Answered step by step

Verified Expert Solution

Question

1 Approved Answer

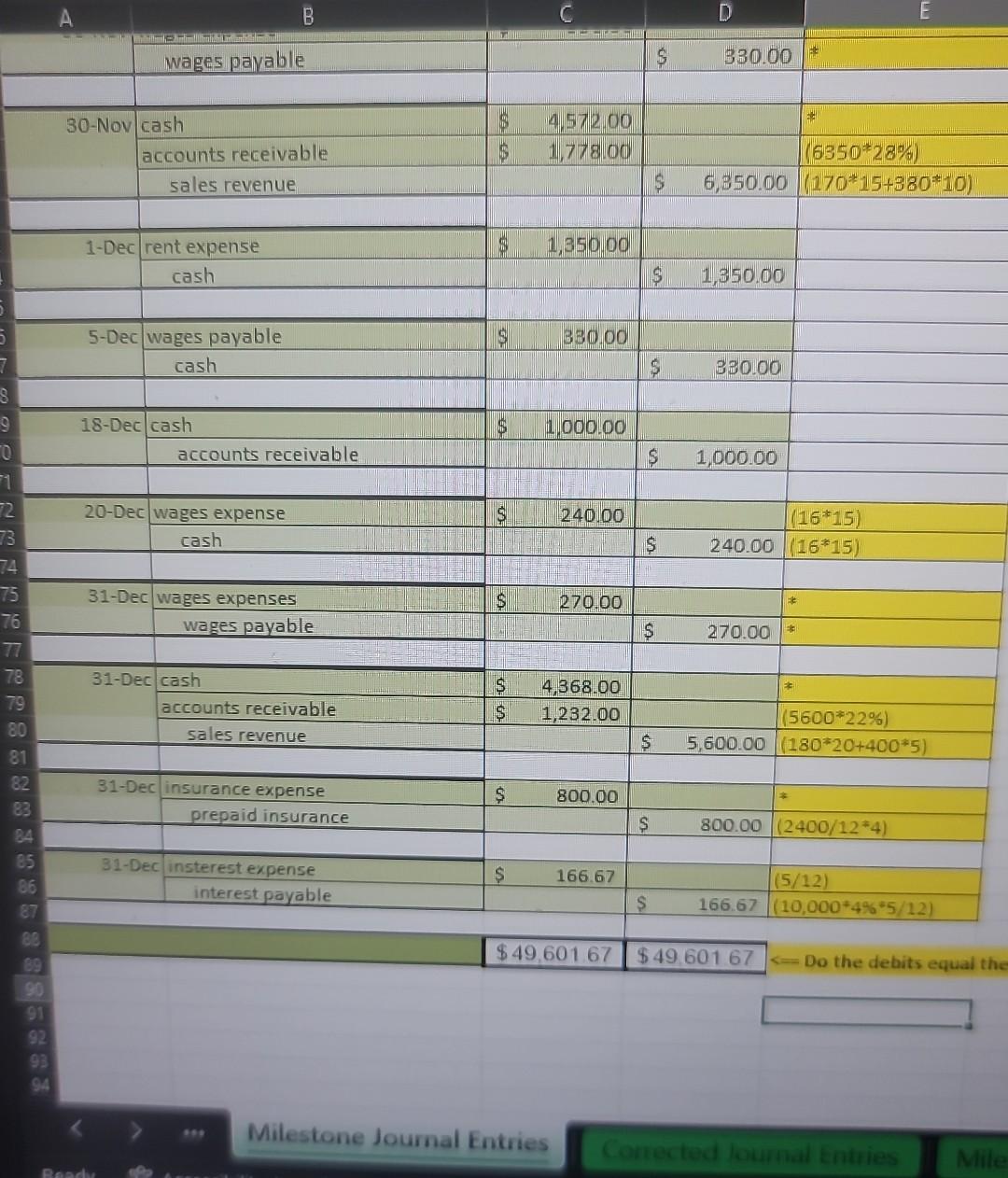

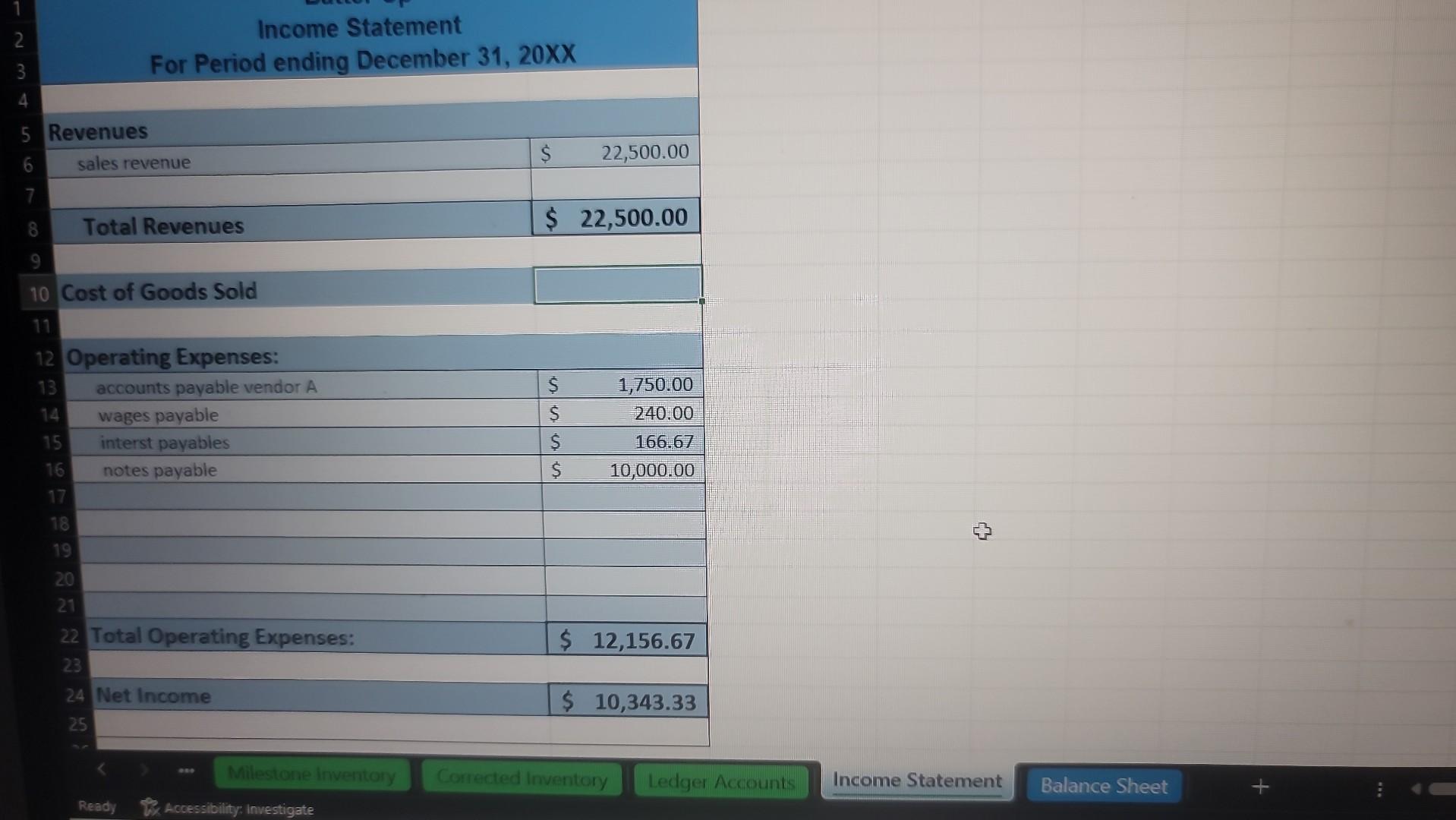

