exercise 8-49 (Algo) Prepare a Production Cost Report: FIFO Method (LO 8-2, 4, 5) Terminal Industries (TI) produces a product using three departments: Mixing, Processing, and Filtering. New material is added only in the Mixing Department. The following information is given for the Processing Department for August. Tl uses process costing. Required: Complete the production cost report for August using FIFO. Note: Round "Cost per equivalent unit" to 2 decimal places. \begin{tabular}{|c|c|c|c|} \hline & & Equivalen & t Units \\ \hline & Units & \begin{tabular}{c} Mixing \\ Department \end{tabular} & \begin{tabular}{l} Processing \\ Department \end{tabular} \\ \hline Flow of units: & & & \\ \hline Units to be accounted for: & & & \\ \hline Beginning WIP inventory & 28,000 & & \\ \hline Units started this period & 75,000 & & \\ \hline Total units to account for & 103,000 & & \\ \hline Units accounted for: & & & \\ \hline Completed and transferred out & & & \\ \hline From beginning WIP inventory & 28,000 & & \\ \hline Mixing & & 02 & \\ \hline Processing & & & 11,200 \\ \hline Started and completed currently & 62,000 & 62,000 & 62,000 \\ \hline Units in ending WIP inventory & 13,000 & & \\ \hline Mixing & & 13,000 & \\ \hline Processing & & & 2,600 \\ \hline Total units accounted for & 103,000 & 75,000 & 75,800 \\ \hline & Total & \begin{tabular}{c} Mixing \\ Department \end{tabular} & \begin{tabular}{l} Processing \\ Department \end{tabular} \\ \hline Flow of costs: & & & \\ \hline Costs to be accounted for: & & & \\ \hline Costs in beginning WIP inventory & $46,152 & 32,140 & 14,012 \\ \hline Current period costs & 137,580 & 80,520 & 57,060 \\ \hline Total costs to be accounted for & $183,732 & 112,660 & 71,072 \\ \hline Cost per equivalent unit & & & \\ \hline Mixing & & 1.07 & \\ \hline Processing & & & 0.75 \\ \hline Costs accounted for: & & & \\ \hline Costs assigned to units transferred out: & & & \\ \hline Costs from beginning WIP inventory & $46,152 & 32,140 & 14,012 \\ \hline Current costs added to complete beginning WIP inventory & 8,431 & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline Current costs added to complete beginning WIP inventory & 8,431 & & & & \\ \hline Mixing & & & 02 & & \\ \hline Processing & & & & & 8,431 \\ \hline \multicolumn{6}{|l|}{ Current costs of units started and completed: } \\ \hline \multicolumn{6}{|l|}{ Mixing } \\ \hline \multicolumn{6}{|l|}{ Processing } \\ \hline Total costs transferred out & $54,583 & $ & 32,140 & $ & 22,443 \\ \hline \multicolumn{6}{|l|}{ Cost of ending WIP inventory } \\ \hline \multicolumn{6}{|l|}{ Mixing } \\ \hline Processing & & & & & 1,957 \\ \hline Total costs accounted for & $54,583 & $ & 32,140 & $ & 24,400 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started