Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help Mini-Project 2: Annuities and Investments Follow-Up Please watch the lecture video from class introducing the project. Submissions should be uploaded on Canvas as

please help

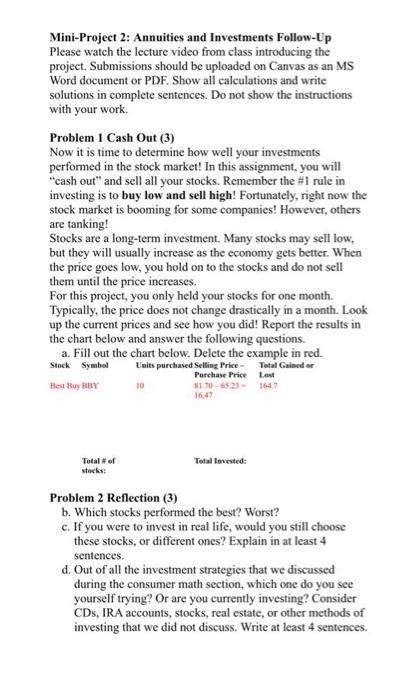

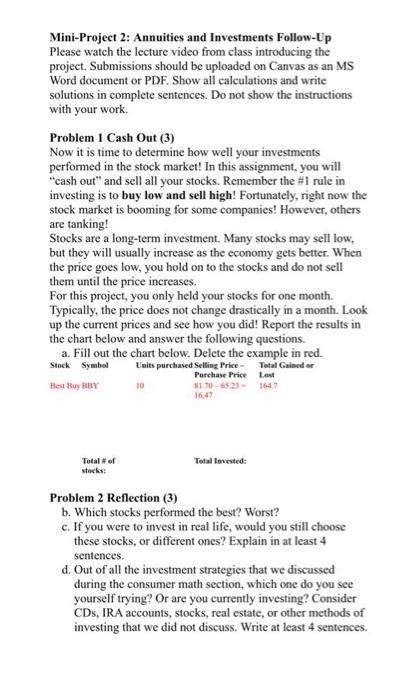

Mini-Project 2: Annuities and Investments Follow-Up Please watch the lecture video from class introducing the project. Submissions should be uploaded on Canvas as an MS Word document or PDF. Show all calculations and write solutions in complete sentences. Do not show the instructions with your work Problem 1 Cash Out (3) Now it is time to determine how well your investments performed in the stock market! In this assignment, you will "cash out" and sell all your stocks. Remember the #1 rule in investing is to buy low and sell high! Fortunately, right now the stock market is booming for some companies! However, others are tanking! Stocks are a long-term investment. Many stocks may sell low, but they will usually increase as the economy gets better. When the price goes low, you hold on to the stocks and do not sell them until the price increases. For this project, you only held your stocks for one month. Typically, the price does not change drastically in a month. Look up the current prices and see how you did! Report the results in the chart below and answer the following questions. a. Fill out the chart below. Delete the example in red. Stock Symbol Units purchased Selling Price - Total Gained or Purchase Price Lest Best Buy BBY 31.10-652-1647 10 16.47 Total of stocks Totallevested: Problem 2 Reflection (3) b. Which stocks performed the best? Worst? c. If you were to invest in real life, would you still choose these stocks, or different ones? Explain in at least 4 sentences. d. Out of all the investment strategies that we discussed during the consumer math section, which one do you see yourself trying? Or are you currently investing? Consider CDs, IRA accounts, stocks, real estate, or other methods of investing that we did not discuss. Write at least 4 sentences. Mini-Project 2: Annuities and Investments Follow-Up Please watch the lecture video from class introducing the project. Submissions should be uploaded on Canvas as an MS Word document or PDF. Show all calculations and write solutions in complete sentences. Do not show the instructions with your work Problem 1 Cash Out (3) Now it is time to determine how well your investments performed in the stock market! In this assignment, you will "cash out" and sell all your stocks. Remember the #1 rule in investing is to buy low and sell high! Fortunately, right now the stock market is booming for some companies! However, others are tanking! Stocks are a long-term investment. Many stocks may sell low, but they will usually increase as the economy gets better. When the price goes low, you hold on to the stocks and do not sell them until the price increases. For this project, you only held your stocks for one month. Typically, the price does not change drastically in a month. Look up the current prices and see how you did! Report the results in the chart below and answer the following questions. a. Fill out the chart below. Delete the example in red. Stock Symbol Units purchased Selling Price - Total Gained or Purchase Price Lest Best Buy BBY 31.10-652-1647 10 16.47 Total of stocks Totallevested: Problem 2 Reflection (3) b. Which stocks performed the best? Worst? c. If you were to invest in real life, would you still choose these stocks, or different ones? Explain in at least 4 sentences. d. Out of all the investment strategies that we discussed during the consumer math section, which one do you see yourself trying? Or are you currently investing? Consider CDs, IRA accounts, stocks, real estate, or other methods of investing that we did not discuss. Write at least 4 sentences

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started