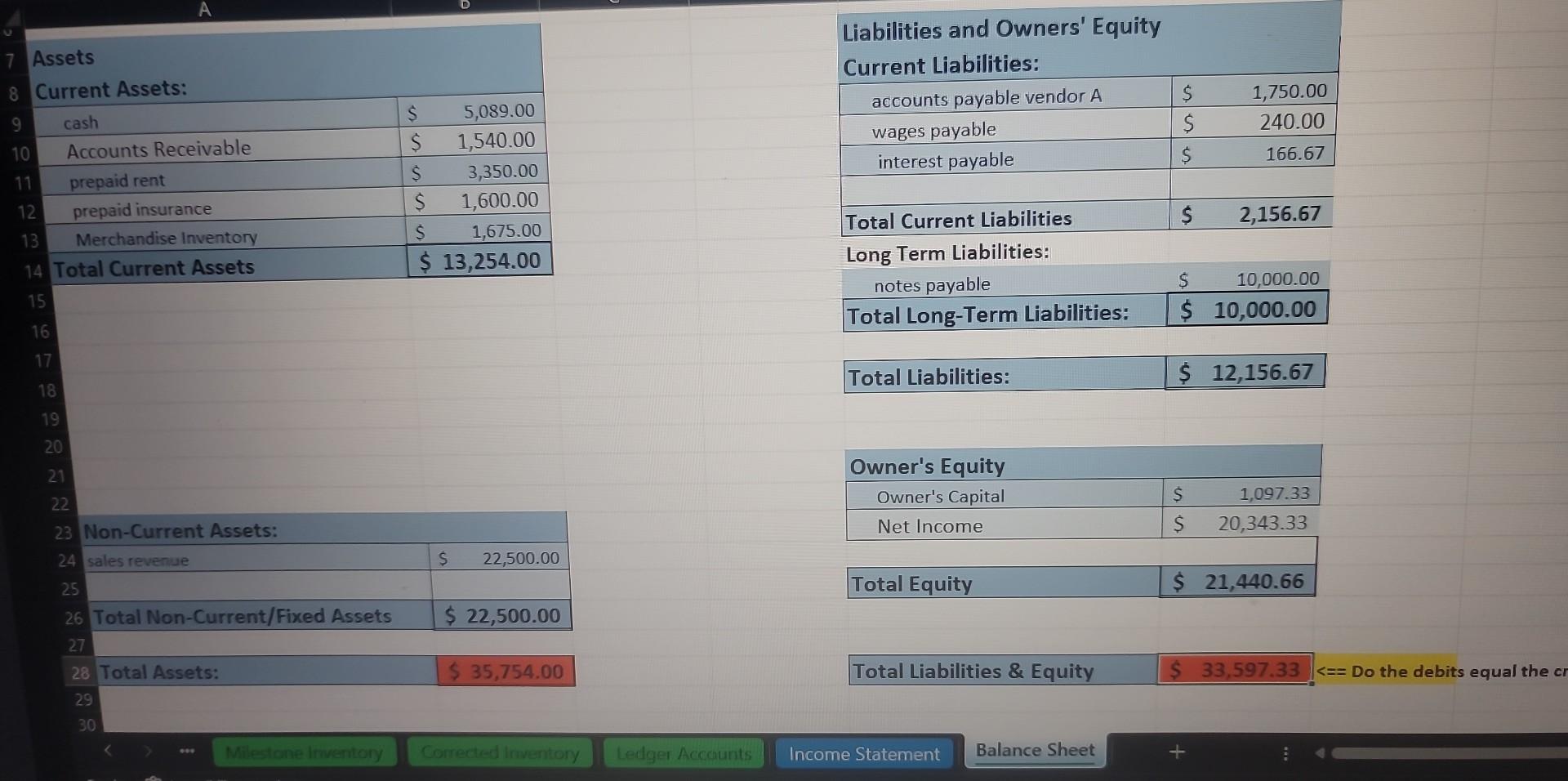

please help need assistance I need assistance on the ledger accounts under expenses. I want to see if it is correct. I also need help

