Please help need it asap-journal entries- T accounts, trial balances,income statement, balance sheet

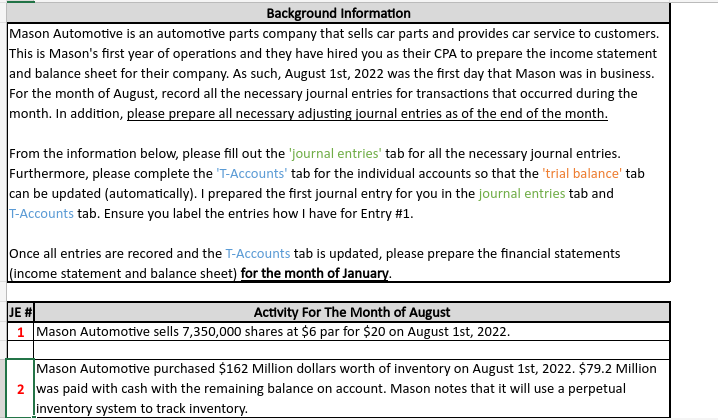

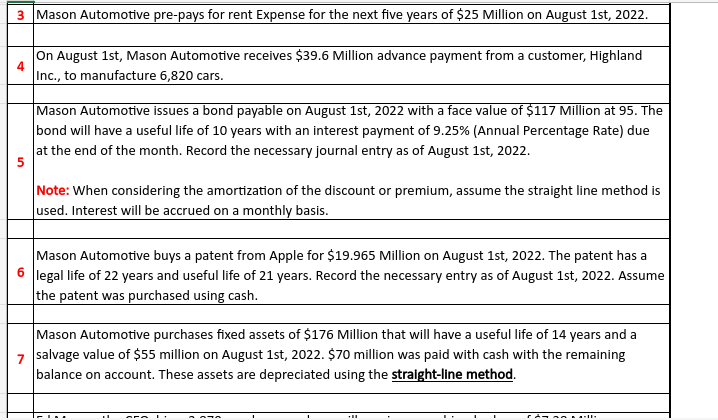

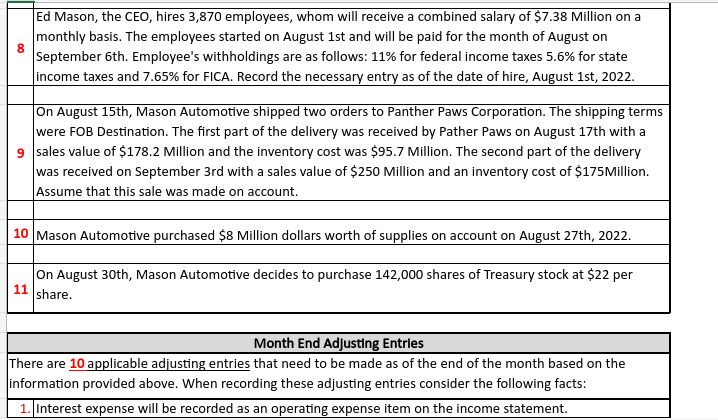

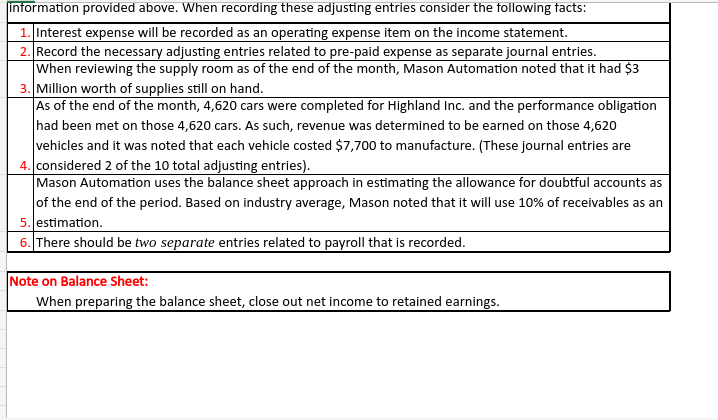

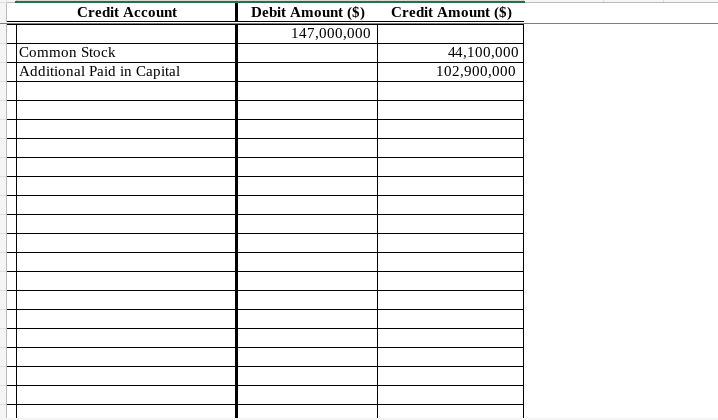

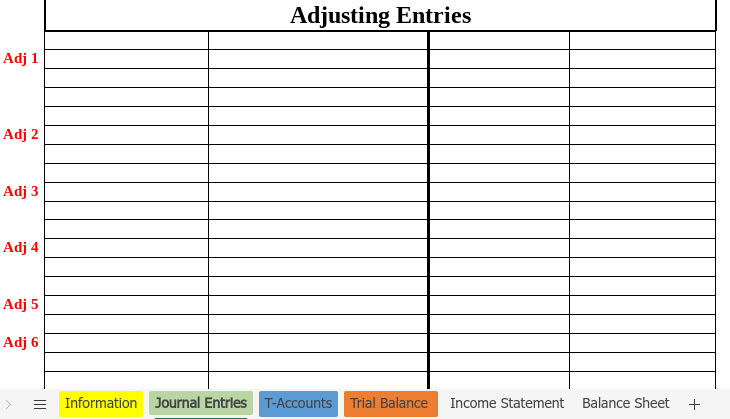

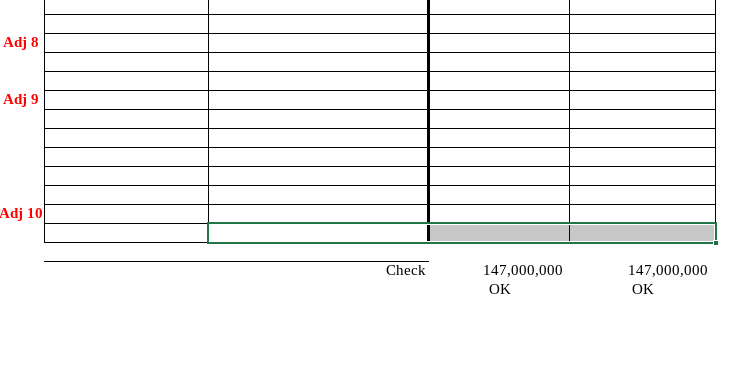

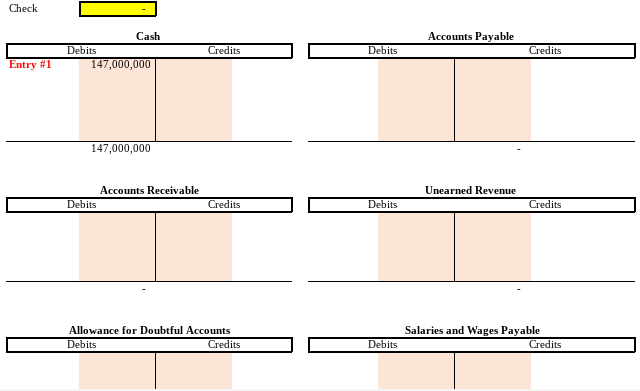

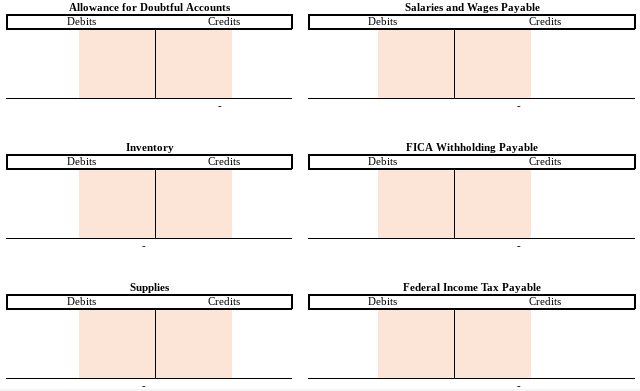

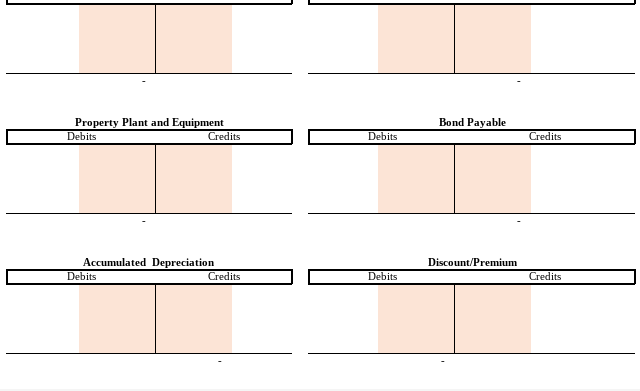

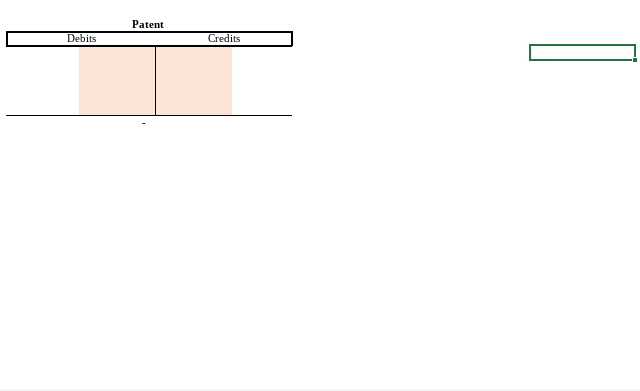

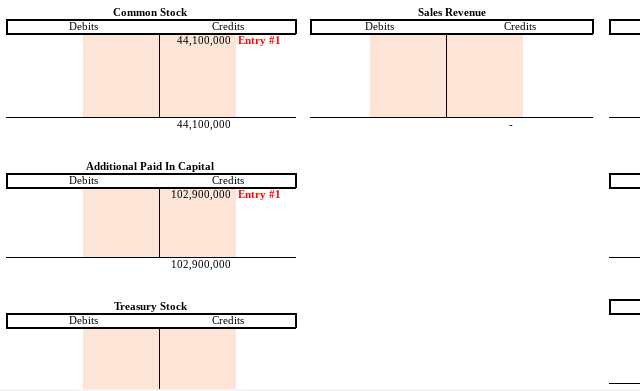

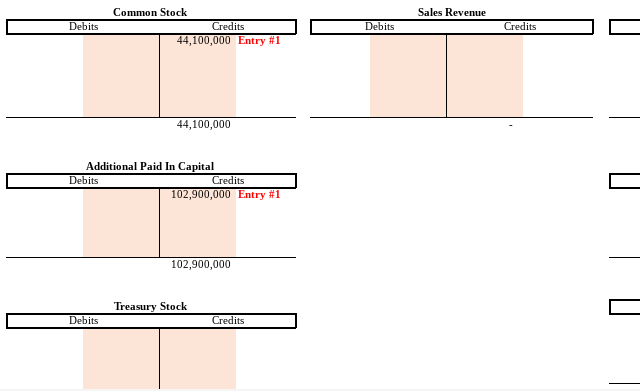

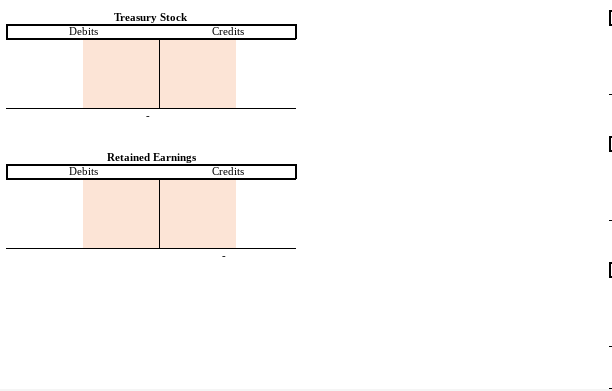

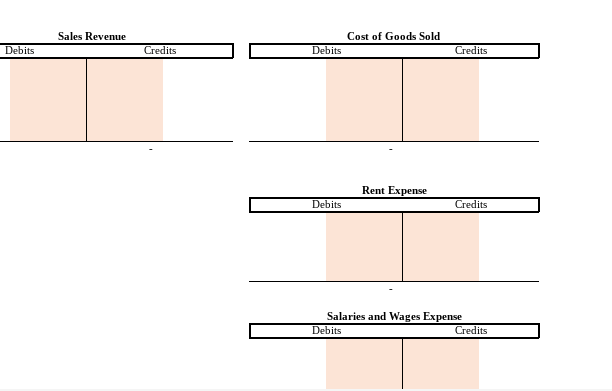

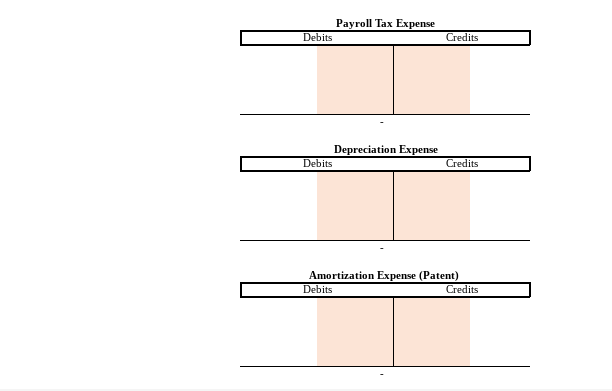

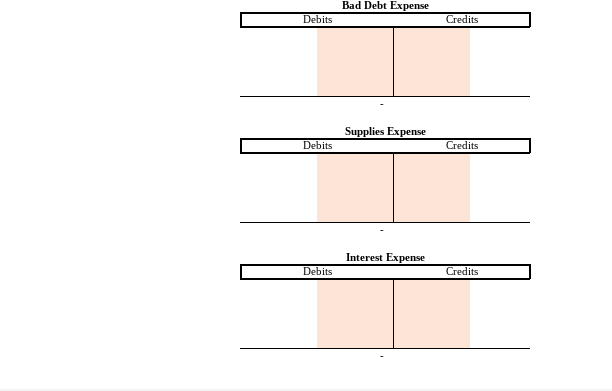

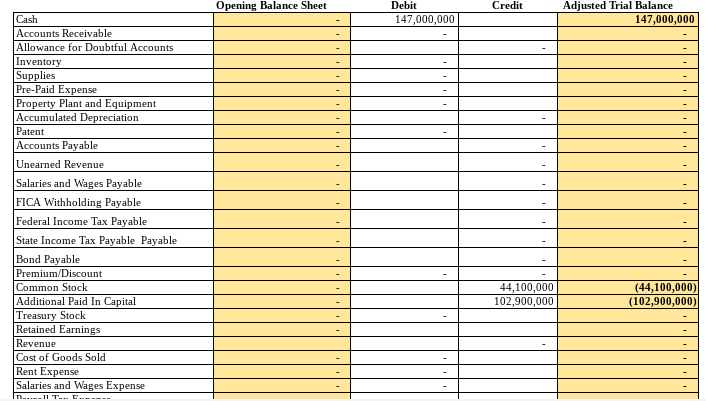

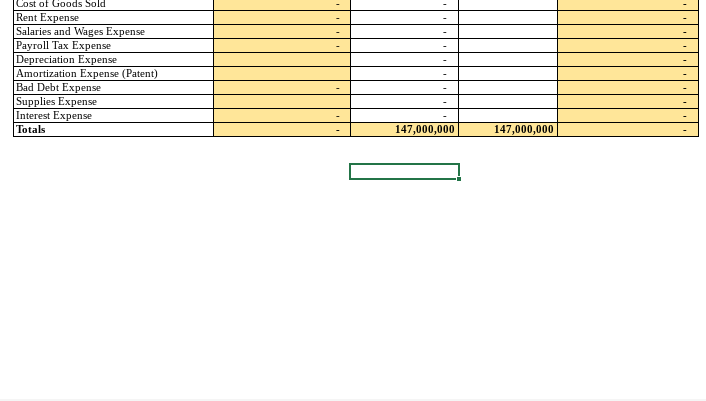

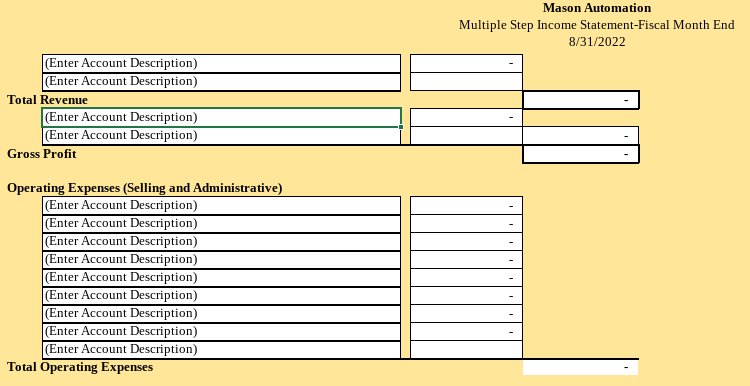

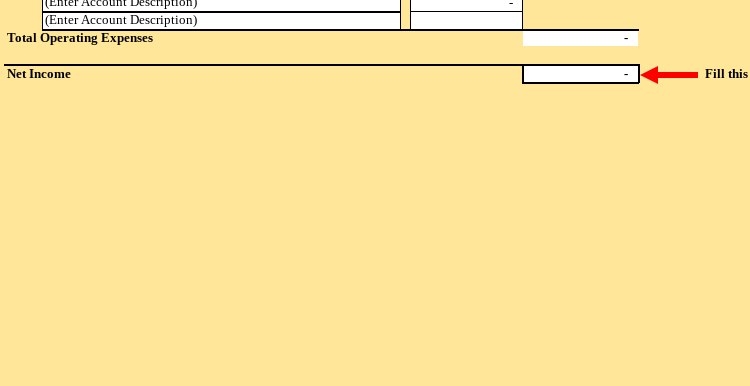

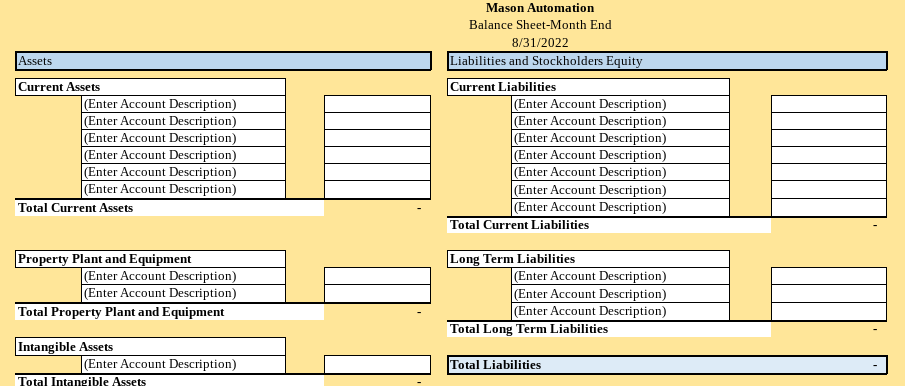

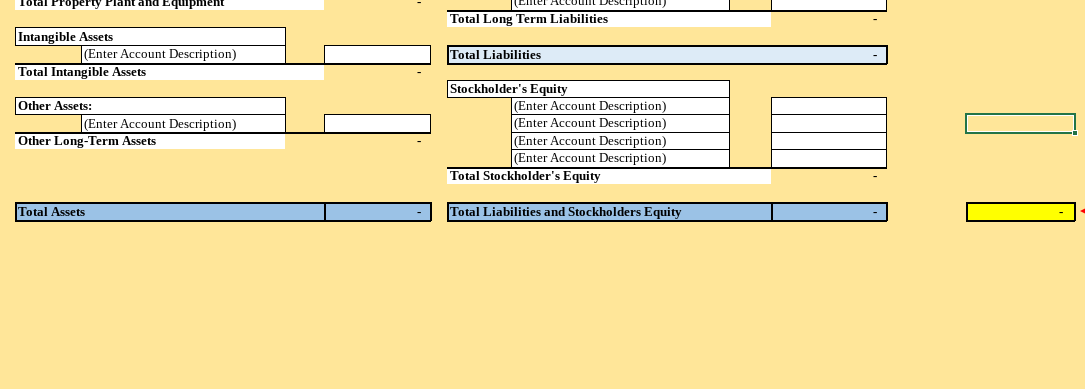

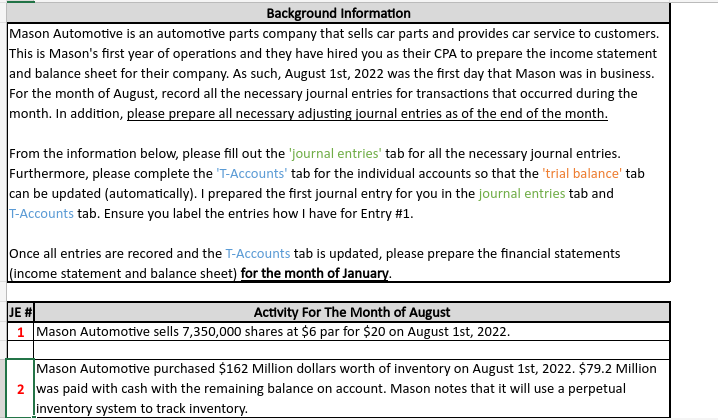

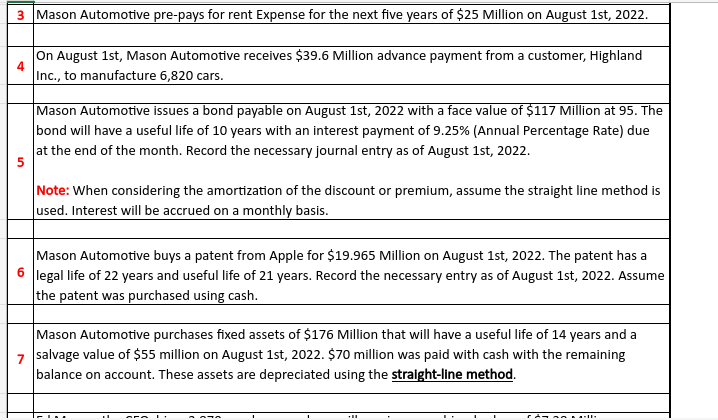

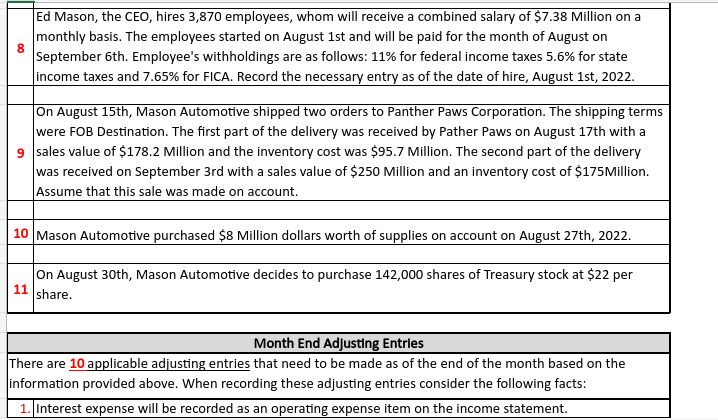

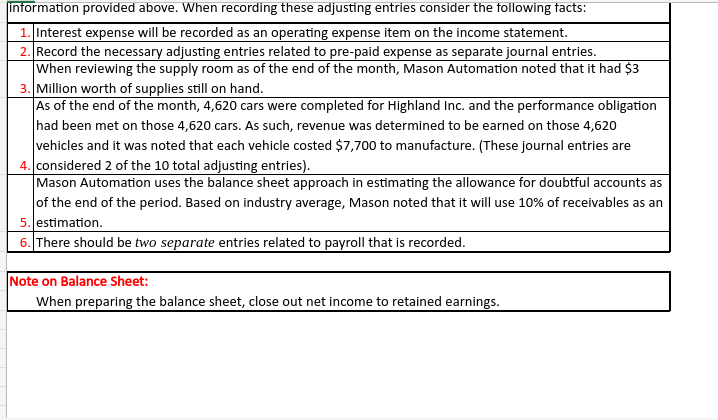

