please help need both the 1040 filled out and the captial gain worksheet

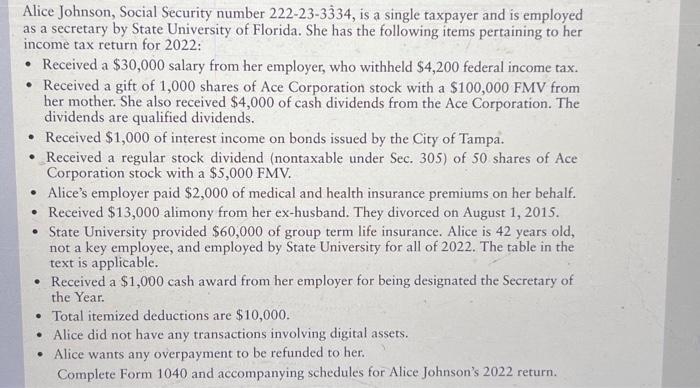

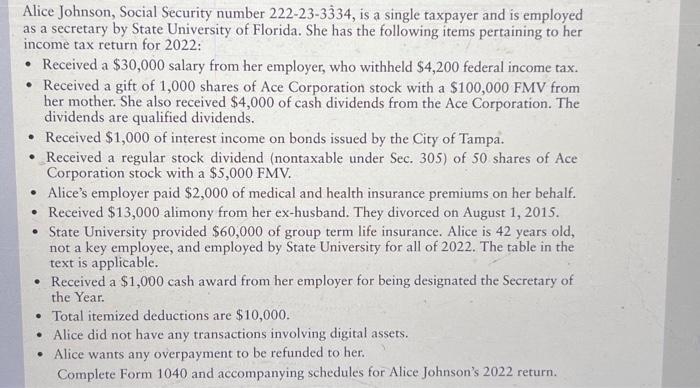

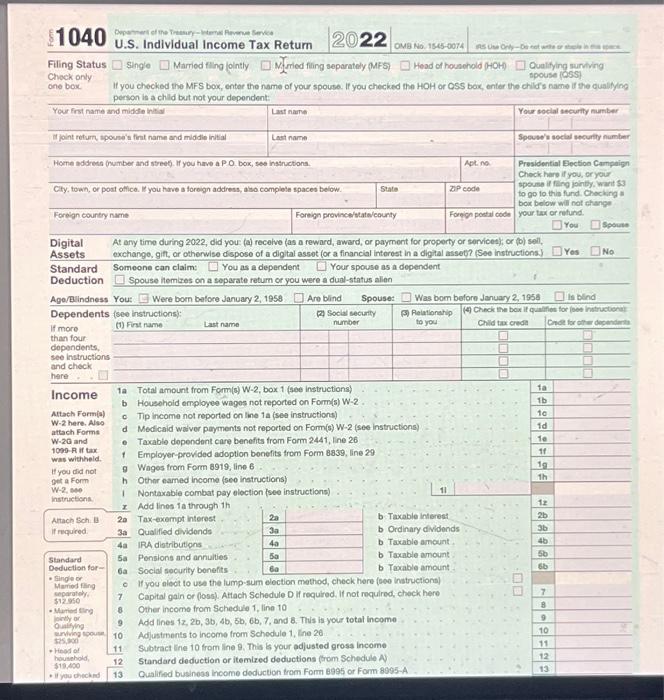

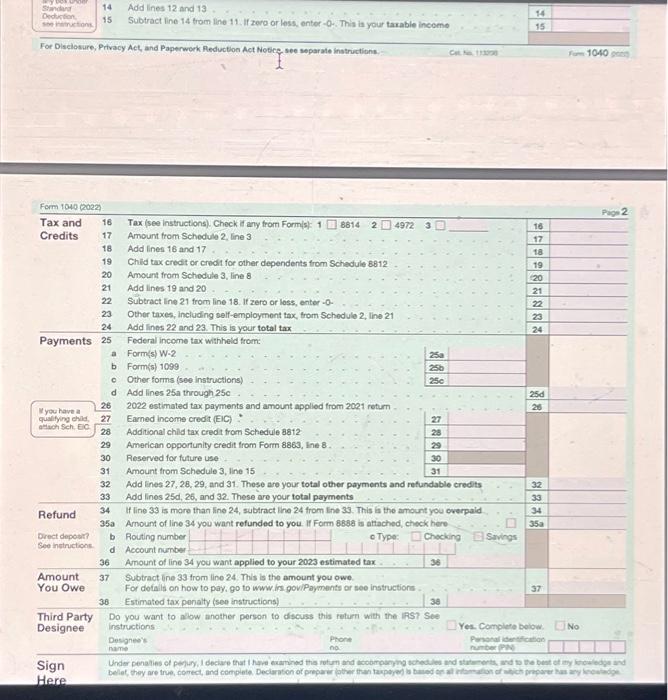

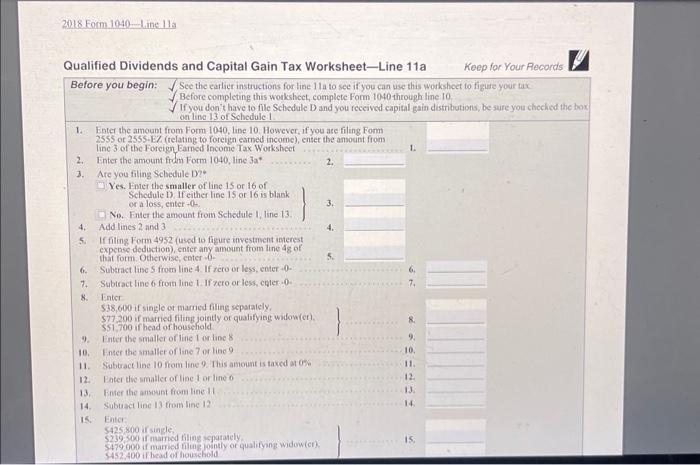

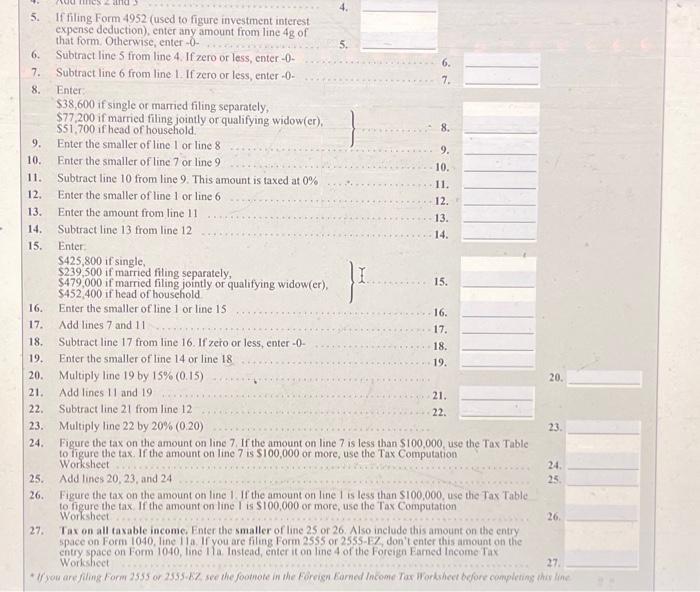

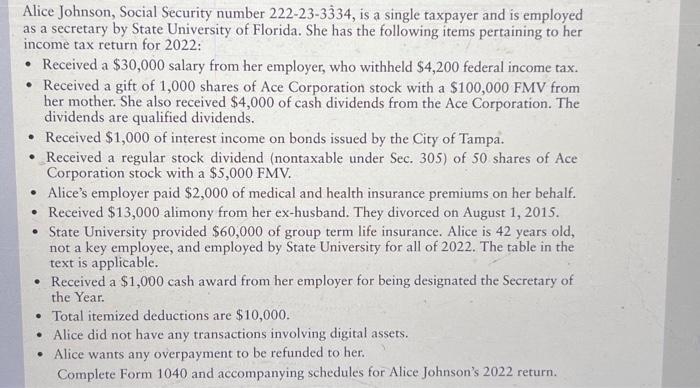

Alice Johnson, Social Security number 222-23-3j34, is a single taxpayer and is employed as a secretary by State University of Florida. She has the following items pertaining to her income tax return for 2022: - Received a $30,000 salary from her employer, who withheld $4,200 federal income tax. - Received a gift of 1,000 shares of Ace Corporation stock with a $100,000 FMV from her mother. She also received $4,000 of cash dividends from the Ace Corporation. The dividends are qualified dividends. - Received \$1,000 of interest income on bonds issued by the City of Tampa. - Received a regular stock dividend (nontaxable under Sec. 305) of 50 shares of Ace Corporation stock with a $5,000FMV. - Alice's employer paid $2,000 of medical and health insurance premiums on her behalf. - Received \$13,000 alimony from her ex-husband. They divorced on August 1, 2015. - State University provided $60,000 of group term life insurance. Alice is 42 years old, not a key employee, and employed by State University for all of 2022 . The table in the text is