please help

need assistance

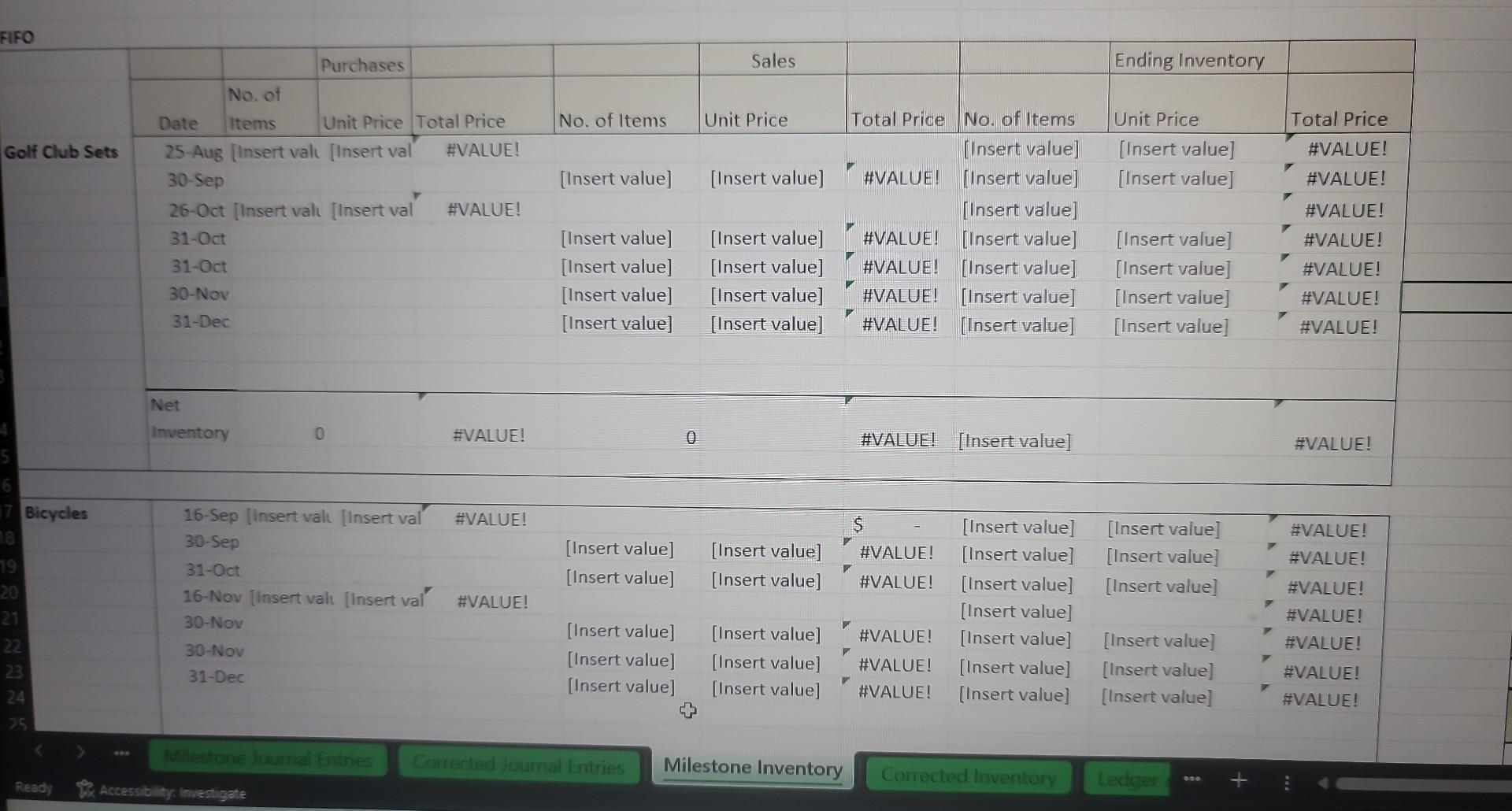

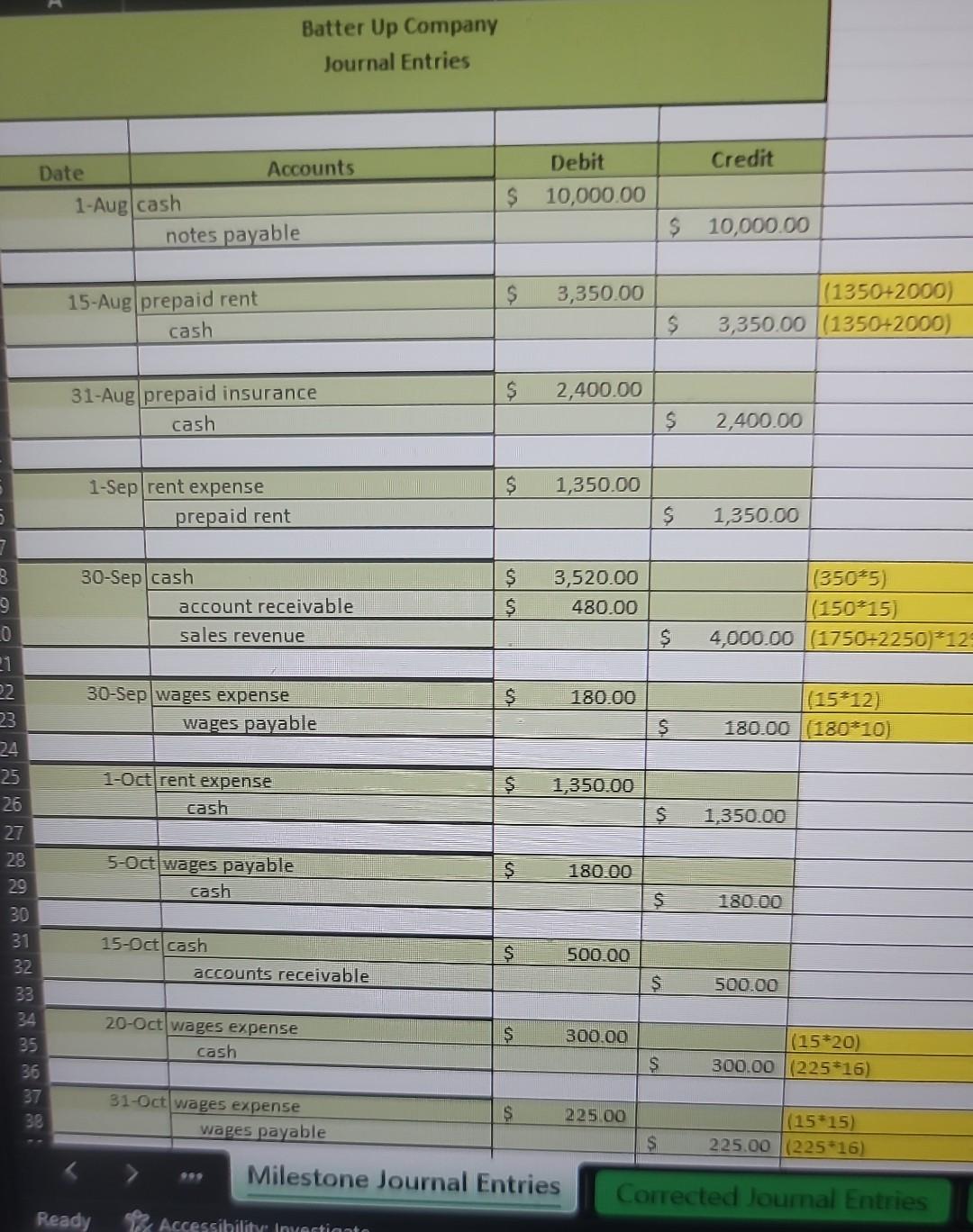

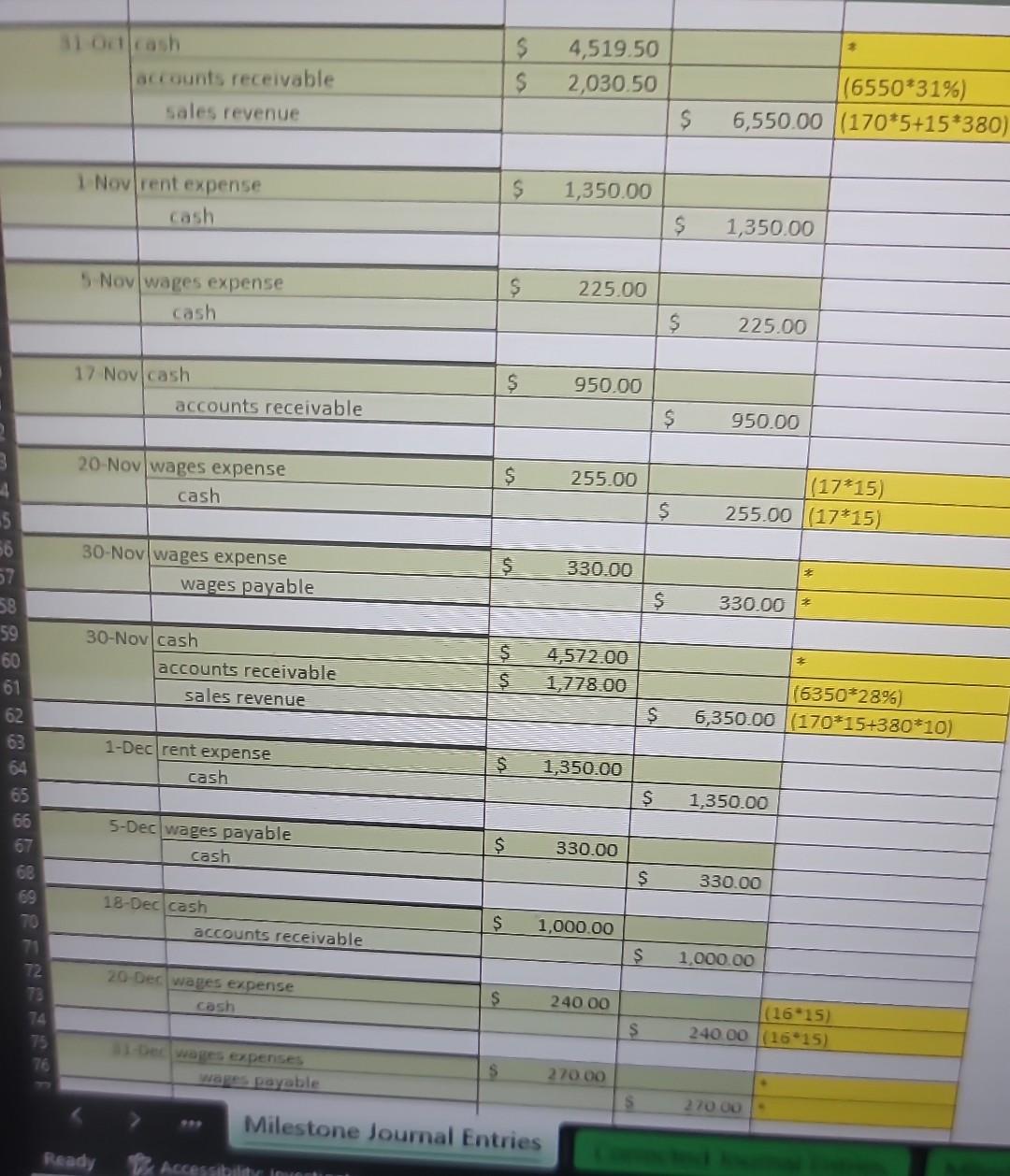