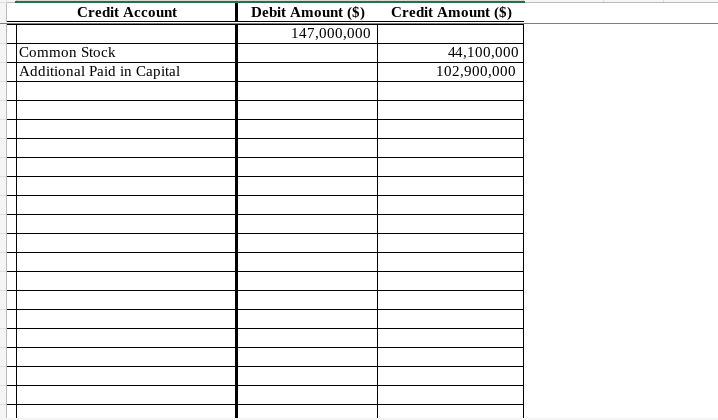

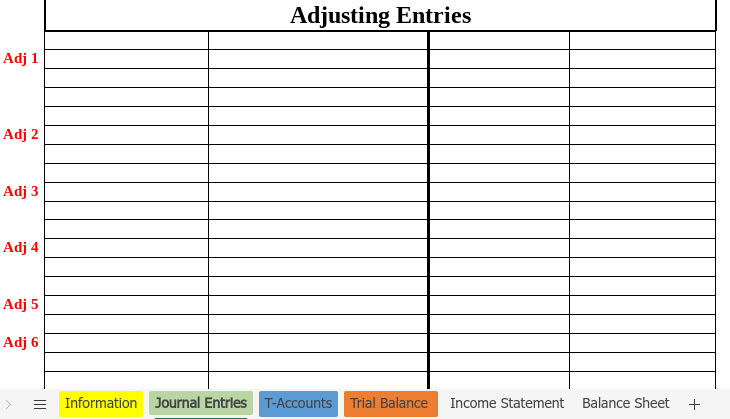

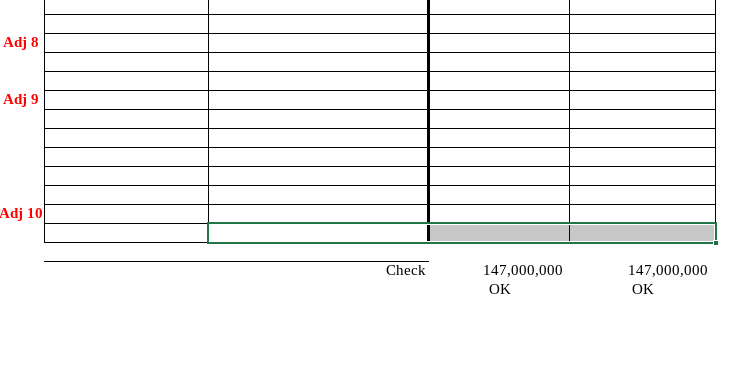

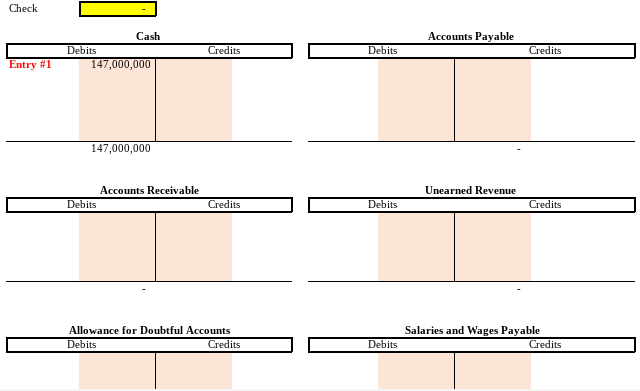

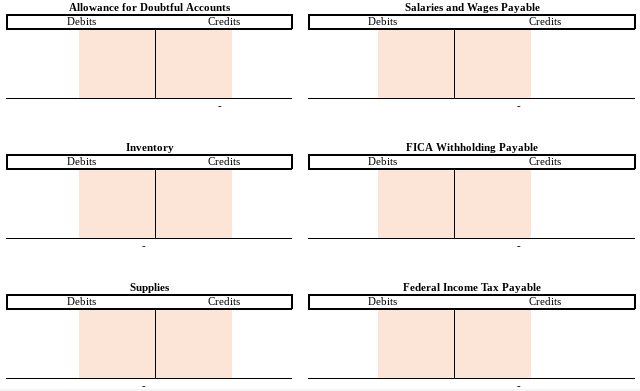

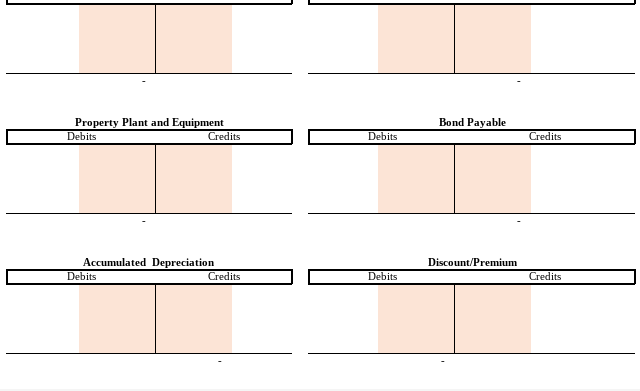

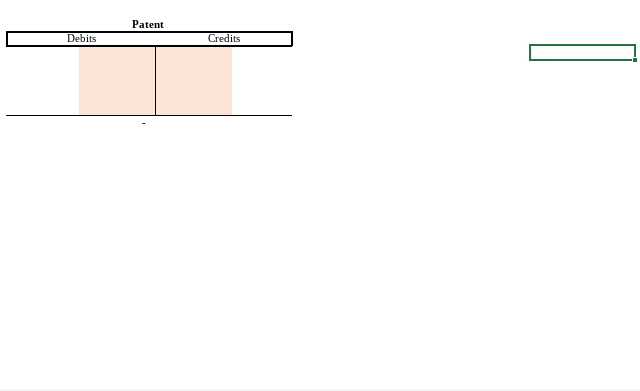

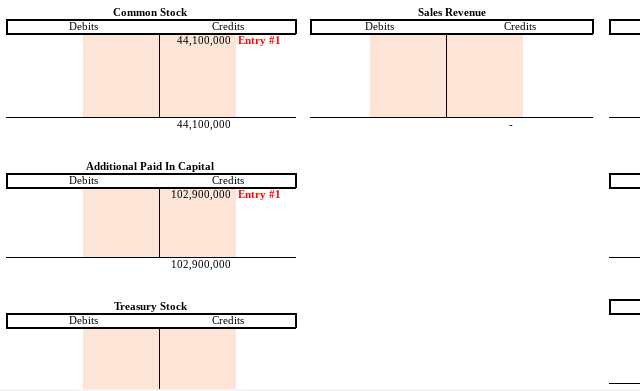

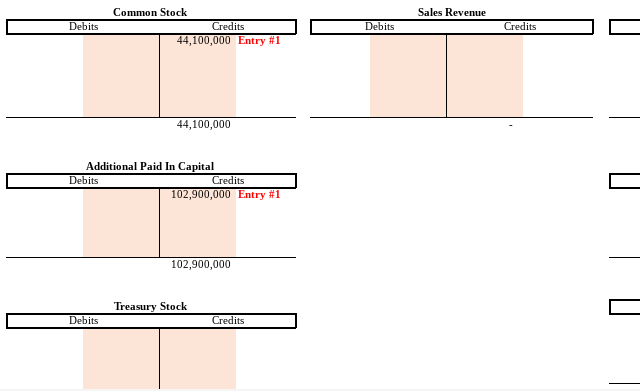

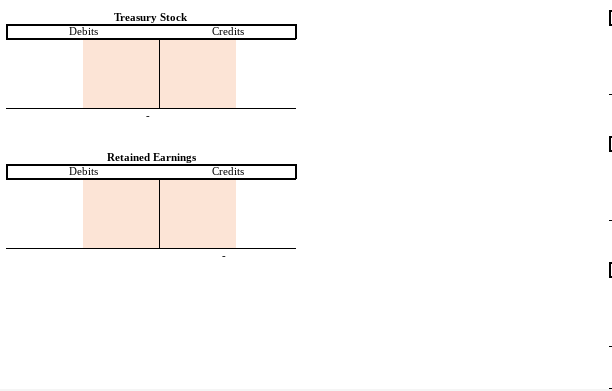

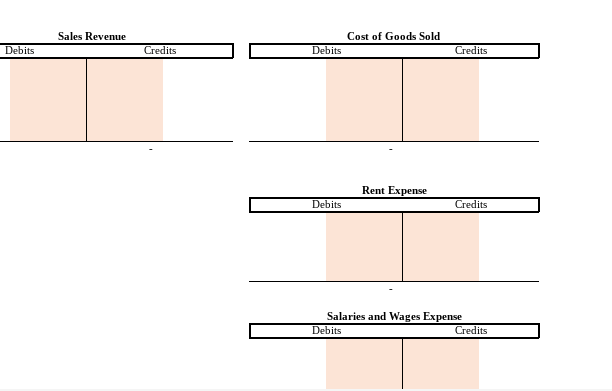

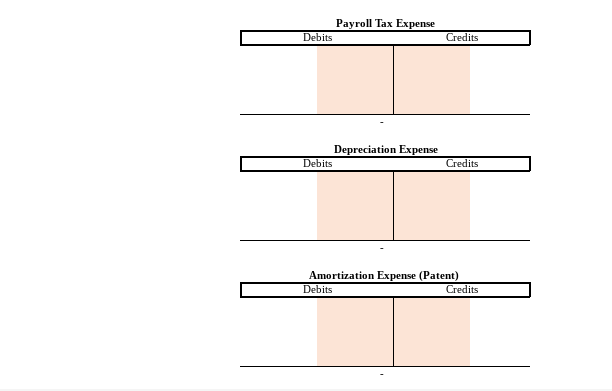

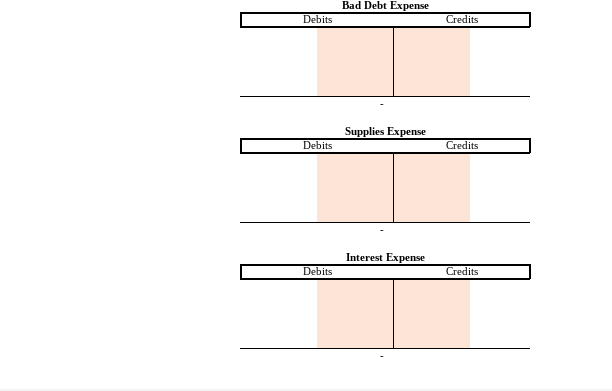

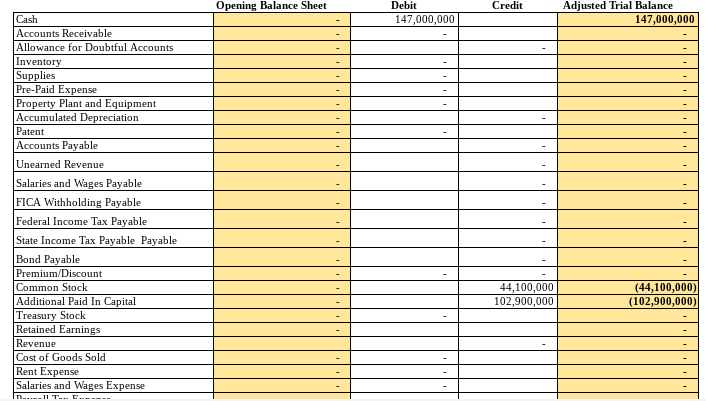

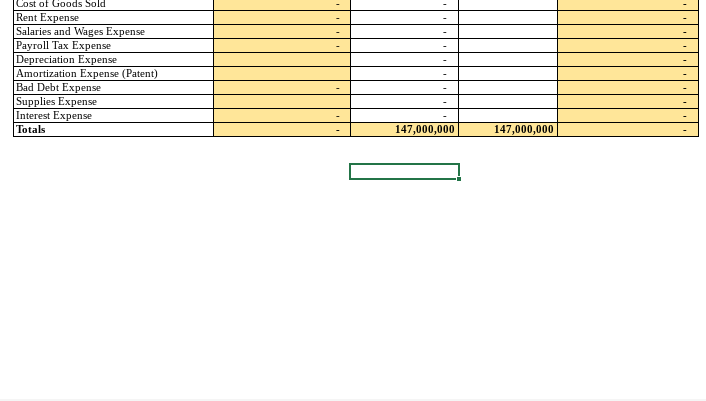

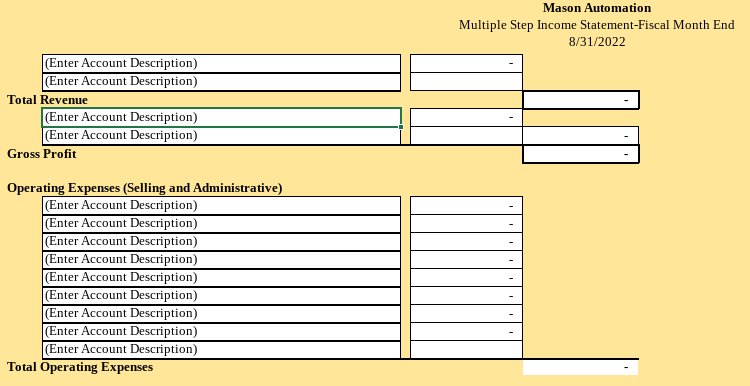

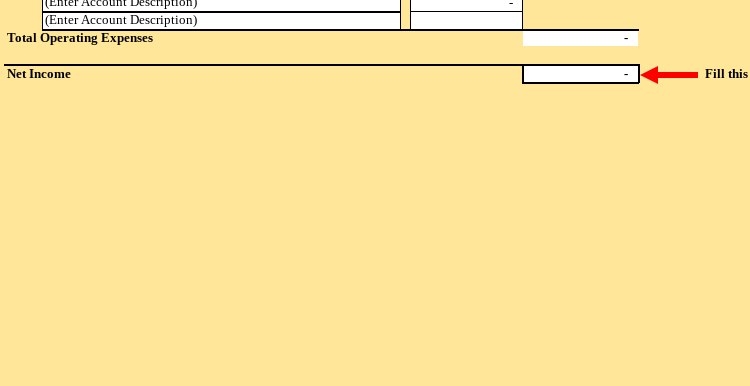

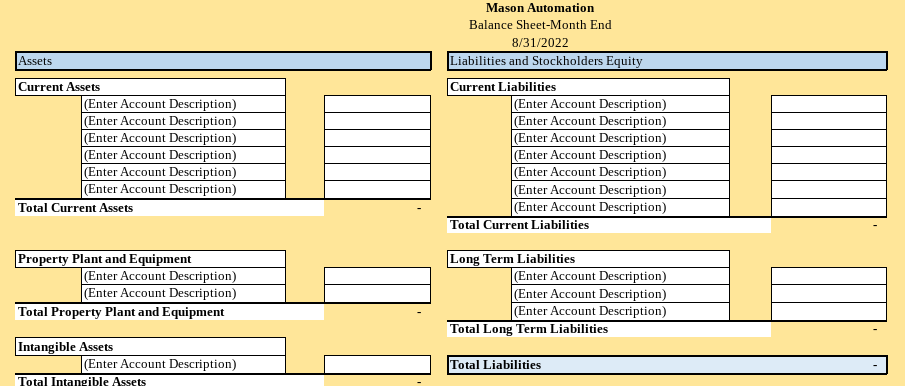

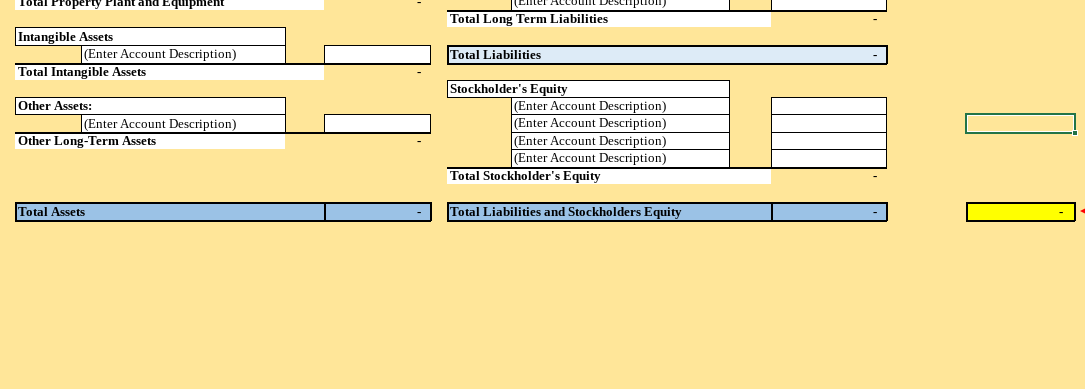

Background Information Mason Automotive is an automotive parts company that sells car parts and provides car service to customers. This is Mason's first year of operations and they have hired you as their CPA to prepare the income statement and balance sheet for their company. As such, August 1st, 2022 was the first day that Mason was in business. For the month of August, record all the necessary journal entries for transactions that occurred during the month. In addition, please