applicable. - Received a $1,000 cash award from her employer for being designated the Secretary of the Year. - Total itemized deductions are $10,000. - Alice did not have any transactions involving digital assets. - Alice wants any overpayment to be refunded to her. Complete Form 1040 and accompanying schedules for Alice Johnson's 2022 return. 5. If filing Form 4952 (used to figure investment interest 4. expense deduction), enter any amount from line 4g of that form. Otherwise, enter - - - 6. Subtract line 5 from line 4 . If zero or less, enter -0 - 7. Subtract line 6 from line 1 . If zero or less, enter -0 . 8. Enter: 5. 6. 7. $38,600 if single or married filing separately, $77,200 if married filing jointly or qualifying widow(er), $51,700 if head of household. 9. Enter the smaller of line 1 or line 8 8. 10. Enter the smaller of line 7 or line 9 9. 11. Subtract line 10 from line 9. This amount is taxed at 0% 10. 12. Enter the smaller of line 1 or line 6 11. 13. Enter the amount from line 11 12. 14. Subtract line 13 from line 12 13. 15. Enter. 14. $425,800 if single, $239,500 if married filing separately, $479,000 if married filing jointly or qualifying widow(er), $452,400 if head of household 16. Enter the smaller of line 1 or line 15 15. 17. Add lines 7 and 11 16. 18. Subtract line 17 from line 16 . If zeio or less, enter -0 - 17. 19. Enter the smaller of line 14 or line 18 18. 