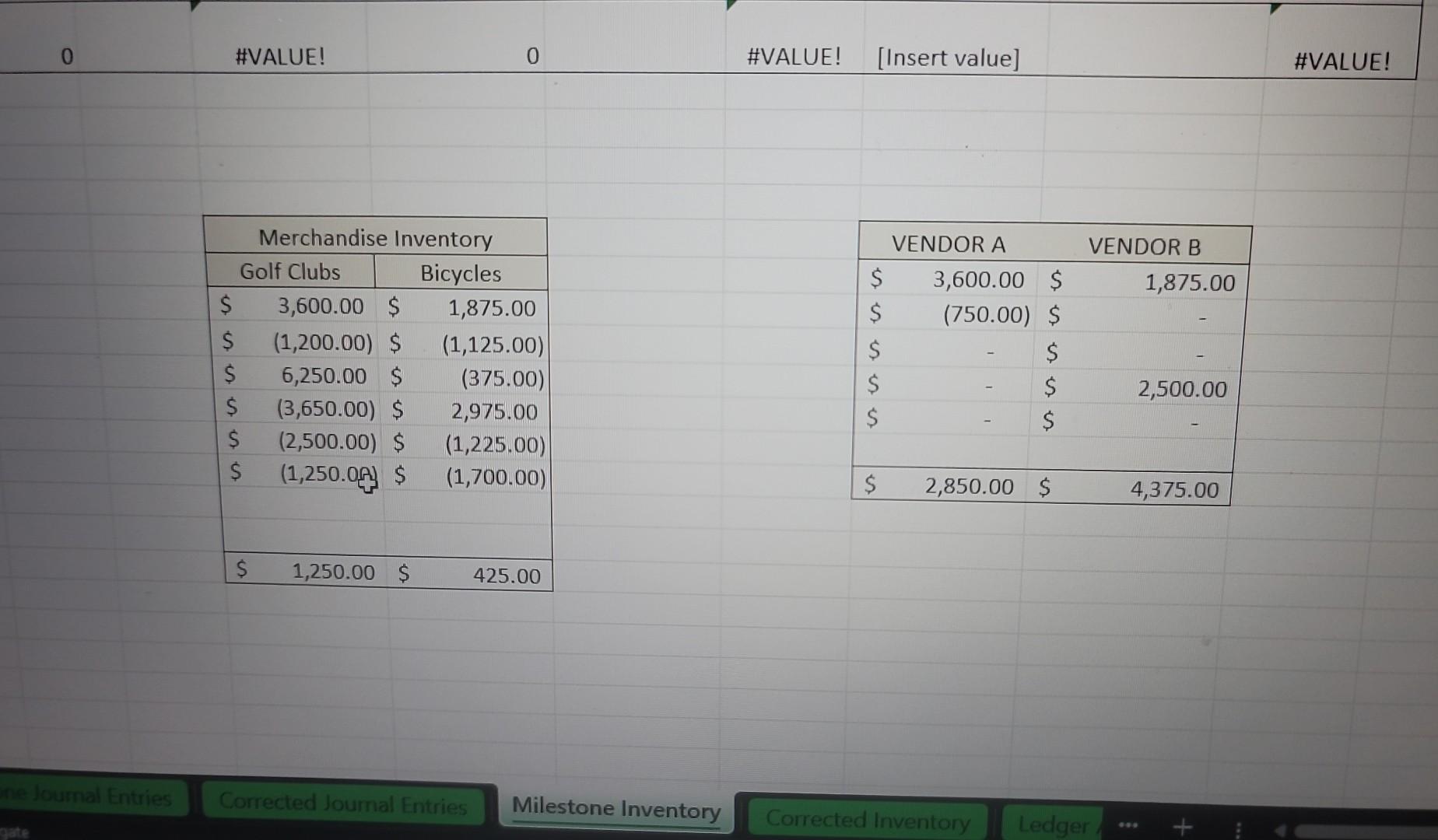

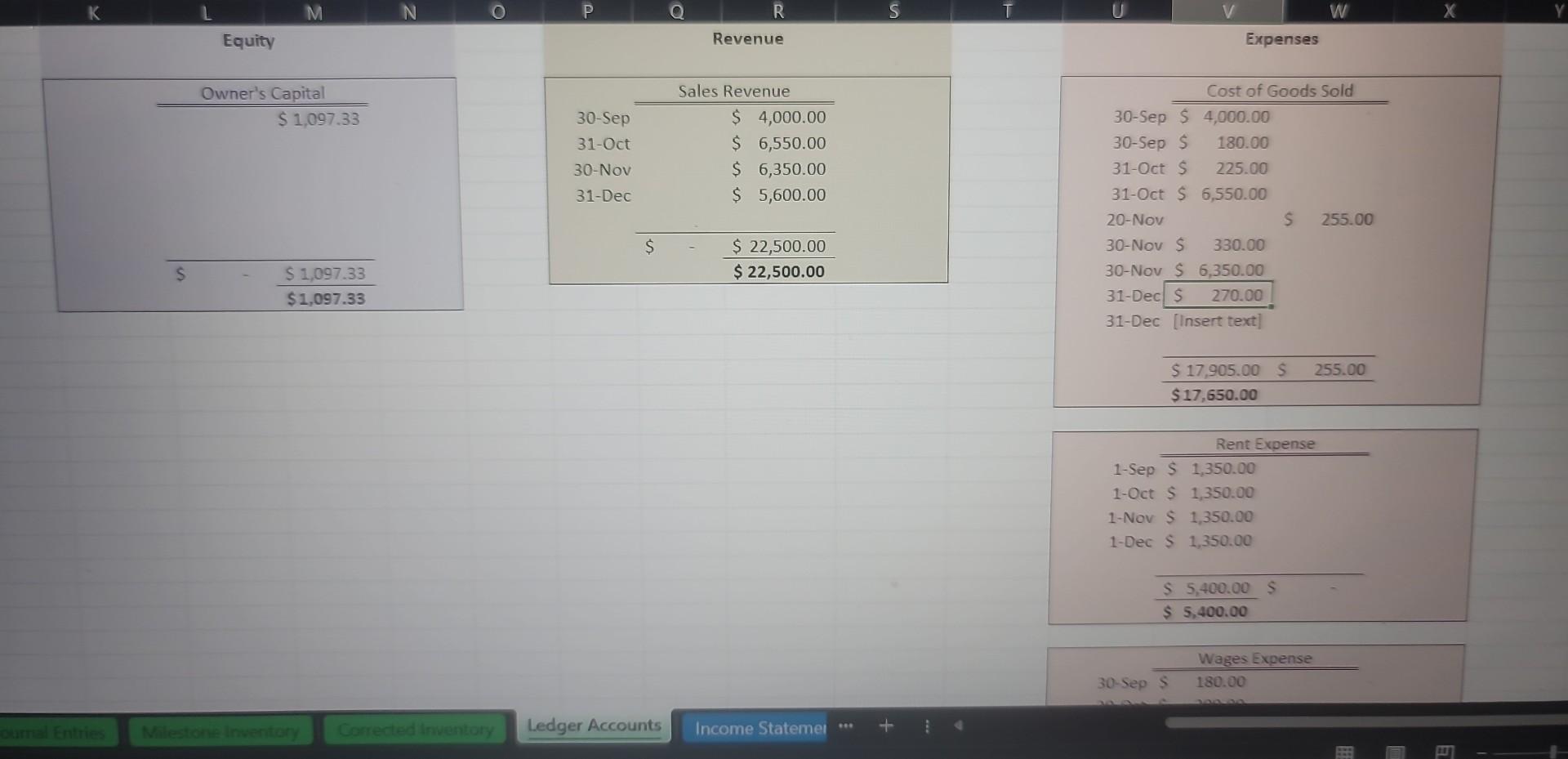

I need assistance on the ledger accounts under expenses. I want to see if it is correct. I also need help with the milestone inventory on how to enter the fifo information as well as assistance to correct my balance sheet. Please? thank you