prepare all necessary adjusting journal entries as of the end of the month. From the information below, please fill out the 'journal entries' tab for all the necessary journal entries. Furthermore, please complete the 'T-Accounts' tab for the individual accounts so that the 'trial balance' tab can be updated (automatically). I prepared the first journal entry for you in the journal entries tab and T-Accounts tab. Ensure you label the entries how I have for Entry \#1. Once all entries are recored and the T-Accounts tab is updated, please prepare the financial statements (income statement and balance sheet) for the month of January. Ed Mason, the CEO, hires 3,870 employees, whom will receive a combined salary of $7.38 Million on a monthly basis. The employees started on August 1st and will be paid for the month of August on 8 September 6th. Employee's withholdings are as follows: 11% for federal income taxes 5.6% for state income taxes and 7.65\% for FICA. Record the necessary entry as of the date of hire, August 1st, 2022. On August 15th, Mason Automotive shipped two orders to Panther Paws Corporation. The shipping terms were FOB Destination. The first part of the delivery was received by Pather Paws on August 17th with a 9 sales value of \$178.2 Million and the inventory cost was \$95.7 Million. The second part of the delivery was received on September 3rd with a sales value of \$250 Million and an inventory cost of \$175Million. Assume that this sale was made on account. 10 Mason Automotive purchased \$8 Million dollars worth of supplies on account on August 27th, 2022. On August 30th, Mason Automotive decides to purchase 142,000 shares of Treasury stock at $22 per 11 share. Month End Adjusting Entries There are 10 applicable adjusting entries that need to be made as of the end of the month based on the information provided above. When recording these adjusting entries consider the following facts: 1. Interest expense will be recorded as an operating expense item on the income statement. information provided above. When recording these adjusting entries consider the following facts: Note on Balance Sheet: When preparing the balance sheet, close out net income to retained earnings. Adjusting Entries Adj 1 Adj 2 Adj 3 Adj 4 Adj 5 Adj 6 Adj 8 Adj 9 Adj 10 \begin{tabular}{|l|l|l|l|} \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} Check 147,000,000 147,000,000 OK OK Check Cash Accounts Payable \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ Debits } \\ \hline & \\ \hline \end{tabular} Accounts Receivable Unearned Revenue \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ Debits } \\ \hline & \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ Debits } \\ \hline & \\ \hline \end{tabular} Allowance for Doubtful Accounts Salaries and Wages Payable \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ Debits } \\ \hline & \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ Debits } \\ \hline & \\ \hline \end{tabular} Allowance for Doubtful Accounts Salaries and Wages Payable \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ Debits } \\ \hline & \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ Debits } \\ \hline & Credits \\ \hline \end{tabular} Inventory FICA Withholding Payable \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ Debits } \\ \hline & \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ Debits } \\ \hline & \\ \hline \end{tabular} Supplies Federal Income Tax Payable \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ Debits } \\ \hline & \\ \hline \end{tabular} Property Plant and Equipment Bond Payable \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ Debits } \\ \hline & \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ Debits } \\ \hline & \\ \hline \end{tabular} Accumulated Depreciation Discount/Premium \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ Debits } \\ \hline & \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ Debits } \\ \hline & \\ \hline \end{tabular} Patent Common Stock Sales Revenue \begin{tabular}{|l|c|} \hline \multicolumn{2}{|c|}{ Debits } \\ \hline & 44,100,000 Entry \# 1 \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ Debits } \\ \hline & \\ \hline \end{tabular} Additional Paid In Capital \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{ Debits Credits } \\ \hline & 102,900,000 Entry \#1 \\ \hline \end{tabular} Treasury Stock Debits Credits Common Stock Sales Revenue \begin{tabular}{|l|c|} \hline \multicolumn{2}{|c|}{ Debits } \\ \hline & 44,100,000 Entry \# 1 \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ Debits } \\ \hline & \\ \hline \end{tabular} Additional Paid In Capital \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{ Debits Credits } \\ \hline & 102,900,000 Entry \#1 \\ \hline \end{tabular} Treasury Stock Debits Credits Treasury Stock \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ Debits } \\ \hline & \\ \hline \end{tabular} Retained Earnings \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ Debits } \\ \hline & \\ \hline \end{tabular} Sales Revenue Cost of Goods Sold Rent Expense \begin{tabular}{|l|l|} \hline Debits & Credits \\ \hline & \\ \hline \end{tabular} Salaries and Wages Expense Debits Credits Payroll Tax Expense Depreciation Expense \begin{tabular}{|l|l|} \hline Debits & Credits \\ \hline & \\ \hline \end{tabular} Amortization Expense (Patent) Debits Credits Bad Debt Expense Supplies Expense Interest Expense \begin{tabular}{|l|l|} \hline Debits & Credits \\ \hline & \\ \hline \end{tabular} \begin{tabular}{|l|r|r|r|} \hline Rost of Goods Sold & & & \\ \hline Rent Expense & & & \\ \hline Salaries and Wages Expense & & & \\ \hline Payroll Tax Expense & & & \\ \hline Depreciation Expense & & & \\ \hline Amortization Expense (Patent) & & \\ \hline Bad Debt Expense & & & \\ \hline Supplies Expense & & & \\ \hline Interest Expense & & & \\ \hline Totals & & & \\ \hline \end{tabular} Mason Automation Multiple Step Income Statement-Fiscal Month End 8/31/7027 To Gr O1 \& , (Enter Account Description) Total Operating Expenses Net Income Fill this Mason Automation Balance Sheet-Month End 8/31/2022 Assets Liabilities and Stockholders Equity \begin{tabular}{|l|l|} \hline \multicolumn{2}{|l|}{ Current Assets } \\ \cline { 2 - 2 } & (Enter Account Description) \\ \cline { 2 - 2 } & (Enter Account Description) \\ \cline { 2 - 2 } & (Enter Account Description) \\ \hline (Enter Account Description) \\ \hline & (Enter Account Description) \\ \cline { 2 - 2 } (Enter Account Description) \\ \hline \end{tabular} Total Current Assets \begin{tabular}{|l|} \hline \\ \hline \\ \hline \\ \hline \\ \hline \\ \hline \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline \multicolumn{2}{|l|}{ Current Liabilities } \\ \hline & (Enter Account Description) \\ \cline { 2 - 2 } & (Enter Account Description) \\ \cline { 2 - 2 } & (Enter Account Description) \\ \cline { 2 - 2 } & (Enter Account Description) \\ \cline { 2 - 2 } & (Enter Account Description) \\ \cline { 2 - 2 } & (Enter Account Description) \\ \cline { 2 - 2 } (Enter Account Description) \\ \hline \end{tabular} Total Current Liabilities Total Property Plant and Equipment \begin{tabular}{|l|l|} \hline Long Term Liabilities \\ \hline & (Enter Account Description) \\ \cline { 2 - 2 } & (Enter Account Description) \\ \cline { 2 - 2 } & (Enter Account Description) \\ \hline \end{tabular} Total Long Term Liabilities Intangible Assets Total Liabilities Total Assets Total Liabilities and Stockholders Equity