20. Multiply line 19 by 15%(0.15) 19. 21. Add lines 11 and 19 21. 22. Subtract line 21 from line 12 22. 20. 23. Multiply line 22 by 20%(0.20) 23. 24. Figure the tax on the amount on line 7. If the amount on line 7 is less than 5100,000 , use the Tax Table to figure the tax. If the amount on line 7 is $100,000 or more, use the Tax Computation Worksheet 25. Add lines 20,23 , and 24 26. Figure the tax on the amount on line 1 . If the amount on line 1 is less than $100,000, use the Tax Table to figure the tax. If the amount on line I is $100,000 or more, use the Tax Computation Worksheet 27. Tax on all taxable income. Enter the smaller of line 25 or 26 . Also include this amount on the entry space on Form 1040, line 11 a. If you are filing Form 2555 or 2555 -EZ, don't enter this amount on the entry space on Form 1040, line Ila. Instead, enter it on line 4 of the Foreign Farned Income Tax Workshect 24. 25. 26. 14 Add lines 12 and 13 Sindivint 15 Subtract line 14 from line 11 . If zero or less, enter -0 . This is your tarable income 14 For Diselosure, Privacy Act, and Paperwork Reduction Act Nesice, see separate instrictions. 15 Form 1040 (2022 Third Party Designee Do you want to alow another person to dscuss this return with the IRST See instructions Designee's Phore no: Centinition Fon 1040 hame Yes. Complete below. UNo Pronalidentication Sign Before completing this workshect, eomplete Form 1040 through line 10