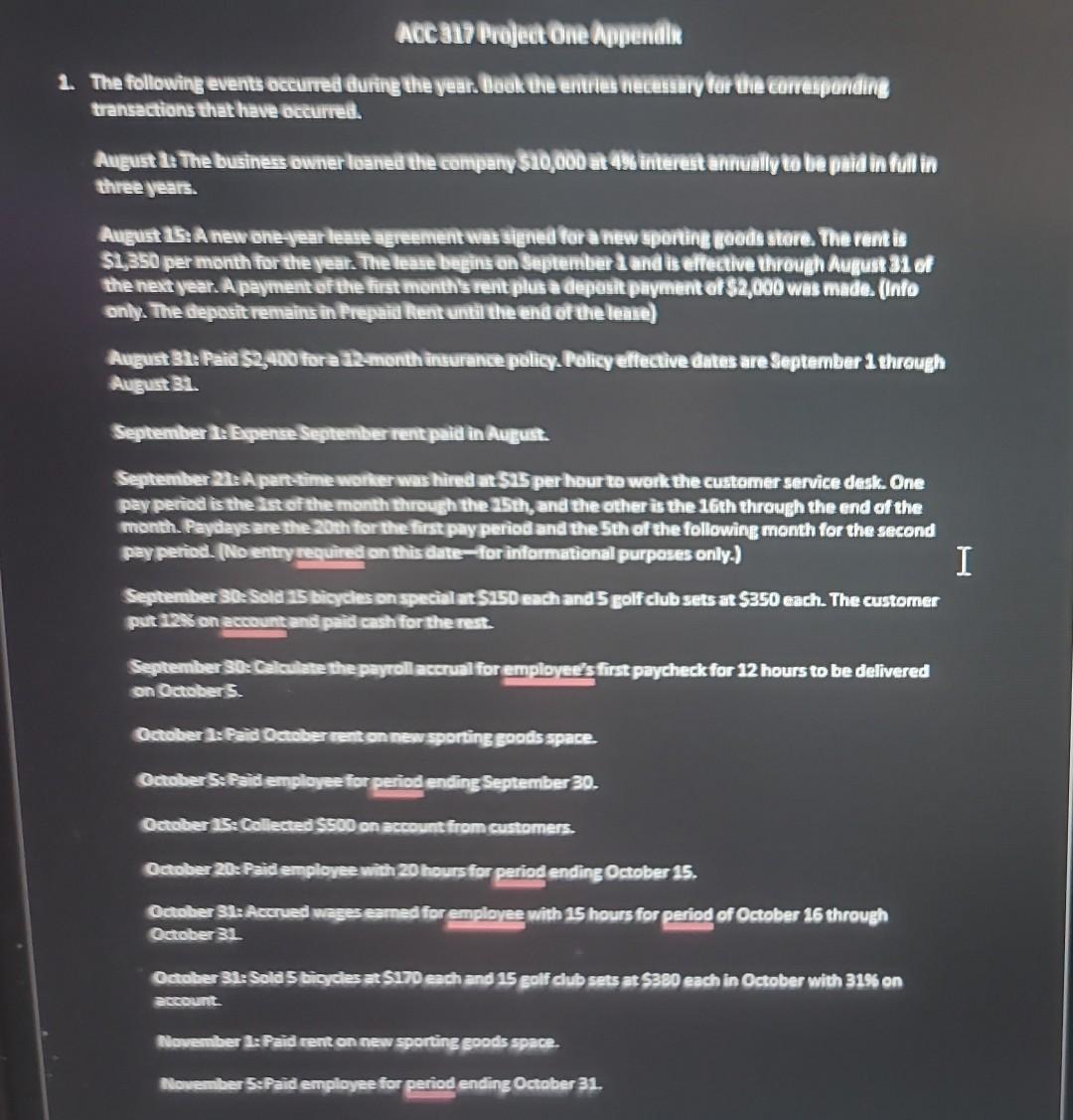

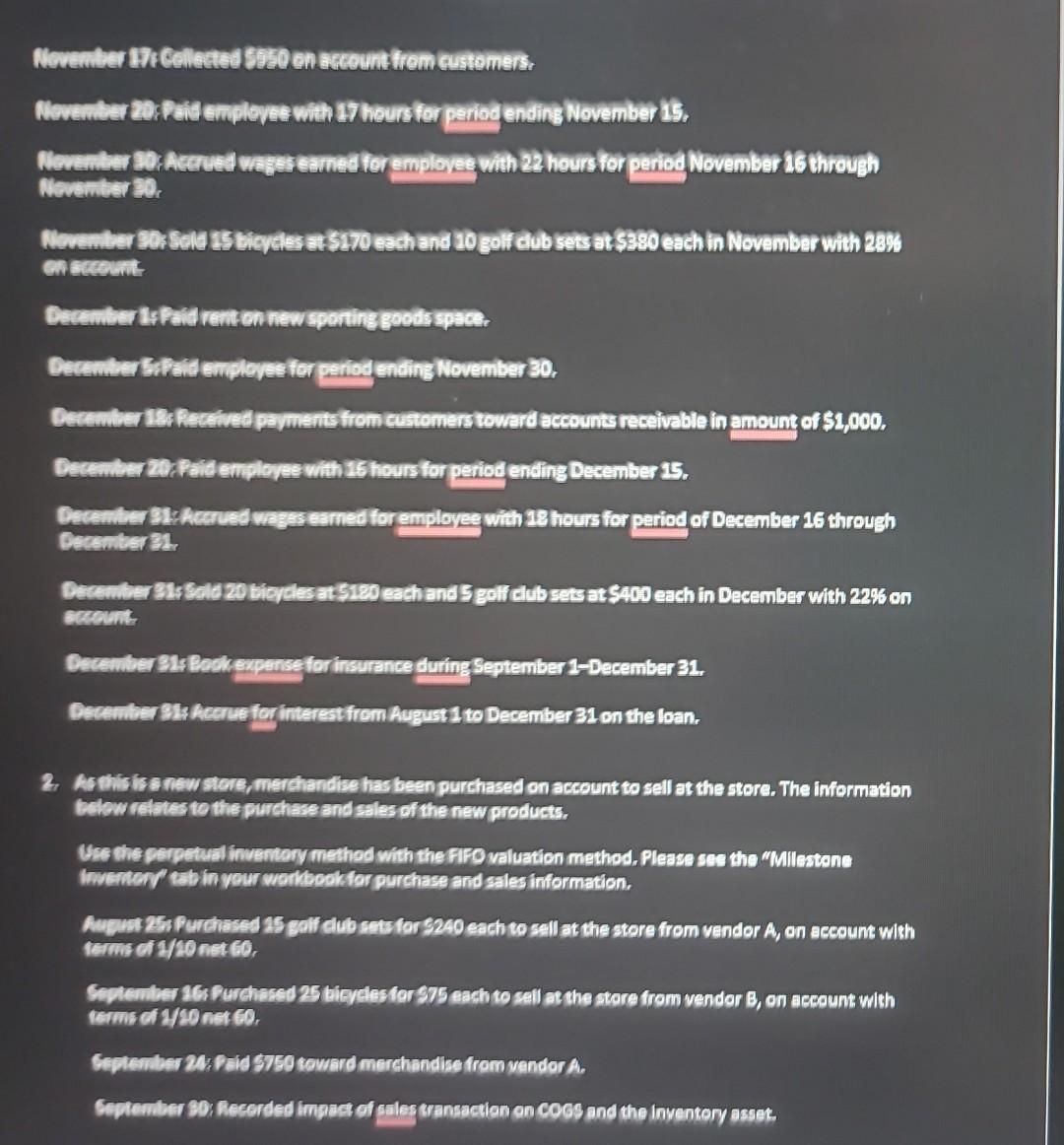

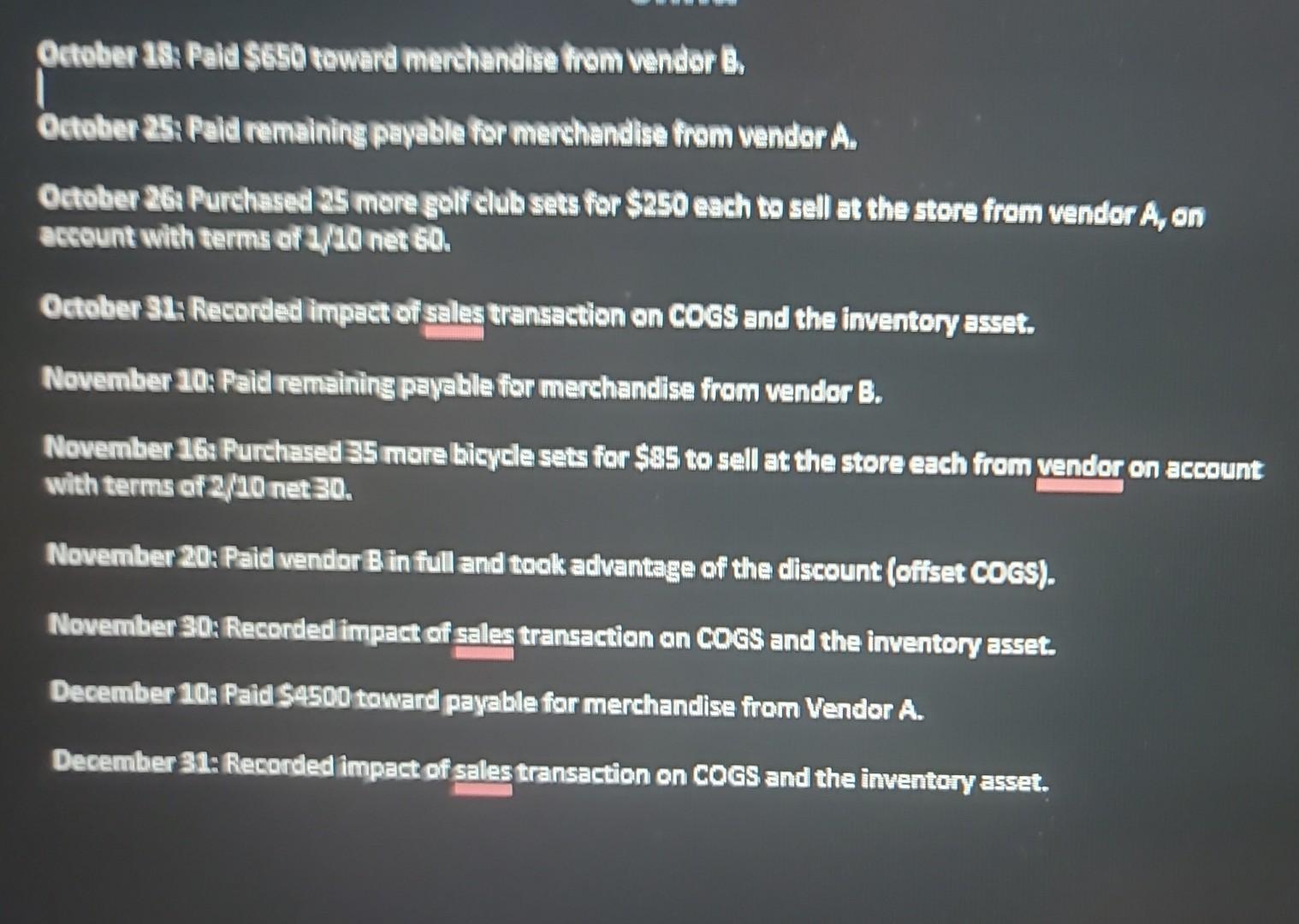

Aocal7probeatone Nppenalis The following events occurrea aturing the year. boak the entras necesary for the comesponaing transactionsthat have bceurrea. August ti The business owner loaneathe compeny 510,000 at 4: interest annuily to be paid in ful in three years. 51,350 per month for the veat. The leare begins an September 2 and is effective through Aupuat 31 of only. The depositremains in Prepaia Rentuntire the ena detele leure) August 31. September I: Bepense September rent peia in Auguat. September 2h: A pantime woner washirea an 525 per hour to wonk the customer service desk. One pey periot is the ast of the month through the 25 th, and the other is the 16 th through the end of the month. Paydiejs are the 20en for the first pay period and the Sth of the following month for the second pey period. (No entry required an this ante-for intlormational purposes only.) September 30 Sold 15 bilyches on special 515150 ench and 5 golf club sets at 5350 each. The customer put a2sisen accountand pilis cash fortherest. on Cctabers. Qctober As Paid October ienten new sporting goodis space October Su faid employe for periog ending September 30. October 15: Collected 5500 on account from customers. Oatober 20: Paid employee with 20 hours for periog ending October 15. October 34: Accurued wases eamed for emplovee with 15 hours for periog of October 26 through October 32 Oatober 31: Sold 5 bigctes at 5470 ench and 15 golf club sets at 5380 each in October with 316 on Moventber a: Faid rent on new sporting soods space. Movember 5sipaid employee for period ending October 31. FIFO Bicycles Novewter the Cellowed 5950 en sccounthom eustomers. Nunember idincerved wasereamedor emplores, with 22 houns for periog November 26 through Nonumer 30 sede s s bicveles at 5170 each and 10 golf dub ses at 5380 each in November with 23% en evecuent- Cecember isi feceived perments from eustomerstowerd accounts receivable in a mount of $1,000, Devember 32 inerned wagsseamed for emploves with 18 hours for period of December 16 through Cecember 32 December 32 s delde 20 bioydes at 5120 eachand 5 golf clubsetsat 5400 each in December with 22% on cacoumt Cecember 32s lackerpense for insurance during September 1-December 31. Becenber 8 sis Acenue for interest from August 1 to December 31 on the loan. 2. Arelisis anew store, merchandise has been purchased on account to sell at the store. The information below reitites to the purchase and sales of the new products. Use the perpetual inventory method with the Firo valuation method, Please ses the "Millestone Invemeng" teb in your wortbock for purchase and sales information. Angut 25 P Purchased 25 gall dub setstar 5240 each to sell at the store from vendor A, on account with terms of 1/20 nat 60 . September 24: Daid 5750 toward merchandise from vendor A. Septenter se: hecended impuse of sales sransaction on coss and the inventory asset. October 184 Paid 5650 tawere merhendise from vendor B. October 254 Paid remaining payeble for mershandise from vendor A. October 264 Purchased 25 mere golf club sets for $250 each to sell at the store from vandor A, en actount with terms of 2//20 net e0. October 34 Recorded impact of seles transaction on cocs and the inventory asset. November 10: Paid remaining payable for merchandise from vendor B. November 168 Purchased 35 more bicycle sets for $85 to sell at the store each from vendor on account with terms of 2/190 net 30 . November 20: Paid vendor Bin full and took advantage of the discount (ofiset COSS). November 30: Reconded impact of sales transaction on COes and the inventory asset. December 10s Paid 54500 toward payable for merchandise from Vendor A. December 31: Recorded impact of sales transaction on COCS and the inventory asset. Batter Up Company Journal Entries 0 \#VALUE! 