Answered step by step

Verified Expert Solution

Question

1 Approved Answer

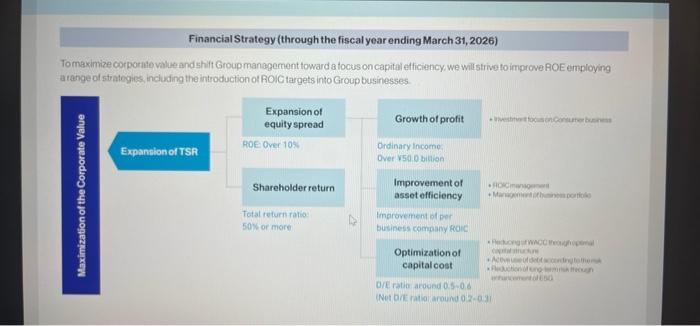

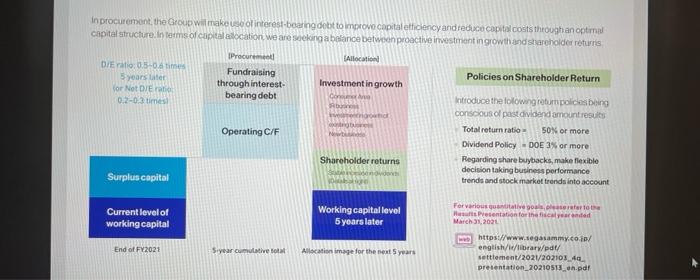

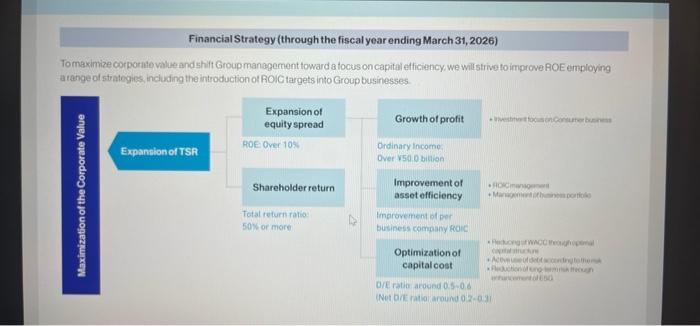

Please help me write summarize the Financial Strategy given the information. Please help me interpret the Financial Strategy Financial Strategy (through the fiscal year ending

Please help me write summarize the Financial Strategy given the information.

Please help me interpret the Financial Strategy

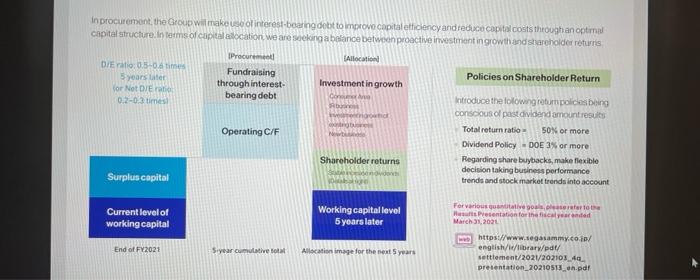

Financial Strategy (through the fiscal year ending March 31, 2026) To maximize corporate value and shift Group management toward a focus on capital efficiency, we will strive to improve ROE employing a range of strategies, including the introduction of ROIC targets into Group businesses Expansion of equity spread ROE Over 10 Growth of profit tre focum innumere Expansion of TSR Ordinary income Over 500 billion Maximization of the Corporate Value Shareholder return + More Improvement of asset efficiency Improvement of per business company ROIC Total return ratio 50% or more WA Optimization of capital cost D/E ratio around 05.06 (Not / taround 01203 in procurement, the Group wil make use of interest-bearing debt to improve capitaletliciency and reduce capital costs through an optimal capital structure. In terms of capitalocation we are seekinga balance between proactive investment in growth and shareholder roturris Allocation DEY:0.5-0 times 5 years iter for Not Erato 0.2-0 times Procure Fundraising through interest bearing debt Policies on Shareholder Return Investment in growth Con R w Operating C/F Introduce the lolowing robum policies being conscious of past dividend amount results Total return ratio 50 or more Dividend Policy - DOE 3% or more Regarding share buybacks, make flexible decision taking business performance trends and stock market trends into account Shareholder returns Surplus capital Current level of working capital Working capital level 5 years later For various live goals He Presentation for the card March 31, 2021 End of FY2021 Styear cumulative to Allocation image for the next years https://www.sega.co.io/ english/id/library/pdt/ settlement/2021/2021034 presentation_20210513_n.pdf Financial Strategy (through the fiscal year ending March 31, 2026) To maximize corporate value and shift Group management toward a focus on capital efficiency, we will strive to improve ROE employing a range of strategies, including the introduction of ROIC targets into Group businesses Expansion of equity spread ROE Over 10 Growth of profit tre focum innumere Expansion of TSR Ordinary income Over 500 billion Maximization of the Corporate Value Shareholder return + More Improvement of asset efficiency Improvement of per business company ROIC Total return ratio 50% or more WA Optimization of capital cost D/E ratio around 05.06 (Not / taround 01203 in procurement, the Group wil make use of interest-bearing debt to improve capitaletliciency and reduce capital costs through an optimal capital structure. In terms of capitalocation we are seekinga balance between proactive investment in growth and shareholder roturris Allocation DEY:0.5-0 times 5 years iter for Not Erato 0.2-0 times Procure Fundraising through interest bearing debt Policies on Shareholder Return Investment in growth Con R w Operating C/F Introduce the lolowing robum policies being conscious of past dividend amount results Total return ratio 50 or more Dividend Policy - DOE 3% or more Regarding share buybacks, make flexible decision taking business performance trends and stock market trends into account Shareholder returns Surplus capital Current level of working capital Working capital level 5 years later For various live goals He Presentation for the card March 31, 2021 End of FY2021 Styear cumulative to Allocation image for the next years https://www.sega.co.io/ english/id/library/pdt/ settlement/2021/2021034 presentation_20210513_n.pdf Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started