Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help! Monthly amortization schedule. Sherry and Sam want to purchase a condo at the coast. They will spend $600,000 on the condo and are

Please help!

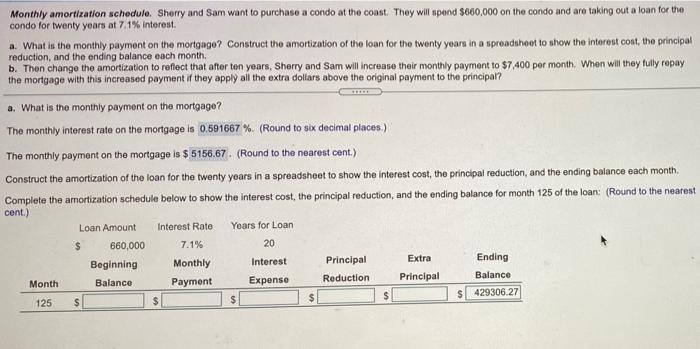

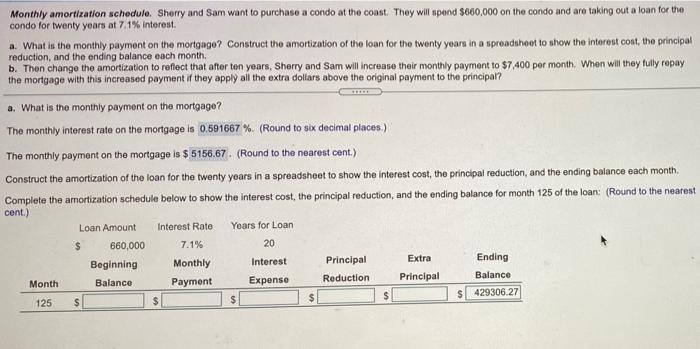

Monthly amortization schedule. Sherry and Sam want to purchase a condo at the coast. They will spend $600,000 on the condo and are taking out a loan for the condo for twenty years at 7.1% Interest, a. What is the monthly payment on the mortgago? Construct the amortization of the loan for the twenty years in a spreadsheet to show the interest cost, the principal reduction, and the ending balance each month. b. Then change the amortization to reflect that after ten years, Sherry and Sam will increase their monthly payment to $7,400 per month. When will they fully ropay the mortgage with this increased payment if they apply all the extra dollars above the original payment to the principal? a. What is the monthly payment on the mortgage? The monthly interest rate on the mortgage is 0.591667 %. (Round to six decimal places.) The monthly payment on the mortgage is $ 5156.67. (Round to the nearest cont.) Construct the amortization of the loan for the twenty years in a spreadsheet to show the interest cost, the principal reduction, and the ending balance each month. Complete the amortization schedule below to show the interest cost, the principal reduction, and the ending balance for month 125 of the loan: (Round to the nearest cent.) Loan Amount Interest Rate Years for Loan $ 660,000 7.1% 20 Beginning Monthly Interest Principal Extra Ending Month Balance Payment Expense Reduction Principal Balance 125 $ $ $ $ $ 429306 27

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started