0 \#VALUE! [Insert value] \#VALUE! \begin{tabular}{|lc|cc|} \hline \multicolumn{4}{|c|}{ Merchandise Inventory } \\ \hline \multicolumn{2}{|c|}{ Golf Clubs } & \multicolumn{2}{c|}{ Bicycles } \\ \hline$ & 3,600.00 & $ & 1,875.00 \\ $ & (1,200.00) & $ & (1,125.00) \\ $ & 6,250.00 & $ & (375.00) \\ $ & (3,650.00) & $ & 2,975.00 \\ $ & (2,500.00) & $ & (1,225.00) \\ $ & (1,250.00) & $ & (1,700.00) \\ & & & \\ \hline$ & 1,250.00 & $ & 425.00 \\ \hline \end{tabular} \begin{tabular}{|lccc|} \hline \multicolumn{2}{|c}{ VENDOR A } & \multicolumn{2}{c|}{ VENDOR B } \\ \hline$ & 3,600.00 & $ & 1,875.00 \\ $ & (750.00) & $ & - \\ $ & - & $ & - \\ $ & - & $ & 2,500.00 \\ $ & - & $ & - \\ \hline$ & 2,850.00 & $ & 4,375.00 \\ \hline \end{tabular} \begin{tabular}{|cr|} \hline & \multicolumn{2}{c|}{ Sales Revenue } \\ \cline { 2 - 2 } 30-Sep & $4,000.00 \\ 31 Oct & $6,550.00 \\ 30 -Nov & $6,350.00 \\ 31 Dec & $5,600.00 \\ \cline { 2 - 2 } & $$22,500.00 \\ \hline & $22,500.00 \\ \hline \end{tabular} Liabilities and Owners' Equity Current Liabilities: \begin{tabular}{|l|lr|} \hline accounts payable vendor A & $ & 1,750.00 \\ \hline wages payable & $ & 240.00 \\ \hline interest payable & $ & 166.67 \\ \hline & & \\ \hline Total Current Liabilities & $ & 2,156.67 \\ \hline LongTermLiabilities:notespayable & & \\ \hline Total Long-Term Liabilities: & $10,000.00 & 10,000.00 \\ \hline \end{tabular} Total Liabilities: $12,156.67 Owner's Equity 3 Non-Current Assets: Net Income \begin{tabular}{|lr|} $ & 1,097.33 \\ \hline & 20,343.33 \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline Total Equity & $21,440.66 \\ \hline \end{tabular} Total Assets: $35,754,00 Aocal7probeatone Nppenalis The following events occurrea aturing the year. boak the entras necesary for the comesponaing transactionsthat have bceurrea. August ti The business owner loaneathe compeny 510,000 at 4: interest annuily to be paid in ful in three years. 51,350 per month for the veat. The leare begins an September 2 and is effective through Aupuat 31 of only. The depositremains in Prepaia Rentuntire the ena detele leure) August 31. September I: Bepense September rent peia in Auguat. September 2h: A pantime woner washirea an 525 per hour to wonk the customer service desk. One pey periot is the ast of the month through the 25 th, and the other is the 16 th through the end of the month. Paydiejs are the 20en for the first pay period and the Sth of the following month for the second pey period. (No entry required an this ante-for intlormational purposes only.) September 30 Sold 15 bilyches on special 515150 ench and 5 golf club sets at 5350 each. The customer put a2sisen accountand pilis cash fortherest. on Cctabers. Qctober As Paid October ienten new sporting goodis space October Su faid employe for periog ending September 30. October 15: Collected 5500 on account from customers. Oatober 20: Paid employee with 20 hours for periog ending October 15. October 34: Accurued wases eamed for emplovee with 15 hours for periog of October 26 through October 32 Oatober 31: Sold 5 bigctes at 5470 ench and 15 golf club sets at 5380 each in October with 316 on Moventber a: Faid rent on new sporting soods space. Movember 5sipaid employee for period ending October 31. FIFO Bicycles Novewter the Cellowed 5950 en sccounthom eustomers. Nunember idincerved wasereamedor emplores, with 22 houns for periog November 26 through Nonumer 30 sede s s bicveles at 5170 each and 10 golf dub ses at 5380 each in