Question: Suppose your give cash flow data of 3 project alternatives in the table below with 4 years of useful lives each and a study

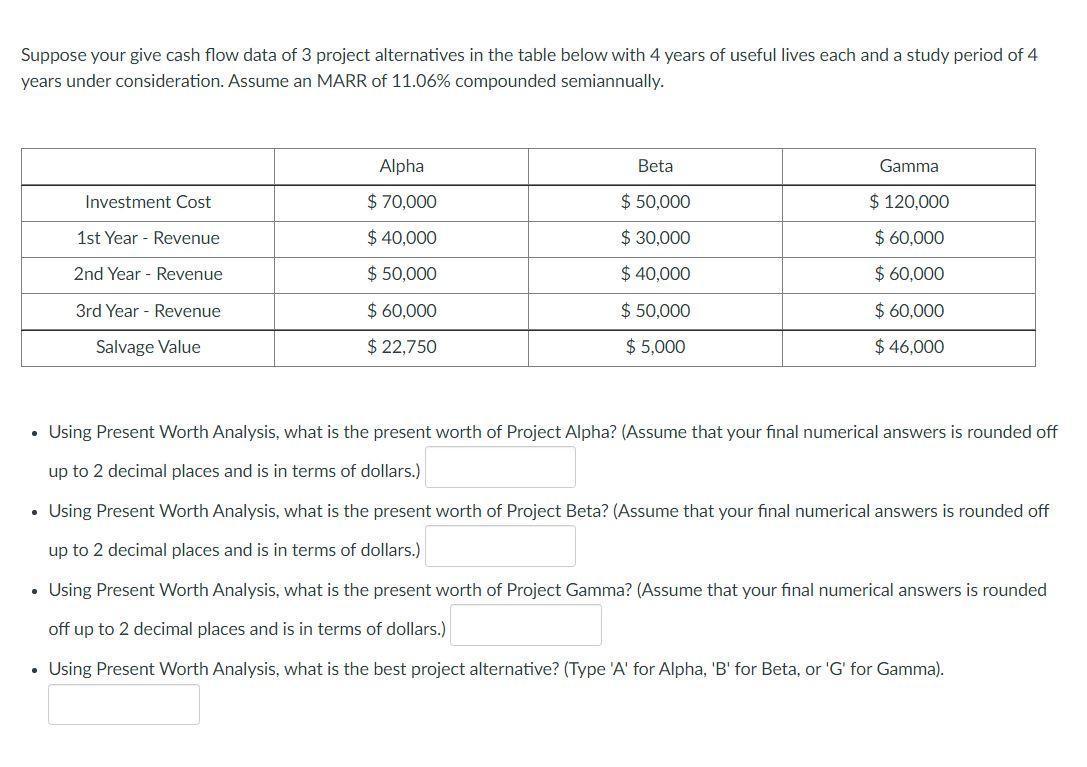

Suppose your give cash flow data of 3 project alternatives in the table below with 4 years of useful lives each and a study period of 4 years under consideration. Assume an MARR of 11.06% compounded semiannually. Investment Cost 1st Year Revenue 2nd Year - Revenue 3rd Year Revenue Salvage Value Alpha $ 70,000 $ 40,000 $ 50,000 $ 60,000 $ 22,750 Beta $ 50,000 $ 30,000 $ 40,000 $ 50,000 $ 5,000 Gamma 120,000 $ 60,000 $ 60,000 $ 60,000 $ 46,000 Using Present Worth Analysis, what is the present worth of Project Alpha? (Assume that your final numerical answers is rounded off up to 2 decimal places and is in terms of dollars.) Using Present Worth Analysis, what is the present worth of Project Beta? (Assume that your final numerical answers is rounded off up to 2 decimal places and is in terms of dollars.) Using Present Worth Analysis, what is the present worth of Project Gamma? (Assume that your final numerical answers is rounded off up to 2 decimal places and is in terms of dollars.) Using Present Worth Analysis, what is the best project alternative? (Type 'A' for Alpha, 'B' for Beta, or 'G' for Gamma).

Step by Step Solution

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Given Alpha Beta Gamma Investment Cost 7000000 5000000 12000000 1st Year Revenue 4000000 3000000 6000000 2nd Year Revenue 5000000 4000000 6000000 3rd ... View full answer

Get step-by-step solutions from verified subject matter experts