Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help need it for today! Part 2. Question 4 Accounting when there is noncontrolling interest. (12 points) On January 1, Year 1, Pop bought

Please help need it for today!

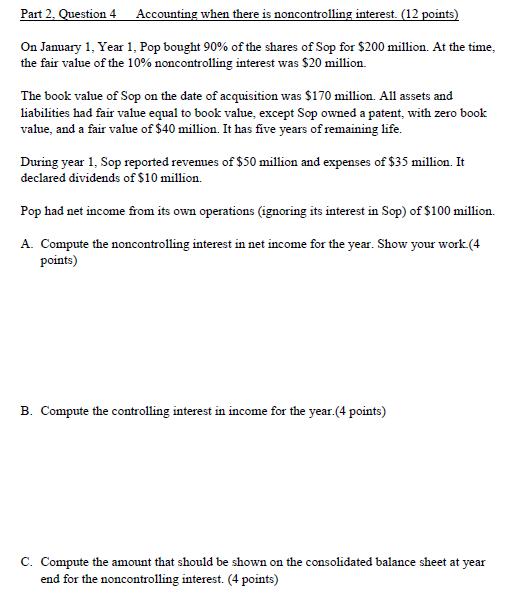

Part 2. Question 4 Accounting when there is noncontrolling interest. (12 points) On January 1, Year 1, Pop bought 90% of the shares of Sop for $200 million. At the time, the fair value of the 10% noncontrolling interest was $20 million. The book value of Sop on the date of acquisition was $170 milion. All assets and liabilities had fair value equal to book value, except Sop owned a patent, with zero book value, and a fair value of $40 million. It has five years of remaining life. During year 1, Sop reported revenues of $50 million and expenses of $35 million. It declared dividends of $10 million. Pop had net income from its own operations (ignoring its interest in Sop) of $100 million. A. Compute the noncontrolling interest in net income for the year. Show your work (4 points) B. Compute the controlling interest in income for the year.(4 points) C. Compute the amount that should be shown on the consolidated balance sheet at year end for the nocrg interest. (4 points)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started