November with 23% en evecuent- Cecember isi feceived perments from eustomerstowerd accounts receivable in a mount of $1,000, Devember 32 inerned wagsseamed for emploves with 18 hours for period of December 16 through Cecember 32 December 32 s delde 20 bioydes at 5120 eachand 5 golf clubsetsat 5400 each in December with 22% on cacoumt Cecember 32s lackerpense for insurance during September 1-December 31. Becenber 8 sis Acenue for interest from August 1 to December 31 on the loan. 2. Arelisis anew store, merchandise has been purchased on account to sell at the store. The information below reitites to the purchase and sales of the new products. Use the perpetual inventory method with the Firo valuation method, Please ses the "Millestone Invemeng" teb in your wortbock for purchase and sales information. Angut 25 P Purchased 25 gall dub setstar 5240 each to sell at the store from vendor A, on account with terms of 1/20 nat 60 . September 24: Daid 5750 toward merchandise from vendor A. Septenter se: hecended impuse of sales sransaction on coss and the inventory asset. October 184 Paid 5650 tawere merhendise from vendor B. October 254 Paid remaining payeble for mershandise from vendor A. October 264 Purchased 25 mere golf club sets for $250 each to sell at the store from vandor A, en actount with terms of 2//20 net e0. October 34 Recorded impact of seles transaction on cocs and the inventory asset. November 10: Paid remaining payable for merchandise from vendor B. November 168 Purchased 35 more bicycle sets for $85 to sell at the store each from vendor on account with terms of 2/190 net 30 . November 20: Paid vendor Bin full and took advantage of the discount (ofiset COSS). November 30: Reconded impact of sales transaction on COes and the inventory asset. December 10s Paid 54500 toward payable for merchandise from Vendor A. December 31: Recorded impact of sales transaction on COCS and the inventory asset. Batter Up Company Journal Entries 0 \#VALUE! 0 \#VALUE! [Insert value] \#VALUE! \begin{tabular}{|lc|cc|} \hline \multicolumn{4}{|c|}{ Merchandise Inventory } \\ \hline \multicolumn{2}{|c|}{ Golf Clubs } & \multicolumn{2}{c|}{ Bicycles } \\ \hline$ & 3,600.00 & $ & 1,875.00 \\ $ & (1,200.00) & $ & (1,125.00) \\ $ & 6,250.00 & $ & (375.00) \\ $ & (3,650.00) & $ & 2,975.00 \\ $ & (2,500.00) & $ & (1,225.00) \\ $ & (1,250.00) & $ & (1,700.00) \\ & & & \\ \hline$ & 1,250.00 & $ & 425.00 \\ \hline \end{tabular} \begin{tabular}{|lccc|} \hline \multicolumn{2}{|c}{ VENDOR A } & \multicolumn{2}{c|}{ VENDOR B } \\ \hline$ & 3,600.00 & $ & 1,875.00 \\ $ & (750.00) & $ & - \\ $ & - & $ & - \\ $ & - & $ & 2,500.00 \\ $ & - & $ & - \\ \hline$ & 2,850.00 & $ & 4,375.00 \\ \hline \end{tabular} \begin{tabular}{|cr|} \hline & \multicolumn{2}{c|}{ Sales Revenue } \\ \cline { 2 - 2 } 30-Sep & $4,000.00 \\ 31 Oct & $6,550.00 \\ 30 -Nov & $6,350.00 \\ 31 Dec & $5,600.00 \\ \cline { 2 - 2 } & $$22,500.00 \\ \hline & $22,500.00 \\ \hline \end{tabular} Liabilities and Owners' Equity Current Liabilities: \begin{tabular}{|l|lr|} \hline accounts payable vendor A & $ & 1,750.00 \\ \hline wages payable & $ & 240.00 \\ \hline interest payable & $ & 166.67 \\ \hline & & \\ \hline Total Current Liabilities & $ & 2,156.67 \\ \hline LongTermLiabilities:notespayable & & \\ \hline Total Long-Term Liabilities: & $10,000.00 & 10,000.00 \\ \hline \end{tabular} Total Liabilities: $12,156.67 Owner's Equity 3 Non-Current Assets: Net Income \begin{tabular}{|lr|} $ & 1,097.33 \\ \hline & 20,343.33 \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline Total Equity & $21,440.66 \\ \hline \end{tabular} Total Assets: $35,754,00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started